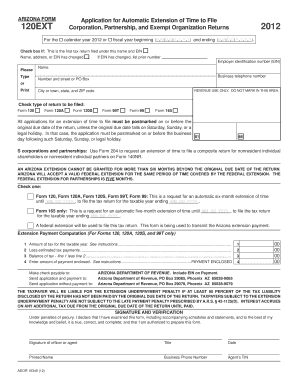

Arizona 120 Ext Fillable Form

What is the Arizona 120 Ext Fillable

The Arizona Form 120S is a tax form specifically designed for S corporations operating within the state of Arizona. This form is essential for reporting income, deductions, and credits for S corporations, which are pass-through entities for federal tax purposes. By using the Arizona 120S, businesses can ensure compliance with state tax regulations while accurately reporting their financial activities. It is crucial for S corporations to understand the specific requirements and implications of this form to maintain their tax status and avoid potential penalties.

How to use the Arizona 120 Ext Fillable

Utilizing the Arizona 120S fillable form involves several steps to ensure accurate completion and submission. First, access the form through a reliable platform that allows for digital filling. Fill in the required fields, including the business name, address, and federal employer identification number (EIN). Next, accurately report the income, deductions, and credits applicable to your S corporation. After completing the form, review all entries for accuracy before proceeding to sign and submit the document. Digital signing tools can enhance the process by ensuring that your signature is legally binding.

Steps to complete the Arizona 120 Ext Fillable

Completing the Arizona Form 120S requires careful attention to detail. Follow these steps for a smooth process:

- Access the Arizona 120S fillable form online.

- Enter your business information, including the name and address.

- Provide your federal employer identification number (EIN).

- Report your total income and any applicable deductions.

- Include any credits your corporation qualifies for.

- Review the completed form for accuracy.

- Sign the form electronically to validate it.

- Submit the form through the designated method, either online or by mail.

Legal use of the Arizona 120 Ext Fillable

The Arizona Form 120S is legally recognized for tax reporting purposes when completed accurately and submitted on time. It is essential for S corporations to adhere to state regulations regarding this form to maintain their status and avoid legal complications. The use of digital signatures on the form is permitted, provided that the signing process complies with the Electronic Signatures in Global and National Commerce (ESIGN) Act and other relevant laws. Ensuring compliance with these legal requirements is vital for the legitimacy of the submissions.

Filing Deadlines / Important Dates

Timely filing of the Arizona Form 120S is critical to avoid penalties. The standard deadline for submitting this form is the fifteenth day of the fourth month following the end of the corporation's tax year. For corporations operating on a calendar year, this typically falls on April 15. If additional time is necessary, S corporations may file for an extension, which grants an additional six months to complete the filing. However, it is important to note that an extension to file does not extend the deadline for any taxes owed.

Required Documents

To complete the Arizona Form 120S accurately, certain documents are necessary. These typically include:

- Financial statements detailing income and expenses.

- Records of any deductions and credits claimed.

- Federal tax return for the S corporation.

- Any supporting documentation for specific deductions or credits.

Having these documents ready will streamline the completion process and help ensure accuracy in reporting.

Quick guide on how to complete arizona 120 ext fillable

Effortlessly Prepare Arizona 120 Ext Fillable on Any Device

Digital document handling has gained signNow traction among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to obtain the necessary form and securely save it online. airSlate SignNow equips you with all the tools required to swiftly create, edit, and eSign your documents without any complications. Manage Arizona 120 Ext Fillable on any platform using the airSlate SignNow Android or iOS applications and simplify any document-related task today.

Steps to Modify and eSign Arizona 120 Ext Fillable with Ease

- Find Arizona 120 Ext Fillable and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize key sections of your documents or obscure sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Generate your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review the details carefully and click the Done button to save your changes.

- Select your preferred method of sharing the form, whether by email, text message (SMS), invitation link, or download it to your computer.

Forget about lost or mislaid documents, the hassle of searching for forms, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs with just a few clicks from any device you select. Edit and eSign Arizona 120 Ext Fillable to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the arizona 120 ext fillable

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Arizona Form 120S and why is it important?

Arizona Form 120S is the state's income tax return form designated for S corporations. Filing this form is crucial for S corporations operating in Arizona to ensure compliance with state tax regulations. Properly submitting Arizona Form 120S can help businesses avoid penalties and maintain good standing.

-

How can airSlate SignNow assist with Arizona Form 120S?

AirSlate SignNow streamlines the process of completing and submitting Arizona Form 120S by offering electronic signatures and secure document management. Users can easily prepare, send, and e-sign their tax documents without the hassle of traditional paperwork. This efficiency can save time and reduce the potential for errors.

-

What are the pricing options for airSlate SignNow?

AirSlate SignNow offers flexible pricing plans tailored to different business needs, ensuring access to tools for managing Arizona Form 120S and other documents. Whether you're a small business or a large enterprise, you can find a suitable plan that fits your budget. Each plan provides essential features to enhance your document workflow.

-

Are there any integrations available with airSlate SignNow for accounting software?

Yes, airSlate SignNow integrates seamlessly with various accounting software platforms, making it easy to manage Arizona Form 120S alongside your financial documents. These integrations enhance efficiency by automating data transfer and ensuring accuracy throughout the e-signing process. Connect your favorite applications for a streamlined experience.

-

What are the benefits of using airSlate SignNow for document management?

Using airSlate SignNow for document management, including Arizona Form 120S, offers numerous benefits such as increased efficiency, reduced paperwork, and enhanced security. This user-friendly platform allows businesses to e-sign documents from anywhere, improving workflow and collaboration. Additionally, all documents are securely stored and easily accessible.

-

Can I track the status of my Arizona Form 120S through airSlate SignNow?

Absolutely! AirSlate SignNow provides real-time tracking features that allow you to monitor the status of your Arizona Form 120S as it moves through the signing process. You will receive notifications and updates, ensuring you are informed every step of the way. This transparency helps maintain accountability in your document workflows.

-

Is airSlate SignNow compliant with Arizona's legal standards for e-signatures?

Yes, airSlate SignNow is compliant with Arizona's legal standards for e-signatures, ensuring that your Arizona Form 120S will be legally binding. The platform adheres to the Electronic Signatures in Global and National Commerce (ESIGN) Act and Uniform Electronic Transactions Act (UETA). This compliance provides peace of mind and assures your documents hold valid legal standing.

Get more for Arizona 120 Ext Fillable

Find out other Arizona 120 Ext Fillable

- How Can I eSign Wisconsin Non-Profit Stock Certificate

- How Do I eSign Wyoming Non-Profit Quitclaim Deed

- eSign Hawaii Orthodontists Last Will And Testament Fast

- eSign South Dakota Legal Letter Of Intent Free

- eSign Alaska Plumbing Memorandum Of Understanding Safe

- eSign Kansas Orthodontists Contract Online

- eSign Utah Legal Last Will And Testament Secure

- Help Me With eSign California Plumbing Business Associate Agreement

- eSign California Plumbing POA Mobile

- eSign Kentucky Orthodontists Living Will Mobile

- eSign Florida Plumbing Business Plan Template Now

- How To eSign Georgia Plumbing Cease And Desist Letter

- eSign Florida Plumbing Credit Memo Now

- eSign Hawaii Plumbing Contract Mobile

- eSign Florida Plumbing Credit Memo Fast

- eSign Hawaii Plumbing Claim Fast

- eSign Hawaii Plumbing Letter Of Intent Myself

- eSign Hawaii Plumbing Letter Of Intent Fast

- Help Me With eSign Idaho Plumbing Profit And Loss Statement

- eSign Illinois Plumbing Letter Of Intent Now