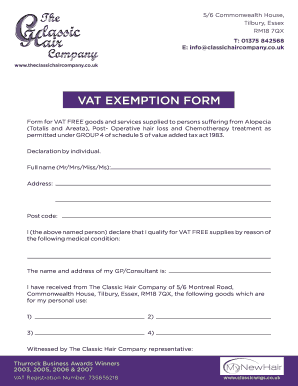

VAT EXEMPTION FORM Classicwigs Co Uk Classicwigs Co

What is the VAT Exemption Certificate?

The VAT exemption certificate is a crucial document that allows businesses to purchase goods and services without paying Value Added Tax (VAT). This exemption is typically available to certain entities, such as non-profit organizations, government agencies, or businesses engaged in specific types of transactions. The certificate serves as proof that the buyer is eligible for VAT exemption, helping to streamline the purchasing process and reduce costs.

Key Elements of the VAT Exemption Certificate

A VAT exemption certificate generally includes several key elements that validate its use. These elements typically include:

- Buyer Information: The name, address, and tax identification number of the entity claiming the exemption.

- Seller Information: The name and address of the seller or supplier providing the goods or services.

- Reason for Exemption: A clear statement indicating the specific reason for the exemption, such as the type of organization or the nature of the transaction.

- Signature: The signature of an authorized representative of the buyer, affirming the validity of the certificate.

- Date: The date the certificate is issued, which may be important for compliance and record-keeping purposes.

Steps to Complete the VAT Exemption Certificate

Completing a VAT exemption certificate involves several straightforward steps. Follow these guidelines to ensure accuracy:

- Gather necessary information, including your organization’s details and the seller's information.

- Clearly state the reason for the exemption, ensuring it aligns with applicable regulations.

- Fill out the certificate accurately, double-checking all entries for correctness.

- Obtain the signature of an authorized representative from your organization.

- Keep a copy of the completed certificate for your records and provide the original to the seller.

Legal Use of the VAT Exemption Certificate

The legal use of a VAT exemption certificate is governed by federal and state regulations. It is essential that the certificate is used only for eligible transactions to avoid potential penalties. Misuse of the certificate can lead to fines or back taxes owed. Therefore, understanding the specific legal requirements in your state is crucial for compliance.

Eligibility Criteria for VAT Exemption

Eligibility for VAT exemption typically depends on the nature of the buyer and the type of goods or services purchased. Common criteria include:

- Non-profit organizations that provide charitable services.

- Government entities purchasing for official use.

- Educational institutions acquiring materials for educational purposes.

- Businesses engaged in specific types of transactions that qualify for exemption under state law.

Examples of Using the VAT Exemption Certificate

There are various scenarios in which a VAT exemption certificate can be utilized effectively. For instance:

- A non-profit organization purchasing office supplies for its operations.

- A government agency acquiring vehicles for public service.

- An educational institution buying textbooks for students.

In each case, presenting the VAT exemption certificate allows the buyer to avoid paying VAT, thereby reducing overall expenses.

Quick guide on how to complete vat exempt

Complete vat exempt effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to access the correct form and securely archive it online. airSlate SignNow provides you with all the resources necessary to create, edit, and eSign your documents swiftly without delays. Handle vat exempt certificate sample on any device using airSlate SignNow's Android or iOS applications and enhance any document-centered workflow today.

The easiest way to edit and eSign vat certificate uk with minimal effort

- Obtain vat exemption certificate and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for this task.

- Create your eSignature with the Sign tool, which takes mere seconds and has the same legal validity as a traditional handwritten signature.

- Review the information and then click the Done button to save your modifications.

- Select your preferred delivery method for your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form navigation, or mistakes that require printing additional document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you choose. Edit and eSign vat exemption letter and ensure outstanding communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the vat exemption certificate

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask vat exempt

-

What is a VAT certificate in the UK?

A VAT certificate in the UK is an official document issued by HM Revenue and Customs that confirms a business is registered for VAT. This certificate is crucial for businesses that need to charge VAT on their sales and allows them to reclaim VAT on their purchases.

-

How can I obtain a VAT certificate in the UK?

To obtain a VAT certificate in the UK, you must first register for VAT with HM Revenue and Customs. Once your application is processed, you'll receive your VAT certificate, which you can then use to verify your VAT registration status.

-

What are the benefits of using airSlate SignNow for managing VAT certificates in the UK?

Using airSlate SignNow streamlines the process of signing and managing VAT certificates in the UK. With its easy-to-use interface and secure eSignature capabilities, businesses can efficiently send, receive, and store their VAT-related documents without hassle.

-

Is airSlate SignNow compliant with UK regulations for VAT certificates?

Yes, airSlate SignNow complies with all relevant UK regulations regarding electronic signatures and document management. This ensures that any VAT certificate processed through our platform adheres to legal standards, giving you peace of mind.

-

What features does airSlate SignNow offer for VAT certificate management?

airSlate SignNow offers features such as customizable templates, audit trails, and integration with popular tools that enhance VAT certificate management. These features help streamline workflows and ensure efficient handling of your VAT documents.

-

Can airSlate SignNow integrate with accounting software for VAT management?

Absolutely! airSlate SignNow integrates seamlessly with various accounting software to help manage your VAT certificates in the UK. This integration simplifies the process of tracking and filing VAT, ensuring you stay compliant with regulations.

-

How much does airSlate SignNow cost for VAT certificate management in the UK?

airSlate SignNow offers a variety of pricing plans to accommodate different business needs, starting with a free option. For comprehensive VAT certificate management, we recommend one of our premium plans that provide additional features and support.

Get more for vat certificate example

Find out other vat certificate sample

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors