Application for Approved Exporter Status HM Revenue & Customs Hmrc Gov Form

What is the Application for Approved Exporter Status HM Revenue & Customs HMRC Gov

The Application for Approved Exporter Status is a formal request submitted to HM Revenue & Customs (HMRC) in the United Kingdom. This application is designed for businesses that wish to benefit from simplified customs procedures when exporting goods. By obtaining this status, exporters can enjoy reduced paperwork and faster processing times, which can significantly enhance their operational efficiency. This application is particularly relevant for businesses engaged in international trade, as it aligns with global trade facilitation efforts.

Steps to Complete the Application for Approved Exporter Status HM Revenue & Customs HMRC Gov

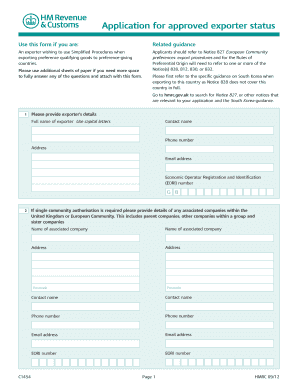

Completing the Application for Approved Exporter Status involves several key steps:

- Gather Required Information: Collect all necessary business details, including registration numbers and financial information.

- Understand Eligibility Criteria: Review the criteria set by HMRC to ensure your business qualifies for approved exporter status.

- Fill Out the Application Form: Carefully complete the application form, ensuring all information is accurate and complete.

- Submit Supporting Documents: Attach any required documentation that supports your application, such as financial statements or proof of business operations.

- Review and Submit: Double-check all entries for accuracy before submitting the application to HMRC.

Legal Use of the Application for Approved Exporter Status HM Revenue & Customs HMRC Gov

The Application for Approved Exporter Status is legally binding when completed and submitted in accordance with HMRC guidelines. It is essential that businesses adhere to all legal requirements, including providing truthful and accurate information. Misrepresentation or failure to comply with the terms of the approved exporter status can result in penalties or revocation of the status. Utilizing a reliable eSignature solution can help ensure that the application is executed legally and securely, maintaining compliance with relevant regulations.

Required Documents for the Application for Approved Exporter Status HM Revenue & Customs HMRC Gov

When applying for Approved Exporter Status, businesses must prepare and submit several key documents, which may include:

- Business registration documents

- Financial statements

- Proof of trading history

- Details of export activities

- Compliance records with customs regulations

Ensuring that all required documents are complete and accurate is crucial for a successful application process.

Application Process & Approval Time for the Application for Approved Exporter Status HM Revenue & Customs HMRC Gov

The application process for Approved Exporter Status can vary in duration based on several factors. Typically, once the application is submitted, HMRC will review it and may conduct an audit of the business's operations. The approval time can range from a few weeks to several months, depending on the complexity of the application and the volume of applications being processed. It is advisable for businesses to prepare for this timeline and ensure they have all necessary documentation ready for review.

How to Use the Application for Approved Exporter Status HM Revenue & Customs HMRC Gov

Once a business has successfully obtained Approved Exporter Status, it can utilize this status to streamline its export processes. This involves using the status to simplify customs declarations and reduce the amount of paperwork required for each export. Businesses should ensure they maintain compliance with HMRC regulations and keep accurate records of their export activities to continue benefiting from this status. Regular audits and reviews of export practices can help maintain compliance and avoid any potential issues.

Quick guide on how to complete application for approved exporter status hm revenue amp customs hmrc gov

Prepare [SKS] effortlessly on any device

Online document management has become increasingly popular among organizations and individuals. It serves as an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides you with all the tools needed to create, modify, and eSign your documents swiftly without delays. Manage [SKS] on any device with airSlate SignNow Android or iOS applications and streamline any document-centric procedure today.

The easiest way to modify and eSign [SKS] with ease

- Locate [SKS] and then click Get Form to begin.

- Utilize the tools available to fill out your document.

- Emphasize key sections of the documents or redact sensitive information using features that airSlate SignNow offers specifically for that purpose.

- Create your eSignature with the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and then click the Done button to save your modifications.

- Select your preferred delivery method for your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from a device of your choosing. Modify and eSign [SKS] and guarantee outstanding communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Application For Approved Exporter Status HM Revenue & Customs Hmrc Gov

Create this form in 5 minutes!

How to create an eSignature for the application for approved exporter status hm revenue amp customs hmrc gov

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Application For Approved Exporter Status HM Revenue & Customs HMRC Gov?

The Application For Approved Exporter Status HM Revenue & Customs HMRC Gov is a process that allows businesses to gain status as approved exporters, enabling them to benefit from simplified customs procedures. This status can enhance efficiency and save money on international trade processes.

-

How can airSlate SignNow help with the Application For Approved Exporter Status HM Revenue & Customs HMRC Gov?

airSlate SignNow provides an easy-to-use digital platform for preparing and signing documents necessary for the Application For Approved Exporter Status HM Revenue & Customs HMRC Gov. The platform ensures that businesses can quickly manage and submit their applications without the hassle of paper forms.

-

What are the costs associated with using airSlate SignNow for my application?

AirSlate SignNow offers a cost-effective solution for handling your Application For Approved Exporter Status HM Revenue & Customs HMRC Gov-related documents. Pricing plans vary based on features and user needs, providing flexible options for businesses of any size.

-

What features does airSlate SignNow offer for export applications?

airSlate SignNow includes features like e-signatures, document templates, and automated workflows that simplify the Application For Approved Exporter Status HM Revenue & Customs HMRC Gov process. These tools enhance collaboration, increase efficiency, and decrease processing times.

-

Is airSlate SignNow compliant with HM Revenue & Customs regulations?

Yes, airSlate SignNow is designed to comply with relevant regulations, making it a reliable choice for businesses submitting the Application For Approved Exporter Status HM Revenue & Customs HMRC Gov. Our platform ensures legally binding e-signatures and secure document management.

-

Can I integrate airSlate SignNow with other business applications?

Absolutely! airSlate SignNow supports integrations with various business applications, allowing seamless document management for your Application For Approved Exporter Status HM Revenue & Customs HMRC Gov. This connectivity streamlines workflows and enhances overall productivity.

-

What are the benefits of using airSlate SignNow for my application process?

Using airSlate SignNow for your Application For Approved Exporter Status HM Revenue & Customs HMRC Gov simplifies complex documentation processes. Benefits include reduced paperwork, faster turnaround times, and enhanced organization, ultimately leading to improved compliance and efficiency.

Get more for Application For Approved Exporter Status HM Revenue & Customs Hmrc Gov

- Tenant consent to background and reference check south dakota form

- Residential lease or rental agreement for month to month south dakota form

- Residential rental lease agreement south dakota form

- Tenant welcome letter south dakota form

- Warning of default on commercial lease south dakota form

- Warning of default on residential lease south dakota form

- Landlord tenant closing statement to reconcile security deposit south dakota form

- South dakota marriage form

Find out other Application For Approved Exporter Status HM Revenue & Customs Hmrc Gov

- Print eSign Word Free

- How Do I Print eSign PDF

- Print eSign PDF Free

- How To Print eSign Document

- Print eSign Form Mobile

- Download eSign PDF Free

- Download eSign PDF Easy

- Download eSign PDF Android

- How To Download eSign PDF

- How Can I Download eSign PDF

- Download eSign Word Online

- Download eSign Word Now

- Download eSign Document iOS

- Download eSign Word Safe

- How To Download eSign Document

- Download eSign Form Free

- Download eSign PPT Free

- Fill eSign PDF Free

- How To Download eSign Presentation

- Fill eSign PDF Mac