Tax Utah GovformscurrentCompany Name Utah Sales Tax Acct Number E Mail Address 2022

Understanding the Utah State Tax Commission

The Utah State Tax Commission is the primary agency responsible for administering tax laws in Utah. This includes overseeing various taxes such as sales tax, income tax, and property tax. The commission ensures compliance with state tax regulations and provides resources for taxpayers to understand their obligations. It plays a critical role in the collection of taxes that fund essential state services.

Steps to Complete the Utah State Tax Commission Form

Completing the Utah State Tax Commission form involves several key steps:

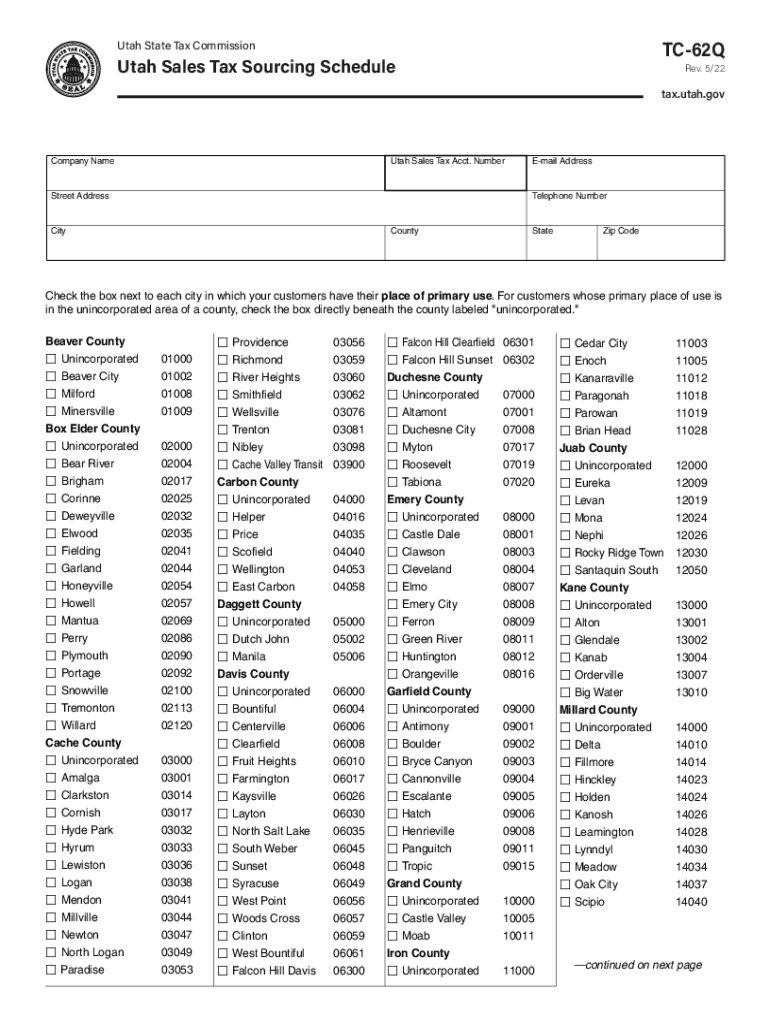

- Gather necessary information, including your company name, Utah sales tax account number, and email address.

- Access the form through the Utah State Tax Commission website or designated platforms.

- Fill in the required fields accurately, ensuring all information is current and correct.

- Review the completed form for any errors or omissions.

- Submit the form electronically or via mail, depending on the submission method you choose.

Legal Use of the Utah State Tax Commission Form

Using the Utah State Tax Commission form legally requires adherence to specific guidelines. The form must be filled out truthfully and accurately to avoid penalties. Electronic submissions are considered legally binding when they comply with the Electronic Signatures in Global and National Commerce (ESIGN) Act and the Uniform Electronic Transactions Act (UETA). This means that eSignatures obtained through a compliant platform are valid for legal purposes.

Required Documents for Submission

To successfully complete the Utah State Tax Commission form, you may need to provide various documents, including:

- Proof of your Utah sales tax account number.

- Identification documents, such as a driver's license or state ID.

- Financial statements if applicable, especially for businesses.

Filing Deadlines and Important Dates

Being aware of filing deadlines is crucial for compliance. The Utah State Tax Commission sets specific dates for tax filings, which may vary based on the type of tax. Generally, sales tax returns are due on a monthly, quarterly, or annual basis, depending on your business's sales volume. It is essential to check the commission's official calendar for the latest deadlines to avoid late fees.

Form Submission Methods

There are several ways to submit your Utah State Tax Commission form:

- Online submission: This is the most efficient method, allowing you to complete and submit your form electronically.

- Mail: You can print the completed form and send it to the appropriate address provided by the commission.

- In-person: For those who prefer face-to-face interaction, you can submit your form at designated tax commission offices.

Quick guide on how to complete tax utah govformscurrentcompany name utah sales tax acct number e mail address

Complete Tax utah govformscurrentCompany Name Utah Sales Tax Acct Number E mail Address effortlessly on any device

Managing documents online has gained popularity among businesses and individuals alike. It offers a superb environmentally friendly substitute for traditional printed and signed documents, as you can easily locate the correct template and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents swiftly without delays. Handle Tax utah govformscurrentCompany Name Utah Sales Tax Acct Number E mail Address on any device with airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to edit and eSign Tax utah govformscurrentCompany Name Utah Sales Tax Acct Number E mail Address with ease

- Obtain Tax utah govformscurrentCompany Name Utah Sales Tax Acct Number E mail Address and then click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize relevant sections of the documents or redact sensitive information using tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature with the Sign feature, which only takes seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the details and then click on the Done button to save your changes.

- Select how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Don't worry about lost or misfiled documents, tedious form searching, or errors that require printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you choose. Edit and eSign Tax utah govformscurrentCompany Name Utah Sales Tax Acct Number E mail Address and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct tax utah govformscurrentcompany name utah sales tax acct number e mail address

Create this form in 5 minutes!

How to create an eSignature for the tax utah govformscurrentcompany name utah sales tax acct number e mail address

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the role of the Utah State Tax Commission?

The Utah State Tax Commission is responsible for administering various tax laws in Utah, including income tax, sales tax, and property tax. They ensure compliance with state tax codes and provide resources for taxpayers to understand their obligations. This signifies the importance of understanding tax regulations for businesses using airSlate SignNow.

-

How can airSlate SignNow assist with compliance related to the Utah State Tax Commission?

AirSlate SignNow can help businesses streamline their document management processes, ensuring that all necessary tax forms are signed and submitted promptly. By providing eSignature solutions, businesses can easily comply with the documentation requirements set by the Utah State Tax Commission. This reduces delays and ensures your tax submissions are timely.

-

What features does airSlate SignNow offer that can aid in tax compliance?

AirSlate SignNow offers features like customizable templates, automated workflows, and secure cloud storage designed to simplify document handling. These features ensure that all tax-related documents are perfectly organized and accessible, thus supporting your compliance with the Utah State Tax Commission. Additionally, the platform enables easy tracking of document statuses.

-

Are there any costs associated with using airSlate SignNow for tax-related documents?

Yes, airSlate SignNow operates on a subscription-based pricing model that is both cost-effective and scalable for businesses of any size. The pricing plans provide various tiers, ensuring flexibility based on your needs, whether for simple forms or complex tax documents related to the Utah State Tax Commission. A trial option may be available for exploration.

-

What benefits does airSlate SignNow provide for businesses facing audits by the Utah State Tax Commission?

By utilizing airSlate SignNow, businesses can maintain a clear audit trail of all signed documents and approvals, which is crucial during audits by the Utah State Tax Commission. This ensures that your business is always prepared with accurate and reliable documentation. The platform's secure storage also means your documents are protected during the audit process.

-

Can airSlate SignNow integrate with accounting software that interfaces with the Utah State Tax Commission?

Absolutely, airSlate SignNow offers integration capabilities with various accounting software that can help manage tax filings and reporting. This integration allows for a seamless exchange of information, thus enhancing your ability to stay compliant with the Utah State Tax Commission's requirements. Streamlined workflows can lead to increased efficiency in document management.

-

How does airSlate SignNow ensure the security of documents related to the Utah State Tax Commission?

AirSlate SignNow employs advanced encryption and multi-factor authentication to ensure that all documents, especially those related to the Utah State Tax Commission, are secure. These security measures protect sensitive data during eSigning and storage, providing peace of mind to businesses that rely on electronic signatures to comply with tax regulations.

Get more for Tax utah govformscurrentCompany Name Utah Sales Tax Acct Number E mail Address

- Chew on these bubble gum facts answers form

- Lesson 3 colonial latin america answer key form

- Appointment or withdrawal of an authorised recipient form

- 24petwatch microchip registration form

- Contractor qualification statement example form

- State fire marshaliowa department of public safety form

- Purchase order request form jchs doc

- Request for utility leak adjustment tukwilawa form

Find out other Tax utah govformscurrentCompany Name Utah Sales Tax Acct Number E mail Address

- eSignature Real Estate Form Louisiana Simple

- eSignature Louisiana Real Estate LLC Operating Agreement Myself

- Can I eSignature Louisiana Real Estate Quitclaim Deed

- eSignature Hawaii Sports Living Will Safe

- eSignature Hawaii Sports LLC Operating Agreement Myself

- eSignature Maryland Real Estate Quitclaim Deed Secure

- eSignature Idaho Sports Rental Application Secure

- Help Me With eSignature Massachusetts Real Estate Quitclaim Deed

- eSignature Police Document Florida Easy

- eSignature Police Document Florida Safe

- How Can I eSignature Delaware Police Living Will

- eSignature Michigan Real Estate LLC Operating Agreement Mobile

- eSignature Georgia Police Last Will And Testament Simple

- How To eSignature Hawaii Police RFP

- Can I eSignature Minnesota Real Estate Warranty Deed

- How Do I eSignature Indiana Police Lease Agreement Form

- eSignature Police PPT Kansas Free

- How Can I eSignature Mississippi Real Estate Rental Lease Agreement

- How Do I eSignature Kentucky Police LLC Operating Agreement

- eSignature Kentucky Police Lease Termination Letter Now