Underpayment of Estimated Tax by Individuals REV 1630 FormsPublications 2021

What is the Underpayment Of Estimated Tax By Individuals REV 1630 FormsPublications

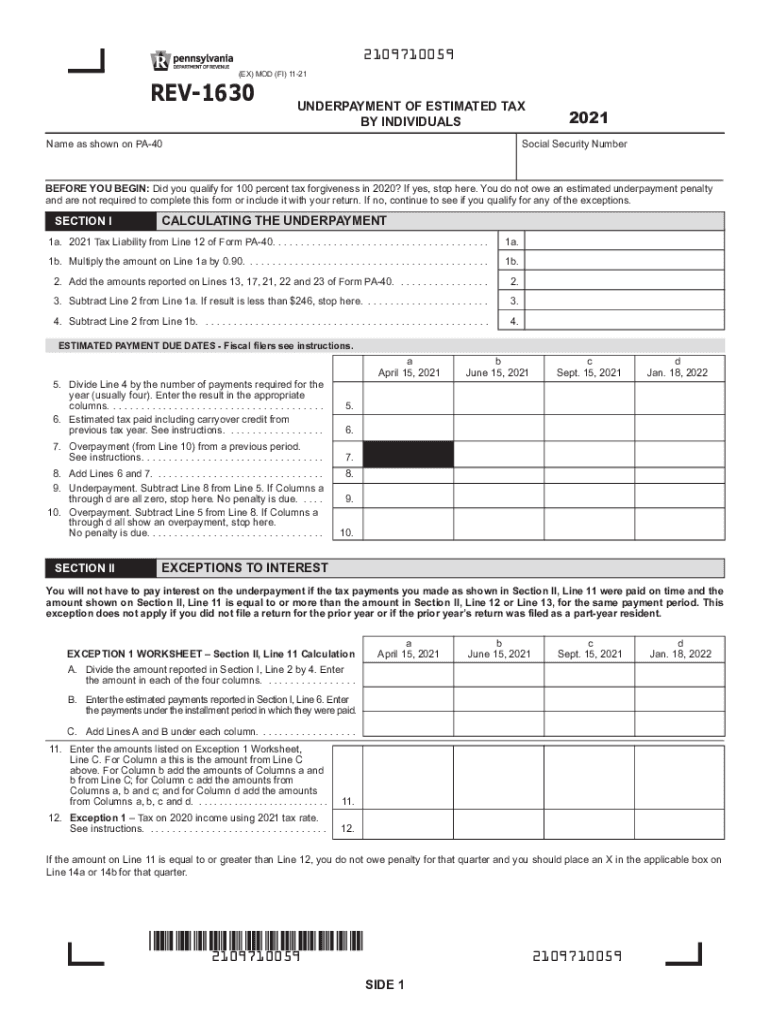

The Underpayment Of Estimated Tax By Individuals REV 1630 FormsPublications is a tax form issued by the Internal Revenue Service (IRS) that helps individuals calculate and report any underpayment of estimated taxes. This form is essential for taxpayers who do not have enough tax withheld from their income throughout the year, leading to potential penalties. By using this form, individuals can determine if they owe any additional tax and if they need to make an estimated payment to avoid penalties.

Steps to complete the Underpayment Of Estimated Tax By Individuals REV 1630 FormsPublications

Completing the Underpayment Of Estimated Tax By Individuals REV 1630 FormsPublications involves several steps:

- Gather all necessary financial documents, including income statements and previous tax returns.

- Calculate your total tax liability for the year.

- Determine the amount of tax withheld and any estimated payments already made.

- Use the form to calculate any underpayment based on the IRS guidelines.

- Complete the form, ensuring all sections are filled out accurately.

- Review the form for any errors before submission.

Legal use of the Underpayment Of Estimated Tax By Individuals REV 1630 FormsPublications

The legal use of the Underpayment Of Estimated Tax By Individuals REV 1630 FormsPublications is crucial for compliance with U.S. tax regulations. This form must be filled out accurately to reflect any underpayment of taxes owed. Failure to use the form correctly can lead to penalties from the IRS. It is important to ensure that all calculations are correct and that the form is submitted by the appropriate deadlines to maintain compliance with tax laws.

Filing Deadlines / Important Dates

Filing deadlines for the Underpayment Of Estimated Tax By Individuals REV 1630 FormsPublications vary based on the tax year and the individual's filing status. Generally, estimated tax payments are due quarterly, with specific dates set by the IRS. It is essential to keep track of these dates to avoid late fees and penalties. Taxpayers should also be aware of the final deadline for filing their annual tax return, as it may impact their estimated tax obligations.

Penalties for Non-Compliance

Non-compliance with the requirements of the Underpayment Of Estimated Tax By Individuals REV 1630 FormsPublications can result in significant penalties. If an individual underpays their estimated taxes, they may face interest charges and penalties calculated based on the amount owed and the duration of the underpayment. Understanding these penalties is crucial for taxpayers to avoid unexpected financial burdens and ensure they meet their tax obligations.

Examples of using the Underpayment Of Estimated Tax By Individuals REV 1630 FormsPublications

Examples of using the Underpayment Of Estimated Tax By Individuals REV 1630 FormsPublications include scenarios where individuals, such as freelancers or self-employed persons, do not have taxes withheld from their income. For instance, a self-employed individual may realize that their income has increased significantly, leading to underpayment. By using this form, they can assess their tax situation and make necessary adjustments to avoid penalties.

Quick guide on how to complete 2021 underpayment of estimated tax by individuals rev 1630 formspublications

Effortlessly Prepare Underpayment Of Estimated Tax By Individuals REV 1630 FormsPublications on Any Device

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to acquire the necessary form and securely archive it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents swiftly and without delays. Manage Underpayment Of Estimated Tax By Individuals REV 1630 FormsPublications across any platform using airSlate SignNow's Android or iOS applications and enhance your document-centric workflows today.

The Simplest Method to Edit and Electronically Sign Underpayment Of Estimated Tax By Individuals REV 1630 FormsPublications with Ease

- Find Underpayment Of Estimated Tax By Individuals REV 1630 FormsPublications and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize important sections of your documents or redact sensitive information using the tools specifically designed for that purpose by airSlate SignNow.

- Generate your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional handwritten signature.

- Review all the details and click the Done button to finalize your updates.

- Choose your preferred method to send your form, whether by email, SMS, or a shareable link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets all your document management needs with just a few clicks from your chosen device. Edit and electronically sign Underpayment Of Estimated Tax By Individuals REV 1630 FormsPublications to ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2021 underpayment of estimated tax by individuals rev 1630 formspublications

Create this form in 5 minutes!

People also ask

-

What is the Underpayment Of Estimated Tax By Individuals REV 1630 FormsPublications?

The Underpayment Of Estimated Tax By Individuals REV 1630 FormsPublications provides guidelines for individuals to understand their tax obligations and avoid penalties. It is essential for taxpayers who need to estimate their taxes throughout the year. Ensuring compliance with these guidelines could help in seamless tax filing.

-

How does airSlate SignNow help with the Underpayment Of Estimated Tax By Individuals REV 1630 FormsPublications?

AirSlate SignNow offers an efficient platform to electronically sign and send documents related to the Underpayment Of Estimated Tax By Individuals REV 1630 FormsPublications. Users can quickly prepare their tax documents and securely share them, enhancing productivity and compliance in tax obligations.

-

What pricing plans does airSlate SignNow offer for document signing?

AirSlate SignNow offers various pricing plans to cater to different business needs, starting from a basic plan up to more advanced solutions. Each plan includes features that facilitate the easy signing of documents related to the Underpayment Of Estimated Tax By Individuals REV 1630 FormsPublications. Evaluate the plans to choose one that best fits your requirements.

-

What features are available to assist with the Underpayment Of Estimated Tax By Individuals REV 1630 FormsPublications?

Features such as document templates, customizable workflows, and automatic reminders are integrated into airSlate SignNow to assist with completing the Underpayment Of Estimated Tax By Individuals REV 1630 FormsPublications. These tools streamline the documentation process, making it easier to comply with tax obligations efficiently.

-

How can I integrate airSlate SignNow with my existing tools?

AirSlate SignNow seamlessly integrates with popular tools such as Google Drive, Salesforce, and more, helping you manage documents related to the Underpayment Of Estimated Tax By Individuals REV 1630 FormsPublications. This integration allows for a hassle-free document management experience, enhancing workflow efficiency.

-

What are the benefits of using airSlate SignNow for tax documents?

Using airSlate SignNow for your tax documents, including those related to the Underpayment Of Estimated Tax By Individuals REV 1630 FormsPublications, offers numerous benefits. It improves accuracy with automated features, saves time with quicker processing, and enhances document security with advanced encryption.

-

Is airSlate SignNow compliant with tax regulations?

Yes, airSlate SignNow is designed to comply with industry standards and regulations, including those associated with the Underpayment Of Estimated Tax By Individuals REV 1630 FormsPublications. Using our platform ensures that all your document signing processes are secure and legally binding, providing peace of mind.

Get more for Underpayment Of Estimated Tax By Individuals REV 1630 FormsPublications

- New mexico affidavit 497320277 form

- Newly divorced individuals package new mexico form

- Statutory general power of attorney with durable provisions new mexico form

- Contractors forms package new mexico

- Power of attorney for sale of motor vehicle new mexico form

- Nm statutory form

- Wedding planning or consulting package new mexico form

- Hunting forms package new mexico

Find out other Underpayment Of Estimated Tax By Individuals REV 1630 FormsPublications

- Electronic signature North Carolina Plumbing Business Letter Template Easy

- Electronic signature Kansas Real Estate Residential Lease Agreement Simple

- How Can I Electronic signature North Carolina Plumbing Promissory Note Template

- Electronic signature North Dakota Plumbing Emergency Contact Form Mobile

- Electronic signature North Dakota Plumbing Emergency Contact Form Easy

- Electronic signature Rhode Island Plumbing Business Plan Template Later

- Electronic signature Louisiana Real Estate Quitclaim Deed Now

- Electronic signature Louisiana Real Estate Quitclaim Deed Secure

- How Can I Electronic signature South Dakota Plumbing Emergency Contact Form

- Electronic signature South Dakota Plumbing Emergency Contact Form Myself

- Electronic signature Maryland Real Estate LLC Operating Agreement Free

- Electronic signature Texas Plumbing Quitclaim Deed Secure

- Electronic signature Utah Plumbing Last Will And Testament Free

- Electronic signature Washington Plumbing Business Plan Template Safe

- Can I Electronic signature Vermont Plumbing Affidavit Of Heirship

- Electronic signature Michigan Real Estate LLC Operating Agreement Easy

- Electronic signature West Virginia Plumbing Memorandum Of Understanding Simple

- Electronic signature Sports PDF Alaska Fast

- Electronic signature Mississippi Real Estate Contract Online

- Can I Electronic signature Missouri Real Estate Quitclaim Deed