Split Interest Trust Annual Return Form 5227Internal Revenue Service 2022

What is the Split Interest Trust Annual Return Form 5227

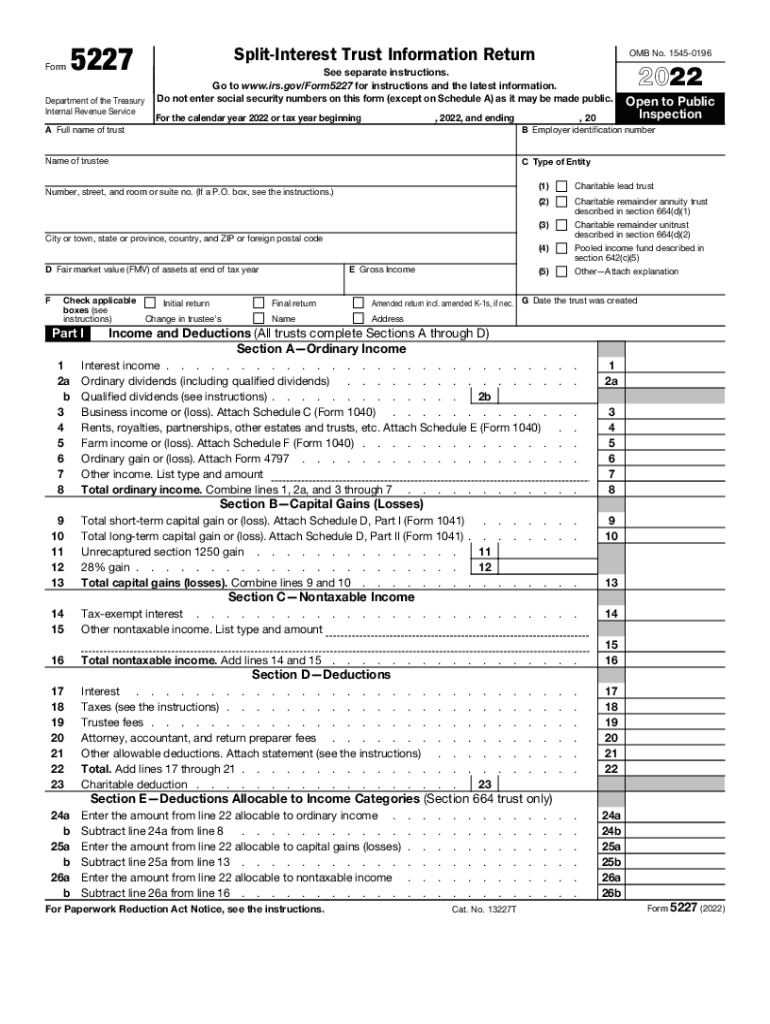

The Split Interest Trust Annual Return Form 5227 is a tax form issued by the Internal Revenue Service (IRS) specifically designed for split-interest trusts. These trusts are unique in that they allow for the distribution of income to one party while designating the principal to another upon termination. The form is essential for reporting the income generated by the trust, as well as the distributions made to beneficiaries. It serves to ensure compliance with federal tax laws and provides the IRS with necessary information regarding the trust's financial activities.

Steps to Complete the Split Interest Trust Annual Return Form 5227

Completing the Form 5227 requires careful attention to detail. Here are the key steps involved:

- Gather necessary information: Collect all relevant financial documents, including trust agreements, income statements, and distribution records.

- Fill out identifying information: Provide the trust's name, employer identification number (EIN), and the tax year for which the form is being filed.

- Report income: Detail all income generated by the trust, including interest, dividends, and capital gains.

- Document distributions: List all distributions made to beneficiaries, ensuring accurate amounts and dates.

- Sign and date the form: Ensure that the form is signed by the trustee or authorized representative, along with the date of signing.

Legal Use of the Split Interest Trust Annual Return Form 5227

The legal use of Form 5227 is crucial for maintaining compliance with IRS regulations. This form must be filed annually by split-interest trusts to report their income and distributions. Failure to file or inaccuracies in reporting can lead to penalties, including fines and interest on unpaid taxes. By using Form 5227 correctly, trustees can ensure that they meet their legal obligations and avoid potential legal complications.

Filing Deadlines / Important Dates

Filing deadlines for the Form 5227 are typically aligned with the tax year of the trust. The form is generally due by the fifteenth day of the fourth month following the end of the trust's tax year. For trusts operating on a calendar year, this means the form must be filed by April 15. If additional time is needed, trustees may file for an extension, but it is important to ensure that any tax owed is paid by the original deadline to avoid penalties.

Key Elements of the Split Interest Trust Annual Return Form 5227

Several key elements must be included in the Form 5227 to ensure it is complete and accurate:

- Trust identification: Name and EIN of the trust.

- Income reporting: Detailed breakdown of all income sources.

- Distribution summary: Comprehensive list of distributions to beneficiaries.

- Compliance statements: Any necessary declarations regarding compliance with IRS regulations.

How to Obtain the Split Interest Trust Annual Return Form 5227

The Form 5227 can be obtained directly from the IRS website or through various tax preparation software that includes IRS forms. It is advisable to ensure that the most current version of the form is used, as tax laws and requirements can change. Additionally, tax professionals can provide assistance in obtaining and completing the form, ensuring that all necessary information is accurately reported.

Quick guide on how to complete split interest trust annual return form 5227internal revenue service

Prepare Split Interest Trust Annual Return Form 5227Internal Revenue Service effortlessly on any device

Web-based document management has surged in popularity among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documentation, allowing you to obtain the right form and securely store it online. airSlate SignNow provides you with all the resources necessary to create, edit, and electronically sign your documents swiftly and without delays. Manage Split Interest Trust Annual Return Form 5227Internal Revenue Service on any platform with airSlate SignNow Android or iOS applications and simplify any document-related process today.

How to modify and eSign Split Interest Trust Annual Return Form 5227Internal Revenue Service easily

- Locate Split Interest Trust Annual Return Form 5227Internal Revenue Service and click Get Form to begin.

- Use the tools available to complete your form.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow provides for that purpose.

- Create your signature using the Sign tool, which takes seconds and holds the same legal validity as a traditional handwritten signature.

- Review all details and click on the Done button to save your changes.

- Choose your delivery method for your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate issues with lost or misplaced documents, tedious form searching, or errors that require reprinting new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Modify and eSign Split Interest Trust Annual Return Form 5227Internal Revenue Service to ensure clear communication at any step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct split interest trust annual return form 5227internal revenue service

Create this form in 5 minutes!

People also ask

-

What is form 5227 and how is it used?

Form 5227 is a tax document that is often required for specific financial transactions and regulatory compliance. Businesses use form 5227 to report financial information accurately and ensure that they meet regulatory standards. Utilizing airSlate SignNow, you can easily eSign and send form 5227 securely and quickly.

-

How can airSlate SignNow help with form 5227 documentation?

airSlate SignNow simplifies the process of filling out and signing form 5227 by providing an intuitive interface. It allows users to upload, edit, and eSign the document seamlessly, enhancing workflow efficiency. This means you can manage your form 5227 submissions faster while ensuring compliance.

-

What are the pricing plans for using airSlate SignNow for form 5227?

airSlate SignNow offers flexible pricing plans that cater to different business needs. Whether you're a small enterprise or a large organization, we have a plan that accommodates the volume of form 5227 you need to process. Contact us for more information on pricing tailored to your requirements.

-

Are there any integrations available for form 5227 with airSlate SignNow?

Yes, airSlate SignNow integrates with various applications that can enhance your workflow for form 5227. You can connect with tools like Google Drive, Dropbox, and CRMs to streamline document management. These integrations enable you to access and manage your form 5227 documents from multiple platforms efficiently.

-

What security features does airSlate SignNow provide for form 5227?

Security is paramount when handling documents like form 5227. airSlate SignNow offers robust encryption and secure storage, ensuring that your data remains safe. Additionally, our platform complies with industry standards, providing users peace of mind when eSigning sensitive documents.

-

Is there a mobile app available for managing form 5227?

Yes, airSlate SignNow has a mobile app that allows you to manage your form 5227 on the go. This mobile solution enables users to send, sign, and manage documents anytime and anywhere, ensuring you never miss an important deadline. The app is user-friendly and designed for efficiency.

-

Can I track the status of my form 5227 submissions?

Absolutely! With airSlate SignNow, you can track the status of your form 5227 submissions in real-time. The platform provides notifications and updates, so you always know where your document stands in the signing process. This feature enhances transparency and accountability.

Get more for Split Interest Trust Annual Return Form 5227Internal Revenue Service

- Il verified form

- Quitclaim deed from individual to husband and wife illinois form

- Illinois husband wife 497306002 form

- Lady bird deed 497306003 form

- Illinois release lien form

- Quitclaim deed from corporation to husband and wife illinois form

- Warranty deed from corporation to husband and wife illinois form

- Il release form

Find out other Split Interest Trust Annual Return Form 5227Internal Revenue Service

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document

- How Do I eSignature Texas Real Estate Document

- How Can I eSignature Colorado Courts PDF

- Can I eSignature Louisiana Courts Document

- How To Electronic signature Arkansas Banking Document

- How Do I Electronic signature California Banking Form