Monthly Communications Service Tax Return Ghana Revenue Authority Form

What is the Monthly Communications Service Tax Return Ghana Revenue Authority

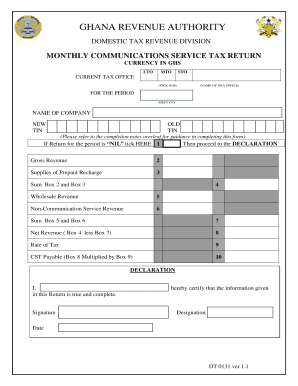

The Monthly Communications Service Tax Return is a tax form required by the Ghana Revenue Authority for telecommunications service providers. This form is used to report the monthly communications service tax, which is levied on the revenue generated from telecommunications services. The tax is applicable to all service providers operating within Ghana, ensuring compliance with local tax regulations. Understanding this form is crucial for businesses to maintain good standing with the tax authorities and avoid potential penalties.

Steps to complete the Monthly Communications Service Tax Return Ghana Revenue Authority

Completing the Monthly Communications Service Tax Return involves several key steps:

- Gather necessary financial data, including total revenue from telecommunications services for the month.

- Calculate the tax owed based on the applicable rate set by the Ghana Revenue Authority.

- Fill out the form accurately, ensuring all sections are completed, including your business information and tax calculations.

- Review the completed form for accuracy and completeness to prevent errors that could lead to penalties.

- Submit the form by the specified deadline, either electronically or through traditional mail, depending on your preference.

Legal use of the Monthly Communications Service Tax Return Ghana Revenue Authority

The Monthly Communications Service Tax Return is legally binding when completed and submitted in compliance with the Ghana Revenue Authority's regulations. To ensure its legal validity, the form must be signed by an authorized representative of the telecommunications service provider. Additionally, electronic submissions must adhere to the eSignature laws, providing a secure method of signing that meets legal standards. This ensures that the form is recognized in legal contexts and can be used in case of audits or disputes.

Filing Deadlines / Important Dates

Timely filing of the Monthly Communications Service Tax Return is essential to avoid penalties. The Ghana Revenue Authority typically requires the form to be submitted by a specific deadline each month, usually within a few days after the end of the reporting month. It is important for businesses to stay informed about these deadlines to ensure compliance and avoid late fees. Keeping a calendar with important tax dates can help manage these responsibilities effectively.

Required Documents

When preparing to complete the Monthly Communications Service Tax Return, certain documents are necessary to ensure accurate reporting. These may include:

- Financial statements detailing monthly revenue from telecommunications services.

- Previous tax returns for reference and consistency.

- Any relevant contracts or agreements that may affect revenue calculations.

- Documentation of any exemptions or deductions applicable to your business.

Penalties for Non-Compliance

Failure to file the Monthly Communications Service Tax Return on time or inaccurately can result in significant penalties. The Ghana Revenue Authority may impose fines based on the amount of tax owed and the duration of the delay. Additionally, repeated non-compliance can lead to more severe consequences, including legal action or revocation of business licenses. It is crucial for businesses to prioritize compliance to avoid these risks.

Quick guide on how to complete monthly communications service tax return ghana revenue authority

Complete Monthly Communications Service Tax Return Ghana Revenue Authority effortlessly on any gadget

Digital document management has gained traction among businesses and individuals alike. It offers a superb eco-friendly substitute for conventional printed and signed paperwork, allowing you to find the suitable form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, alter, and eSign your documents promptly without delays. Handle Monthly Communications Service Tax Return Ghana Revenue Authority on any device using airSlate SignNow Android or iOS applications and simplify any document-related task today.

The optimal method to edit and eSign Monthly Communications Service Tax Return Ghana Revenue Authority effortlessly

- Find Monthly Communications Service Tax Return Ghana Revenue Authority and click Get Form to begin.

- Make use of the tools we offer to fill out your form.

- Emphasize relevant sections of your documents or obscure sensitive information with tools that airSlate SignNow supplies specifically for that purpose.

- Create your eSignature with the Sign feature, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your changes.

- Select your preferred method of sharing your form, whether by email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and eSign Monthly Communications Service Tax Return Ghana Revenue Authority and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the monthly communications service tax return ghana revenue authority

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Monthly Communications Service Tax Return required by the Ghana Revenue Authority?

The Monthly Communications Service Tax Return is a compliance document submitted to the Ghana Revenue Authority by telecommunications service providers. It outlines the tax obligations based on monthly revenues from communication services offered. Accurate filing ensures adherence to tax regulations and avoids penalties.

-

How can airSlate SignNow help with the Monthly Communications Service Tax Return process?

airSlate SignNow simplifies the process of managing the Monthly Communications Service Tax Return by providing a secure platform for document preparation and e-signatures. With our easy-to-use interface, businesses can create, send, and sign documents without hassle. This streamlines the compliance process and enhances efficiency.

-

What are the costs associated with using airSlate SignNow for handling the Monthly Communications Service Tax Return?

airSlate SignNow offers a variety of pricing plans that cater to different business needs. The cost is typically based on the number of users and features required, ensuring that you only pay for what you need. Additionally, the cost-effectiveness of our solution can signNowly reduce administrative burdens related to the Monthly Communications Service Tax Return.

-

Is airSlate SignNow compliant with Ghana Revenue Authority regulations?

Yes, airSlate SignNow is designed to comply with regulations set forth by the Ghana Revenue Authority. Our platform helps ensure that all documentation related to the Monthly Communications Service Tax Return adheres to legal requirements. This reliability gives businesses peace of mind when managing their tax filings.

-

Can airSlate SignNow integrate with existing accounting systems for tax filings?

Absolutely! airSlate SignNow can seamlessly integrate with a variety of accounting software and tools. This integration allows for smooth data transfer and accurate reporting for the Monthly Communications Service Tax Return, streamlining your financial processes even further.

-

What features does airSlate SignNow offer to enhance document management for tax returns?

airSlate SignNow includes features like customizable templates, cloud storage, and real-time collaboration, all of which are vital for managing the Monthly Communications Service Tax Return. These features ensure that businesses can efficiently prepare and organize their tax documentation for quick access and review.

-

How does airSlate SignNow ensure the security of documents related to the Monthly Communications Service Tax Return?

Security is a top priority for airSlate SignNow. We implement advanced encryption protocols and stringent access controls to protect sensitive data, including that related to the Monthly Communications Service Tax Return. This commitment to security helps businesses safeguard their information against unauthorized access.

Get more for Monthly Communications Service Tax Return Ghana Revenue Authority

- Identity theft by known imposter package north dakota form

- Nd assets form

- Essential documents for the organized traveler package north dakota form

- North dakota personal form

- Postnuptial agreements package north dakota form

- Letters of recommendation package north dakota form

- North dakota mechanics form

- Nd lien form

Find out other Monthly Communications Service Tax Return Ghana Revenue Authority

- Sign Kansas Business Operations Emergency Contact Form Easy

- How To Sign Montana Business Operations Warranty Deed

- Sign Nevada Business Operations Emergency Contact Form Simple

- Sign New Hampshire Business Operations Month To Month Lease Later

- Can I Sign New York Business Operations Promissory Note Template

- Sign Oklahoma Business Operations Contract Safe

- Sign Oregon Business Operations LLC Operating Agreement Now

- Sign Utah Business Operations LLC Operating Agreement Computer

- Sign West Virginia Business Operations Rental Lease Agreement Now

- How To Sign Colorado Car Dealer Arbitration Agreement

- Sign Florida Car Dealer Resignation Letter Now

- Sign Georgia Car Dealer Cease And Desist Letter Fast

- Sign Georgia Car Dealer Purchase Order Template Mobile

- Sign Delaware Car Dealer Limited Power Of Attorney Fast

- How To Sign Georgia Car Dealer Lease Agreement Form

- How To Sign Iowa Car Dealer Resignation Letter

- Sign Iowa Car Dealer Contract Safe

- Sign Iowa Car Dealer Limited Power Of Attorney Computer

- Help Me With Sign Iowa Car Dealer Limited Power Of Attorney

- Sign Kansas Car Dealer Contract Fast