Form NC 1099 ITIN NC Department of Revenue Dor State Nc

What is the Form NC 1099 ITIN NC Department Of Revenue Dor State NC

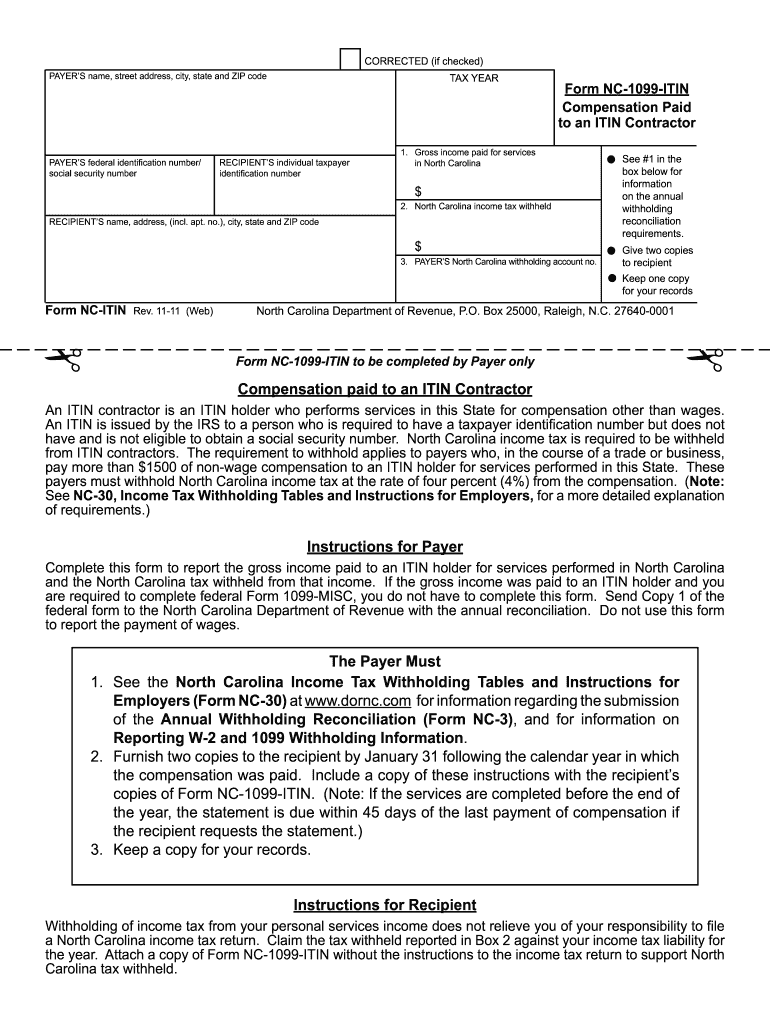

The Form NC 1099 ITIN is a tax document issued by the North Carolina Department of Revenue. It is primarily used to report income paid to individuals who are not eligible for a Social Security Number but have an Individual Taxpayer Identification Number (ITIN). This form is crucial for ensuring that individuals comply with state tax laws, allowing the state to track income and enforce tax obligations.

How to use the Form NC 1099 ITIN NC Department Of Revenue Dor State NC

The Form NC 1099 ITIN is used by businesses and organizations to report payments made to non-resident individuals or foreign entities. When using this form, it is essential to accurately fill in the recipient's information, including their ITIN, the amount paid, and the nature of the payment. This ensures proper reporting to the state and helps avoid potential penalties for non-compliance.

Steps to complete the Form NC 1099 ITIN NC Department Of Revenue Dor State NC

Completing the Form NC 1099 ITIN involves several steps:

- Gather necessary information, including the recipient's ITIN and payment details.

- Fill out the form with accurate information, ensuring all fields are completed.

- Review the completed form for any errors or omissions.

- Submit the form to the North Carolina Department of Revenue by the specified deadline.

Legal use of the Form NC 1099 ITIN NC Department Of Revenue Dor State NC

The legal use of the Form NC 1099 ITIN is governed by state tax laws. It is essential for businesses to issue this form to report payments accurately. Failure to do so can result in penalties, including fines and interest on unpaid taxes. The form must be submitted in compliance with the deadlines set by the North Carolina Department of Revenue to ensure legal protection for both the payer and the recipient.

Key elements of the Form NC 1099 ITIN NC Department Of Revenue Dor State NC

Key elements of the Form NC 1099 ITIN include:

- Recipient Information: Name, address, and ITIN of the individual receiving the payment.

- Payment Amount: Total amount paid to the recipient during the tax year.

- Type of Payment: Description of the nature of the payment, such as wages, rents, or other income.

- Payer Information: Name, address, and tax identification number of the business or organization issuing the form.

Filing Deadlines / Important Dates

Filing deadlines for the Form NC 1099 ITIN are crucial to avoid penalties. Typically, the form must be submitted to the North Carolina Department of Revenue by January thirty-first of the year following the tax year in which payments were made. It is important to stay informed about any changes to these deadlines to ensure compliance.

Quick guide on how to complete form nc 1099 itin nc department of revenue dor state nc

Complete Form NC 1099 ITIN NC Department Of Revenue Dor State Nc seamlessly on any device

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the correct format and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents quickly without delays. Manage Form NC 1099 ITIN NC Department Of Revenue Dor State Nc on any device with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to modify and electronically sign Form NC 1099 ITIN NC Department Of Revenue Dor State Nc with ease

- Obtain Form NC 1099 ITIN NC Department Of Revenue Dor State Nc and click on Get Form to begin.

- Make use of the tools we offer to fill out your document.

- Highlight important sections of the documents or redact sensitive information with features specifically designed by airSlate SignNow.

- Create your electronic signature using the Sign tool, which takes mere seconds and carries the same legal authority as a conventional handwritten signature.

- Review the information and click on the Done button to save your changes.

- Select your preferred method for delivering your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns over lost or misplaced documents, tiresome form searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you choose. Edit and electronically sign Form NC 1099 ITIN NC Department Of Revenue Dor State Nc while ensuring excellent communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form nc 1099 itin nc department of revenue dor state nc

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form NC 1099 ITIN for NC Department of Revenue?

Form NC 1099 ITIN is a tax document required by the NC Department of Revenue for reporting income paid to individuals who have an ITIN instead of a social security number. This form ensures that all tax obligations are met for those working in North Carolina but not having SSNs.

-

How can airSlate SignNow help with Form NC 1099 ITIN?

airSlate SignNow streamlines the process of preparing and eSigning Form NC 1099 ITIN by allowing users to create, send, and sign documents electronically. This feature speeds up documentation for quicker compliance with the NC Department of Revenue requirements.

-

What are the pricing options for using airSlate SignNow with Form NC 1099 ITIN?

airSlate SignNow offers flexible pricing plans to suit various business needs, including options for individual users and teams. These plans provide access to essential features for managing Form NC 1099 ITIN, making it cost-effective for any organization.

-

Are there any key features that support Form NC 1099 ITIN processing in airSlate SignNow?

Yes, airSlate SignNow includes key features like template management, real-time tracking, and secure cloud storage to assist in the processing of Form NC 1099 ITIN. These features enhance efficiency and ensure compliance with the NC Department of Revenue requirements.

-

Can I integrate airSlate SignNow with other software for handling Form NC 1099 ITIN?

Absolutely! airSlate SignNow provides integrations with various accounting and tax software, making it easy to manage Form NC 1099 ITIN alongside your existing systems. This seamless integration simplifies your workflow and enhances document management efficiency.

-

What are the benefits of using airSlate SignNow for Form NC 1099 ITIN?

Using airSlate SignNow for Form NC 1099 ITIN offers numerous benefits, including improved accuracy, faster turnaround times, and reduced administrative burdens. The ease of eSigning and legal compliance makes it a valuable tool for businesses of all sizes.

-

Is it secure to send Form NC 1099 ITIN documents through airSlate SignNow?

Yes, airSlate SignNow prioritizes security and employs leading encryption protocols to protect all documents, including Form NC 1099 ITIN. This ensures that your sensitive information remains confidential while fulfilling the requirements of the NC Department of Revenue.

Get more for Form NC 1099 ITIN NC Department Of Revenue Dor State Nc

- Collection letter templates form

- Assignment of rights to unpublished manuscript form

- Trustee acceptance form

- Assignment beneficiary form

- Assignment trust form 497329764

- Landlord waiver form

- Release of landlord waiver of liability and assumption of all risks of personal bodily injury regarding use of swimming pool form

- Motion paternity 497329767 form

Find out other Form NC 1099 ITIN NC Department Of Revenue Dor State Nc

- Electronic signature Texas Internship Contract Safe

- Electronic signature North Carolina Day Care Contract Later

- Electronic signature Tennessee Medical Power of Attorney Template Simple

- Electronic signature California Medical Services Proposal Mobile

- How To Electronic signature West Virginia Pharmacy Services Agreement

- How Can I eSignature Kentucky Co-Branding Agreement

- How Can I Electronic signature Alabama Declaration of Trust Template

- How Do I Electronic signature Illinois Declaration of Trust Template

- Electronic signature Maryland Declaration of Trust Template Later

- How Can I Electronic signature Oklahoma Declaration of Trust Template

- Electronic signature Nevada Shareholder Agreement Template Easy

- Electronic signature Texas Shareholder Agreement Template Free

- Electronic signature Mississippi Redemption Agreement Online

- eSignature West Virginia Distribution Agreement Safe

- Electronic signature Nevada Equipment Rental Agreement Template Myself

- Can I Electronic signature Louisiana Construction Contract Template

- Can I eSignature Washington Engineering Proposal Template

- eSignature California Proforma Invoice Template Simple

- eSignature Georgia Proforma Invoice Template Myself

- eSignature Mississippi Proforma Invoice Template Safe