Form M99, Credit for Military Service in a Combat Zone Minnesota Revenue State Mn

What is the Form M99, Credit For Military Service In A Combat Zone Minnesota Revenue State Mn

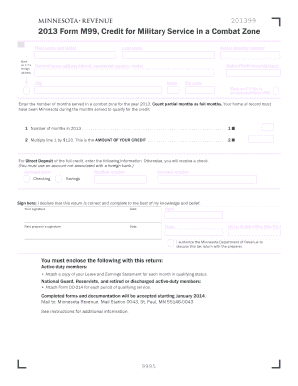

The Form M99 is a specific document used in Minnesota to provide credits for military service performed in a combat zone. This form is essential for veterans and active-duty military members who wish to claim tax benefits related to their service. It allows eligible individuals to receive credits that can significantly reduce their tax liability, reflecting the state's recognition of their service and sacrifices. Understanding the purpose and implications of the Form M99 is crucial for those who qualify.

How to use the Form M99, Credit For Military Service In A Combat Zone Minnesota Revenue State Mn

Using the Form M99 involves several steps to ensure proper completion and submission. First, individuals must gather necessary documentation that verifies their military service in a combat zone. This may include service records or deployment orders. Next, the form must be filled out accurately, providing personal information and details regarding the combat service. Once completed, the form can be submitted either electronically or by mail to the Minnesota Department of Revenue, depending on the preferred method of filing.

Steps to complete the Form M99, Credit For Military Service In A Combat Zone Minnesota Revenue State Mn

Completing the Form M99 requires careful attention to detail. Follow these steps for successful submission:

- Obtain the Form M99 from the Minnesota Department of Revenue website or through authorized channels.

- Gather all required documentation that confirms your military service in a combat zone.

- Fill out the form, ensuring that all personal information is accurate and complete.

- Review the form for any errors or omissions before submission.

- Submit the completed form electronically or by mailing it to the appropriate address.

Eligibility Criteria

To qualify for the credits available through the Form M99, applicants must meet specific eligibility criteria. Generally, this includes being a veteran or an active-duty service member who has served in a designated combat zone. Additionally, the individual must have been deployed during the specified time frames recognized by the state. It is important to review the eligibility requirements thoroughly to ensure compliance before submitting the form.

Legal use of the Form M99, Credit For Military Service In A Combat Zone Minnesota Revenue State Mn

The legal use of the Form M99 is governed by state tax laws that recognize the contributions of military personnel. When properly completed and submitted, the form serves as a legal document that entitles eligible individuals to claim specific tax credits. Adhering to the guidelines set forth by the Minnesota Department of Revenue ensures that the form is valid and that the credits claimed are legally recognized. Understanding these legal frameworks is vital for all applicants.

Form Submission Methods (Online / Mail / In-Person)

The Form M99 can be submitted through various methods, providing flexibility for applicants. Individuals may choose to file the form online through the Minnesota Department of Revenue's e-filing system, which offers a streamlined process. Alternatively, the form can be printed and mailed to the designated address. In-person submissions may also be possible at local revenue offices, although checking for availability and hours is recommended. Each method has its own advantages, so select the one that best fits your needs.

Quick guide on how to complete form m99 credit for military service in a combat zone minnesota revenue state mn

Complete Form M99, Credit For Military Service In A Combat Zone Minnesota Revenue State Mn seamlessly on any gadget

Online document management has become popular with businesses and individuals alike. It offers a perfect eco-friendly alternative to traditional printed and signed documents, as you can easily access the necessary form and securely store it online. airSlate SignNow provides you with all the resources you need to create, modify, and eSign your files quickly without delays. Manage Form M99, Credit For Military Service In A Combat Zone Minnesota Revenue State Mn on any gadget with airSlate SignNow Android or iOS applications and enhance any document-related task today.

The simplest way to modify and eSign Form M99, Credit For Military Service In A Combat Zone Minnesota Revenue State Mn effortlessly

- Obtain Form M99, Credit For Military Service In A Combat Zone Minnesota Revenue State Mn and click Get Form to commence.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically provides for this purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal significance as a conventional wet ink signature.

- Verify the information and click on the Done button to store your changes.

- Choose how you would like to submit your form, via email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow takes care of all your document management needs in just a few clicks from a device of your preference. Modify and eSign Form M99, Credit For Military Service In A Combat Zone Minnesota Revenue State Mn and ensure outstanding communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form m99 credit for military service in a combat zone minnesota revenue state mn

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form M99, Credit For Military Service In A Combat Zone Minnesota Revenue State Mn?

Form M99 is a tax credit specifically designed for Minnesota residents who served in active duty in a combat zone. This credit allows qualified individuals to receive a financial benefit that can reduce their state tax liability. Understanding this form is crucial for maximizing tax savings for military service members.

-

How can airSlate SignNow help me with Form M99, Credit For Military Service In A Combat Zone Minnesota Revenue State Mn?

With airSlate SignNow, you can easily create, send, and eSign Form M99, ensuring a seamless filing process. Our platform simplifies document management, allowing you to focus on your military service benefits without the hassle of paperwork. Utilize our user-friendly interface to expedite your tax credit claims efficiently.

-

Is there a fee associated with using airSlate SignNow for Form M99, Credit For Military Service In A Combat Zone Minnesota Revenue State Mn?

airSlate SignNow offers a cost-effective solution with a variety of pricing plans to fit your needs. While there may be a subscription fee, the time and money saved in managing documentation may outweigh these costs. Rest easy knowing that you can efficiently handle Form M99 without incurring hidden fees.

-

What are the benefits of using airSlate SignNow for signing Form M99, Credit For Military Service In A Combat Zone Minnesota Revenue State Mn?

Using airSlate SignNow provides numerous benefits, including faster processing times and secure storage of your Form M99. The platform ensures compliance with legal standards while providing a convenient solution for eSigning. Additionally, you can track the document’s status, which adds peace of mind during the submission process.

-

Can I integrate airSlate SignNow with other software for processing Form M99, Credit For Military Service In A Combat Zone Minnesota Revenue State Mn?

Yes, airSlate SignNow offers integrations with various software tools that can help streamline your workflow for Form M99. Whether it’s accounting software or another document management system, our platform can coordinate with your existing applications. This ensures a seamless transition when managing your tax credit documentation.

-

What features does airSlate SignNow offer for managing Form M99, Credit For Military Service In A Combat Zone Minnesota Revenue State Mn?

airSlate SignNow provides a range of features designed to enhance document management, including customizable templates and audit trails. You can also access mobile functionality, allowing you to manage Form M99 on-the-go. Our robust security measures protect your personal and financial information while facilitating efficient eSigning.

-

How does airSlate SignNow ensure the security of my information when processing Form M99, Credit For Military Service In A Combat Zone Minnesota Revenue State Mn?

Security is a top priority for airSlate SignNow, especially when handling sensitive documents like Form M99. We utilize encryption and secure servers to protect your data from unauthorized access. Additionally, our platform is compliant with industry standards, ensuring your information remains confidential during the entire signing process.

Get more for Form M99, Credit For Military Service In A Combat Zone Minnesota Revenue State Mn

- Ampquotsponsorship agreementampquot or ampquotagreementampquot jarhead kart form

- Notice of rejected bid form

- Notice to disregard letter indicating inability to ship form

- Assignment of certificate of depositsavings account to the form

- Notice of upcoming temporary interruption of service form

- Notice of charge account credit limit raise form

- Sales agency agreement servicespractical law form

- Notice of credit limit conversion to c form

Find out other Form M99, Credit For Military Service In A Combat Zone Minnesota Revenue State Mn

- Sign Rhode Island Finance & Tax Accounting Cease And Desist Letter Computer

- Sign Vermont Finance & Tax Accounting RFP Later

- Can I Sign Wyoming Finance & Tax Accounting Cease And Desist Letter

- Sign California Government Job Offer Now

- How Do I Sign Colorado Government Cease And Desist Letter

- How To Sign Connecticut Government LLC Operating Agreement

- How Can I Sign Delaware Government Residential Lease Agreement

- Sign Florida Government Cease And Desist Letter Online

- Sign Georgia Government Separation Agreement Simple

- Sign Kansas Government LLC Operating Agreement Secure

- How Can I Sign Indiana Government POA

- Sign Maryland Government Quitclaim Deed Safe

- Sign Louisiana Government Warranty Deed Easy

- Sign Government Presentation Massachusetts Secure

- How Can I Sign Louisiana Government Quitclaim Deed

- Help Me With Sign Michigan Government LLC Operating Agreement

- How Do I Sign Minnesota Government Quitclaim Deed

- Sign Minnesota Government Affidavit Of Heirship Simple

- Sign Missouri Government Promissory Note Template Fast

- Can I Sign Missouri Government Promissory Note Template