United Kingdom Property Majesty Revenue Customs 2023

What is the United Kingdom Property Majesty Revenue Customs

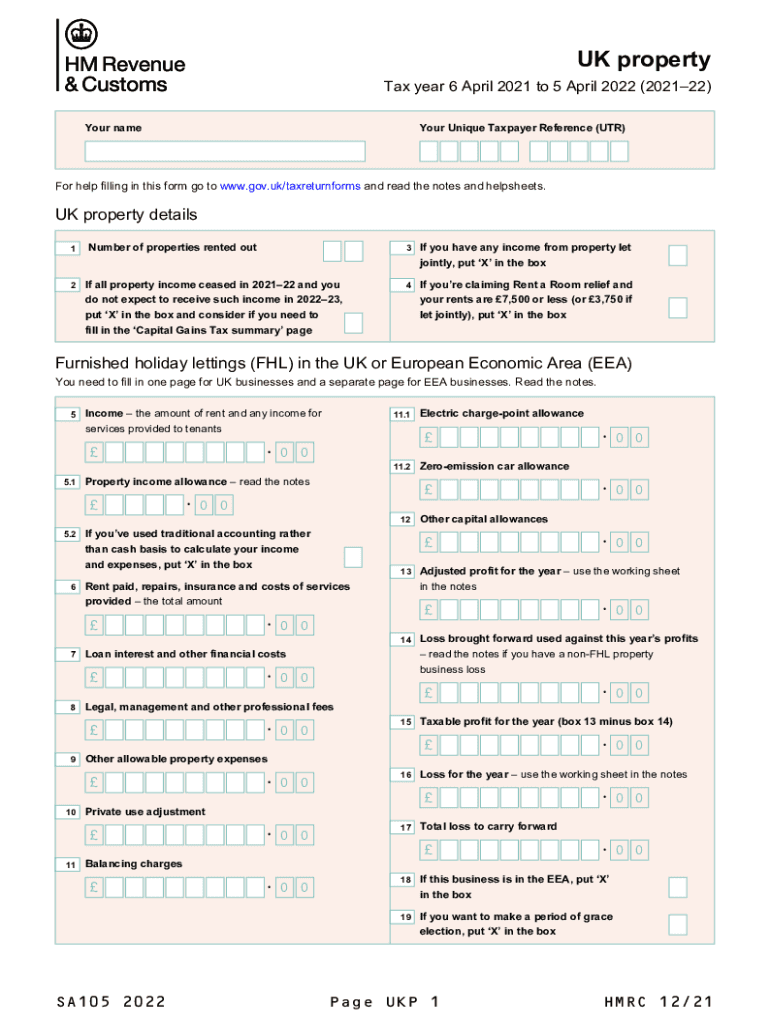

The United Kingdom Property Majesty Revenue Customs (HMRC) is the government department responsible for the collection of taxes and the administration of various tax-related processes in the UK. It oversees property tax regulations, ensuring compliance and proper reporting from property owners. The HMRC provides guidelines and forms, such as the UK property tax form, which are essential for individuals and businesses involved in property transactions.

Steps to complete the United Kingdom Property Majesty Revenue Customs

Completing the United Kingdom Property Majesty Revenue Customs forms involves several key steps to ensure accuracy and compliance. First, gather all necessary documentation, including proof of property ownership and any relevant financial records. Next, fill out the required forms, such as the UK property tax return form or the SA105 form, ensuring all information is accurate and complete. After completing the forms, review them for any errors before submission. Finally, submit the forms through the designated method, whether online or by mail, and keep copies for your records.

Legal use of the United Kingdom Property Majesty Revenue Customs

The legal use of the United Kingdom Property Majesty Revenue Customs forms is critical for property owners to fulfill their tax obligations. These forms must be completed in accordance with UK tax laws to be considered valid. Utilizing a reliable eSignature solution like airSlate SignNow can enhance the legal standing of submitted documents, ensuring they meet compliance standards set by regulations such as ESIGN and UETA. This legal framework supports the use of electronic signatures, making it easier for property owners to manage their tax responsibilities digitally.

Required Documents

When dealing with the United Kingdom Property Majesty Revenue Customs, several documents are typically required to complete the tax forms accurately. Essential documents include:

- Proof of property ownership, such as title deeds

- Financial records related to property income and expenses

- Previous tax returns, if applicable

- Identification documents for the property owner

Having these documents ready can streamline the process and help ensure compliance with HMRC requirements.

Form Submission Methods (Online / Mail / In-Person)

Submitting forms to the United Kingdom Property Majesty Revenue Customs can be done through various methods. Property owners can choose to submit their forms online via the HMRC website, which offers a secure and efficient process. Alternatively, forms can be mailed to the appropriate HMRC address, ensuring they are sent well before any deadlines. In-person submissions are also possible at designated HMRC offices, although this method may require an appointment. Each submission method has its advantages, so property owners should consider their preferences and needs when choosing how to submit their forms.

Penalties for Non-Compliance

Failure to comply with the requirements set by the United Kingdom Property Majesty Revenue Customs can result in significant penalties. These penalties may include fines, interest on unpaid taxes, and even legal action in severe cases. It is crucial for property owners to understand their obligations and meet deadlines to avoid these consequences. Regularly reviewing tax regulations and ensuring timely submissions can help mitigate the risk of non-compliance.

Quick guide on how to complete united kingdom property majesty revenue customs

Effortlessly Prepare United Kingdom Property Majesty Revenue Customs on Any Device

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal environmentally-friendly alternative to traditional printed and signed documents, allowing you to access the necessary forms and securely store them online. airSlate SignNow equips you with all the resources needed to create, modify, and electronically sign your documents quickly and efficiently. Manage United Kingdom Property Majesty Revenue Customs on any device using the airSlate SignNow Android or iOS applications and enhance any document-driven process today.

The easiest method to edit and electronically sign United Kingdom Property Majesty Revenue Customs stress-free

- Obtain United Kingdom Property Majesty Revenue Customs and click on Get Form to commence.

- Utilize the tools we provide to fill out your document.

- Emphasize important sections of the documents or obscure sensitive information with tools specifically designed by airSlate SignNow for this purpose.

- Generate your electronic signature using the Sign tool, which takes just seconds and carries the same legal validity as a conventional handwritten signature.

- Review all details and click on the Done button to save your modifications.

- Select your preferred method for delivering your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the hassle of lost or overlooked documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs with just a few clicks from any device of your choice. Edit and electronically sign United Kingdom Property Majesty Revenue Customs and ensure excellent communication throughout every phase of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct united kingdom property majesty revenue customs

Create this form in 5 minutes!

How to create an eSignature for the united kingdom property majesty revenue customs

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow and how does it relate to united kingdom property majesty revenue customs?

airSlate SignNow is a streamlined solution for sending and eSigning documents efficiently. It simplifies compliance with regulations such as those set by the united kingdom property majesty revenue customs, ensuring your transactions meet legal requirements seamlessly.

-

How does airSlate SignNow support businesses dealing with united kingdom property majesty revenue customs?

With airSlate SignNow, businesses can electronically sign essential documents required for transactions involving united kingdom property majesty revenue customs. This electronic process enhances compliance and helps avoid delays associated with traditional paperwork.

-

What are the pricing plans for airSlate SignNow for UK-based customers?

airSlate SignNow offers flexible pricing plans tailored for UK customers, ensuring affordability while meeting the needs of businesses navigating the united kingdom property majesty revenue customs. Our plans are designed to provide maximum value without compromising on features.

-

What features does airSlate SignNow offer for documents related to united kingdom property majesty revenue customs?

Key features of airSlate SignNow include secure eSigning, customizable templates, and comprehensive audit trails. These features are essential for ensuring compliance with the united kingdom property majesty revenue customs and for maintaining accurate records.

-

Can airSlate SignNow integrate with other platforms used for property transactions in the UK?

Yes, airSlate SignNow integrates with various platforms that facilitate property transactions, helping streamline processes related to the united kingdom property majesty revenue customs. This integration allows users to manage documents efficiently across multiple systems.

-

What are the benefits of using airSlate SignNow for property transactions?

Using airSlate SignNow enhances the efficiency of property transactions by enabling quick eSigning and secure document management. This is particularly beneficial for navigating the requirements set by the united kingdom property majesty revenue customs, thereby reducing administrative burdens.

-

Is airSlate SignNow compliant with UK regulations concerning property transactions?

airSlate SignNow is designed to comply with UK regulations and standards, making it a suitable choice for businesses dealing with the united kingdom property majesty revenue customs. Our solution ensures that your documentation meets local legal requirements.

Get more for United Kingdom Property Majesty Revenue Customs

- Abm forms

- Imm1294 form

- Praecipe to satisfy judgment form

- Supervising electrician examination bapplicationb form

- Ckgs order form india pio card oci card ckgs order form india pio card oci card

- Fillable school safety drill act 105 ilcs 128 et illinois form

- Bid proxy sheet psd150 form

- Building permits kankakee county planning department form

Find out other United Kingdom Property Majesty Revenue Customs

- eSignature Alaska Debt Settlement Agreement Template Safe

- eSignature New Jersey Debt Settlement Agreement Template Simple

- eSignature New Mexico Debt Settlement Agreement Template Free

- eSignature Tennessee Debt Settlement Agreement Template Secure

- eSignature Wisconsin Debt Settlement Agreement Template Safe

- Can I eSignature Missouri Share Transfer Agreement Template

- eSignature Michigan Stock Purchase Agreement Template Computer

- eSignature California Indemnity Agreement Template Online

- eSignature New Mexico Promissory Note Template Now

- eSignature Pennsylvania Promissory Note Template Later

- Help Me With eSignature North Carolina Bookkeeping Contract

- eSignature Georgia Gym Membership Agreement Mobile

- eSignature Michigan Internship Contract Computer

- Can I eSignature Nebraska Student Data Sheet

- How To eSignature Michigan Application for University

- eSignature North Carolina Weekly Class Evaluation Now

- eSignature Colorado Medical Power of Attorney Template Fast

- Help Me With eSignature Florida Medical Power of Attorney Template

- eSignature Iowa Medical Power of Attorney Template Safe

- eSignature Nevada Medical Power of Attorney Template Secure