Form 8689 Allocation of Individual Income Tax to the U S Virgin Islands 2022-2026

What is the Form 8689 Allocation Of Individual Income Tax To The U S Virgin Islands

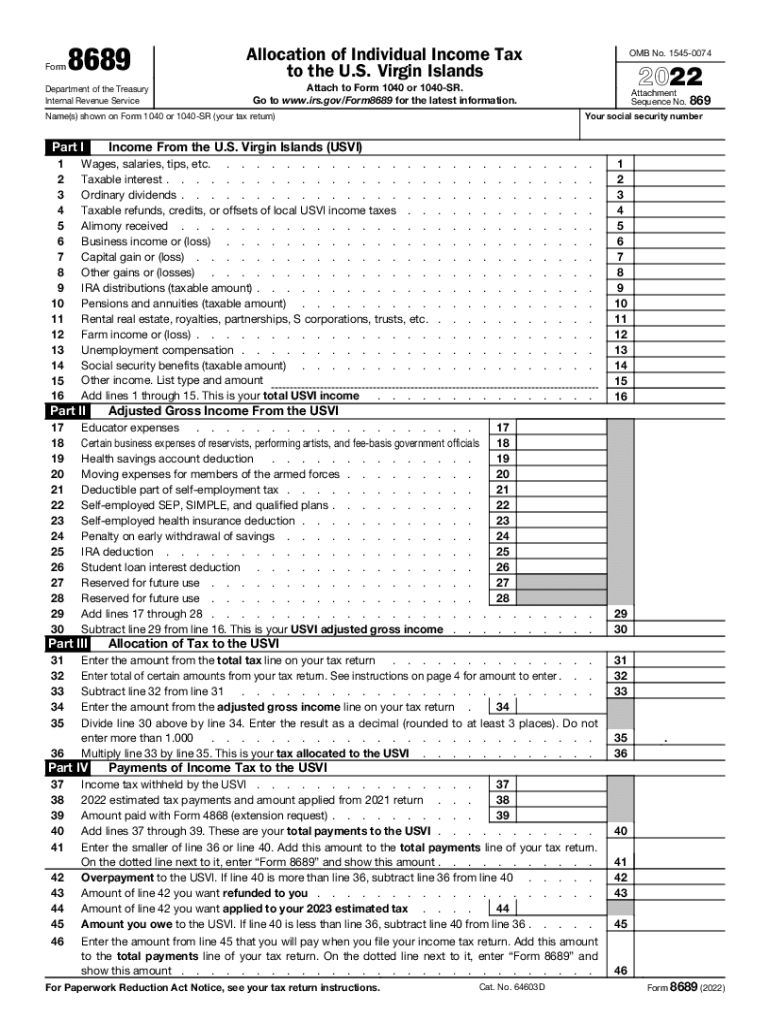

The Form 8689, known as the Allocation of Individual Income Tax to the U.S. Virgin Islands, is a crucial document for individuals who earn income in the U.S. Virgin Islands while being residents of the mainland United States. This form allows taxpayers to allocate their income tax liability between the U.S. Virgin Islands and the United States. It is essential for ensuring that individuals do not pay double taxes on the same income, as it helps in determining the correct amount of tax owed to each jurisdiction.

How to use the Form 8689 Allocation Of Individual Income Tax To The U S Virgin Islands

Using the Form 8689 involves a few key steps. First, gather all necessary financial documents, including income statements and previous tax returns. Next, complete the form by accurately reporting your income earned in the U.S. Virgin Islands and any applicable deductions. It is important to follow the instructions provided on the form carefully to ensure compliance with tax regulations. Once completed, the form can be submitted along with your federal tax return to the IRS.

Steps to complete the Form 8689 Allocation Of Individual Income Tax To The U S Virgin Islands

Completing the Form 8689 requires attention to detail. Here are the steps to follow:

- Begin by entering your personal information, including your name, address, and Social Security number.

- Report your total income earned in the U.S. Virgin Islands for the tax year.

- Calculate the portion of your income that is allocable to the U.S. Virgin Islands using the provided worksheets.

- Include any credits or deductions that apply to your situation.

- Review the completed form for accuracy and completeness before submission.

IRS Guidelines

The IRS provides specific guidelines regarding the use of Form 8689. It is essential to refer to the latest IRS publications and instructions to ensure compliance with current tax laws. The IRS outlines the eligibility criteria for using this form, the necessary documentation, and the filing procedures. Staying updated with these guidelines helps avoid penalties and ensures that your tax filings are accurate.

Filing Deadlines / Important Dates

Filing deadlines for Form 8689 align with the general tax filing deadlines set by the IRS. Typically, individual tax returns are due on April fifteenth of each year. However, if you are unable to meet this deadline, you may request an extension. It is important to note that any taxes owed must still be paid by the original deadline to avoid interest and penalties.

Required Documents

To successfully complete the Form 8689, you will need several documents, including:

- W-2 forms or 1099 forms showing income earned in the U.S. Virgin Islands.

- Previous year’s tax returns for reference.

- Documentation of any deductions or credits you plan to claim.

- Any other relevant financial records that support your income and tax situation.

Penalties for Non-Compliance

Failure to accurately complete and file Form 8689 can result in significant penalties. The IRS may impose fines for late filings, underreporting income, or failing to pay taxes owed. Additionally, taxpayers may face interest charges on any unpaid tax liabilities. It is crucial to ensure that all information is correct and submitted on time to avoid these penalties.

Quick guide on how to complete 2022 form 8689 allocation of individual income tax to the us virgin islands

Finalize Form 8689 Allocation Of Individual Income Tax To The U S Virgin Islands effortlessly on any gadget

The management of digital documents has gained traction among businesses and individuals alike. It serves as an ideal environmentally friendly alternative to traditional printed and signed paperwork, allowing you to access the appropriate form and safeguard it online. airSlate SignNow equips you with all the resources necessary to design, modify, and electronically sign your documents rapidly without any delays. Manage Form 8689 Allocation Of Individual Income Tax To The U S Virgin Islands on any device using airSlate SignNow Android or iOS applications and enhance any document-focused workflow today.

The easiest method to modify and electronically sign Form 8689 Allocation Of Individual Income Tax To The U S Virgin Islands with ease

- Locate Form 8689 Allocation Of Individual Income Tax To The U S Virgin Islands and click Get Form to initiate the process.

- Utilize the tools available to complete your document.

- Emphasize important sections of the documents or redact sensitive content with features that airSlate SignNow provides specifically for that purpose.

- Generate your electronic signature with the Sign feature, which takes mere seconds and carries the same legal value as a conventional handwritten signature.

- Review all the details and click on the Done button to save your adjustments.

- Select how you wish to send your document, via email, text message (SMS), or invitation link, or download it to your computer.

Forget about lost or mislaid documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow fulfills your needs in document management with just a few clicks from any device of your choosing. Edit and electronically sign Form 8689 Allocation Of Individual Income Tax To The U S Virgin Islands and guarantee excellent communication at any stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2022 form 8689 allocation of individual income tax to the us virgin islands

Create this form in 5 minutes!

People also ask

-

What is publication 570 and how does it relate to eSigning?

Publication 570 is an important IRS resource that provides guidelines for tax benefits and deductions. For businesses using airSlate SignNow, understanding these guidelines ensures that eSigned documents comply with tax regulations, helping to avoid potential issues during tax season.

-

How does airSlate SignNow support compliance with publication 570?

airSlate SignNow offers secure eSigning features that align with the regulations outlined in publication 570. This includes encrypted signatures and a clear audit trail, ensuring that all documents meet the necessary legal standards mandated by the IRS.

-

What are the pricing options for airSlate SignNow?

AirSlate SignNow provides flexible pricing plans designed to meet the specific needs of different businesses. Each plan offers features that help users handle documents efficiently while maintaining compliance with guidelines, including those in publication 570.

-

Can I integrate airSlate SignNow with other software for document management?

Yes, airSlate SignNow can be seamlessly integrated with various software applications, enhancing document management workflows. These integrations help users stay compliant with publication 570 while efficiently managing their eSigned documents.

-

What features does airSlate SignNow offer for tracking eSigned documents?

airSlate SignNow provides robust tracking features that allow users to monitor the status of eSigned documents in real-time. This functionality is crucial for maintaining compliance with publication 570 requirements, ensuring all necessary documentation is available for tax review.

-

How does airSlate SignNow enhance the eSigning experience?

airSlate SignNow enhances the eSigning experience with its user-friendly interface and intuitive features, making it easy for businesses to send and sign documents. This ease of use is essential for adhering to the guidelines set forth in publication 570, allowing for smoother transactions.

-

Are there any security measures in place for eSigned documents?

Absolutely, airSlate SignNow places a strong emphasis on security, utilizing encryption and secure storage for all eSigned documents. These measures ensure that your documents not only meet eSigning standards but also adhere to the stipulations in publication 570 for data protection.

Get more for Form 8689 Allocation Of Individual Income Tax To The U S Virgin Islands

- Employment interview package new mexico form

- Employment employee 497320302 form

- Assignment of mortgage package new mexico form

- Assignment of lease package new mexico form

- New mexico purchase form

- Satisfaction cancellation or release of mortgage package new mexico form

- Premarital agreements package new mexico form

- Painting contractor package new mexico form

Find out other Form 8689 Allocation Of Individual Income Tax To The U S Virgin Islands

- eSign Massachusetts Orthodontists Last Will And Testament Now

- eSign Illinois Plumbing Permission Slip Free

- eSign Kansas Plumbing LLC Operating Agreement Secure

- eSign Kentucky Plumbing Quitclaim Deed Free

- eSign Legal Word West Virginia Online

- Can I eSign Wisconsin Legal Warranty Deed

- eSign New Hampshire Orthodontists Medical History Online

- eSign Massachusetts Plumbing Job Offer Mobile

- How To eSign Pennsylvania Orthodontists Letter Of Intent

- eSign Rhode Island Orthodontists Last Will And Testament Secure

- eSign Nevada Plumbing Business Letter Template Later

- eSign Nevada Plumbing Lease Agreement Form Myself

- eSign Plumbing PPT New Jersey Later

- eSign New York Plumbing Rental Lease Agreement Simple

- eSign North Dakota Plumbing Emergency Contact Form Mobile

- How To eSign North Dakota Plumbing Emergency Contact Form

- eSign Utah Orthodontists Credit Memo Easy

- How To eSign Oklahoma Plumbing Business Plan Template

- eSign Vermont Orthodontists Rental Application Now

- Help Me With eSign Oregon Plumbing Business Plan Template