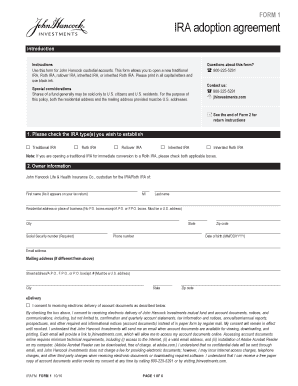

Jhinvestments Ira Form

What is the Jhinvestments IRA?

The Jhinvestments IRA is a specialized retirement account designed to provide individuals with tax advantages while saving for retirement. This account allows for a variety of investment options, including stocks, bonds, and mutual funds, enabling account holders to tailor their investment strategies according to their financial goals. The Jhinvestments IRA aims to help users maximize their retirement savings while adhering to IRS regulations.

How to Use the Jhinvestments IRA

Using the Jhinvestments IRA involves several straightforward steps. First, individuals must open an account through the Jhinvestments platform, which typically requires personal information and documentation. Once the account is established, users can fund their IRA by transferring money from an existing retirement account or contributing directly. After funding, account holders can select their preferred investment options, monitor performance, and make adjustments as needed to align with their retirement objectives.

Steps to Complete the Jhinvestments IRA

Completing the Jhinvestments IRA involves a series of organized steps:

- Open an Account: Visit the Jhinvestments website and fill out the application form.

- Provide Documentation: Submit required identification and financial documents for verification.

- Fund Your IRA: Transfer funds from another retirement account or make a direct contribution.

- Select Investments: Choose from available investment options that suit your risk tolerance and goals.

- Monitor and Adjust: Regularly review your account performance and make adjustments as necessary.

Legal Use of the Jhinvestments IRA

The Jhinvestments IRA is governed by IRS regulations, ensuring that all contributions, withdrawals, and investment activities comply with federal laws. To maintain the account's tax-advantaged status, users must adhere to contribution limits and withdrawal rules set by the IRS. Understanding these legal requirements is essential for maximizing the benefits of the Jhinvestments IRA while avoiding potential penalties.

Eligibility Criteria

To qualify for a Jhinvestments IRA, individuals must meet specific eligibility criteria. Generally, anyone with earned income can contribute to an IRA, but income limits may apply for tax-deductible contributions. Additionally, individuals must be under the age of seventy and a half to make contributions. It is important for potential account holders to review these criteria to ensure compliance before opening an account.

Required Documents

When applying for a Jhinvestments IRA, several documents may be required to verify identity and eligibility. Commonly needed documents include:

- Government-issued identification (e.g., driver's license, passport)

- Social Security number

- Proof of income (e.g., pay stubs, tax returns)

- Bank account information for funding the IRA

Having these documents ready can streamline the application process and facilitate a smooth account setup.

Quick guide on how to complete jhinvestments ira

Effortlessly prepare Jhinvestments Ira on any device

Digital document management has become increasingly popular among businesses and individuals. It offers a great eco-friendly alternative to traditional printed and signed documents, allowing you to easily find the correct form and safely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents quickly without any hold-ups. Handle Jhinvestments Ira on any device with airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The simplest way to modify and electronically sign Jhinvestments Ira with ease

- Locate Jhinvestments Ira and click on Get Form to begin.

- Utilize the provided tools to complete your document.

- Highlight important sections of your documents or obscure sensitive information using tools specifically offered by airSlate SignNow for that purpose.

- Create your electronic signature with the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Select how you want to send your form, via email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Jhinvestments Ira to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the jhinvestments ira

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is jhinvestments and how does it relate to airSlate SignNow?

JHInvestments is a key component in optimizing your document management processes with airSlate SignNow. By implementing jhinvestments, businesses can streamline eSignature workflows, making it easier to manage contracts and agreements. This integration helps enhance productivity and minimize operational costs.

-

What pricing plans does airSlate SignNow offer for users interested in jhinvestments?

AirSlate SignNow provides flexible pricing plans tailored to businesses looking to leverage jhinvestments. Whether you're a small startup or a large enterprise, there are cost-effective options available. This ensures that users can choose a plan that meets their budget while gaining access to powerful eSigning features.

-

What key features does airSlate SignNow provide for jhinvestments?

The airSlate SignNow platform offers a range of features ideal for jhinvestments, including easy document sharing, customizable templates, and secure eSigning capabilities. These features empower users to efficiently complete transactions and maintain compliance within their industries. The intuitive interface ensures ease of use for all team members.

-

How can jhinvestments benefit my business using airSlate SignNow?

Implementing jhinvestments with airSlate SignNow can signNowly improve document turnaround times and reduce manual errors. It allows businesses to automate processes, saving time and resources. Additionally, these efficiencies contribute to better customer relations through rapid response times.

-

Are there integrations available for jhinvestments within airSlate SignNow?

Yes, airSlate SignNow offers various integrations that enhance the functionality of jhinvestments. Users can connect with popular CRMs, cloud storage solutions, and workflow automation tools. This seamless integration ensures that your document processes are fully optimized and tailored to your specific needs.

-

Is it easy to set up airSlate SignNow for jhinvestments?

Setting up airSlate SignNow for jhinvestments is straightforward and user-friendly. The platform offers guided tutorials and customer support to assist users in getting started. Within minutes, businesses can begin sending and signing documents electronically, maximizing their workflow efficiency.

-

What type of customer support does airSlate SignNow offer related to jhinvestments?

AirSlate SignNow provides comprehensive customer support for users interested in jhinvestments. This includes multiple channels such as email, phone, and live chat assistance. The support team is dedicated to resolving queries quickly, helping businesses maximize their eSigning experience.

Get more for Jhinvestments Ira

- Phq9 and gad7 template form

- Multimodal dangerous goods form 15657925

- Funeral planning checklist template form

- Form fis0261

- Counselling risk assessment template form

- Scholarship application for after school programs ststanschicago form

- Writ of control form

- Trimark of excellence mystery shop programsoutheast petro form

Find out other Jhinvestments Ira

- eSignature Arkansas Legal Affidavit Of Heirship Fast

- Help Me With eSignature Colorado Legal Cease And Desist Letter

- How To eSignature Connecticut Legal LLC Operating Agreement

- eSignature Connecticut Legal Residential Lease Agreement Mobile

- eSignature West Virginia High Tech Lease Agreement Template Myself

- How To eSignature Delaware Legal Residential Lease Agreement

- eSignature Florida Legal Letter Of Intent Easy

- Can I eSignature Wyoming High Tech Residential Lease Agreement

- eSignature Connecticut Lawers Promissory Note Template Safe

- eSignature Hawaii Legal Separation Agreement Now

- How To eSignature Indiana Legal Lease Agreement

- eSignature Kansas Legal Separation Agreement Online

- eSignature Georgia Lawers Cease And Desist Letter Now

- eSignature Maryland Legal Quitclaim Deed Free

- eSignature Maryland Legal Lease Agreement Template Simple

- eSignature North Carolina Legal Cease And Desist Letter Safe

- How Can I eSignature Ohio Legal Stock Certificate

- How To eSignature Pennsylvania Legal Cease And Desist Letter

- eSignature Oregon Legal Lease Agreement Template Later

- Can I eSignature Oregon Legal Limited Power Of Attorney