Lost Wages Form 2014-2026

What is the Lost Wages Form

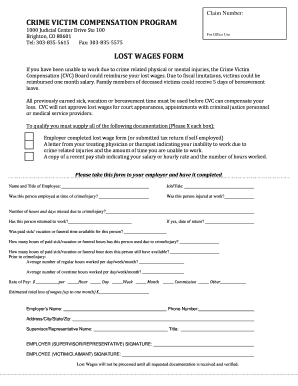

The lost wages form is a document used primarily to claim compensation for income lost due to unemployment. This form is often required by state unemployment agencies when individuals file for benefits after losing their job. It serves as an official request for payment, detailing the amount of wages lost and the reason for unemployment. Understanding the purpose of this form is crucial for anyone seeking financial assistance during a period of joblessness.

How to use the Lost Wages Form

Using the lost wages form involves several key steps to ensure proper submission and processing. First, gather all necessary information, including your employment history and the details surrounding your job loss. Next, accurately fill out the form, making sure to provide clear and truthful information about your lost wages. Once completed, submit the form according to your state’s guidelines, which may include online submission or mailing it to the appropriate agency.

Steps to complete the Lost Wages Form

Completing the lost wages form requires careful attention to detail. Start by entering your personal information, including your name, address, and Social Security number. Next, specify the dates of unemployment and the total amount of wages lost during that period. It is essential to provide supporting documentation, such as pay stubs or termination letters, to substantiate your claim. Finally, review the form for accuracy before submitting it to ensure that all information is correct and complete.

Legal use of the Lost Wages Form

The legal use of the lost wages form is governed by state laws and regulations regarding unemployment benefits. To be considered valid, the form must be filled out truthfully and submitted within the designated time frame set by your state’s unemployment office. Misrepresentation or failure to comply with these regulations can result in penalties, including denial of benefits or legal repercussions. Understanding the legal implications of this form is vital for ensuring compliance and receiving the benefits you are entitled to.

Eligibility Criteria

Eligibility for using the lost wages form typically depends on several factors, including the reason for job loss and the duration of unemployment. Generally, individuals must have lost their job through no fault of their own, such as layoffs or company closures. Additionally, applicants must meet specific income thresholds and actively seek new employment. Each state may have its own criteria, so it is important to review local regulations to determine your eligibility.

Required Documents

When completing the lost wages form, certain documents are often required to support your claim. These may include recent pay stubs, termination letters, and any correspondence from your employer regarding your job loss. Additionally, proof of your job search efforts, such as applications or interview confirmations, may be necessary. Gathering these documents ahead of time can streamline the process and help ensure your claim is processed efficiently.

Form Submission Methods

The lost wages form can typically be submitted through various methods, depending on state guidelines. Common submission methods include online portals, where applicants can fill out and submit the form electronically. Alternatively, some states allow for submission via mail or in-person at designated unemployment offices. Understanding the available submission methods can help you choose the most convenient option for your situation.

Quick guide on how to complete lost wages form 41670838

Effortlessly Prepare Lost Wages Form on Any Device

Managing documents online has become increasingly popular among organizations and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed documents since you can easily locate the correct form and safely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents promptly without any delays. Handle Lost Wages Form on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to Edit and eSign Lost Wages Form with Ease

- Obtain Lost Wages Form and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Highlight important sections of your documents or redact sensitive information with tools that airSlate SignNow specifically provides for this purpose.

- Create your eSignature using the Sign tool, which takes just a few seconds and holds the same legal validity as a conventional wet ink signature.

- Verify the information and click on the Done button to save your changes.

- Choose your preferred method for delivering your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your preference. Edit and eSign Lost Wages Form to ensure effective communication throughout the entire form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the lost wages form 41670838

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a lost wages form and why do I need one?

A lost wages form is a document used to claim compensation for income lost due to an injury or other situations. It is essential for individuals seeking reimbursement, as it provides necessary proof of income loss to insurance companies or employers. Using airSlate SignNow, you can easily create and send a lost wages form digitally.

-

How does airSlate SignNow simplify the process of creating a lost wages form?

airSlate SignNow allows you to create a lost wages form quickly and efficiently with customizable templates. Its user-friendly interface makes it easy to fill out required fields and include additional information. Plus, eSigning features enable you to get necessary signatures in a matter of minutes.

-

Is there a cost associated with using the lost wages form feature on airSlate SignNow?

Yes, airSlate SignNow offers various pricing plans tailored to fit different business needs. The lost wages form feature is included in most of these plans, allowing users to manage document workflows effectively without breaking the bank. You can check the pricing section on our website for more details.

-

Can I integrate airSlate SignNow with other platforms for my lost wages form?

Absolutely! airSlate SignNow provides seamless integrations with a variety of third-party applications, enhancing your workflow. You can link your lost wages form to project management tools, CRM systems, and more, streamlining the document management process across platforms.

-

What are the benefits of using airSlate SignNow for a lost wages form?

Using airSlate SignNow for your lost wages form offers numerous benefits, including faster processing times and reduced paper usage. The digital document can be sent, signed, and stored securely, minimizing clutter and increasing efficiency. Additionally, it enables tracking and ensures compliance with legal requirements.

-

Is the lost wages form secure with airSlate SignNow?

Yes, security is a top priority at airSlate SignNow. Your lost wages form and any other sensitive documents are encrypted and stored in compliance with industry standards. This ensures that your information is protected from unauthorized access and remains confidential.

-

How do I send a lost wages form using airSlate SignNow?

To send a lost wages form using airSlate SignNow, simply create your document using our user-friendly interface, add the required details, and then use the 'Send for Signature' feature. You can input recipient emails directly within the platform for a quick and efficient sending process. Notifications will keep you informed on the signing status.

Get more for Lost Wages Form

Find out other Lost Wages Form

- How Do I Sign Vermont Online Tutoring Services Proposal Template

- How Do I Sign North Carolina Medical Records Release

- Sign Idaho Domain Name Registration Agreement Easy

- Sign Indiana Domain Name Registration Agreement Myself

- Sign New Mexico Domain Name Registration Agreement Easy

- How To Sign Wisconsin Domain Name Registration Agreement

- Sign Wyoming Domain Name Registration Agreement Safe

- Sign Maryland Delivery Order Template Myself

- Sign Minnesota Engineering Proposal Template Computer

- Sign Washington Engineering Proposal Template Secure

- Sign Delaware Proforma Invoice Template Online

- Can I Sign Massachusetts Proforma Invoice Template

- How Do I Sign Oklahoma Equipment Purchase Proposal

- Sign Idaho Basic rental agreement or residential lease Online

- How To Sign Oregon Business agreements

- Sign Colorado Generic lease agreement Safe

- How Can I Sign Vermont Credit agreement

- Sign New York Generic lease agreement Myself

- How Can I Sign Utah House rent agreement format

- Sign Alabama House rental lease agreement Online