Deferred Compensation Agreement Form

What is the Deferred Compensation Agreement Form

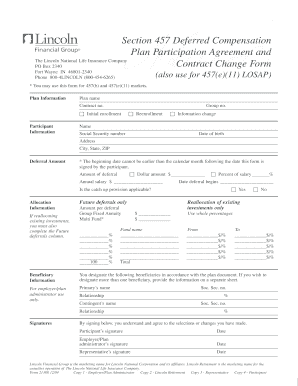

The Deferred Compensation Agreement Form is a legal document that outlines an arrangement between an employer and an employee regarding the deferral of a portion of the employee's income to a future date. This form is often utilized to provide tax advantages for employees, as the deferred income is not taxed until it is received. Such agreements are common in various sectors and can include various types of compensation, such as bonuses, commissions, or retirement contributions.

How to use the Deferred Compensation Agreement Form

Using the Deferred Compensation Agreement Form involves several key steps. First, both the employer and employee should review the terms of the agreement to ensure mutual understanding. Next, the employee fills out the form, specifying the amount of income to be deferred and the timeline for receiving this compensation. After both parties have signed the form, it should be stored securely as part of the employee's financial records. It is advisable to keep a copy for personal records and provide one to the employer for their files.

Steps to complete the Deferred Compensation Agreement Form

Completing the Deferred Compensation Agreement Form requires careful attention to detail. Here are the steps to follow:

- Read the form thoroughly to understand all terms and conditions.

- Fill in personal information, including the employee's name, position, and contact details.

- Specify the amount of compensation to be deferred and the intended date for payment.

- Review the agreement with a financial advisor if necessary.

- Both the employer and employee should sign and date the form.

- Store the completed form in a secure location.

Key elements of the Deferred Compensation Agreement Form

Several critical elements must be included in the Deferred Compensation Agreement Form to ensure its validity and effectiveness. These elements typically include:

- The names and signatures of both the employer and employee.

- A clear description of the compensation being deferred.

- The specific timeline for when the deferred compensation will be paid out.

- Any conditions or contingencies related to the agreement.

- Legal disclaimers regarding tax implications and compliance with relevant laws.

Legal use of the Deferred Compensation Agreement Form

The Deferred Compensation Agreement Form is legally binding when executed in compliance with applicable laws and regulations. In the United States, it must adhere to the Internal Revenue Code and relevant state laws governing deferred compensation. Proper execution includes obtaining signatures from both parties and ensuring that the terms are clear and unambiguous. It is advisable to consult with legal counsel to ensure that the agreement complies with all necessary legal standards.

Eligibility Criteria

Eligibility for a Deferred Compensation Agreement typically depends on the employee's role within the organization and the policies set forth by the employer. Generally, full-time employees may qualify, while part-time or temporary employees might not. Additionally, certain income thresholds may apply, and the employer may have specific criteria regarding which positions are eligible for deferred compensation plans. Understanding these criteria is essential for employees considering this option.

Quick guide on how to complete deferred compensation agreement form

Effortlessly Prepare Deferred Compensation Agreement Form on Any Device

Digital document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed papers, allowing you to acquire the necessary form and securely store it online. airSlate SignNow provides you with all the resources you require to create, edit, and electronically sign your documents quickly and without delay. Manage Deferred Compensation Agreement Form on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The Simplest Way to Edit and eSign Deferred Compensation Agreement Form with Ease

- Locate Deferred Compensation Agreement Form and click on Get Form to initiate.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of the documents or obscure sensitive information using tools that airSlate SignNow specifically provides for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Verify the information and click on the Done button to save your changes.

- Choose your preferred delivery method for your form, whether by email, SMS, invitation link, or downloading it to your computer.

Eliminate the hassle of lost or misfiled documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs within a few clicks from any device you prefer. Edit and eSign Deferred Compensation Agreement Form to ensure smooth communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the deferred compensation agreement form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Deferred Compensation Agreement Form?

A Deferred Compensation Agreement Form is a legal document used to outline arrangements for deferring a portion of an employee's earnings until a later date, often for tax benefits. It specifies the terms of the deferred compensation, ensuring clarity for both the employer and the employee. This form is crucial for planning retirement benefits and reducing taxable income.

-

Why should I use airSlate SignNow for my Deferred Compensation Agreement Form?

Using airSlate SignNow for your Deferred Compensation Agreement Form simplifies the e-signing process, allowing you to quickly send and receive signed documents. Its user-friendly interface ensures that both employers and employees can easily manage their agreements. With cost-effective solutions, airSlate SignNow makes compliance and record-keeping straightforward.

-

Are there any fees associated with using airSlate SignNow for Deferred Compensation Agreement Forms?

Yes, there are subscription plans available for airSlate SignNow that cater to various business needs. However, the cost is typically competitive and provides great value, especially considering the time and resources saved when managing Deferred Compensation Agreement Forms. You can choose a plan that best fits your organizational requirements.

-

Can I customize my Deferred Compensation Agreement Form using airSlate SignNow?

Absolutely! airSlate SignNow allows users to customize their Deferred Compensation Agreement Form to fit specific business needs or legal requirements. You can add company logos, adjust clauses, and include unique terms to ensure the agreement meets all necessary specifications.

-

How does airSlate SignNow ensure the security of my Deferred Compensation Agreement Form?

airSlate SignNow prioritizes document security by employing advanced encryption methods both in transit and at rest. Additionally, the platform provides audit trails and access controls, ensuring that your Deferred Compensation Agreement Form is protected from unauthorized access and alterations.

-

Can I integrate airSlate SignNow with other software for managing Deferred Compensation Agreement Forms?

Yes, airSlate SignNow offers integration with various applications such as CRMs, document storage solutions, and productivity tools. This interoperability allows businesses to streamline their workflows and manage Deferred Compensation Agreement Forms more efficiently without switching between different platforms.

-

What are the benefits of using a Deferred Compensation Agreement Form?

The primary benefits of using a Deferred Compensation Agreement Form include tax deferral, retirement planning, and enhanced employee retention. By deferring income, employees can reduce their taxable income and plan their finances more effectively. This also enables companies to offer a competitive benefits package that attracts and retains top talent.

Get more for Deferred Compensation Agreement Form

Find out other Deferred Compensation Agreement Form

- How To eSign New Mexico Education Promissory Note Template

- eSign New Mexico Education Affidavit Of Heirship Online

- eSign California Finance & Tax Accounting IOU Free

- How To eSign North Dakota Education Rental Application

- How To eSign South Dakota Construction Promissory Note Template

- eSign Education Word Oregon Secure

- How Do I eSign Hawaii Finance & Tax Accounting NDA

- eSign Georgia Finance & Tax Accounting POA Fast

- eSign Georgia Finance & Tax Accounting POA Simple

- How To eSign Oregon Education LLC Operating Agreement

- eSign Illinois Finance & Tax Accounting Resignation Letter Now

- eSign Texas Construction POA Mobile

- eSign Kansas Finance & Tax Accounting Stock Certificate Now

- eSign Tennessee Education Warranty Deed Online

- eSign Tennessee Education Warranty Deed Now

- eSign Texas Education LLC Operating Agreement Fast

- eSign Utah Education Warranty Deed Online

- eSign Utah Education Warranty Deed Later

- eSign West Virginia Construction Lease Agreement Online

- How To eSign West Virginia Construction Job Offer