Application under Section 281 of Income Tax Act in Word Format

What is the application under section 281 of the Income Tax Act in Word format

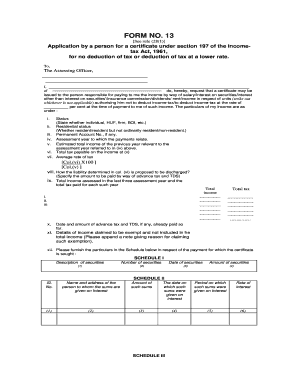

The application under section 281 of the Income Tax Act is a formal request made to the tax authorities for a certificate that allows taxpayers to obtain clearance regarding their tax liabilities. This document is essential for individuals and businesses seeking to ensure compliance with tax regulations before entering into certain transactions. The Word format of this application provides a convenient template that can be easily filled out and customized according to individual needs. It typically includes sections for personal information, details about the tax liabilities, and specific requests for clearance.

Steps to complete the application under section 281 of the Income Tax Act in Word format

Completing the application under section 281 involves several key steps:

- Download the Word format template from a reliable source.

- Fill in your personal information, including your name, address, and taxpayer identification number.

- Provide details of the tax liabilities you wish to clear, including relevant amounts and periods.

- Clearly state the purpose of the application, specifying the transaction or reason for the request.

- Review the document for accuracy and completeness before submission.

Legal use of the application under section 281 of the Income Tax Act in Word format

The application under section 281 is legally binding when filled out correctly and submitted to the appropriate tax authority. It serves as an official request for clearance, and its proper completion is crucial for ensuring that the application is accepted. Legal use also involves adhering to the specific requirements set forth by the tax authorities, which may include providing supporting documentation or additional information as needed.

Required documents for the application under section 281 of the Income Tax Act

When submitting the application under section 281, certain documents may be required to support your request. These documents typically include:

- Proof of identity, such as a government-issued ID.

- Tax returns or statements for the relevant periods.

- Any correspondence from the tax authority regarding outstanding liabilities.

- Financial statements if applicable, especially for businesses.

Application process and approval time for section 281 certificate

The application process for obtaining a section 281 certificate generally involves submitting the completed application form along with the required documents to the tax authority. The approval time can vary based on the complexity of the request and the workload of the tax office. Typically, applicants can expect a response within a few weeks, but it is advisable to check with the local tax authority for specific timelines.

Eligibility criteria for the application under section 281 of the Income Tax Act

Eligibility for the application under section 281 primarily depends on the taxpayer's compliance with tax obligations. Individuals or businesses must not have any outstanding tax liabilities that are unresolved. Additionally, the nature of the transaction for which the clearance is sought may also affect eligibility, as certain transactions may require specific conditions to be met before a certificate can be issued.

Quick guide on how to complete application under section 281 of income tax act in word format

Complete Application Under Section 281 Of Income Tax Act In Word Format effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It serves as an ideal environmentally-friendly alternative to conventional printed and signed documents, as you can access the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, edit, and eSign your documents swiftly without delays. Manage Application Under Section 281 Of Income Tax Act In Word Format on any device with airSlate SignNow's Android or iOS applications and simplify any document-related tasks today.

The easiest way to edit and eSign Application Under Section 281 Of Income Tax Act In Word Format with ease

- Locate Application Under Section 281 Of Income Tax Act In Word Format and then click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the information and then click the Done button to save your modifications.

- Choose how you want to send your form, via email, text message (SMS), or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from your chosen device. Edit and eSign Application Under Section 281 Of Income Tax Act In Word Format and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the application under section 281 of income tax act in word format

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a 281 certificate?

A 281 certificate is a digital certification used to validate electronic signatures in documents. It ensures that your eSignatures meet legal standards, providing security and authenticity for your agreements. With airSlate SignNow, you can easily incorporate the 281 certificate into your document signing process.

-

How does airSlate SignNow utilize the 281 certificate?

airSlate SignNow leverages the 281 certificate to enhance the legal compliance and integrity of your eSigned documents. This feature helps businesses maintain a clear audit trail and guarantees the legitimacy of signed agreements. Using the 281 certificate, you can be confident that your digital transactions are secure.

-

Is the 281 certificate included in airSlate SignNow's pricing plans?

Yes, the 281 certificate is included in all airSlate SignNow pricing plans, ensuring that users have access to essential compliance features. Our cost-effective solution eliminates additional fees for maintaining the integrity of your documents. Choose airSlate SignNow for a comprehensive package that includes the 281 certificate.

-

What are the benefits of using the 281 certificate with airSlate SignNow?

Using the 281 certificate with airSlate SignNow ensures that your documents hold legal weight in electronic transactions. It provides advanced security measures to protect against fraud, making it a vital asset for businesses. Additionally, it enhances user confidence in the validity of agreements, streamlining the signing process.

-

Can I integrate the 281 certificate feature with other tools?

Yes, airSlate SignNow allows you to integrate the 281 certificate feature with various tools and applications to streamline your workflows. Whether you use CRM systems, accounting software, or other platforms, our integrations enhance your document management capabilities. Enjoy the flexibility of a solution that fits your existing processes.

-

How do I obtain the 281 certificate for my documents?

When you use airSlate SignNow to eSign your documents, obtaining the 281 certificate is straightforward and automatic. After signing, the certificate is generated and attached to your document, ensuring compliance without extra steps. This user-friendly process allows you to focus on your business while we manage the certification.

-

Are there any limitations to using the 281 certificate?

While the 281 certificate provides robust validation for your electronic signatures, it is essential to understand that it must be used within the legal frameworks specific to your jurisdiction. airSlate SignNow helps you navigate these requirements and ensures that your usage aligns with current standards. Always stay informed about the legal implications of digital signatures.

Get more for Application Under Section 281 Of Income Tax Act In Word Format

Find out other Application Under Section 281 Of Income Tax Act In Word Format

- Electronic signature Indiana Cease and Desist Letter Free

- Electronic signature Arkansas Hold Harmless (Indemnity) Agreement Fast

- Electronic signature Kentucky Hold Harmless (Indemnity) Agreement Online

- How To Electronic signature Arkansas End User License Agreement (EULA)

- Help Me With Electronic signature Connecticut End User License Agreement (EULA)

- Electronic signature Massachusetts Hold Harmless (Indemnity) Agreement Myself

- Electronic signature Oklahoma Hold Harmless (Indemnity) Agreement Free

- Electronic signature Rhode Island Hold Harmless (Indemnity) Agreement Myself

- Electronic signature California Toll Manufacturing Agreement Now

- How Do I Electronic signature Kansas Toll Manufacturing Agreement

- Can I Electronic signature Arizona Warranty Deed

- How Can I Electronic signature Connecticut Warranty Deed

- How To Electronic signature Hawaii Warranty Deed

- Electronic signature Oklahoma Warranty Deed Myself

- Can I Electronic signature Texas Warranty Deed

- How To Electronic signature Arkansas Quitclaim Deed

- Electronic signature Washington Toll Manufacturing Agreement Simple

- Can I Electronic signature Delaware Quitclaim Deed

- Electronic signature Iowa Quitclaim Deed Easy

- Electronic signature Kentucky Quitclaim Deed Safe