FORM CF 2210 2022

What is the FORM CF 2210

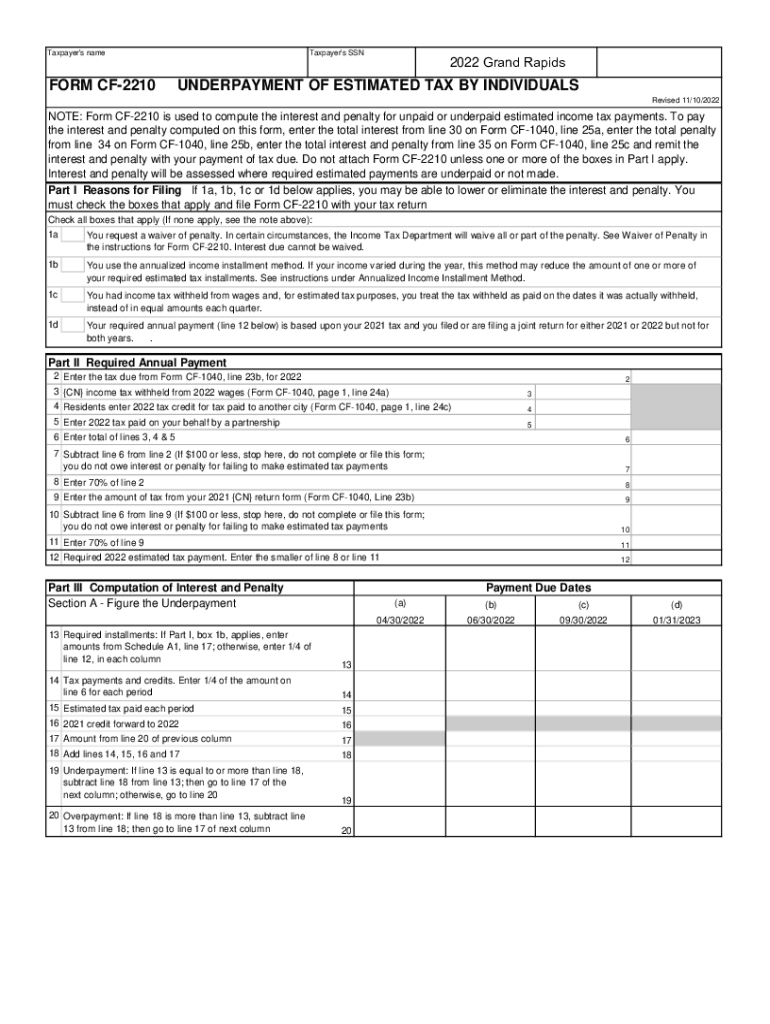

The FORM CF 2210 is a tax form used by individuals in the United States to calculate their underpayment of estimated tax for the year. This form is particularly relevant for taxpayers who do not have enough tax withheld from their income or who do not make estimated tax payments. By using this form, taxpayers can determine whether they owe a penalty for underpayment and how much that penalty may be. Understanding the purpose of the FORM CF 2210 is essential for ensuring compliance with tax obligations and avoiding unnecessary penalties.

How to use the FORM CF 2210

Using the FORM CF 2210 involves a few straightforward steps. Taxpayers need to gather their income information, including wages, dividends, and any other sources of income. Next, they should calculate their total tax liability for the year. The form will guide users through the process of determining whether they have underpaid their taxes based on their withholding and estimated payments. It is crucial to follow the instructions carefully to ensure accurate calculations and compliance with IRS guidelines.

Steps to complete the FORM CF 2210

Completing the FORM CF 2210 involves several key steps:

- Gather all relevant income documents, including W-2s and 1099s.

- Calculate your total tax liability for the year.

- Determine the amount of tax withheld and any estimated payments made.

- Follow the form's instructions to calculate any underpayment penalty.

- Review the completed form for accuracy before submission.

Each step is designed to ensure that taxpayers can accurately assess their tax situation and avoid penalties for underpayment.

Key elements of the FORM CF 2210

The FORM CF 2210 contains several key elements that are essential for its completion:

- Taxpayer Information: This section requires personal details such as name, address, and Social Security number.

- Income Details: Taxpayers must report all sources of income to determine their total tax liability.

- Withholding and Payments: This section captures the total amount of tax withheld from income and any estimated tax payments made throughout the year.

- Penalty Calculation: The form provides a method for calculating any penalties due to underpayment.

Understanding these key elements helps ensure that taxpayers complete the form correctly and minimize the risk of errors.

IRS Guidelines

IRS guidelines for the FORM CF 2210 outline the requirements for filing and the criteria for determining underpayment penalties. Taxpayers should refer to the official IRS instructions for the form, which provide detailed information on eligibility, calculations, and submission procedures. Adhering to these guidelines is crucial for compliance and for avoiding potential audits or penalties.

Filing Deadlines / Important Dates

Filing deadlines for the FORM CF 2210 coincide with the annual tax filing deadline. Typically, taxpayers must submit their completed forms by April 15 of the following year. However, if the deadline falls on a weekend or holiday, it may be extended to the next business day. Being aware of these important dates ensures that taxpayers can file on time and avoid penalties for late submission.

Quick guide on how to complete form cf 2210

Effortlessly Prepare FORM CF 2210 on Any Device

Digital document management has gained popularity among businesses and individuals alike. It serves as an excellent environmentally friendly substitute for traditional printed and signed paperwork, allowing you to locate the right form and securely store it online. airSlate SignNow offers all the tools you need to create, modify, and electronically sign your documents quickly and without complications. Handle FORM CF 2210 on any device using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

How to Alter and Electronically Sign FORM CF 2210 with Ease

- Locate FORM CF 2210 and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize key sections of your documents or obscure confidential information with tools specifically designed by airSlate SignNow for this purpose.

- Create your electronic signature using the Sign feature, which takes just seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your updates.

- Choose your preferred delivery method for your form, whether by email, SMS, or invitation link, or download it directly to your computer.

Eliminate concerns about lost or mislaid files, tedious form searches, or errors that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Modify and electronically sign FORM CF 2210 to ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form cf 2210

Create this form in 5 minutes!

How to create an eSignature for the form cf 2210

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form 2210 and why is it important for taxpayers?

What is form 2210? It is a tax form used by individuals to determine if they owe an underpayment penalty for not paying enough tax throughout the year. Understanding what is form 2210 helps in ensuring compliance with IRS requirements and avoiding unexpected penalties.

-

Who needs to file what is form 2210?

Taxpayers who did not pay enough taxes during the year may need to file what is form 2210. This includes those who underpaid their estimated taxes or did not meet the withholding requirements. Knowing if you need to file helps in managing potential penalties effectively.

-

How can airSlate SignNow help with filing what is form 2210?

AirSlate SignNow streamlines the document signing process, making it easy to prepare and file what is form 2210. With its user-friendly interface, you can eSign and send your forms securely and quickly, saving you time in the tax filing process. Our platform ensures you meet deadlines with ease.

-

What features make airSlate SignNow ideal for managing what is form 2210?

AirSlate SignNow offers features like electronic signatures, secure document storage, and tracking capabilities that facilitate the management of what is form 2210. These features ensure that your documents are handled efficiently and that you can easily access and audit them when needed.

-

What are the benefits of eSigning what is form 2210 through airSlate SignNow?

Using airSlate SignNow to eSign what is form 2210 provides signNow benefits, including reduced processing time and enhanced security. ESigning eliminates the need for printing and scanning, making it a more efficient way to handle important documents. This convenience helps in meeting tax deadlines promptly.

-

Does airSlate SignNow integrate with accounting software for what is form 2210?

Yes, airSlate SignNow integrates with various accounting software solutions, allowing smooth management of tax documents like what is form 2210. This integration helps streamline the financial processes and enhances accuracy by ensuring consistent data across platforms.

-

Is there a cost associated with using airSlate SignNow for what is form 2210?

AirSlate SignNow offers cost-effective pricing plans that cater to different business sizes when managing documents like what is form 2210. Its competitive pricing provides excellent value for the features offered, making it accessible for individuals and businesses alike.

Get more for FORM CF 2210

- Mahiti adhikar form

- Hiffa form

- Stormwater observation report form

- Canada ontario tenant rights form

- Avenant n au contrat de travail pajemploiurssaffr form

- Axial flow combine inspection form

- Adolescent ages 12 17 episode completion interview ncdhhs form

- Form or tm tri county metropolitan transportation district self employment tax 150 555 001 771963007

Find out other FORM CF 2210

- How Can I Electronic signature Alabama Legal PDF

- How To Electronic signature Alaska Legal Document

- Help Me With Electronic signature Arkansas Legal PDF

- How Can I Electronic signature Arkansas Legal Document

- How Can I Electronic signature California Legal PDF

- Can I Electronic signature Utah High Tech PDF

- How Do I Electronic signature Connecticut Legal Document

- How To Electronic signature Delaware Legal Document

- How Can I Electronic signature Georgia Legal Word

- How Do I Electronic signature Alaska Life Sciences Word

- How Can I Electronic signature Alabama Life Sciences Document

- How Do I Electronic signature Idaho Legal Form

- Help Me With Electronic signature Arizona Life Sciences PDF

- Can I Electronic signature Colorado Non-Profit Form

- How To Electronic signature Indiana Legal Form

- How To Electronic signature Illinois Non-Profit Document

- Can I Electronic signature Kentucky Legal Document

- Help Me With Electronic signature New Jersey Non-Profit PDF

- Can I Electronic signature New Jersey Non-Profit Document

- Help Me With Electronic signature Michigan Legal Presentation