Estimated Tax Payment Voucher 1 1 $ Important Information Mass

What is the Estimated Tax Payment Voucher 1 1 $ Important Information Mass

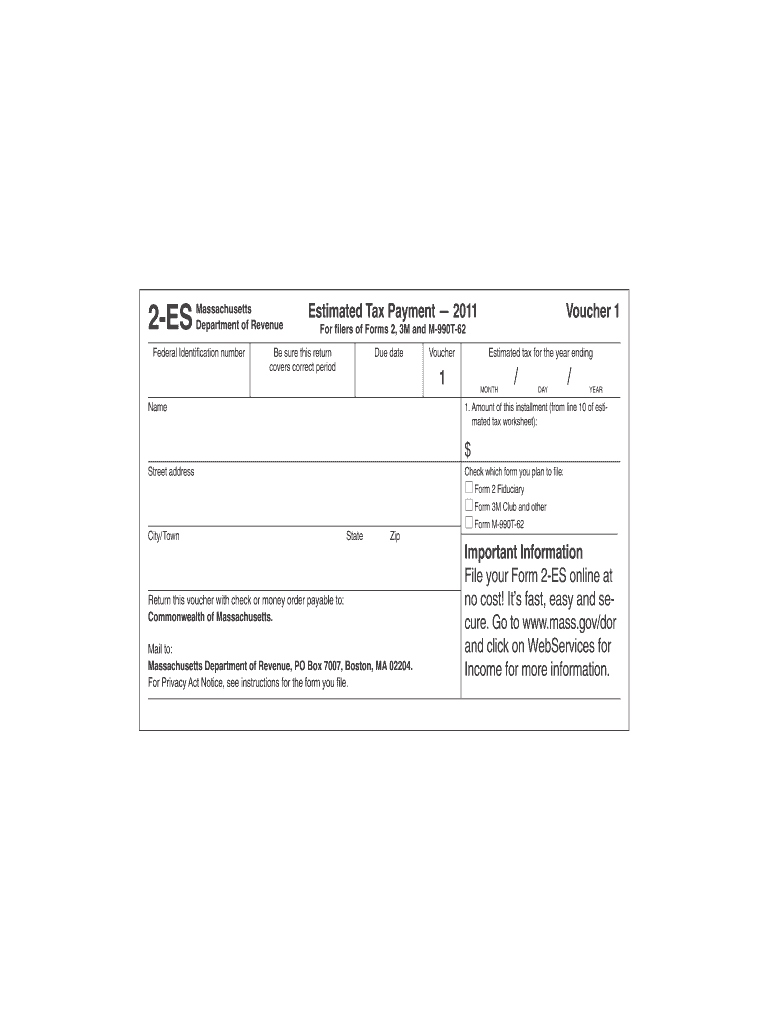

The Estimated Tax Payment Voucher 1 1 $ is a crucial document for individuals and businesses in Massachusetts who need to report and pay estimated taxes. This form is typically used by taxpayers who expect to owe tax of $500 or more when they file their annual tax return. It allows for the timely submission of estimated tax payments to avoid penalties and interest charges. Understanding the importance of this voucher is essential for maintaining compliance with state tax laws.

Steps to complete the Estimated Tax Payment Voucher 1 1 $ Important Information Mass

Completing the Estimated Tax Payment Voucher involves several key steps to ensure accuracy and compliance. First, gather all necessary financial information, including income estimates and deductions. Next, calculate your estimated tax liability based on your expected income for the year. Fill out the voucher with your personal information, including your name, address, and Social Security number. Be sure to include the payment amount and select the appropriate payment method. Finally, review the form for any errors before submitting it to the Massachusetts Department of Revenue.

Legal use of the Estimated Tax Payment Voucher 1 1 $ Important Information Mass

The Estimated Tax Payment Voucher is legally binding when filled out and submitted according to Massachusetts tax regulations. To ensure its validity, taxpayers must adhere to the guidelines set forth by the Massachusetts Department of Revenue. This includes providing accurate information and making payments on time. Failure to comply with these legal requirements can result in penalties or interest charges on unpaid taxes.

Filing Deadlines / Important Dates

Timely submission of the Estimated Tax Payment Voucher is critical for avoiding penalties. In Massachusetts, estimated tax payments are typically due on the fifteenth day of April, June, September, and January. Taxpayers should mark these dates on their calendars to ensure they submit their payments on time. Missing a deadline may lead to additional fees and complications in tax filing.

Who Issues the Form

The Estimated Tax Payment Voucher is issued by the Massachusetts Department of Revenue. This state agency is responsible for administering tax laws and ensuring compliance among taxpayers. It provides the necessary forms and guidelines for individuals and businesses to fulfill their tax obligations accurately and efficiently.

Penalties for Non-Compliance

Failure to submit the Estimated Tax Payment Voucher on time can result in significant penalties. Taxpayers may face interest charges on any unpaid amounts, as well as additional fines for late submissions. Understanding these penalties can motivate timely compliance and help taxpayers avoid unnecessary financial burdens.

Quick guide on how to complete estimated tax payment 2011 voucher 1 1 important information mass

Effortlessly Prepare [SKS] on Any Device

The management of online documents has become increasingly popular among businesses and individuals. It offers a superb eco-friendly alternative to conventional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and electronically sign your documents quickly without delays. Manage [SKS] on any platform using airSlate SignNow's Android or iOS applications and enhance any document-based process today.

The Simplest Method to Edit and eSign [SKS] with Ease

- Find [SKS] and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically offers for this purpose.

- Create your eSignature using the Sign tool, which only takes a few seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to save your changes.

- Select your preferred delivery method for your form: by email, SMS, invite link, or download it to your computer.

Forget about misplaced files, cumbersome form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs with just a few clicks from any device you prefer. Edit and eSign [SKS] and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Estimated Tax Payment Voucher 1 1 $ Important Information Mass

Create this form in 5 minutes!

How to create an eSignature for the estimated tax payment 2011 voucher 1 1 important information mass

How to generate an electronic signature for your Estimated Tax Payment 2011 Voucher 1 1 Important Information Mass online

How to create an eSignature for your Estimated Tax Payment 2011 Voucher 1 1 Important Information Mass in Google Chrome

How to generate an electronic signature for putting it on the Estimated Tax Payment 2011 Voucher 1 1 Important Information Mass in Gmail

How to generate an eSignature for the Estimated Tax Payment 2011 Voucher 1 1 Important Information Mass straight from your mobile device

How to make an electronic signature for the Estimated Tax Payment 2011 Voucher 1 1 Important Information Mass on iOS

How to make an electronic signature for the Estimated Tax Payment 2011 Voucher 1 1 Important Information Mass on Android devices

People also ask

-

What is the Estimated Tax Payment Voucher 1 1 $ Important Information Mass?

The Estimated Tax Payment Voucher 1 1 $ Important Information Mass is a document used by taxpayers in Massachusetts to facilitate their estimated tax payments. It helps individuals and businesses report and remit their estimated tax liabilities to the state. Using this voucher ensures compliance with state tax regulations.

-

How can airSlate SignNow help with the Estimated Tax Payment Voucher 1 1 $ Important Information Mass?

airSlate SignNow provides a user-friendly platform to electronically sign and send your Estimated Tax Payment Voucher 1 1 $ Important Information Mass. Our service streamlines the process, allowing you to complete tax documents quickly and securely. This can save you time and reduce the hassle of managing paper forms.

-

Is airSlate SignNow affordable for small businesses needing the Estimated Tax Payment Voucher 1 1 $ Important Information Mass?

Yes, airSlate SignNow offers cost-effective pricing plans suited for businesses of all sizes, including small businesses needing the Estimated Tax Payment Voucher 1 1 $ Important Information Mass. With competitive pricing and various features, you can choose a plan that best fits your budget and document management needs.

-

What features does airSlate SignNow offer for managing the Estimated Tax Payment Voucher 1 1 $ Important Information Mass?

airSlate SignNow offers features like document templates, real-time tracking, and secure eSigning for the Estimated Tax Payment Voucher 1 1 $ Important Information Mass. These functionalities simplify the process of preparing, signing, and sending tax documents while ensuring that they are secure and compliant with regulations.

-

Can I integrate airSlate SignNow with other software for the Estimated Tax Payment Voucher 1 1 $ Important Information Mass?

Yes, airSlate SignNow provides integrations with a variety of other software platforms to enhance your workflow related to the Estimated Tax Payment Voucher 1 1 $ Important Information Mass. This interoperability allows for seamless data transfer and improved efficiency, enabling you to use our service alongside your existing tools.

-

What are the benefits of using airSlate SignNow for the Estimated Tax Payment Voucher 1 1 $ Important Information Mass compared to traditional methods?

Using airSlate SignNow for the Estimated Tax Payment Voucher 1 1 $ Important Information Mass offers numerous benefits over traditional methods. It eliminates the need for paper, reduces the risk of errors, and speeds up the signing and submission process. Additionally, our platform securely stores your documents, providing easy access whenever you need it.

-

Is there customer support available for assistance with the Estimated Tax Payment Voucher 1 1 $ Important Information Mass?

Absolutely! airSlate SignNow provides dedicated customer support to assist you with any questions or issues related to the Estimated Tax Payment Voucher 1 1 $ Important Information Mass. Our team is available through various channels to ensure you get the help you need in real-time.

Get more for Estimated Tax Payment Voucher 1 1 $ Important Information Mass

Find out other Estimated Tax Payment Voucher 1 1 $ Important Information Mass

- How Do I Sign Rhode Island Real Estate Form

- Can I Sign Vermont Real Estate Document

- How To Sign Wyoming Orthodontists Document

- Help Me With Sign Alabama Courts Form

- Help Me With Sign Virginia Police PPT

- How To Sign Colorado Courts Document

- Can I eSign Alabama Banking PPT

- How Can I eSign California Banking PDF

- How To eSign Hawaii Banking PDF

- How Can I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- Help Me With eSign Hawaii Banking Document

- How To eSign Hawaii Banking Document

- Can I eSign Hawaii Banking Presentation

- Can I Sign Iowa Courts Form

- Help Me With eSign Montana Banking Form

- Can I Sign Kentucky Courts Document

- How To eSign New York Banking Word

- Can I eSign South Dakota Banking PPT