Property Ownership Estate Form

What is the Property Ownership Estate

The property ownership estate refers to the legal rights and interests that an individual or entity holds in real estate. This concept encompasses various forms of ownership, including fee simple, life estate, and leasehold interests. Understanding the property ownership estate is crucial for managing assets, transferring rights, and ensuring compliance with legal obligations. Each type of ownership has specific implications for how property can be used, transferred, or inherited, making it essential for individuals to grasp these distinctions when dealing with estate matters.

Steps to Complete the Property Ownership Estate

Completing the property ownership estate involves several key steps to ensure that all legal requirements are met. First, identify the type of ownership you wish to establish, such as joint tenancy or tenancy in common. Next, gather all necessary documentation, including titles, deeds, and any existing agreements. After that, complete the required forms accurately, ensuring that all parties involved are clearly identified. Once the forms are filled out, submit them to the appropriate local government office, such as the county recorder or assessor, for official recording. Finally, retain copies of all documents for your records, as they may be needed for future reference or legal purposes.

Legal Use of the Property Ownership Estate

The legal use of the property ownership estate is governed by state and federal laws that dictate how property can be owned, transferred, and inherited. It is essential to comply with these laws to ensure that the ownership remains valid and enforceable. For instance, certain types of ownership may require specific legal documentation or adherence to particular procedures during transfers. Additionally, understanding local zoning laws and property regulations can impact how the property is utilized. Engaging with a legal professional can provide clarity on these aspects and help navigate any complexities associated with property ownership.

Required Documents

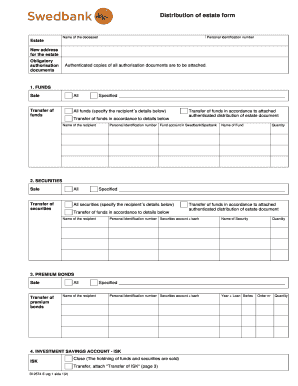

When dealing with the property ownership estate, several documents are typically required to facilitate the process. These may include:

- Property deed: This document establishes ownership and outlines the property description.

- Title report: A title report verifies the legal ownership and identifies any liens or encumbrances.

- Transfer forms: Specific forms may be needed to officially transfer ownership from one party to another.

- Identification: Personal identification for all parties involved is necessary to validate the transaction.

Having these documents prepared can streamline the process and reduce potential legal complications.

State-Specific Rules for the Property Ownership Estate

Each state has unique regulations that govern the property ownership estate. These rules can affect how property is titled, the rights of co-owners, and the process for transferring ownership. For example, some states may have specific requirements for notarization or witness signatures on property deeds. Additionally, tax implications and inheritance laws can vary significantly between states. It is important for individuals to familiarize themselves with their state’s specific laws to ensure compliance and protect their ownership rights.

Examples of Using the Property Ownership Estate

Understanding practical examples of the property ownership estate can provide valuable insights. For instance, a couple may choose to hold their property as joint tenants with rights of survivorship, ensuring that if one partner passes away, the other automatically inherits the property. Alternatively, a parent may establish a life estate for their child, allowing the child to use the property during their lifetime while retaining the right to transfer ownership upon their death. These examples illustrate how different ownership structures can serve various personal and financial goals.

Quick guide on how to complete property ownership estate

Effortlessly Prepare Property Ownership Estate on Any Device

Digital document management has gained popularity among businesses and individuals. It offers an ideal sustainable alternative to traditional printed and signed documents, as you can locate the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and electronically sign your documents swiftly with no delays. Handle Property Ownership Estate on any platform using airSlate SignNow Android or iOS applications and simplify any document-related task today.

Efficiently Modify and Electronically Sign Property Ownership Estate with Ease

- Obtain Property Ownership Estate and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your electronic signature with the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to store your changes.

- Select how you wish to distribute your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, exhausting searches for forms, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Edit and electronically sign Property Ownership Estate to ensure excellent communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the property ownership estate

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an ownership estate, and how does airSlate SignNow simplify its management?

An ownership estate refers to the legal rights held by a person or entity over a property. airSlate SignNow simplifies the management of ownership estates by providing a user-friendly platform to create, send, and securely eSign documents related to property transactions, ensuring legal compliance and efficiency.

-

How does airSlate SignNow aid in the document signing process for ownership estates?

airSlate SignNow streamlines the document signing process for ownership estates by allowing users to send contracts and agreements electronically. This eliminates the need for physical paperwork, reduces processing time, and provides a secure way to track the signing of ownership estate documents.

-

What pricing options are available for airSlate SignNow concerning ownership estate management?

airSlate SignNow offers a variety of pricing plans tailored to meet the needs of businesses managing ownership estates. These plans provide different features such as unlimited document sending, advanced integrations, and support services, allowing users to choose the best fit for their budget and requirements.

-

Can airSlate SignNow integrate with other tools for managing ownership estates?

Yes, airSlate SignNow seamlessly integrates with various third-party applications such as CRM and document management systems. This enhances the efficiency of managing ownership estates by allowing users to pull information directly from their existing systems, reducing duplication of efforts.

-

What are the security features of airSlate SignNow for ownership estate documents?

airSlate SignNow prioritizes the security of documents related to ownership estates by utilizing high-level encryption and compliance with legal standards. Features like password protection, two-factor authentication, and secure storage ensure that your sensitive ownership estate documents remain safe.

-

How can airSlate SignNow benefit real estate professionals managing ownership estates?

airSlate SignNow provides real estate professionals with a powerful tool to streamline their operations. By facilitating fast, secure eSigning of ownership estate documents, it allows professionals to focus on closing deals rather than getting bogged down in paperwork.

-

What types of documents can be managed using airSlate SignNow for ownership estates?

With airSlate SignNow, users can manage a variety of documents important to ownership estates, including purchase agreements, leases, title transfers, and power of attorney forms. This comprehensive document management capability helps ensure all legal aspects of ownership estates are covered.

Get more for Property Ownership Estate

- Chapter 1 section 2 geography application place catal huyuk answers form

- Kor whitening consent form

- Obc non creamy layer certificate format annexure ii

- Demand letter texas form

- 9904167 barclays dd form

- Oregon health authority ohp forms and publications state of oregon

- Hkihrm toolkits form time sheet for parttime staff xxx company to hr department time sheet for part time staff reference no

- Bid postingsstorm sewer line cleaning amp television detect form

Find out other Property Ownership Estate

- How To eSign Hawaii Government Word

- Can I eSign Hawaii Government Word

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Document

- How Can I eSign Hawaii Government Document

- Can I eSign Hawaii Government Document

- How Can I eSign Hawaii Government Document

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Form

- How Can I eSign Hawaii Government Form

- Help Me With eSign Hawaii Healthcare / Medical PDF

- How To eSign Arizona High Tech Document

- How Can I eSign Illinois Healthcare / Medical Presentation

- Can I eSign Hawaii High Tech Document

- How Can I eSign Hawaii High Tech Document

- How Do I eSign Hawaii High Tech Document

- Can I eSign Hawaii High Tech Word

- How Can I eSign Hawaii High Tech Form

- How Do I eSign New Mexico Healthcare / Medical Word

- How To eSign Washington High Tech Presentation