RPD 41329, Sustainable Building Tax Credit Claim Form Tax Newmexico

What is the RPD 41329, Sustainable Building Tax Credit Claim Form Tax Newmexico

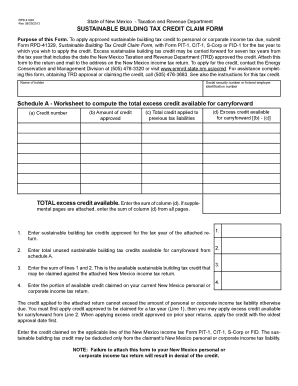

The RPD 41329, Sustainable Building Tax Credit Claim Form Tax Newmexico, is a document used by taxpayers in New Mexico to claim tax credits for sustainable building projects. This form is specifically designed for individuals and businesses that have made investments in energy-efficient construction or retrofitting of buildings. By completing this form, claimants can potentially reduce their tax liability based on the costs associated with qualifying sustainable improvements.

How to obtain the RPD 41329, Sustainable Building Tax Credit Claim Form Tax Newmexico

The RPD 41329 form can be obtained from the New Mexico Taxation and Revenue Department's official website. Taxpayers can download the form directly in PDF format for easy access. Additionally, physical copies may be available at local tax offices or through authorized agents. It is advisable to ensure that you are using the most current version of the form to avoid any compliance issues.

Steps to complete the RPD 41329, Sustainable Building Tax Credit Claim Form Tax Newmexico

Completing the RPD 41329 form involves several key steps:

- Gather all necessary documentation related to your sustainable building project, including receipts and invoices.

- Fill out the form accurately, providing details about the project, including the type of improvements made and their costs.

- Ensure that you meet all eligibility criteria for the tax credit, as outlined in the form instructions.

- Review the completed form for accuracy and completeness.

- Submit the form according to the provided instructions, either online, by mail, or in person.

Legal use of the RPD 41329, Sustainable Building Tax Credit Claim Form Tax Newmexico

The RPD 41329 form is legally binding when completed and submitted in accordance with New Mexico tax laws. To ensure its validity, the form must be signed by the taxpayer or an authorized representative. Electronic signatures are acceptable, provided they comply with the Electronic Signatures in Global and National Commerce Act (ESIGN) and other relevant regulations. It is important to retain copies of all submitted documents for future reference and potential audits.

Eligibility Criteria

To qualify for the tax credit claimed through the RPD 41329 form, taxpayers must meet specific eligibility criteria, including:

- The improvements must be made to a building located in New Mexico.

- Projects must comply with state-defined sustainability standards.

- Taxpayers must provide documentation proving the costs incurred for the eligible improvements.

- Claimants must file the form within the designated tax year to receive the credit.

Form Submission Methods (Online / Mail / In-Person)

The RPD 41329 form can be submitted through multiple methods to accommodate taxpayer preferences:

- Online: Submit the form electronically via the New Mexico Taxation and Revenue Department's online portal.

- Mail: Send the completed form to the designated address provided in the form instructions.

- In-Person: Deliver the form directly to a local tax office for immediate processing.

Quick guide on how to complete rpd 41329 sustainable building tax credit claim form tax newmexico

Effortlessly Complete RPD 41329, Sustainable Building Tax Credit Claim Form Tax Newmexico on Any Device

Digital document management has gained immense traction among businesses and individuals alike. It offers an ideal eco-friendly substitute to conventional printed and signed papers, allowing you to access the required forms and securely store them online. airSlate SignNow equips you with all the essential tools to create, edit, and electronically sign your documents promptly without delays. Manage RPD 41329, Sustainable Building Tax Credit Claim Form Tax Newmexico on any device using the airSlate SignNow applications for Android or iOS and streamline any document-related workflow today.

How to Modify and eSign RPD 41329, Sustainable Building Tax Credit Claim Form Tax Newmexico with Ease

- Obtain RPD 41329, Sustainable Building Tax Credit Claim Form Tax Newmexico and click on Get Form to begin.

- Make use of the tools available to finish your form.

- Emphasize pertinent sections of your documents or obscure sensitive data with features specifically offered by airSlate SignNow.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all details and click on the Done button to save your updates.

- Choose how you want to deliver your form, via email, SMS, invitational link, or download it to your computer.

Eliminate worries about lost or misfiled documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs swiftly from any device of your choice. Edit and eSign RPD 41329, Sustainable Building Tax Credit Claim Form Tax Newmexico and ensure effective communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the rpd 41329 sustainable building tax credit claim form tax newmexico

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the RPD 41329, Sustainable Building Tax Credit Claim Form Tax Newmexico?

The RPD 41329, Sustainable Building Tax Credit Claim Form Tax Newmexico is a state tax form that allows businesses to claim tax credits for investments in sustainable building projects. This form is essential for anyone seeking to maximize their tax benefits while promoting eco-friendly practices in New Mexico.

-

How can airSlate SignNow help with the RPD 41329, Sustainable Building Tax Credit Claim Form Tax Newmexico?

airSlate SignNow simplifies the process of obtaining signatures for the RPD 41329, Sustainable Building Tax Credit Claim Form Tax Newmexico. With our platform, you can easily fill out, send, and eSign your documents securely, ensuring a hassle-free experience in managing your tax credit claims.

-

Is there a cost associated with using airSlate SignNow for the RPD 41329 form?

Yes, there is a subscription fee for using airSlate SignNow, which varies based on your chosen plan. The platform offers various pricing tiers that provide a cost-effective solution for businesses looking to manage documents like the RPD 41329, Sustainable Building Tax Credit Claim Form Tax Newmexico.

-

Are there any features specifically designed for the RPD 41329 form in airSlate SignNow?

airSlate SignNow offers features tailored to manage forms like the RPD 41329, Sustainable Building Tax Credit Claim Form Tax Newmexico. These include customizable document templates, tracking for signed agreements, and secure storage options, enhancing your workflow for tax credit claims.

-

What are the benefits of using airSlate SignNow for tax documents?

Using airSlate SignNow for documents like the RPD 41329, Sustainable Building Tax Credit Claim Form Tax Newmexico, helps streamline your document management process. You can save time, reduce paperwork, and ensure compliance with legal requirements, all while maintaining full control over your documents.

-

Can I integrate airSlate SignNow with other software for my tax filing needs?

Yes, airSlate SignNow offers integrations with various third-party applications, enhancing your workflow for forms like the RPD 41329, Sustainable Building Tax Credit Claim Form Tax Newmexico. This enables you to synchronize your data, improving efficiency in your overall tax filing process.

-

Is airSlate SignNow secure for handling the RPD 41329 tax form?

Absolutely, airSlate SignNow prioritizes security and compliance, ensuring that your RPD 41329, Sustainable Building Tax Credit Claim Form Tax Newmexico is handled securely. We employ advanced encryption methods and strict data protection measures to keep your documents safe and confidential.

Get more for RPD 41329, Sustainable Building Tax Credit Claim Form Tax Newmexico

- Expedite 30 form

- Rs 94802 improvement of immovable by contractor claims form

- Hereinafter referred to as vendor does hereby grant bargain sell convey form

- Located at the following address hereinafter form

- Referred to as vendor does hereby grant bargain sell convey deliver and warrant with full guarantee form

- Hereinafter referred to as vendor does hereby grant bargain sell convey deliver and warrant with full form

- Hereinafter referred to as vendor does hereby quitclaim give grant sell convey and deliver unto form

- And two individuals as joint tenants with rights form

Find out other RPD 41329, Sustainable Building Tax Credit Claim Form Tax Newmexico

- eSignature West Virginia Construction Lease Agreement Myself

- How To eSignature Alabama Education POA

- How To eSignature California Education Separation Agreement

- eSignature Arizona Education POA Simple

- eSignature Idaho Education Lease Termination Letter Secure

- eSignature Colorado Doctors Business Letter Template Now

- eSignature Iowa Education Last Will And Testament Computer

- How To eSignature Iowa Doctors Business Letter Template

- Help Me With eSignature Indiana Doctors Notice To Quit

- eSignature Ohio Education Purchase Order Template Easy

- eSignature South Dakota Education Confidentiality Agreement Later

- eSignature South Carolina Education Executive Summary Template Easy

- eSignature Michigan Doctors Living Will Simple

- How Do I eSignature Michigan Doctors LLC Operating Agreement

- How To eSignature Vermont Education Residential Lease Agreement

- eSignature Alabama Finance & Tax Accounting Quitclaim Deed Easy

- eSignature West Virginia Education Quitclaim Deed Fast

- eSignature Washington Education Lease Agreement Form Later

- eSignature Missouri Doctors Residential Lease Agreement Fast

- eSignature Wyoming Education Quitclaim Deed Easy