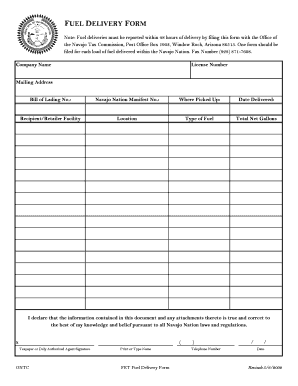

Navajo Nation Tax Commission Form

What is the Navajo Nation Tax Commission

The Navajo Nation Tax Commission is the governing body responsible for administering tax laws within the Navajo Nation. This commission oversees the collection of various taxes, including sales tax, income tax, and property tax, ensuring compliance with tribal regulations. It plays a crucial role in managing the financial resources of the Navajo Nation, which supports public services and infrastructure development.

How to use the Navajo Nation Tax Commission

Using the Navajo Nation Tax Commission involves understanding the tax obligations and processes applicable to individuals and businesses operating within the Navajo Nation. Taxpayers can access forms, guidelines, and resources through the commission's official channels. It is essential to stay informed about tax rates, filing deadlines, and compliance requirements to ensure proper adherence to tax laws.

Steps to complete the Navajo Nation Tax Commission form

Completing the Navajo Nation Tax Commission form requires several steps to ensure accuracy and compliance. Begin by gathering all necessary documents, such as income statements and identification. Next, fill out the form carefully, providing all required information. Review the completed form for any errors before submission. Finally, submit the form through the designated method, whether online, by mail, or in person, ensuring it is done before the filing deadline.

Legal use of the Navajo Nation Tax Commission

The legal use of the Navajo Nation Tax Commission is governed by tribal laws and regulations. Taxpayers must comply with the requirements set forth by the commission to avoid penalties. This includes accurate reporting of income, timely filing of tax returns, and payment of any owed taxes. Understanding the legal framework helps ensure that individuals and businesses operate within the law while benefiting from the services provided by the Navajo Nation.

Required Documents

To complete transactions with the Navajo Nation Tax Commission, several documents may be required. Commonly needed documents include proof of income, identification, and any prior tax returns. Businesses may also need to provide additional documentation, such as business licenses and financial statements. Ensuring that all required documents are prepared in advance can facilitate a smoother filing process.

Filing Deadlines / Important Dates

Filing deadlines for the Navajo Nation Tax Commission are crucial for compliance. Taxpayers should be aware of specific dates for income tax returns, sales tax submissions, and other relevant filings. It is advisable to mark these dates on a calendar and set reminders to avoid late submissions, which can result in penalties or interest charges.

Quick guide on how to complete navajo nation tax commission

Easily Set Up Navajo Nation Tax Commission on Any Device

Digital document management has gained traction among businesses and individuals. It offers an excellent eco-friendly substitute for conventional printed and signed papers, as you can locate the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, alter, and electronically sign your documents swiftly without any holdups. Handle Navajo Nation Tax Commission on any device using airSlate SignNow's Android or iOS applications and simplify any document-related tasks today.

The Easiest Method to Modify and Electronically Sign Navajo Nation Tax Commission Effortlessly

- Locate Navajo Nation Tax Commission and click Get Form to begin.

- Use the tools provided to complete your form.

- Highlight pertinent sections of the documents or hide sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Create your signature using the Sign tool, which takes merely seconds and carries the same legal validity as a traditional wet ink signature.

- Verify the information and click the Done button to save your edits.

- Choose how you want to submit your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searches, or errors that require new document copies. airSlate SignNow meets all your document management needs with just a few clicks from your preferred device. Modify and electronically sign Navajo Nation Tax Commission to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the navajo nation tax commission

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Navajo Nation Tax Commission?

The Navajo Nation Tax Commission is responsible for administering and enforcing tax policies within the Navajo Nation. It oversees various tax types, including sales, income, and excise taxes. Understanding how it operates can help businesses comply with local tax regulations.

-

How does airSlate SignNow support the Navajo Nation Tax Commission?

airSlate SignNow provides a streamlined eSigning solution that can efficiently handle documents related to the Navajo Nation Tax Commission. This ensures that businesses can complete necessary paperwork quickly and legally, thereby facilitating compliance with tax regulations. Its user-friendly interface simplifies document management.

-

What are the pricing options for airSlate SignNow when dealing with the Navajo Nation Tax Commission?

airSlate SignNow offers flexible pricing plans to cater to various business sizes. Depending on your organization's needs, you can choose a plan that simplifies interactions with the Navajo Nation Tax Commission, making document signing and submission more affordable and efficient. Pricing is transparent and competitive.

-

Can airSlate SignNow integrate with other software for tax-related purposes?

Yes, airSlate SignNow offers robust integrations with various accounting and tax software, enhancing the workflow for businesses interacting with the Navajo Nation Tax Commission. These integrations help streamline processes, automate document handling, and ensure compliance with tax requirements. This flexibility saves time and reduces errors.

-

What features does airSlate SignNow offer that can assist with tax compliance for the Navajo Nation Tax Commission?

airSlate SignNow includes features such as customizable templates, secure storage, and advanced tracking capabilities. These tools help ensure that the documents submitted to the Navajo Nation Tax Commission are accurate and compliant. Moreover, the option for team collaboration enhances productivity.

-

What benefits does eSigning with airSlate SignNow provide for the Navajo Nation Tax Commission?

Using airSlate SignNow for eSigning offers numerous benefits such as increased efficiency, reduced turnaround times, and enhanced security for sensitive tax documents. For businesses navigating the Navajo Nation Tax Commission, these advantages lead to faster approval processes and fewer compliance issues. It's a cost-effective solution that fosters trust.

-

Is airSlate SignNow compliant with the regulations of the Navajo Nation Tax Commission?

Yes, airSlate SignNow ensures that all eSigning processes comply with the legal requirements set by the Navajo Nation Tax Commission. This adherence guarantees that your signed documents are legally binding and accepted by regulatory authorities. Employing compliant solutions is crucial for successful tax administration.

Get more for Navajo Nation Tax Commission

Find out other Navajo Nation Tax Commission

- eSign Hawaii Lawers Rental Application Fast

- eSign Hawaii Lawers Cease And Desist Letter Later

- How To eSign Hawaii Lawers Cease And Desist Letter

- How Can I eSign Hawaii Lawers Cease And Desist Letter

- eSign Hawaii Lawers Cease And Desist Letter Free

- eSign Maine Lawers Resignation Letter Easy

- eSign Louisiana Lawers Last Will And Testament Mobile

- eSign Louisiana Lawers Limited Power Of Attorney Online

- eSign Delaware Insurance Work Order Later

- eSign Delaware Insurance Credit Memo Mobile

- eSign Insurance PPT Georgia Computer

- How Do I eSign Hawaii Insurance Operating Agreement

- eSign Hawaii Insurance Stock Certificate Free

- eSign New Hampshire Lawers Promissory Note Template Computer

- Help Me With eSign Iowa Insurance Living Will

- eSign North Dakota Lawers Quitclaim Deed Easy

- eSign Ohio Lawers Agreement Computer

- eSign North Dakota Lawers Separation Agreement Online

- How To eSign North Dakota Lawers Separation Agreement

- eSign Kansas Insurance Moving Checklist Free