For Calendar Year Decedent Was Due a Refund 2 0 2 0 or Fiscal Year Ending M M Y Y Form

What is the For Calendar Year Decedent Was Due A Refund 2 0 2 0 OR Fiscal Year Ending M M Y Y

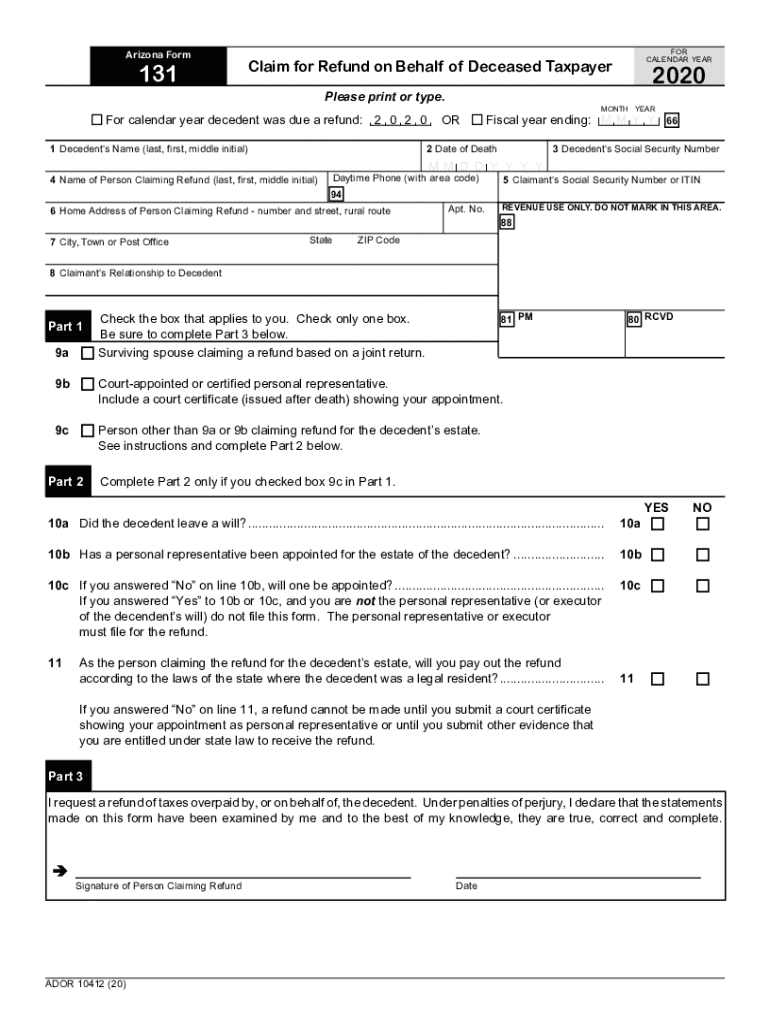

The form titled "For Calendar Year Decedent Was Due A Refund 2 0 2 0 OR Fiscal Year Ending M M Y Y" is primarily used in the context of tax filings for individuals who have passed away during the specified calendar year. This form is essential for the estate's executor or administrator to claim any tax refund that may be due to the decedent's estate. It ensures that the tax obligations are settled and any refunds are processed correctly, allowing the estate to manage its financial responsibilities effectively.

Steps to complete the For Calendar Year Decedent Was Due A Refund 2 0 2 0 OR Fiscal Year Ending M M Y Y

Completing the form involves several key steps to ensure accuracy and compliance with tax regulations. Begin by gathering all necessary documents, including the decedent's previous tax returns and any relevant financial statements. Next, fill out the form with accurate information regarding the decedent's income, deductions, and any tax credits applicable for the year in question. After entering all required details, review the form for completeness and accuracy. Finally, sign and date the form before submission to the appropriate tax authority.

Legal use of the For Calendar Year Decedent Was Due A Refund 2 0 2 0 OR Fiscal Year Ending M M Y Y

This form serves a critical legal function in the estate settlement process. It is legally binding when properly completed and signed, ensuring that the claims for any refunds are legitimate. The executor or administrator must adhere to IRS guidelines and state laws when filing this form. Compliance with legal requirements not only protects the estate from potential penalties but also ensures that the decedent's tax matters are resolved in accordance with the law.

IRS Guidelines

The IRS provides specific guidelines for the use of the "For Calendar Year Decedent Was Due A Refund 2 0 2 0 OR Fiscal Year Ending M M Y Y" form. It is essential to follow these guidelines to avoid delays in processing. The IRS requires that the form be filed within a certain timeframe, typically within two years of the decedent's passing. Additionally, the executor must ensure that all information reported is accurate and that any required supporting documentation is included with the submission.

Filing Deadlines / Important Dates

Filing deadlines for this form are crucial to ensure timely processing of any refunds due to the decedent's estate. Generally, the form must be submitted by the tax filing deadline for the year in which the decedent passed away. For example, if the decedent died in 2020, the form should be filed by April 15 of the following year, unless an extension is granted. It is important to be aware of these deadlines to avoid penalties and interest on any unpaid taxes.

Required Documents

To complete the "For Calendar Year Decedent Was Due A Refund 2 0 2 0 OR Fiscal Year Ending M M Y Y" form, several documents are required. These typically include the decedent's previous tax returns, W-2 forms, 1099 forms, and any other relevant income statements. Additionally, documentation supporting deductions and credits claimed on the form must be gathered. Having these documents ready will facilitate a smoother completion process and help ensure accuracy in the filing.

Quick guide on how to complete for calendar year decedent was due a refund 2 0 2 0 or fiscal year ending m m y y

Effortlessly Prepare For Calendar Year Decedent Was Due A Refund 2 0 2 0 OR Fiscal Year Ending M M Y Y on Any Device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal environmentally-friendly alternative to traditional printed and signed paperwork, allowing you to locate the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Handle For Calendar Year Decedent Was Due A Refund 2 0 2 0 OR Fiscal Year Ending M M Y Y on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process now.

How to Modify and eSign For Calendar Year Decedent Was Due A Refund 2 0 2 0 OR Fiscal Year Ending M M Y Y with Ease

- Locate For Calendar Year Decedent Was Due A Refund 2 0 2 0 OR Fiscal Year Ending M M Y Y and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of the documents or redact sensitive information using the tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature with the Sign tool, which takes only seconds and holds the same legal validity as a traditional ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you would like to share your form, via email, SMS, or invite link, or download it to your computer.

Eliminate lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow fulfills your document management requirements in just a few clicks from any device you prefer. Edit and eSign For Calendar Year Decedent Was Due A Refund 2 0 2 0 OR Fiscal Year Ending M M Y Y and ensure exceptional communication at every step of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct for calendar year decedent was due a refund 2 0 2 0 or fiscal year ending m m y y

Create this form in 5 minutes!

How to create an eSignature for the for calendar year decedent was due a refund 2 0 2 0 or fiscal year ending m m y y

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the significance of the 'For Calendar Year Decedent Was Due A Refund 2 0 2 0 OR Fiscal Year Ending M M Y Y' feature?

The 'For Calendar Year Decedent Was Due A Refund 2 0 2 0 OR Fiscal Year Ending M M Y Y' feature allows users to accurately capture essential tax information for decedents. This is important for ensuring compliance and proper processing of refunds in a timely manner. When leveraging this feature, businesses can streamline document management directly related to such crucial financial matters.

-

How does airSlate SignNow handle document security for sensitive information like refunds for decedents?

Security is a top priority for airSlate SignNow, especially when dealing with sensitive information like 'For Calendar Year Decedent Was Due A Refund 2 0 2 0 OR Fiscal Year Ending M M Y Y'. The platform employs advanced encryption methods and secure cloud storage to protect your documents. With features like customizable access controls, users can safely manage documents while ensuring that only authorized personnel can view or edit them.

-

What pricing plans are available for using airSlate SignNow?

airSlate SignNow offers multiple pricing plans to cater to different business needs, including options suited for handling cases like 'For Calendar Year Decedent Was Due A Refund 2 0 2 0 OR Fiscal Year Ending M M Y Y'. Each plan provides various features, ranging from basic eSigning capabilities to advanced integrations and custom workflows. Users can choose a plan that best fits their volume and feature requirements.

-

Can airSlate SignNow integrate with other software for tax management?

Yes, airSlate SignNow seamlessly integrates with a variety of third-party software applications, enhancing workflows, including those dealing with 'For Calendar Year Decedent Was Due A Refund 2 0 2 0 OR Fiscal Year Ending M M Y Y'. Popular integrations include platforms like accounting software and CRM systems, enabling users to manage their documents more efficiently while keeping all necessary details organized.

-

What are the benefits of using airSlate SignNow for managing documents related to decedent refunds?

Using airSlate SignNow for documents tied to 'For Calendar Year Decedent Was Due A Refund 2 0 2 0 OR Fiscal Year Ending M M Y Y' provides a streamlined process for eSigning and tracking. It not only reduces paperwork but also helps in ensuring that required documentation is completed and stored securely. Additionally, the platform's ease of use empowers teams to focus on higher-value tasks rather than tedious paperwork.

-

Is it easy to set up airSlate SignNow for first-time users?

Absolutely! airSlate SignNow is designed with user-friendliness in mind, allowing first-time users to quickly set up their accounts and start managing documents. The intuitive interface guides users through the essential steps, even when dealing with complex scenarios like 'For Calendar Year Decedent Was Due A Refund 2 0 2 0 OR Fiscal Year Ending M M Y Y'. Comprehensive support resources are also available to assist new users.

-

Does airSlate SignNow offer mobile solutions for document signing?

Yes, airSlate SignNow provides mobile access, allowing users to sign documents on the go, including for those associated with 'For Calendar Year Decedent Was Due A Refund 2 0 2 0 OR Fiscal Year Ending M M Y Y'. The mobile application is designed to function flawlessly on smartphones and tablets, ensuring that important documents can be signed and sent from anywhere, at any time.

Get more for For Calendar Year Decedent Was Due A Refund 2 0 2 0 OR Fiscal Year Ending M M Y Y

Find out other For Calendar Year Decedent Was Due A Refund 2 0 2 0 OR Fiscal Year Ending M M Y Y

- eSign New York Plumbing Rental Lease Agreement Simple

- eSign North Dakota Plumbing Emergency Contact Form Mobile

- How To eSign North Dakota Plumbing Emergency Contact Form

- eSign Utah Orthodontists Credit Memo Easy

- How To eSign Oklahoma Plumbing Business Plan Template

- eSign Vermont Orthodontists Rental Application Now

- Help Me With eSign Oregon Plumbing Business Plan Template

- eSign Pennsylvania Plumbing RFP Easy

- Can I eSign Pennsylvania Plumbing RFP

- eSign Pennsylvania Plumbing Work Order Free

- Can I eSign Pennsylvania Plumbing Purchase Order Template

- Help Me With eSign South Carolina Plumbing Promissory Note Template

- How To eSign South Dakota Plumbing Quitclaim Deed

- How To eSign South Dakota Plumbing Affidavit Of Heirship

- eSign South Dakota Plumbing Emergency Contact Form Myself

- eSign Texas Plumbing Resignation Letter Free

- eSign West Virginia Orthodontists Living Will Secure

- Help Me With eSign Texas Plumbing Business Plan Template

- Can I eSign Texas Plumbing Cease And Desist Letter

- eSign Utah Plumbing Notice To Quit Secure