Fidelity Charitable Grant Application Form

What is the Fidelity Charitable Grant Application

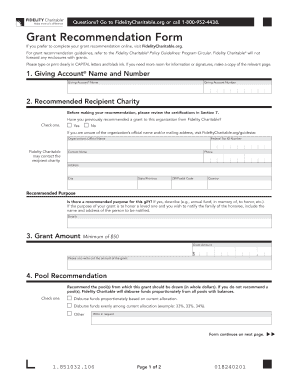

The Fidelity Charitable Grant Application is a formal request submitted by individuals or organizations seeking to distribute funds from a Fidelity Investments Charitable Gift Fund. This application allows donors to recommend grants to qualified charities, enabling them to support causes they care about. The application process ensures that funds are allocated appropriately and in compliance with IRS regulations. It is essential for donors to understand the guidelines and requirements associated with this application to facilitate a smooth granting process.

Steps to complete the Fidelity Charitable Grant Application

Completing the Fidelity Charitable Grant Application involves several key steps:

- Gather necessary information about the charitable organization you wish to support, including its legal name and tax identification number.

- Access the application form through the Fidelity Charitable website or your donor account.

- Fill out the required fields, ensuring that all information is accurate and complete.

- Review the application for any errors or omissions before submission.

- Submit the application electronically or via mail, depending on your preference and the instructions provided.

Following these steps can help ensure that your application is processed efficiently and effectively.

Required Documents

When submitting the Fidelity Charitable Grant Application, certain documents may be required to support your request. These documents can include:

- Proof of the charitable organization’s tax-exempt status, such as a determination letter from the IRS.

- A detailed description of the project or program for which funding is being requested.

- Any additional documentation that may be relevant to your grant request, such as budgets or financial statements.

Having these documents ready can expedite the review process and increase the likelihood of grant approval.

Eligibility Criteria

To be eligible for a grant through the Fidelity Charitable Grant Application, the recommended organization must meet specific criteria. These typically include:

- Being a qualified 501(c)(3) nonprofit organization recognized by the IRS.

- Operating for charitable, educational, religious, or scientific purposes.

- Not being a private foundation or a supporting organization.

Understanding these eligibility criteria is crucial for donors to ensure that their recommendations align with Fidelity's guidelines.

Form Submission Methods

The Fidelity Charitable Grant Application can be submitted through various methods, providing flexibility for donors. The primary submission methods include:

- Online submission via the Fidelity Charitable donor portal, which allows for quick processing.

- Mailing a printed copy of the completed application to the designated address provided by Fidelity.

- In-person submission at Fidelity Charitable offices, if applicable.

Choosing the right submission method can impact the speed and efficiency of the grant application process.

Application Process & Approval Time

The application process for the Fidelity Charitable Grant Application typically involves several stages, including review and approval. After submission, the application will undergo a thorough evaluation to ensure compliance with all guidelines. The approval time can vary based on factors such as:

- The completeness of the application and supporting documents.

- The volume of applications being processed at the time.

- Any additional information required from the applicant.

Generally, applicants can expect a response within a few weeks, but it is advisable to check specific timelines on the Fidelity Charitable website for the most accurate information.

Quick guide on how to complete fidelity charitable grant application

Complete Fidelity Charitable Grant Application effortlessly on any gadget

Managing documents online has gained signNow traction among both companies and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to obtain the necessary form and securely store it in the cloud. airSlate SignNow equips you with all the features required to create, modify, and electronically sign your documents swiftly without delays. Manage Fidelity Charitable Grant Application on any gadget with airSlate SignNow’s Android or iOS applications and simplify any document-related workflow today.

How to modify and eSign Fidelity Charitable Grant Application effortlessly

- Find Fidelity Charitable Grant Application and then click Get Form to initiate the process.

- Utilize the tools provided to finalize your document.

- Emphasize important sections of your documents or conceal sensitive information with tools that airSlate SignNow specifically offers for this purpose.

- Generate your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your modifications.

- Choose your preferred method for sending your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or mislaid documents, cumbersome form navigation, or errors that necessitate printing additional copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Edit and eSign Fidelity Charitable Grant Application and guarantee excellent communication at any phase of the form creation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the fidelity charitable grant application

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the fidelity investments charitable gift fund grant application process?

The fidelity investments charitable gift fund grant application process is straightforward and user-friendly. Applicants can easily fill out the necessary forms online, ensuring that all required information is readily accessible. With airSlate SignNow, you can efficiently manage and eSign your documents during the application process.

-

Are there fees associated with the fidelity investments charitable gift fund grant application?

While the fidelity investments charitable gift fund grant application itself does not have direct fees, you should be aware of potential processing fees for donations. Utilizing airSlate SignNow can help streamline your documentation process, potentially saving you time and costs associated with traditional paper methods.

-

What features does airSlate SignNow offer for the fidelity investments charitable gift fund grant application?

airSlate SignNow provides numerous features, including intuitive document editing, secure eSigning capabilities, and automated workflows. These features ensure that your fidelity investments charitable gift fund grant application is handled seamlessly and efficiently, enhancing your overall experience.

-

Can I integrate airSlate SignNow with other tools while completing the fidelity investments charitable gift fund grant application?

Yes, airSlate SignNow offers integrations with various applications and platforms, allowing for a more seamless workflow when submitting your fidelity investments charitable gift fund grant application. You can connect with tools like Google Drive, Dropbox, and more to manage your documents effectively.

-

What benefits does using airSlate SignNow provide for the fidelity investments charitable gift fund grant application?

Using airSlate SignNow for your fidelity investments charitable gift fund grant application brings numerous benefits, such as increased efficiency and reduced paperwork. The platform also enhances compliance and security, ensuring that your sensitive information is protected throughout the application process.

-

Is airSlate SignNow easy to use for first-time users of the fidelity investments charitable gift fund grant application?

Absolutely! airSlate SignNow is designed with user-friendliness in mind, making it easy for first-time users to navigate the fidelity investments charitable gift fund grant application process. The intuitive interface and helpful resources mean that you can quickly get started, even if you have no prior experience.

-

How can I track the status of my fidelity investments charitable gift fund grant application?

With airSlate SignNow, you can easily track the status of your fidelity investments charitable gift fund grant application in real-time. The platform provides notifications and updates, allowing you to stay informed throughout the application process and respond promptly to any requests or feedback.

Get more for Fidelity Charitable Grant Application

- Kyc format for company

- Nutrition crossword puzzle form

- Pharmacy customer satisfaction survey examples form

- Powerlifting score sheet form

- Grade 8 social science exam papers and memos eastern cape form

- Pet sitting questionnaire form

- Genemark submission form

- English language information immigration new zealand

Find out other Fidelity Charitable Grant Application

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors