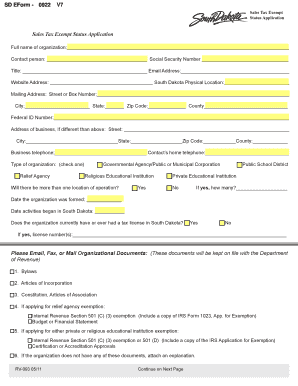

Fillable South Dakota Sales Tax Form

What is the fillable South Dakota sales tax form?

The fillable South Dakota sales tax form is an official document used by businesses to report and remit sales tax collected on taxable sales made within the state. This form is essential for ensuring compliance with state tax regulations and is required for businesses that sell goods or services subject to sales tax. The form captures various details, including the total sales amount, tax collected, and any exemptions that may apply.

How to use the fillable South Dakota sales tax form

Using the fillable South Dakota sales tax form involves several straightforward steps. First, access the form through a reliable source, ensuring it is the most current version. Fill in the required fields accurately, including your business information, sales figures, and tax calculations. After completing the form, review it for accuracy before submitting it. The fillable format allows for easy corrections and adjustments, making it user-friendly for businesses of all sizes.

Steps to complete the fillable South Dakota sales tax form

Completing the fillable South Dakota sales tax form requires careful attention to detail. Follow these steps:

- Download the fillable form from a trusted source.

- Enter your business name, address, and sales tax permit number.

- Report total sales for the reporting period.

- Calculate the total sales tax due based on applicable rates.

- Include any exemptions or deductions if applicable.

- Review all entries for accuracy.

- Submit the form electronically or print it for mailing, as required.

Legal use of the fillable South Dakota sales tax form

The fillable South Dakota sales tax form is legally binding when completed and submitted according to state regulations. To ensure its legal validity, it must be filled out accurately, signed where required, and submitted by the designated deadline. Compliance with state laws regarding sales tax reporting is crucial to avoid penalties and maintain good standing with tax authorities.

Key elements of the fillable South Dakota sales tax form

Understanding the key elements of the fillable South Dakota sales tax form is essential for accurate completion. Important sections include:

- Business Information: Name, address, and tax identification number.

- Sales Data: Total sales amount and tax collected.

- Exemptions: Any applicable exemptions must be documented.

- Payment Information: Instructions for remitting the tax due.

Form submission methods

The fillable South Dakota sales tax form can be submitted through various methods to accommodate different preferences. Options include:

- Online Submission: Many businesses opt for electronic filing through the state’s tax portal.

- Mail: Print the completed form and send it to the appropriate tax office.

- In-Person: Submit the form directly at designated tax offices if preferred.

Quick guide on how to complete fillable south dakota sales tax form

Easily prepare Fillable South Dakota Sales Tax Form on any device

Digital document management has become increasingly popular among businesses and individuals alike. It offers an ideal environmentally friendly substitute for traditional printed and signed paperwork, allowing you to locate the needed form and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and electronically sign your documents quickly and without interruptions. Manage Fillable South Dakota Sales Tax Form on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to modify and electronically sign Fillable South Dakota Sales Tax Form effortlessly

- Locate Fillable South Dakota Sales Tax Form and click Get Form to begin.

- Use the tools we provide to fill out your form.

- Emphasize signNow sections of the documents or obscure sensitive information with tools specifically offered by airSlate SignNow for this purpose.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all information thoroughly and click on the Done button to save your modifications.

- Choose your preferred method for sending your form: via email, text message (SMS), or invite link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searches, or errors that require reprinting new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your preference. Modify and electronically sign Fillable South Dakota Sales Tax Form to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the fillable south dakota sales tax form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a fillable South Dakota sales tax form?

A fillable South Dakota sales tax form is an electronic document that allows businesses to input their tax information easily and submit it to the state. Using this form can streamline the filing process, helping businesses avoid errors and ensure compliance with state regulations.

-

How can I use airSlate SignNow to complete my fillable South Dakota sales tax form?

With airSlate SignNow, you can easily upload and edit the fillable South Dakota sales tax form. Not only can you fill in the necessary data, but you can also eSign it and send it directly to the relevant tax authorities, saving you time and effort.

-

Is airSlate SignNow a cost-effective solution for managing fillable forms?

Yes, airSlate SignNow offers a competitive pricing model that makes it a cost-effective solution for managing fillable forms, including the South Dakota sales tax form. The platform provides various subscription options to suit different business needs, ensuring you get value for your investment.

-

Can I store my completed fillable South Dakota sales tax form on airSlate SignNow?

Absolutely! airSlate SignNow allows you to securely store all your completed fillable South Dakota sales tax forms in the cloud. This ensures you can access them anytime, anywhere, and helps keep your documents organized and retrievable when needed.

-

Are there integrations available for airSlate SignNow?

Yes, airSlate SignNow offers a range of integrations with popular business applications, making it easy to use alongside your existing tools. This compatibility enhances your workflow when managing fillable South Dakota sales tax forms and other documents.

-

What are the benefits of using a fillable South Dakota sales tax form?

Using a fillable South Dakota sales tax form simplifies the tax filing process and reduces the likelihood of human error. This electronic format allows for easy editing and quick submissions, ensuring you meet deadlines efficiently and accurately.

-

Is it possible to eSign my fillable South Dakota sales tax form using airSlate SignNow?

Yes, airSlate SignNow enables you to eSign your fillable South Dakota sales tax form securely. This feature not only boosts the authenticity of your document but also expedites the filing process by eliminating the need for printing and scanning.

Get more for Fillable South Dakota Sales Tax Form

Find out other Fillable South Dakota Sales Tax Form

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors