Dcbs Form 440 392 2017

Understanding the Oregon Form

The Oregon Form is a crucial document used for tax reporting purposes. This form is specifically designed for individuals and businesses to report their income and calculate their tax liabilities within the state of Oregon. It serves as an official declaration of income, deductions, and credits, ensuring compliance with state tax laws. Understanding the components of this form is essential for accurate tax reporting and to avoid potential penalties.

Steps to Complete the Oregon Form

Filling out the Oregon Form involves several key steps to ensure accuracy and compliance:

- Gather necessary documents such as W-2s, 1099s, and any other income statements.

- Begin by entering your personal information, including your name, address, and Social Security number.

- Report your total income, including wages, interest, dividends, and any other taxable income sources.

- Deduct eligible expenses and credits to calculate your taxable income.

- Review all entries for accuracy before signing and dating the form.

Legal Use of the Oregon Form

The Oregon Form must be completed in accordance with state tax regulations. Legally, this form serves as a binding document that reflects your financial activities for the tax year. Submitting an accurate and complete form is essential to avoid legal repercussions, including fines or audits from the Oregon Department of Revenue. It is advisable to consult with a tax professional if there are uncertainties regarding the form's requirements.

Filing Deadlines for the Oregon Form

Timely submission of the Oregon Form is critical to avoid penalties. The standard deadline for filing this form is typically April 15 of the following year. However, it is important to verify specific deadlines for the current tax year, as they may vary due to holidays or other factors. Filing extensions may be available, but they do not exempt taxpayers from payment obligations.

Form Submission Methods for the Oregon Form

The Oregon Form can be submitted through various methods to accommodate different preferences:

- Online: Many taxpayers prefer to file electronically through state-approved e-filing platforms, which can streamline the process.

- Mail: The form can be printed and mailed to the Oregon Department of Revenue. Ensure that it is sent to the correct address and postmarked by the deadline.

- In-Person: Taxpayers may also choose to submit the form in person at designated state offices, which can provide immediate confirmation of receipt.

Required Documents for the Oregon Form

To complete the Oregon Form accurately, certain documents are required:

- W-2 forms from employers.

- 1099 forms for additional income sources.

- Records of deductible expenses, such as receipts for business expenses or medical costs.

- Any relevant tax credits documentation.

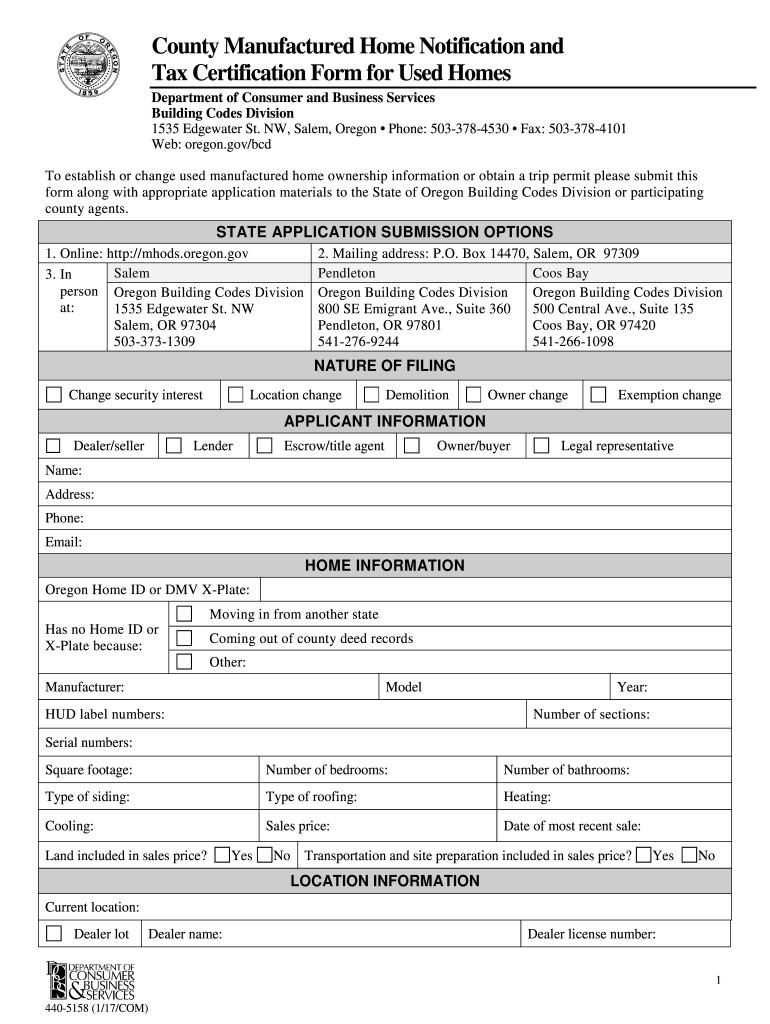

Quick guide on how to complete dcbs form 440 5158 2952 oregongov

Your assistance manual on how to prepare your Dcbs Form 440 392

If you’re wondering how to fill out and submit your Dcbs Form 440 392, here are a few straightforward guidelines to simplify tax preparation.

To begin, you just need to create your airSlate SignNow account to change the way you handle documents online. airSlate SignNow is an extremely intuitive and effective document management solution that enables you to modify, draft, and finalize your income tax forms with ease. With its editor, you can alternate between text, checkboxes, and eSignatures, and revert to amend any information as necessary. Streamline your tax management with advanced PDF editing, eSigning, and easy sharing.

Follow these steps to finalize your Dcbs Form 440 392 in no time:

- Create your account and start editing PDFs within moments.

- Consult our catalog to find any IRS tax form; browse through variations and schedules.

- Click Get form to access your Dcbs Form 440 392 in our editor.

- Complete the required fillable fields with your details (text, numbers, checkmarks).

- Utilize the Sign Tool to include your legally-binding eSignature (if necessary).

- Review your document and rectify any mistakes.

- Save changes, print your copy, send it to your recipient, and download it to your device.

Make the most of this guide to file your taxes electronically with airSlate SignNow. Please keep in mind that filing on paper can result in return errors and postponed refunds. Certainly, before e-filing your taxes, verify the IRS website for filing regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct dcbs form 440 5158 2952 oregongov

Create this form in 5 minutes!

How to create an eSignature for the dcbs form 440 5158 2952 oregongov

How to make an electronic signature for your Dcbs Form 440 5158 2952 Oregongov online

How to generate an eSignature for the Dcbs Form 440 5158 2952 Oregongov in Chrome

How to create an electronic signature for signing the Dcbs Form 440 5158 2952 Oregongov in Gmail

How to generate an electronic signature for the Dcbs Form 440 5158 2952 Oregongov straight from your mobile device

How to create an electronic signature for the Dcbs Form 440 5158 2952 Oregongov on iOS

How to generate an eSignature for the Dcbs Form 440 5158 2952 Oregongov on Android OS

People also ask

-

What is the Oregon form 440 5158?

The Oregon form 440 5158 is a specific document used for tax purposes in the state of Oregon. It is essential for organizations to complete this form accurately to comply with state regulations. Utilizing airSlate SignNow allows you to fill out and eSign the Oregon form 440 5158 efficiently, ensuring seamless processing.

-

How can airSlate SignNow help with filling out the Oregon form 440 5158?

airSlate SignNow provides an intuitive platform for filling out the Oregon form 440 5158. Our easy-to-use interface allows users to input necessary information quickly and accurately. Plus, you can save and retrieve completed forms, streamlining your documentation process.

-

Is there a cost to use airSlate SignNow for the Oregon form 440 5158?

airSlate SignNow offers affordable pricing plans that cater to different business needs for managing documents, including the Oregon form 440 5158. You can choose a plan that suits your volume and frequency of use, ensuring you get the best value. Additionally, try our free trial to see how it works for your organization before committing.

-

Are there any integration options for using the Oregon form 440 5158 with airSlate SignNow?

Yes, airSlate SignNow integrates seamlessly with various applications to facilitate the management of the Oregon form 440 5158 and other documents. You can connect with tools like Google Drive, Dropbox, and others to easily access, share, and store your forms. This enhances your workflow and increases efficiency.

-

What are the benefits of using airSlate SignNow for the Oregon form 440 5158?

Using airSlate SignNow for the Oregon form 440 5158 provides several benefits, including streamlined document processing and improved accuracy. Our eSigning feature ensures that all signatures are securely captured, making the process more efficient. Moreover, the platform helps you maintain compliance with Oregon state regulations effortlessly.

-

Can I access the Oregon form 440 5158 from mobile devices using airSlate SignNow?

Absolutely! airSlate SignNow is mobile-friendly, allowing you to access and complete the Oregon form 440 5158 from your smartphone or tablet. This flexibility ensures that you can manage your documents anytime, anywhere, making it a versatile solution for busy professionals.

-

What support options are available for completing the Oregon form 440 5158 with airSlate SignNow?

airSlate SignNow offers robust customer support to assist you with any questions or issues regarding the Oregon form 440 5158. You can signNow our support team via chat, email, or phone for prompt assistance. Comprehensive resources and tutorials are also available to help you navigate the platform effectively.

Get more for Dcbs Form 440 392

Find out other Dcbs Form 440 392

- eSignature Tennessee Business Operations Moving Checklist Easy

- eSignature Georgia Construction Residential Lease Agreement Easy

- eSignature Kentucky Construction Letter Of Intent Free

- eSignature Kentucky Construction Cease And Desist Letter Easy

- eSignature Business Operations Document Washington Now

- How To eSignature Maine Construction Confidentiality Agreement

- eSignature Maine Construction Quitclaim Deed Secure

- eSignature Louisiana Construction Affidavit Of Heirship Simple

- eSignature Minnesota Construction Last Will And Testament Online

- eSignature Minnesota Construction Last Will And Testament Easy

- How Do I eSignature Montana Construction Claim

- eSignature Construction PPT New Jersey Later

- How Do I eSignature North Carolina Construction LLC Operating Agreement

- eSignature Arkansas Doctors LLC Operating Agreement Later

- eSignature Tennessee Construction Contract Safe

- eSignature West Virginia Construction Lease Agreement Myself

- How To eSignature Alabama Education POA

- How To eSignature California Education Separation Agreement

- eSignature Arizona Education POA Simple

- eSignature Idaho Education Lease Termination Letter Secure