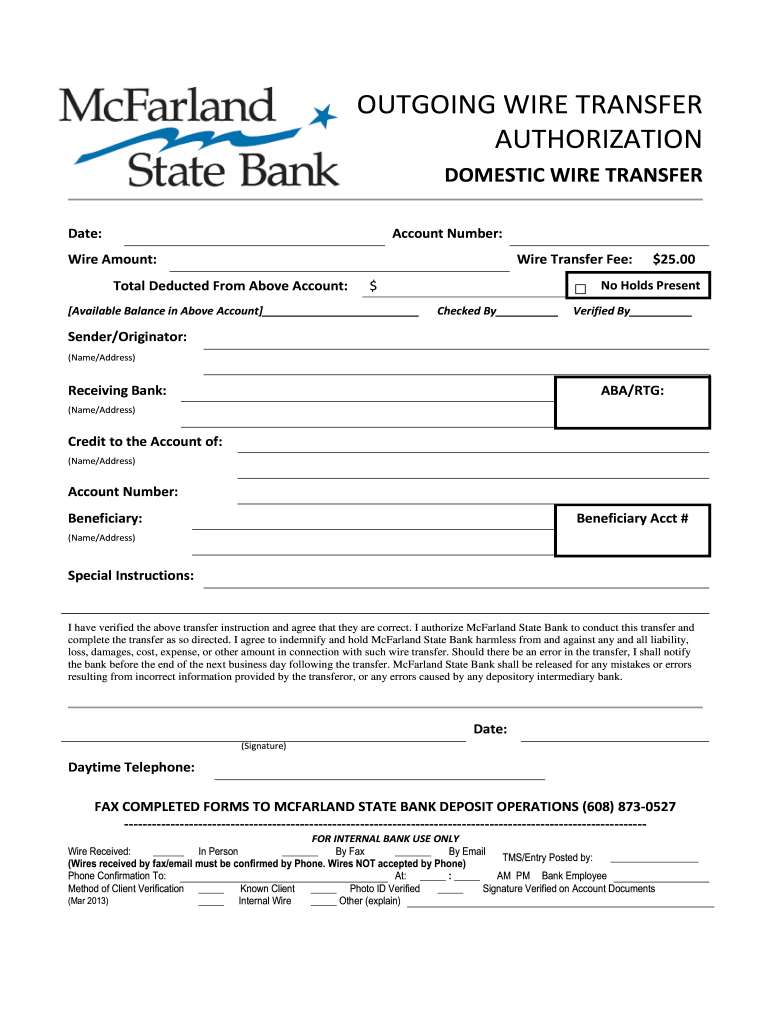

Domestic Wire Transfer Form

What is the domestic wire transfer?

A domestic wire transfer is a method of electronically transferring funds between banks or financial institutions within the United States. This process allows individuals and businesses to send money quickly and securely without the need for physical checks or cash. The funds are typically available to the recipient within hours, making it a popular choice for urgent payments. Wire transfers can be used for various purposes, including paying bills, making purchases, or transferring funds between personal accounts.

Steps to complete the domestic wire transfer

Completing a domestic wire transfer involves several straightforward steps to ensure accuracy and security:

- Gather necessary information, including the recipient's name, bank account number, and routing number.

- Fill out the domestic wire transfer form, ensuring all details are correct.

- Provide your own bank account information and any required identification.

- Review the information for accuracy before submitting the form to your bank or financial institution.

- Confirm the transaction and keep a record of the confirmation number for your records.

Key elements of the domestic wire transfer

When filling out a domestic wire transfer form, several key elements must be included to ensure the transfer is processed correctly:

- Sender's Information: This includes your full name, address, and bank account details.

- Recipient's Information: The recipient's name, address, and bank account number are essential for accurate processing.

- Bank Routing Number: This nine-digit number identifies the recipient's bank and is crucial for directing the funds appropriately.

- Transfer Amount: Clearly state the amount being transferred to avoid any discrepancies.

- Purpose of Transfer: Some banks may require you to specify the reason for the wire transfer.

Legal use of the domestic wire transfer

Domestic wire transfers are governed by various laws and regulations to protect both senders and recipients. The Electronic Fund Transfer Act (EFTA) outlines the rights of consumers regarding electronic transactions, including wire transfers. Additionally, financial institutions must comply with anti-money laundering (AML) regulations, which may require them to verify the identities of both parties involved in the transfer. Ensuring compliance with these legal requirements helps maintain the integrity and security of the wire transfer process.

How to obtain the domestic wire transfer form

The domestic wire transfer form can typically be obtained directly from your bank or financial institution. Many banks offer the form online through their websites, allowing customers to download and complete it at their convenience. Alternatively, you can visit a local branch to request a physical copy of the form. It is essential to use the correct form provided by your bank, as different institutions may have specific requirements and formats.

Examples of using the domestic wire transfer

Domestic wire transfers are commonly used in various scenarios, such as:

- Paying for real estate transactions, where large sums of money need to be transferred securely and promptly.

- Sending money to family members or friends for personal expenses, such as tuition or medical bills.

- Making payments to vendors or contractors for services rendered, ensuring timely compensation.

- Transferring funds between business accounts for operational needs or investments.

Quick guide on how to complete domestic wire transfer

Effortlessly Prepare Domestic Wire Transfer on Any Device

The management of online documents has become increasingly popular among businesses and individuals. It serves as an ideal environmentally friendly alternative to conventional printed and signed papers, as you can easily locate the required form and securely store it online. airSlate SignNow provides all the necessary tools to quickly create, modify, and eSign your documents without delays. Manage Domestic Wire Transfer on any platform with airSlate SignNow's Android or iOS applications and enhance any document-centered process today.

How to Modify and eSign Domestic Wire Transfer with Ease

- Locate Domestic Wire Transfer and click on Get Form to begin.

- Utilize the tools we offer to submit your document.

- Accentuate important sections of the documents or obscure sensitive details with the tools that airSlate SignNow specifically provides for this purpose.

- Create your eSignature using the Sign tool, which takes just seconds and holds the same legal recognition as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select how you want to send your form, whether by email, text message (SMS), invite link, or download it to your computer.

Leave behind the issues of lost or misfiled documents, tedious form searching, or mistakes that require reprinting new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Modify and eSign Domestic Wire Transfer to ensure smooth communication at any point of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the domestic wire transfer

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a domestic wire transfer form?

A domestic wire transfer form is a document used to authorize and process the transfer of funds between banks within the same country. Using airSlate SignNow, you can easily create and eSign this form electronically, ensuring a secure and efficient transaction every time.

-

How can airSlate SignNow help with domestic wire transfer forms?

airSlate SignNow streamlines the creation and signing of domestic wire transfer forms, allowing businesses to complete transactions faster. Our user-friendly interface makes it simple to input required information and get documents eSigned securely, reducing delays in your financial operations.

-

Are there any costs associated with using the domestic wire transfer form feature?

No, airSlate SignNow provides an affordable solution for managing domestic wire transfer forms without hidden fees. Pricing plans cater to various business sizes and needs, ensuring you get the best value while efficiently handling your wire transfer documents.

-

Can I integrate airSlate SignNow with other financial software for domestic wire transfers?

Yes, airSlate SignNow offers seamless integrations with various financial software, making it simple to manage your domestic wire transfer forms alongside your existing systems. This enhances workflow efficiency and helps you track transactions effortlessly.

-

What are the security measures for domestic wire transfer forms with airSlate SignNow?

airSlate SignNow prioritizes your data security by implementing advanced encryption and authentication measures for all domestic wire transfer forms. This ensures that your sensitive financial information remains protected throughout the signing and submission process.

-

Can I customize my domestic wire transfer form?

Absolutely! airSlate SignNow allows users to customize their domestic wire transfer forms to include specific details and branding. This flexibility ensures that the form meets your business requirements and improves recognition and trust among your clients.

-

How long does it take to complete a domestic wire transfer form with airSlate SignNow?

Completing a domestic wire transfer form with airSlate SignNow is quick and efficient, typically taking only a few minutes. The streamlined process helps minimize time spent on paperwork, allowing your business to execute transfers without unnecessary delays.

Get more for Domestic Wire Transfer

- Residential rental lease agreement ohio form

- Tenant welcome letter ohio form

- Warning of default on commercial lease ohio form

- Warning of default on residential lease ohio form

- Landlord tenant closing statement to reconcile security deposit ohio form

- Oh name change form

- Name change notification form ohio

- Commercial building or space lease ohio form

Find out other Domestic Wire Transfer

- How To Electronic signature New York Legal Lease Agreement

- How Can I Electronic signature New York Legal Stock Certificate

- Electronic signature North Carolina Legal Quitclaim Deed Secure

- How Can I Electronic signature North Carolina Legal Permission Slip

- Electronic signature Legal PDF North Dakota Online

- Electronic signature North Carolina Life Sciences Stock Certificate Fast

- Help Me With Electronic signature North Dakota Legal Warranty Deed

- Electronic signature North Dakota Legal Cease And Desist Letter Online

- Electronic signature North Dakota Legal Cease And Desist Letter Free

- Electronic signature Delaware Orthodontists Permission Slip Free

- How Do I Electronic signature Hawaii Orthodontists Lease Agreement Form

- Electronic signature North Dakota Life Sciences Business Plan Template Now

- Electronic signature Oklahoma Legal Bill Of Lading Fast

- Electronic signature Oklahoma Legal Promissory Note Template Safe

- Electronic signature Oregon Legal Last Will And Testament Online

- Electronic signature Life Sciences Document Pennsylvania Simple

- Electronic signature Legal Document Pennsylvania Online

- How Can I Electronic signature Pennsylvania Legal Last Will And Testament

- Electronic signature Rhode Island Legal Last Will And Testament Simple

- Can I Electronic signature Rhode Island Legal Residential Lease Agreement