Form W 8EXP Rev February

What is the Form W-8EXP?

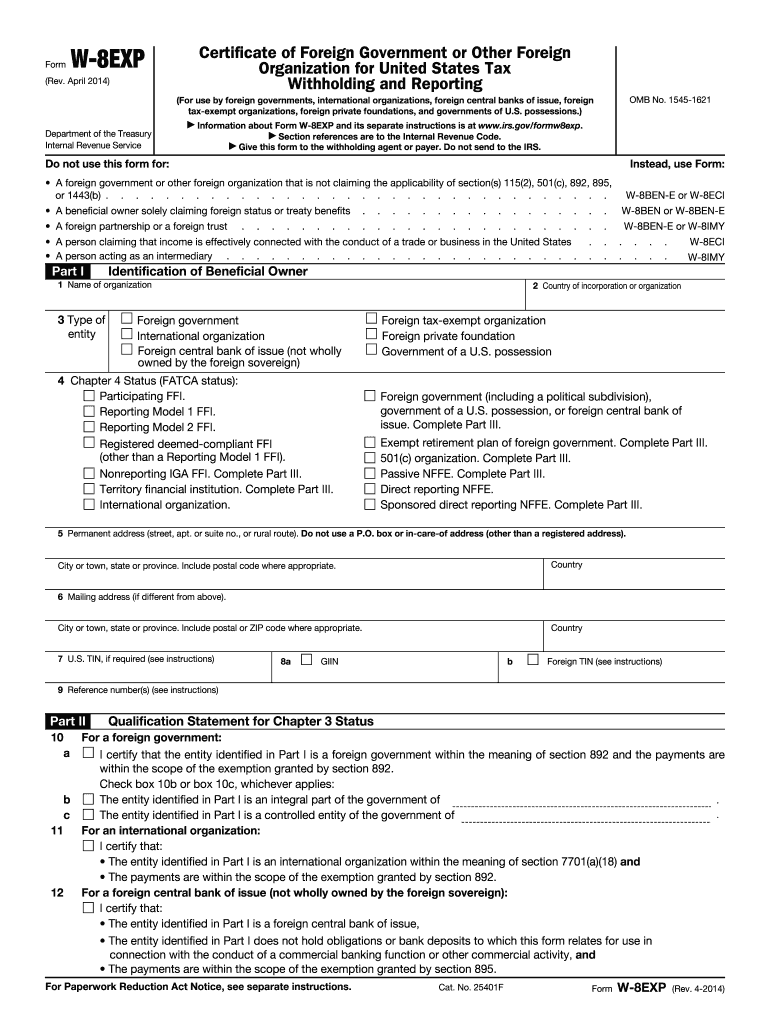

The Form W-8EXP is a document used by foreign entities to certify their status for withholding tax purposes. Specifically, it is designed for foreign governments, international organizations, and foreign central banks of issue. By submitting this form, these entities can claim exemption from certain U.S. tax withholding on income received from U.S. sources. The form is essential for compliance with U.S. tax regulations and ensures that the appropriate tax treatment is applied to payments made to foreign entities.

How to Use the Form W-8EXP

To effectively use the Form W-8EXP, foreign entities must complete it accurately and submit it to the U.S. withholding agent or financial institution that is responsible for making payments. The form requires specific information, including the entity's name, country of incorporation, and tax identification number. Once completed, the form should be kept on file by the withholding agent to demonstrate compliance with IRS regulations. It is important to ensure that the form is updated periodically, especially if there are changes in the entity's status or relevant tax laws.

Steps to Complete the Form W-8EXP

Completing the Form W-8EXP involves several key steps:

- Provide the name of the foreign entity and its country of incorporation.

- Indicate the type of entity and provide the relevant tax identification number.

- Complete the certification section, confirming the entity's status and eligibility for tax exemption.

- Sign and date the form to validate the information provided.

It is crucial to review the completed form for accuracy and completeness before submission to avoid delays or issues with tax compliance.

Legal Use of the Form W-8EXP

The legal use of the Form W-8EXP is governed by U.S. tax laws, which require foreign entities to provide documentation to claim tax exemptions. This form serves as proof of the entity's foreign status and eligibility for reduced withholding rates or exemptions under applicable tax treaties. Failure to provide a valid Form W-8EXP may result in the withholding agent applying the maximum withholding tax rate on payments made to the entity. Therefore, it is essential for foreign entities to understand their obligations and ensure compliance with IRS regulations.

Eligibility Criteria for the Form W-8EXP

To be eligible to use the Form W-8EXP, an entity must meet specific criteria:

- It must be a foreign government, international organization, or foreign central bank of issue.

- The entity must not be engaged in a trade or business in the United States.

- The entity must be claiming exemption from U.S. tax withholding under applicable provisions of U.S. tax law.

Entities that do not meet these criteria should consider other forms, such as the Form W-8BEN or W-8BEN-E, which cater to different types of foreign entities.

Form Submission Methods

The Form W-8EXP can be submitted through various methods depending on the requirements of the withholding agent. Common submission methods include:

- Electronic submission through secure online portals provided by financial institutions.

- Mailing a physical copy of the form directly to the withholding agent.

- In-person submission at designated offices or branches of the withholding agent.

It is important to confirm the preferred submission method with the withholding agent to ensure timely processing and compliance with IRS requirements.

Quick guide on how to complete form w 8exp rev february 2006

Prepare Form W 8EXP Rev February effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers a perfect eco-friendly substitute for conventional printed and signed documents, allowing you to locate the appropriate form and securely archive it online. airSlate SignNow equips you with all the resources necessary to generate, modify, and electronically sign your documents swiftly without delays. Manage Form W 8EXP Rev February on any platform with airSlate SignNow Android or iOS applications and enhance any document-centric process today.

How to alter and eSign Form W 8EXP Rev February without effort

- Obtain Form W 8EXP Rev February and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize relevant sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select your preferred method of delivering your form, via email, SMS, or invite link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Edit and eSign Form W 8EXP Rev February to ensure outstanding communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

When do I have to learn how to fill out a W-2 form?

Form W-2 is an obligatory form to be completed by every employer. Form W-2 doesn’t have to be filled out by the employee. It is given to inform the employee about the amount of his annual income and taxes withheld from it.You can find a lot of information here: http://bit.ly/2NjjlJi

-

How can I repeat the HSC Maharashtra board 2019? Which kind of form should I have to fill and when?

If you have passed HSC but not satisfied due to less marks and wants to appear again then you can go for HSC improvement exam. Just contact your Institute and fill out form of it and appear exam again.You can also apply online through site https://mahahsscboard.maharashtra.gov.in/ select class improvement and fill the form.

-

How do I fill out a W-4 form?

The main thing you need to put on your W-4 besides your name, address and social security number is whether you are married or single and the number of exemptions you wish to take to lower the amount of money with held for taxes from your paycheck. The number of exemptions refers to how many people you support, i. e. children. Say you are single and have 3 children, you can put down 4 exemptions, 1 for your self and 1 for each child. This means you will have more pay to take home because you aren’t having it with held from your paycheck. If you are single and have no children, you can either take 1 or 0 exemptions. If you make decent money, take 0 deductions, if you are barely making it you could probably take 1 exemption. Just realize that if you take exemptions, and not enough money is taken out of your check to pay your taxes, you will be liable for it come April 15th.If you are married and have no children and you make decent money, take 0 deductions. If you have children, only one spouse should take them as exemptions and it should be the one who makes the most money. For example, say your spouse is the major bread winner and you have 2 children, your spouse could take 4 exemptions (one for each member of the family) and then you would take 0 exemptions.Usually, it’s best to err on the side of caution and take the smaller amount of deductions so that you won’t owe a lot of money come tax time. If you’ve had too much with held it will come back to you as a refund.

-

How do I fill a W-9 Tax Form out?

Download a blank Form W-9To get started, download the latest Form W-9 from the IRS website at https://www.irs.gov/pub/irs-pdf/.... Check the date in the top left corner of the form as it is updated occasionally by the IRS. The current revision should read (Rev. December 2014). Click anywhere on the form and a menu appears at the top that will allow you to either print or save the document. If the browser you are using doesn’t allow you to type directly into the W-9 then save the form to your desktop and reopen using signNow Reader.General purposeThe general purpose of Form W-9 is to provide your correct taxpayer identification number (TIN) to an individual or entity (typically a company) that is required to submit an “information return” to the IRS to report an amount paid to you, or other reportable amount.U.S. personForm W-9 should only be completed by what the IRS calls a “U.S. person”. Some examples of U.S. persons include an individual who is a U.S. citizen or a U.S. resident alien. Partnerships, corporations, companies, or associations created or organized in the United States or under the laws of the United States are also U.S. persons.If you are not a U.S. person you should not use this form. You will likely need to provide Form W-8.Enter your informationLine 1 – Name: This line should match the name on your income tax return.Line 2 – Business name: This line is optional and would include your business name, trade name, DBA name, or disregarded entity name if you have any of these. You only need to complete this line if your name here is different from the name on line 1. See our related blog, What is a disregarded entity?Line 3 – Federal tax classification: Check ONE box for your U.S. federal tax classification. This should be the tax classification of the person or entity name that is entered on line 1. See our related blog, What is the difference between an individual and a sole proprietor?Limited Liability Company (LLC). If the name on line 1 is an LLC treated as a partnership for U.S. federal tax purposes, check the “Limited liability company” box and enter “P” in the space provided. If the LLC has filed Form 8832 or 2553 to be taxed as a corporation, check the “Limited liability company” box and in the space provided enter “C” for C corporation or “S” for S corporation. If it is a single-member LLC that is a disregarded entity, do not check the “Limited liability company” box; instead check the first box in line 3 “Individual/sole proprietor or single-member LLC.” See our related blog, What tax classification should an LLC select?Other (see instructions) – This line should be used for classifications that are not listed such as nonprofits, governmental entities, etc.Line 4 – Exemptions: If you are exempt from backup withholding enter your exempt payee code in the first space. If you are exempt from FATCA reporting enter your exemption from FATCA reporting code in the second space. Generally, individuals (including sole proprietors) are not exempt from backup withholding. See the “Specific Instructions” for line 4 shown with Form W-9 for more detailed information on exemptions.Line 5 – Address: Enter your address (number, street, and apartment or suite number). This is where the requester of the Form W-9 will mail your information returns.Line 6 – City, state and ZIP: Enter your city, state and ZIP code.Line 7 – Account numbers: This is an optional field to list your account number(s) with the company requesting your W-9 such as a bank, brokerage or vendor. We recommend that you do not list any account numbers as you may have to provide additional W-9 forms for accounts you do not include.Requester’s name and address: This is an optional section you can use to record the requester’s name and address you sent your W-9 to.Part I – Taxpayer Identification Number (TIN): Enter in your taxpayer identification number here. This is typically a social security number for an individual or sole proprietor and an employer identification number for a company. See our blog, What is a TIN number?Part II – Certification: Sign and date your form.For additional information visit w9manager.com.

-

Why did my employer give me a W-9 Form to fill out instead of a W-4 Form?

I wrote about the independent-contractor-vs-employee issue last year, see http://nctaxpro.wordpress.com/20...Broadly speaking, you are an employee when someone else - AKA the employer - has control over when and where you work and the processes by which you perform the work that you do for that individual. A DJ or bartender under some circumstances, I suppose, might qualify as an independent contractor at a restaurant, but the waitstaff, bus help, hosts, kitchen aides, etc. almost certainly would not.There's always risk in confronting an employer when faced with a situation like yours - my experience is that most employers know full well that they are violating the law when they treat employees as independent contractors, and for that reason they don't tolerate questions about that policy very well - so you definitely should tread cautiously if you want to keep this position. Nonetheless, I think you owe it to yourself to ask whether or not the restaurant intends to withhold federal taxes from your checks - if for no other reason than you don't want to get caught short when it comes to filing your own return, even if you don't intend to challenge the policy.

-

How do you fill out a W-2 form?

In general, the W-2 form is divided into two parts each with numerous fields to be completed carefully by an employer. The section on the left contains both the employer's and employee`s names and contact information as well social security number and identification number.You can find a lot of information here: http://bit.ly/2NjjlJi

-

How should I fill out my w-2 or w-4 form?

To calculate how much you should withhold you need to calculate two things. Step 1 - Estimate your TaxFirst go to Intuit's TaxCaster (Link -> TurboTax® TaxCaster, Free Tax Calculator, Free Tax Refund Estimator) and put in your family's information and income (estimate what you'll make in 2016 before taxes and put zero for federal and state taxes withheld, don't worry that the TaxCaster is for 2015, you're just trying to get a general number). Once you enter in your correct information it will tell you what you would owe to the federal government.Step 2 - Estimate your Tax Withholding Based on Allowances ClaimedSecond go to Paycheck City (Link -> Salary Paycheck Calculator | Payroll Calculator | Paycheck City) select the correct state, enter in your pay information. Select married filing jointly then try putting in 3 or 4 for withholdings. Once you calculate it will tell you how much taxes are being withheld. Set the pay frequency to annual instead of bi-monthly or bi-weekly since you need a total number for the year. Try changing the Federal withholding allowance until you have enough Federal taxes withheld to cover the amount calculated in the TaxCaster. The Federal withholding allowance number that covers all taxes owed should be the number claimed on your W-4.Don't worry too much about your state. If you claim the same as Federal what will usually happen is you might get a small refund for Federal and owe a small amount for State. I usually end up getting a Federal refund for ~$100 and owing state for just over $100. In the end I net owing state $20-40.Remember, the more details you can put into the TaxCaster and Paycheck City the more accurate your tax estimate will be.

-

How can you fill out the W-8BEN form (no tax treaty)?

A payer of a reportable payment may treat a payee as foreign if the payer receives an applicable Form W-8 from the payee. Provide this Form W-8BEN to the requestor if you are a foreign individual that is a participating payee receiving payments in settlement of payment card transactions that are not effectively connected with a U.S. trade or business of the payee.As stated by Mr. Ivanov below, Since Jordan is not one of the countries listed as a tax treaty country, it appears that you would only complete Part I of the Form W-8BEN, Sign your name and date the Certification in Part III.http://www.irs.gov/pub/irs-pdf/i...Hope this is helpful.

Create this form in 5 minutes!

How to create an eSignature for the form w 8exp rev february 2006

How to make an eSignature for your Form W 8exp Rev February 2006 in the online mode

How to generate an electronic signature for the Form W 8exp Rev February 2006 in Google Chrome

How to create an electronic signature for signing the Form W 8exp Rev February 2006 in Gmail

How to generate an electronic signature for the Form W 8exp Rev February 2006 straight from your smartphone

How to make an electronic signature for the Form W 8exp Rev February 2006 on iOS devices

How to make an eSignature for the Form W 8exp Rev February 2006 on Android OS

People also ask

-

What is w8exp and how does it work?

The w8exp form is used by non-U.S. persons to signNow their foreign status for tax withholding purposes. With airSlate SignNow, users can easily fill out, sign, and send w8exp forms electronically, streamlining the documentation process.

-

How much does it cost to use airSlate SignNow for w8exp forms?

airSlate SignNow offers flexible pricing plans that cater to businesses of any size. The pricing for using the service to manage w8exp forms is competitive and provides signNow savings compared to traditional methods.

-

What features does airSlate SignNow offer for w8exp processing?

airSlate SignNow includes features like template creation, automated reminders, and secure storage, which enhance the handling of w8exp forms. These tools save time and reduce the risk of errors during the signing process.

-

What are the benefits of using airSlate SignNow for w8exp forms?

By using airSlate SignNow for w8exp forms, businesses can expedite their operations and ensure compliance with IRS requirements. The platform is user-friendly and designed to enhance productivity while providing a seamless signing experience.

-

Can I integrate airSlate SignNow with other tools for w8exp management?

Yes, airSlate SignNow integrates with popular applications such as CRM systems and cloud storage. These integrations allow for more efficient management of w8exp documents as part of your existing workflows.

-

Is airSlate SignNow secure for handling sensitive w8exp information?

Absolutely, airSlate SignNow prioritizes security and employs robust encryption protocols to protect sensitive w8exp data. Users can be confident that their documents are safe and compliant with regulations.

-

How can small businesses benefit from using airSlate SignNow for w8exp forms?

Small businesses can benefit signNowly from using airSlate SignNow for w8exp forms by saving time and reducing costs associated with paper-based processes. The platform offers a cost-effective solution that enhances efficiency in document management.

Get more for Form W 8EXP Rev February

- Brand ambassador agreement digital docx form

- Errata sheet pdf 321457819 form

- Cdph8230 form

- Worldcare claim form now health international

- Fire and tornado drill record form

- Representation anonymity form

- Credential request for kansas residents temporarily out of state form

- Mf 206 liquid fuel carrier petroleum products report rev 5 24 form

Find out other Form W 8EXP Rev February

- Can I Electronic signature West Virginia Courts PPT

- Send Sign PDF Free

- How To Send Sign PDF

- Send Sign Word Online

- Send Sign Word Now

- Send Sign Word Free

- Send Sign Word Android

- Send Sign Word iOS

- Send Sign Word iPad

- How To Send Sign Word

- Can I Send Sign Word

- How Can I Send Sign Word

- Send Sign Document Online

- Send Sign Document Computer

- Send Sign Document Myself

- Send Sign Document Secure

- Send Sign Document iOS

- Send Sign Document iPad

- How To Send Sign Document

- Fax Sign PDF Online