It 215 Instructions Form

What is the IT 215 Instructions

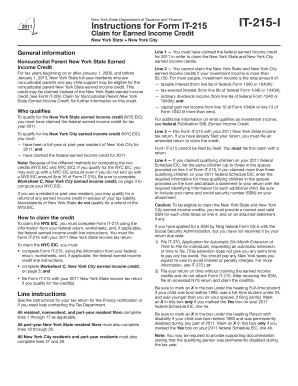

The IT 215 instructions provide essential guidelines for individuals and businesses in the United States regarding the completion of the IT 215 form. This form is typically associated with tax reporting and is crucial for ensuring compliance with federal and state tax regulations. Understanding the IT 215 instructions helps users navigate the complexities of tax obligations, ensuring accurate reporting and minimizing the risk of errors that could lead to penalties.

How to Use the IT 215 Instructions

Using the IT 215 instructions effectively involves several steps. First, familiarize yourself with the structure and requirements of the IT 215 form. Next, carefully read through the instructions to understand what information is needed, including any supporting documents that may be required. It is important to follow the guidelines precisely to ensure that your submission is complete and correct. If you have questions, consider consulting a tax professional for assistance.

Steps to Complete the IT 215 Instructions

Completing the IT 215 instructions involves a systematic approach:

- Gather all necessary documents, such as previous tax returns and financial statements.

- Review the IT 215 form to understand the sections that require your input.

- Fill out the form accurately, following the guidelines provided in the instructions.

- Double-check your entries for accuracy and completeness.

- Submit the completed form according to the specified submission methods.

Legal Use of the IT 215 Instructions

The legal use of the IT 215 instructions is paramount for ensuring that all tax filings are compliant with IRS regulations. Properly following these instructions not only aids in fulfilling tax obligations but also protects taxpayers from potential audits and penalties. The IT 215 instructions outline the legal requirements for completing the form, including necessary signatures and the importance of accurate reporting.

Filing Deadlines / Important Dates

Adhering to filing deadlines is critical when dealing with the IT 215 instructions. The specific deadlines can vary depending on the tax year and the type of taxpayer. Generally, individual taxpayers must file by April fifteenth, while businesses may have different deadlines based on their fiscal year. It is advisable to check the IRS website or consult a tax professional for the most current deadlines to avoid late fees and penalties.

Required Documents

When completing the IT 215 instructions, several documents may be required to support your claims and entries. Commonly needed documents include:

- Previous tax returns

- W-2 forms from employers

- 1099 forms for additional income

- Receipts for deductible expenses

- Bank statements and financial records

Having these documents ready will streamline the completion process and help ensure accuracy.

Quick guide on how to complete it 215 instructions

Prepare It 215 Instructions seamlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It serves as an ideal environmentally friendly substitute for conventional printed and signed documents, allowing you to obtain the necessary form and securely save it online. airSlate SignNow equips you with all the tools needed to create, modify, and eSign your documents promptly without delays. Manage It 215 Instructions across any platform using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

How to modify and eSign It 215 Instructions effortlessly

- Locate It 215 Instructions and click Get Form to commence.

- Use the tools we provide to complete your document.

- Emphasize important sections of the documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review all details and click the Done button to save your changes.

- Choose your preferred method to send your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searches, or mistakes requiring new printed document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Edit and eSign It 215 Instructions and ensure exceptional communication at every step of your document preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the it 215 instructions

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the IT 215 instructions for using airSlate SignNow?

The IT 215 instructions for airSlate SignNow provide a step-by-step guide on how to effectively send and eSign documents. These instructions are designed to help users navigate the platform's features and maximize efficiency in their workflow. Following these instructions ensures a smooth experience and leverages the app's full potential.

-

How does airSlate SignNow handle document security?

airSlate SignNow prioritizes document security by utilizing advanced encryption protocols and secure access controls. Users can trust that their documents are protected while following the IT 215 instructions for proper usage. This commitment to security ensures compliance with various industry regulations, providing peace of mind to businesses.

-

What pricing plans are available for airSlate SignNow?

airSlate SignNow offers flexible pricing plans tailored to fit the needs of any business. Users can explore a variety of options, ensuring they find a plan that suits their budget while benefiting from the comprehensive features described in the IT 215 instructions. This cost-effective solution simplifies document management without compromising quality.

-

Can airSlate SignNow integrate with other software tools?

Yes, airSlate SignNow offers seamless integrations with popular software applications like Salesforce, Google Drive, and Dropbox. These integrations enhance overall productivity and streamline workflows, providing users with a more comprehensive toolset when following the IT 215 instructions. This flexibility makes airSlate SignNow a versatile choice for businesses.

-

What are the benefits of using airSlate SignNow?

The benefits of using airSlate SignNow include increased efficiency, reduced turnaround time for documents, and a user-friendly interface. By adhering to the IT 215 instructions, users can fully leverage these advantages to improve their signing processes. Companies can save time and resources, making it a smart investment for document management.

-

How can I get support if I have questions about the IT 215 instructions?

For any queries regarding the IT 215 instructions or the airSlate SignNow platform, users can easily access customer support via chat, email, or phone. The support team is equipped to provide prompt assistance and guide users in following the instructions effectively. This ensures a smooth experience with minimal disruptions.

-

Are there mobile options available for airSlate SignNow?

Absolutely, airSlate SignNow is accessible on mobile devices through its dedicated app. This mobile capability allows users to follow the IT 215 instructions on the go, making it easier to send and eSign documents anytime, anywhere. Users benefit from the convenience and flexibility that mobile access provides.

Get more for It 215 Instructions

Find out other It 215 Instructions

- eSignature Tennessee Sports Last Will And Testament Mobile

- How Can I eSignature Nevada Courts Medical History

- eSignature Nebraska Courts Lease Agreement Online

- eSignature Nebraska Courts LLC Operating Agreement Easy

- Can I eSignature New Mexico Courts Business Letter Template

- eSignature New Mexico Courts Lease Agreement Template Mobile

- eSignature Courts Word Oregon Secure

- Electronic signature Indiana Banking Contract Safe

- Electronic signature Banking Document Iowa Online

- Can I eSignature West Virginia Sports Warranty Deed

- eSignature Utah Courts Contract Safe

- Electronic signature Maine Banking Permission Slip Fast

- eSignature Wyoming Sports LLC Operating Agreement Later

- Electronic signature Banking Word Massachusetts Free

- eSignature Wyoming Courts Quitclaim Deed Later

- Electronic signature Michigan Banking Lease Agreement Computer

- Electronic signature Michigan Banking Affidavit Of Heirship Fast

- Electronic signature Arizona Business Operations Job Offer Free

- Electronic signature Nevada Banking NDA Online

- Electronic signature Nebraska Banking Confidentiality Agreement Myself