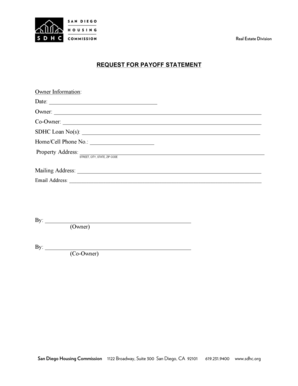

Request for Payoff Statement San Diego Housing Commission Form

Understanding the Loan Approval Process

The loan approval process is a critical step for individuals seeking financial assistance. It involves several stages, including application submission, credit evaluation, and underwriting. Lenders assess the applicant's creditworthiness by reviewing credit scores, income, and existing debts. This thorough evaluation helps determine whether a loan can be approved and under what terms.

Key Elements of Loan Approval

Several key elements play a significant role in the loan approval process. These include:

- Credit Score: A numerical representation of an individual's credit history, impacting the likelihood of loan approval.

- Debt-to-Income Ratio: A measure of an applicant's monthly debt payments compared to their gross monthly income.

- Employment History: Lenders prefer stable employment, as it indicates reliable income.

- Loan Type: Different loans have varying requirements and approval criteria.

Steps to Complete a Loan Application

Completing a loan application involves several important steps:

- Gather Necessary Documents: Collect financial statements, proof of income, and identification.

- Fill Out the Application: Provide accurate information regarding personal and financial details.

- Submit the Application: Send the completed application to the lender, either online or in person.

- Await Approval: The lender will review the application and notify the applicant of the decision.

Legal Considerations for Loan Approval

Understanding the legal aspects of loan approval is essential. Lenders must comply with federal and state regulations, ensuring fair lending practices. This includes adherence to the Equal Credit Opportunity Act, which prohibits discrimination based on race, gender, or other protected characteristics. Additionally, borrowers should be aware of their rights regarding loan terms and conditions.

Eligibility Criteria for Loan Approval

Eligibility criteria for loan approval may vary by lender and loan type. Common requirements include:

- Minimum credit score thresholds.

- Proof of stable income and employment.

- Verification of assets and liabilities.

- Age and residency status, as some lenders may have specific requirements.

Application Process and Approval Time

The application process for loan approval can vary in duration. Typically, it involves:

- Initial application submission, which can be done online or in person.

- Review period, where the lender assesses the application, which may take a few days to weeks.

- Final decision notification, where the lender communicates the outcome to the applicant.

Factors such as the lender's workload and the complexity of the application can influence the approval time.

Quick guide on how to complete request for payoff statement san diego housing commission

Prepare Request For Payoff Statement San Diego Housing Commission effortlessly on any device

Digital document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can easily find the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, edit, and electronically sign your documents quickly without any wait. Manage Request For Payoff Statement San Diego Housing Commission on any device with airSlate SignNow's Android or iOS applications and streamline any document-related task today.

How to modify and electronically sign Request For Payoff Statement San Diego Housing Commission with ease

- Find Request For Payoff Statement San Diego Housing Commission and click on Get Form to begin.

- Make use of the tools we offer to complete your form.

- Highlight pertinent sections of your documents or redact sensitive information with tools provided by airSlate SignNow specifically for that purpose.

- Generate your electronic signature using the Sign tool, which takes only seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the information and click on the Done button to save your changes.

- Choose how you want to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious document searches, or errors that require reprinting new copies. airSlate SignNow caters to your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Request For Payoff Statement San Diego Housing Commission and ensure outstanding communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the request for payoff statement san diego housing commission

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What does it mean to have a loan approved with airSlate SignNow?

Having a loan approved with airSlate SignNow means that you can efficiently manage your loan documents through secure eSigning. This streamlined process helps you finalize your loan agreements faster, ensuring that your funds are available when you need them. With our platform, every step is simplified for your convenience.

-

How does airSlate SignNow speed up the loan approval process?

airSlate SignNow speeds up the loan approval process by allowing users to send, sign, and manage documents online quickly. No more faxing or mail delays; everything happens digitally, ensuring all parties can promptly review and sign necessary documents. This efficiency is crucial for getting your loan approved in a timely manner.

-

What are the pricing options for airSlate SignNow?

Our pricing options are designed to be cost-effective, making loan management simpler without breaking the bank. We offer various tiers that cater to businesses of all sizes, ensuring you have access to the features necessary for keeping your loan approved documentation in order. You can choose a plan that fits your budget and document volume.

-

Can I integrate airSlate SignNow with my existing loan management software?

Yes, airSlate SignNow can easily integrate with many popular loan management software systems. This ensures that you can seamlessly manage your documents and track the loan approved status without having to switch platforms. Integration enhances workflow efficiency, helping facilitate quicker loan approvals.

-

What features does airSlate SignNow offer for loan management?

airSlate SignNow offers features such as digital workflows, customizable templates, and advanced signing options tailored for loan management. These tools help you manage the documentation required for loan approval more effectively. Additionally, secure storage and tracking features make it easy to monitor your loan documents.

-

Is airSlate SignNow secure for submitting loan documents?

Absolutely, airSlate SignNow prioritizes security, ensuring that all loan documents are encrypted and safely stored. Compliance with industry standards guarantees that your information remains confidential during the loan approval process. You can trust that your sensitive data is safeguarded at all times.

-

Do I need technical skills to use airSlate SignNow for loan approvals?

No technical skills are required to use airSlate SignNow, making it accessible for everyone. The platform is designed to be user-friendly, ensuring that both businesses and customers can easily navigate the process to get their loan documents signed and approved. Training resources are also available for added support.

Get more for Request For Payoff Statement San Diego Housing Commission

Find out other Request For Payoff Statement San Diego Housing Commission

- How Do I Sign Massachusetts Real Estate LLC Operating Agreement

- Can I Sign Massachusetts Real Estate LLC Operating Agreement

- Sign Massachusetts Real Estate Quitclaim Deed Simple

- Sign Massachusetts Sports NDA Mobile

- Sign Minnesota Real Estate Rental Lease Agreement Now

- How To Sign Minnesota Real Estate Residential Lease Agreement

- Sign Mississippi Sports Confidentiality Agreement Computer

- Help Me With Sign Montana Sports Month To Month Lease

- Sign Mississippi Real Estate Warranty Deed Later

- How Can I Sign Mississippi Real Estate Affidavit Of Heirship

- How To Sign Missouri Real Estate Warranty Deed

- Sign Nebraska Real Estate Letter Of Intent Online

- Sign Nebraska Real Estate Limited Power Of Attorney Mobile

- How Do I Sign New Mexico Sports Limited Power Of Attorney

- Sign Ohio Sports LLC Operating Agreement Easy

- Sign New Jersey Real Estate Limited Power Of Attorney Computer

- Sign New Mexico Real Estate Contract Safe

- How To Sign South Carolina Sports Lease Termination Letter

- How Can I Sign New York Real Estate Memorandum Of Understanding

- Sign Texas Sports Promissory Note Template Online