Comparing Regressive Progressive and Proportional Taxes Form

What is the comparing regressive progressive and proportional taxes?

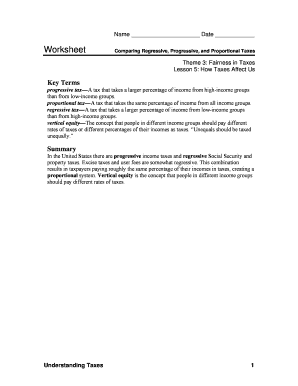

The comparing regressive progressive and proportional taxes form serves as a tool for understanding different taxation systems and their implications. Regressive taxes take a larger percentage from low-income earners, while progressive taxes impose higher rates on those with greater income. Proportional taxes apply the same rate regardless of income level. This form helps individuals and businesses analyze these tax structures, which can influence financial planning and compliance with tax regulations.

How to use the comparing regressive progressive and proportional taxes

To effectively use the comparing regressive progressive and proportional taxes worksheet, begin by gathering relevant financial data. This includes income levels, deductions, and applicable tax rates. Input this information into the worksheet to visualize how each tax type affects your overall tax liability. Comparing the outcomes can guide decisions regarding income strategies and tax planning, ensuring compliance with U.S. tax laws.

Steps to complete the comparing regressive progressive and proportional taxes

Completing the comparing regressive progressive and proportional taxes form involves several key steps:

- Gather your financial information, including income sources and deductions.

- Identify the tax rates applicable to your income level for each tax type.

- Input your data into the worksheet, ensuring accuracy in all fields.

- Calculate your tax liability under each system to see the differences.

- Review the results to assess which tax structure may be more beneficial for your situation.

Legal use of the comparing regressive progressive and proportional taxes

The comparing regressive progressive and proportional taxes worksheet is legally recognized when filled out correctly and used for legitimate tax planning purposes. It is important to ensure that all information is accurate and complies with IRS guidelines. Using this form can aid in understanding tax obligations and preparing for potential audits, as it provides a clear record of your tax analysis.

Key elements of the comparing regressive progressive and proportional taxes

Several key elements are essential in the comparing regressive progressive and proportional taxes form:

- Income Levels: Understanding how different income brackets are taxed is crucial.

- Tax Rates: Knowing the specific rates for regressive, progressive, and proportional taxes helps in accurate calculations.

- Deductions: Identifying applicable deductions can significantly affect tax liabilities.

- Comparative Analysis: The ability to compare outcomes under different tax structures is vital for informed decision-making.

Examples of using the comparing regressive progressive and proportional taxes

Examples of using the comparing regressive progressive and proportional taxes worksheet can illustrate its practical application. For instance, a self-employed individual might analyze how their income would be taxed under each system, considering potential deductions. A business owner could use the form to evaluate the impact of different tax structures on their overall profitability. Such analyses can lead to strategic decisions regarding income and expenditures.

Quick guide on how to complete comparing regressive progressive and proportional taxes

Complete Comparing Regressive Progressive And Proportional Taxes seamlessly on any device

Online document handling has become increasingly favored by both businesses and individuals. It serves as an ideal eco-friendly substitute for conventional printed and signed documents, as you can locate the correct template and securely keep it online. airSlate SignNow equips you with all the essential tools to create, modify, and eSign your documents swiftly without delays. Manage Comparing Regressive Progressive And Proportional Taxes on any platform with airSlate SignNow Android or iOS applications and streamline any document-related process today.

How to alter and eSign Comparing Regressive Progressive And Proportional Taxes effortlessly

- Obtain Comparing Regressive Progressive And Proportional Taxes and click Get Form to begin.

- Make use of the tools we provide to fill out your form.

- Emphasize pertinent sections of your documents or redact confidential information with tools that airSlate SignNow provides specifically for that task.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal standing as a conventional wet ink signature.

- Review all the information and click the Done button to save your modifications.

- Select how you wish to send your form, whether via email, SMS, or invite link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from a device of your selection. Modify and eSign Comparing Regressive Progressive And Proportional Taxes to ensure outstanding communication at any point during your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the comparing regressive progressive and proportional taxes

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the difference when comparing regressive progressive and proportional taxes regarding document signing solutions?

When comparing regressive progressive and proportional taxes, it's important to note how each type impacts overall financial strategies. Regressive taxes tend to burden low-income individuals more, while progressive taxes aim for higher contributions from the wealthy. Understanding these implications can help businesses choose the right eSigning solutions that align with their financial goals.

-

How does airSlate SignNow help in understanding tax implications when comparing regressive progressive and proportional taxes?

airSlate SignNow offers tools that facilitate the collaboration necessary for understanding tax implications. By providing templates and workflows tailored to finance and accounting, users can efficiently manage documents that clarify the differences when comparing regressive progressive and proportional taxes.

-

Are there specific features in airSlate SignNow that cater to financial professionals comparing regressive progressive and proportional taxes?

Yes, airSlate SignNow includes features such as customizable templates and audit trails that appeal to financial professionals. These tools can streamline the documentation process, allowing professionals to better analyze and document findings when comparing regressive progressive and proportional taxes.

-

What pricing options are available for businesses needing to eSign documents while comparing regressive progressive and proportional taxes?

airSlate SignNow offers various pricing plans to accommodate businesses of all sizes. Whether you need basic eSigning capabilities or advanced features for comprehensive analysis, there is a plan to suit your needs while considering the implications of comparing regressive progressive and proportional taxes.

-

How can integrating airSlate SignNow enhance efficiency for teams working on tax comparisons?

Integrating airSlate SignNow with other business tools can greatly enhance team efficiency. By centralizing document signing and approval processes, teams can focus more on analyzing data and comparing regressive progressive and proportional taxes rather than getting bogged down in administrative tasks.

-

What benefits does airSlate SignNow offer for businesses preparing tax-related documents while comparing regressive progressive and proportional taxes?

airSlate SignNow simplifies the process of preparing tax-related documents by providing a user-friendly interface. This can save time and reduce errors, which is crucial when comparing regressive progressive and proportional taxes to ensure compliance and accurate reporting.

-

Can I manage document workflows in airSlate SignNow while addressing issues related to comparing regressive progressive and proportional taxes?

Absolutely! airSlate SignNow allows you to create comprehensive document workflows tailored to your specific needs. This means you can effectively manage presentations and analyses while addressing issues related to comparing regressive progressive and proportional taxes seamlessly.

Get more for Comparing Regressive Progressive And Proportional Taxes

- Aha acls roster form

- Psychological checklist form

- Additional signature addendum form

- Sonyma form r7 12 14

- Example alphanumeric outline form

- Form i 601 instructions for application for waiver of

- Form i 918 supplement b u nonimmigrant status certification form i 918 supplement b u nonimmigrant status certification

- Form i 918 supplement a petition for qualifying family member of u 1 recipient form i 918 supplement a petition for qualifying

Find out other Comparing Regressive Progressive And Proportional Taxes

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors