Borrower Assistance Form 710 Indicate a Non Borrower Contributes to Your House Fillable and Printable

What is the Borrower Assistance Form 710 Indicate A Non Borrower Contributes To Your House Fillable And Printable

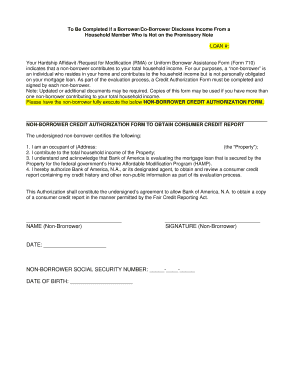

The Borrower Assistance Form 710 is a crucial document used in the United States to indicate that a non-borrower contributes to a house. This form is particularly relevant in situations where individuals who are not the primary borrowers wish to establish their financial involvement in a property. The fillable and printable format of this form allows for easy completion and submission, ensuring that all necessary information is clearly documented. This form plays a significant role in the lending process, as it helps lenders assess the financial contributions of all parties involved in a mortgage agreement.

How to Use the Borrower Assistance Form 710 Indicate A Non Borrower Contributes To Your House Fillable And Printable

Using the Borrower Assistance Form 710 is straightforward. First, ensure you have the most recent version of the form, which can be filled out digitally or printed for manual completion. Begin by entering the required personal information for both the borrower and the non-borrower contributor. This includes names, addresses, and any relevant identification numbers. It is essential to provide accurate information to avoid delays in processing. After filling out the form, review all entries for accuracy before submitting it to the lender or relevant financial institution.

Steps to Complete the Borrower Assistance Form 710 Indicate A Non Borrower Contributes To Your House Fillable And Printable

Completing the Borrower Assistance Form 710 involves several key steps:

- Download the form from a trusted source or access it through your lender's website.

- Fill in the personal details of the borrower and non-borrower, ensuring all fields are completed accurately.

- Provide information regarding the property, including the address and any relevant financial details.

- Sign and date the form, ensuring that both parties have reviewed the information.

- Submit the completed form to the lender, either electronically or by mail, as per their submission guidelines.

Legal Use of the Borrower Assistance Form 710 Indicate A Non Borrower Contributes To Your House Fillable And Printable

The Borrower Assistance Form 710 is legally binding when filled out correctly and submitted according to the lender's requirements. It serves as an official record of the non-borrower’s financial contribution to the property, which can be critical in legal and financial contexts. Compliance with applicable laws, such as the ESIGN Act, ensures that electronic signatures and submissions are recognized in court. It is advisable to retain a copy of the completed form for personal records, as this can be beneficial in future financial dealings or disputes.

Key Elements of the Borrower Assistance Form 710 Indicate A Non Borrower Contributes To Your House Fillable And Printable

Several key elements are essential in the Borrower Assistance Form 710. These include:

- Personal Information: Names and addresses of the borrower and non-borrower.

- Property Details: The address and type of property involved.

- Financial Contributions: Clear documentation of the non-borrower's contributions.

- Signatures: Required signatures from both parties to validate the form.

Eligibility Criteria for the Borrower Assistance Form 710 Indicate A Non Borrower Contributes To Your House Fillable And Printable

Eligibility to use the Borrower Assistance Form 710 typically includes individuals who are not the primary borrowers but wish to document their financial contributions to a property. This may include family members, friends, or business partners involved in the property purchase or mortgage process. It is important that all contributors understand their rights and responsibilities as outlined in the form, ensuring transparency and compliance with lender requirements.

Quick guide on how to complete borrower assistance form 710 indicate a non borrower contributes to your house fillable and printable

Prepare Borrower Assistance Form 710 Indicate A Non Borrower Contributes To Your House Fillable And Printable effortlessly on any device

Online document management has become increasingly favored by businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can easily find the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, edit, and eSign your documents swiftly without interruptions. Handle Borrower Assistance Form 710 Indicate A Non Borrower Contributes To Your House Fillable And Printable on any device with airSlate SignNow Android or iOS applications and enhance any document-based workflow today.

The easiest way to edit and eSign Borrower Assistance Form 710 Indicate A Non Borrower Contributes To Your House Fillable And Printable effortlessly

- Locate Borrower Assistance Form 710 Indicate A Non Borrower Contributes To Your House Fillable And Printable and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize signNow sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Verify the details and then click on the Done button to preserve your modifications.

- Select your preferred method to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Forget about lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets all your needs in document management in just a few clicks from any device of your preference. Edit and eSign Borrower Assistance Form 710 Indicate A Non Borrower Contributes To Your House Fillable And Printable and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the borrower assistance form 710 indicate a non borrower contributes to your house fillable and printable

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the borrower assistance form 710 and how does it indicate a non-borrower contributes to your house?

The borrower assistance form 710 is a crucial document for borrowers, especially when a non-borrower contributes to the home financing process. This form helps outline the contributions made by non-borrowers, ensuring that all parties’ interests are accurately represented. It is fillable and printable, making it easy to complete and submit.

-

How can I access the borrower assistance form 710 in a fillable format?

You can easily access the borrower assistance form 710 in a fillable format through airSlate SignNow. Our platform allows you to download, fill out, and print the form conveniently. This feature simplifies the process of ensuring all contributions are documented effectively.

-

Are there any fees associated with using airSlate SignNow for the borrower assistance form 710?

airSlate SignNow offers competitive pricing tailored to your needs, including access to the borrower assistance form 710. Most plans provide an affordable way to manage documents digitally with eSigning capabilities. Make sure to check our pricing page for the latest offers!

-

What features does airSlate SignNow offer for managing the borrower assistance form 710?

With airSlate SignNow, you get features like eSigning, document sharing, and collaboration tools that enhance your experience with the borrower assistance form 710. These tools ensure that everyone involved can efficiently manage their contributions and sign digitally. Additionally, our platform improves overall document workflow efficiency.

-

Is it possible to integrate the borrower assistance form 710 with other applications?

Yes, airSlate SignNow supports various integrations, allowing you to connect the borrower assistance form 710 with other applications you might use. This integration capability enhances productivity and ensures that all data flows seamlessly across platforms. Check our integration directory for supported applications.

-

What benefits does using the borrower assistance form 710 offer to homeowners?

Utilizing the borrower assistance form 710 helps homeowners clarify financial contributions from non-borrowers, which is essential for accurate loan processing. This form not only streamlines the home financing process but also protects everyone's interests involved. Completing it via airSlate SignNow is quick and efficient.

-

Can the borrower assistance form 710 be customized to fit specific needs?

Absolutely! While the borrower assistance form 710 follows a standard format, airSlate SignNow allows customization to better fit your specific situation. This adaptability ensures that you can adequately represent all contributions, making the documentation process much more effective.

Get more for Borrower Assistance Form 710 Indicate A Non Borrower Contributes To Your House Fillable And Printable

- Living trust for individual who is single divorced or widow or widower with no children iowa form

- Living trust for individual who is single divorced or widow or widower with children iowa form

- Living trust for husband and wife with one child iowa form

- Living trust for husband and wife with minor and or adult children iowa form

- Amendment to living trust iowa form

- Living trust property record iowa form

- Financial account transfer to living trust iowa form

- Assignment to living trust iowa form

Find out other Borrower Assistance Form 710 Indicate A Non Borrower Contributes To Your House Fillable And Printable

- Help Me With eSign Hawaii Construction LLC Operating Agreement

- eSign Hawaii Construction Work Order Myself

- eSign Delaware Doctors Quitclaim Deed Free

- eSign Colorado Doctors Operating Agreement Computer

- Help Me With eSign Florida Doctors Lease Termination Letter

- eSign Florida Doctors Lease Termination Letter Myself

- eSign Hawaii Doctors Claim Later

- eSign Idaho Construction Arbitration Agreement Easy

- eSign Iowa Construction Quitclaim Deed Now

- How Do I eSign Iowa Construction Quitclaim Deed

- eSign Louisiana Doctors Letter Of Intent Fast

- eSign Maine Doctors Promissory Note Template Easy

- eSign Kentucky Construction Claim Online

- How Can I eSign Maine Construction Quitclaim Deed

- eSign Colorado Education Promissory Note Template Easy

- eSign North Dakota Doctors Affidavit Of Heirship Now

- eSign Oklahoma Doctors Arbitration Agreement Online

- eSign Oklahoma Doctors Forbearance Agreement Online

- eSign Oregon Doctors LLC Operating Agreement Mobile

- eSign Hawaii Education Claim Myself