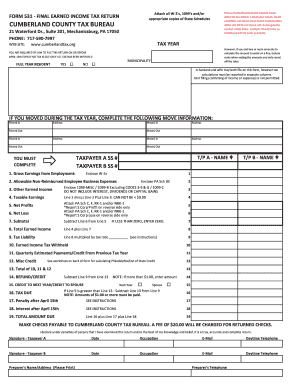

Pa Income Tax Return Form

What is the Pennsylvania Income Tax Return Form?

The Pennsylvania income tax return form is a document that residents and certain non-residents use to report their income to the Pennsylvania Department of Revenue. This form is crucial for calculating the state income tax owed based on the income earned during the tax year. The primary form used for this purpose is the PA-40, which is designed for individual taxpayers. It captures various types of income, deductions, and credits that may apply to the taxpayer's situation.

Steps to Complete the Pennsylvania Income Tax Return Form

Completing the Pennsylvania income tax return form involves several key steps:

- Gather all necessary documents, including W-2s, 1099s, and any other income statements.

- Determine your residency status, as this affects the tax rates and forms used.

- Fill out the PA-40 form, ensuring all income sources are accurately reported.

- Apply any eligible deductions and credits to reduce your taxable income.

- Calculate the total tax owed or refund due based on the completed form.

- Review the form for accuracy before submission.

Legal Use of the Pennsylvania Income Tax Return Form

The Pennsylvania income tax return form must be completed and submitted in compliance with state laws and regulations. It serves as a legal document that can be used to verify income and tax obligations. Ensuring that the form is filled out accurately and submitted on time is essential to avoid penalties. The form also requires signatures that validate the information provided, which can be done electronically through secure eSignature solutions.

Required Documents for Filing the Pennsylvania Income Tax Return Form

To successfully file the Pennsylvania income tax return form, taxpayers need to gather several important documents:

- W-2 forms from employers detailing wages and taxes withheld.

- 1099 forms for any freelance or contract work.

- Records of other income sources, such as rental income or dividends.

- Documentation for deductions, including receipts for medical expenses or charitable contributions.

- Any prior year tax returns may also be helpful for reference.

Filing Deadlines for the Pennsylvania Income Tax Return Form

Taxpayers must be aware of key filing deadlines to avoid late fees and penalties. The Pennsylvania income tax return form is typically due by April 15 of each year, aligning with federal tax deadlines. If April 15 falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers should also be aware of any extensions they may need to file, which can provide additional time to submit their returns.

Form Submission Methods for the Pennsylvania Income Tax Return Form

Taxpayers have several options for submitting their Pennsylvania income tax return form:

- Online: Many taxpayers opt to file electronically using approved e-filing software, which can streamline the process and reduce errors.

- Mail: The completed form can be printed and mailed to the Pennsylvania Department of Revenue. It is advisable to send it via certified mail for tracking purposes.

- In-Person: Taxpayers may also submit their forms in person at designated offices, although this option may vary by location.

Who Issues the Pennsylvania Income Tax Return Form?

The Pennsylvania income tax return form is issued by the Pennsylvania Department of Revenue. This state agency is responsible for collecting state taxes and ensuring compliance with tax laws. Taxpayers can access the form and any related instructions directly from the Department of Revenue's official website or through authorized tax preparation services. Keeping up-to-date with any changes to the form or filing requirements is essential for accurate tax reporting.

Quick guide on how to complete pa income tax return form

Complete Pa Income Tax Return Form effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute to conventional printed and signed documents, as you can obtain the necessary form and securely store it online. airSlate SignNow equips you with all the resources you require to create, alter, and eSign your documents quickly and without holdups. Manage Pa Income Tax Return Form on any device using airSlate SignNow's Android or iOS applications and enhance any document-focused procedure today.

How to modify and eSign Pa Income Tax Return Form with ease

- Obtain Pa Income Tax Return Form and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize pertinent sections of your documents or obscure sensitive details with tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to preserve your changes.

- Select how you wish to submit your form, via email, text message (SMS), or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, cumbersome form navigation, or mistakes that require printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Modify and eSign Pa Income Tax Return Form and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the pa income tax return form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Pennsylvania income tax return?

A Pennsylvania income tax return is a tax document that residents must file to report their income and calculate their tax liability for the state of Pennsylvania. It includes information on wages, interest, dividends, and other sources of income. Understanding how to properly complete your Pennsylvania income tax return is crucial to ensure compliance and avoid penalties.

-

How can airSlate SignNow assist with filing a Pennsylvania income tax return?

airSlate SignNow offers a streamlined solution for businesses needing to send and eSign documents related to their Pennsylvania income tax return. With its user-friendly interface and secure electronic signature functionalities, users can easily manage the documents necessary for their tax filings. This enhances workflow efficiency and simplifies the tax preparation process.

-

What features does airSlate SignNow provide for managing tax documents?

airSlate SignNow provides features such as customizable templates, collaboration tools, and secure document storage, all of which are beneficial for managing documents related to your Pennsylvania income tax return. These features allow users to efficiently track and sign documents while ensuring that sensitive information is safeguarded. Additionally, users can access their documents anytime, making tax season easier.

-

Are there any fees associated with airSlate SignNow for Pennsylvania income tax return services?

Yes, airSlate SignNow operates on a subscription model with various pricing plans that cater to different business needs. These plans include features specifically designed to assist with Pennsylvania income tax return management, ensuring users have access to all necessary tools at an affordable rate. It's advisable to review the pricing details on their website to choose the best option for your business.

-

Can I use airSlate SignNow to integrate with tax software for my Pennsylvania income tax return?

Absolutely, airSlate SignNow allows integration with various accounting and tax software, facilitating a smoother process for filing your Pennsylvania income tax return. This integration helps in transferring data securely and efficiently without the need for manual entry, saving valuable time during tax season. Always check for compatibility with your preferred tax software.

-

What are the benefits of using airSlate SignNow for Pennsylvania income tax return management?

The main benefits of using airSlate SignNow for Pennsylvania income tax return management include its cost-effectiveness, ease of use, and enhanced efficiency. Users can quickly prepare and sign documents, signNowly reducing the time taken to handle tax paperwork. Moreover, the platform's security features ensure that sensitive tax information remains confidential.

-

Is airSlate SignNow compliant with federal and state tax regulations for Pennsylvania income tax return?

Yes, airSlate SignNow complies with federal and state tax regulations, making it a reliable tool for preparing and signing documents for your Pennsylvania income tax return. The platform is designed to adhere to legal standards, ensuring that users remain compliant while minimizing the risk of tax-related issues. Always consult a tax professional to ensure complete compliance.

Get more for Pa Income Tax Return Form

- Hctra app form

- Wedding vendor list template form

- Moose mountain cafe form

- Tdcj medical records form

- Patient information amp insurance verification sheet

- Scholarship bapplicationb west hills hospital amp medical center form

- Efa 7 621 the emergency food assistance program tefap certification of eligibility form

- Titre report for measles mumps rubella form

Find out other Pa Income Tax Return Form

- Electronic signature New Jersey Lease Renewal Free

- Electronic signature Texas Lease Renewal Fast

- How Can I Electronic signature Colorado Notice of Intent to Vacate

- eSignature Delaware Employee Compliance Survey Later

- eSignature Kansas Employee Compliance Survey Myself

- Can I Electronic signature Colorado Bill of Sale Immovable Property

- How Can I Electronic signature West Virginia Vacation Rental Short Term Lease Agreement

- How Do I Electronic signature New Hampshire Bill of Sale Immovable Property

- Electronic signature North Dakota Bill of Sale Immovable Property Myself

- Can I Electronic signature Oregon Bill of Sale Immovable Property

- How To Electronic signature West Virginia Bill of Sale Immovable Property

- Electronic signature Delaware Equipment Sales Agreement Fast

- Help Me With Electronic signature Louisiana Assignment of Mortgage

- Can I Electronic signature Minnesota Assignment of Mortgage

- Electronic signature West Virginia Sales Receipt Template Free

- Electronic signature Colorado Sales Invoice Template Computer

- Electronic signature New Hampshire Sales Invoice Template Computer

- Electronic signature Tennessee Introduction Letter Free

- How To eSignature Michigan Disclosure Notice

- How To Electronic signature Ohio Product Defect Notice