1082 Form

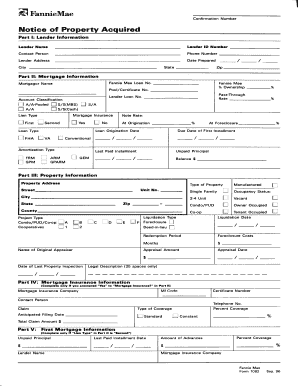

What is the 1082 Form

The 1082 tax form, also known as the IRS Form 1082, is primarily used for reporting certain tax-related information. This form is particularly relevant for individuals and businesses involved in real estate transactions, specifically those dealing with Fannie Mae loans. Understanding the purpose of the 1082 form is essential for ensuring compliance with IRS regulations and for accurately reporting financial activities related to property transactions.

How to use the 1082 Form

Using the 1082 form involves several key steps to ensure accurate reporting. First, gather all necessary financial documents related to the property transaction. This may include purchase agreements, loan documents, and any relevant financial statements. Next, fill out the form by providing accurate information about the transaction, including details about the buyer, seller, and the property itself. Once completed, the form must be signed and submitted according to IRS guidelines.

Steps to complete the 1082 Form

Completing the 1082 form requires careful attention to detail. Here are the steps to follow:

- Review the instructions provided by the IRS for the 1082 form.

- Gather all relevant documents related to the transaction.

- Fill in the required fields, ensuring all information is accurate and complete.

- Double-check the form for any errors or omissions.

- Sign and date the form as required.

- Submit the form either electronically or via mail, following the specified submission guidelines.

Legal use of the 1082 Form

The legal use of the 1082 form is governed by IRS regulations. It is essential to ensure that the form is filled out accurately to avoid any potential legal issues. The form serves as an official document that may be required for audits or other legal proceedings. Compliance with the instructions and legal requirements associated with the 1082 form is crucial for maintaining the integrity of the transaction and ensuring that all parties involved are protected under the law.

Filing Deadlines / Important Dates

Filing deadlines for the 1082 form can vary based on the specifics of the transaction and the taxpayer's circumstances. Generally, it is advisable to submit the form as soon as the transaction is completed to avoid any penalties or delays. Keeping track of important dates related to tax reporting and compliance is essential for ensuring timely submission and adherence to IRS regulations.

Required Documents

To complete the 1082 form, several documents may be required. These typically include:

- Purchase agreements related to the property transaction.

- Loan documents if applicable.

- Financial statements that reflect the transaction.

- Any additional documentation that supports the information provided on the form.

Form Submission Methods

The 1082 form can be submitted through various methods, depending on the preferences of the taxpayer and the requirements set by the IRS. Common submission methods include:

- Online submission through the IRS e-filing system.

- Mailing a physical copy of the form to the appropriate IRS address.

- In-person submission at designated IRS offices, if applicable.

Quick guide on how to complete 1082 form

Complete 1082 Form effortlessly on any device

Web-based document administration has become increasingly favored by businesses and individuals alike. It offers an ideal environmentally friendly alternative to conventional printed and signed papers, as you can locate the necessary form and securely keep it online. airSlate SignNow provides you with all the tools you need to create, modify, and electronically sign your documents quickly without delays. Manage 1082 Form on any device using airSlate SignNow’s Android or iOS applications and enhance any document-related process today.

The easiest way to edit and electronically sign 1082 Form with ease

- Obtain 1082 Form and click Get Form to begin.

- Use the tools we offer to fill out your form.

- Mark important sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature with the Sign feature, which takes mere seconds and holds the same legal authority as a conventional wet ink signature.

- Verify the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, SMS, invite link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choice. Edit and electronically sign 1082 Form and guarantee exceptional communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 1082 form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 1082 tax form?

The 1082 tax form is a document used for reporting specific financial details to the IRS. It often pertains to business income and deductions. Understanding the 1082 tax form is crucial for accurate tax filing and compliance.

-

How can airSlate SignNow help with the 1082 tax form?

airSlate SignNow streamlines the process of preparing and signing the 1082 tax form. Our platform allows you to easily upload, fill out, and eSign the form securely. This ensures that your documents are signed and sent efficiently, saving you time and increasing productivity.

-

Is there a fee for using airSlate SignNow for the 1082 tax form?

Yes, airSlate SignNow offers flexible pricing plans suitable for various business needs. Our pricing is competitive and designed to provide value, especially for users needing to manage multiple documents and forms, including the 1082 tax form.

-

What are the benefits of using airSlate SignNow for my 1082 tax form?

Using airSlate SignNow for your 1082 tax form brings multiple benefits, including enhanced security, faster processing times, and ease of use. You can ensure compliance and minimize errors with our intuitive tools, which aid in document preparation and signing.

-

Can I integrate airSlate SignNow with my accounting software for the 1082 tax form?

Yes, airSlate SignNow offers integration capabilities with various accounting software. This means you can seamlessly transfer data needed for the 1082 tax form from your accounting system to our platform, enhancing efficiency and reducing manual entry.

-

Is it easy to share the 1082 tax form with my accountant using airSlate SignNow?

Absolutely! airSlate SignNow enables you to share the 1082 tax form easily with your accountant or tax preparer. You can send secure links or invitations to collaborate on documents, ensuring everyone has access to the necessary information.

-

How secure is the signing process for the 1082 tax form on airSlate SignNow?

The signing process for your 1082 tax form on airSlate SignNow is highly secure. We utilize advanced encryption protocols to protect your documents and data. Additionally, we offer signature authentication options to ensure that only authorized individuals can sign documents.

Get more for 1082 Form

- This agreement is made between the wife and form

- No other use may be made of the leased property without the written consent of the form

- Original lease form

- Or other provisions as follows form

- Described on exhibit a attached hereto the quotpropertyquot this agreement the loan agreement the note the deed of form

- Notice of assignment of lease agreement and form

- Guarantors above stated address indicating that lessee has failed to timely pay rent form

- Lease agreement by and between binyan realty lp and form

Find out other 1082 Form

- eSignature Virginia Car Dealer Cease And Desist Letter Online

- eSignature Virginia Car Dealer Lease Termination Letter Easy

- eSignature Alabama Construction NDA Easy

- How To eSignature Wisconsin Car Dealer Quitclaim Deed

- eSignature California Construction Contract Secure

- eSignature Tennessee Business Operations Moving Checklist Easy

- eSignature Georgia Construction Residential Lease Agreement Easy

- eSignature Kentucky Construction Letter Of Intent Free

- eSignature Kentucky Construction Cease And Desist Letter Easy

- eSignature Business Operations Document Washington Now

- How To eSignature Maine Construction Confidentiality Agreement

- eSignature Maine Construction Quitclaim Deed Secure

- eSignature Louisiana Construction Affidavit Of Heirship Simple

- eSignature Minnesota Construction Last Will And Testament Online

- eSignature Minnesota Construction Last Will And Testament Easy

- How Do I eSignature Montana Construction Claim

- eSignature Construction PPT New Jersey Later

- How Do I eSignature North Carolina Construction LLC Operating Agreement

- eSignature Arkansas Doctors LLC Operating Agreement Later

- eSignature Tennessee Construction Contract Safe