Form R 1035

What is the Form R 1035

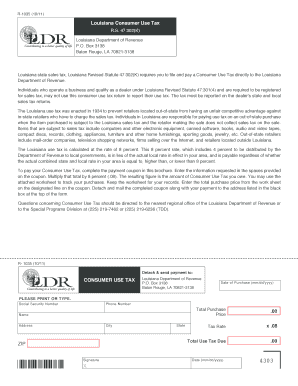

The Form R 1035 is a tax document used in the state of Louisiana to report consumer use tax. This form is essential for individuals and businesses that purchase goods or services from out-of-state vendors without paying the corresponding sales tax. By completing this form, taxpayers ensure compliance with state tax regulations and contribute to the funding of public services in Louisiana.

How to use the Form R 1035

Using the Form R 1035 involves several steps to accurately report your use tax liability. First, gather all necessary information regarding your purchases, including dates, descriptions, and amounts. Next, fill out the form by providing your personal or business information, detailing the items purchased, and calculating the total use tax owed. Finally, submit the completed form to the Louisiana Department of Revenue by the specified deadline.

Steps to complete the Form R 1035

Completing the Form R 1035 requires careful attention to detail. Follow these steps:

- Collect receipts and documentation for all out-of-state purchases.

- Enter your name, address, and taxpayer identification number at the top of the form.

- List each item purchased, including its cost and the corresponding use tax rate.

- Calculate the total use tax owed based on the items listed.

- Sign and date the form to certify that the information provided is accurate.

Legal use of the Form R 1035

The legal use of the Form R 1035 ensures compliance with Louisiana tax laws. It is crucial to file this form accurately and on time to avoid penalties. The form serves as a legal declaration of your use tax liability, and failure to submit it can result in fines or additional tax assessments. Proper use of this form contributes to the integrity of the state’s tax system.

Filing Deadlines / Important Dates

Filing deadlines for the Form R 1035 are typically aligned with the state’s tax calendar. Taxpayers should be aware of the annual deadline, which is usually set for April 15 of the following year after the tax year ends. It is important to stay informed about any changes to these deadlines and to file the form promptly to avoid late fees.

Required Documents

When completing the Form R 1035, certain documents are required to substantiate your claims. These include:

- Receipts for out-of-state purchases.

- Invoices from vendors.

- Any previous correspondence with the Louisiana Department of Revenue regarding use tax.

Having these documents ready will facilitate a smoother filing process and ensure that all reported information is accurate.

Quick guide on how to complete form r 1035

Complete Form R 1035 effortlessly on any gadget

Web-based document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly substitute to traditional printed and signed files, as you can obtain the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, modify, and eSign your documents quickly without any holdups. Manage Form R 1035 on any system with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to modify and eSign Form R 1035 with ease

- Find Form R 1035 and then click Get Form to commence.

- Utilize the tools we offer to complete your document.

- Highlight pertinent sections of your documents or obscure sensitive data with tools that airSlate SignNow provides specifically for this purpose.

- Create your signature using the Sign utility, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Verify the information and then click on the Done button to preserve your modifications.

- Choose how you'd like to send your form, via email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tiring form searches, or errors that necessitate printing new copies. airSlate SignNow addresses all your document administration needs in just a few clicks from a device of your preference. Modify and eSign Form R 1035 and ensure outstanding communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form r 1035

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form R 1035, and why is it important?

Form R 1035 is a crucial document used for specific tax purposes. It enables businesses to report certain financial information accurately. Understanding how to fill out form R 1035 correctly can help avoid penalties and ensure compliance with tax regulations.

-

How does airSlate SignNow facilitate the completion of form R 1035?

airSlate SignNow provides an intuitive platform for electronically signing and sending documents, including form R 1035. With its user-friendly interface, users can quickly complete and eSign the form, ensuring a hassle-free process. This can save time and reduce errors when submitting your form R 1035.

-

What are the pricing options for using airSlate SignNow for form R 1035?

airSlate SignNow offers competitive pricing plans designed to fit various business needs. Depending on the features required, users can choose from different subscription tiers that provide access to essential tools for managing form R 1035 and other documents. This cost-effective solution ensures that organizations can easily handle their eSigning needs.

-

Can airSlate SignNow integrate with other software for handling form R 1035?

Yes, airSlate SignNow supports integration with various software applications, making the management of form R 1035 even more efficient. Integrating with tools like CRMs or document management systems can streamline your workflow. This integration capability enhances productivity and decreases the time spent on paperwork.

-

What features does airSlate SignNow offer for managing documents like form R 1035?

airSlate SignNow includes features such as document templates, advanced eSignature capabilities, and status tracking. These features ensure that filling out and submitting form R 1035 is straightforward and organized. Users can save time and minimize errors with these robust capabilities.

-

Is it safe to use airSlate SignNow for form R 1035 submissions?

Absolutely! airSlate SignNow employs industry-standard security measures to protect sensitive information when processing form R 1035. With encryption and secure cloud storage, businesses can trust that their data remains confidential and safe from unauthorized access.

-

Who can benefit from using airSlate SignNow for form R 1035?

Businesses of all sizes can benefit from using airSlate SignNow for managing form R 1035. Whether you're a small business owner or part of a large corporation, the streamlined eSigning process can enhance efficiency and ensure compliance. It's an ideal solution for those looking to simplify their document management.

Get more for Form R 1035

- Form 814

- Notice of appearance and intent to represent form

- Form 803

- Form 832d

- Fm 004 rev 0616 divorce complaint with mainegov form

- Ucc 3 amendment sc secretary of state form

- Additional secured partys name or name of total assignee insert only one name 24a or 24b form

- All check this box to request a response that is complete including filings that have lapsed form

Find out other Form R 1035

- eSign Utah Divorce Settlement Agreement Template Online

- eSign Vermont Child Custody Agreement Template Secure

- eSign North Dakota Affidavit of Heirship Free

- How Do I eSign Pennsylvania Affidavit of Heirship

- eSign New Jersey Affidavit of Residence Free

- eSign Hawaii Child Support Modification Fast

- Can I eSign Wisconsin Last Will and Testament

- eSign Wisconsin Cohabitation Agreement Free

- How To eSign Colorado Living Will

- eSign Maine Living Will Now

- eSign Utah Living Will Now

- eSign Iowa Affidavit of Domicile Now

- eSign Wisconsin Codicil to Will Online

- eSign Hawaii Guaranty Agreement Mobile

- eSign Hawaii Guaranty Agreement Now

- How Can I eSign Kentucky Collateral Agreement

- eSign Louisiana Demand for Payment Letter Simple

- eSign Missouri Gift Affidavit Myself

- eSign Missouri Gift Affidavit Safe

- eSign Nevada Gift Affidavit Easy