Establishing secure connection…Loading editor…Preparing document…

We are not affiliated with any brand or entity on this form.

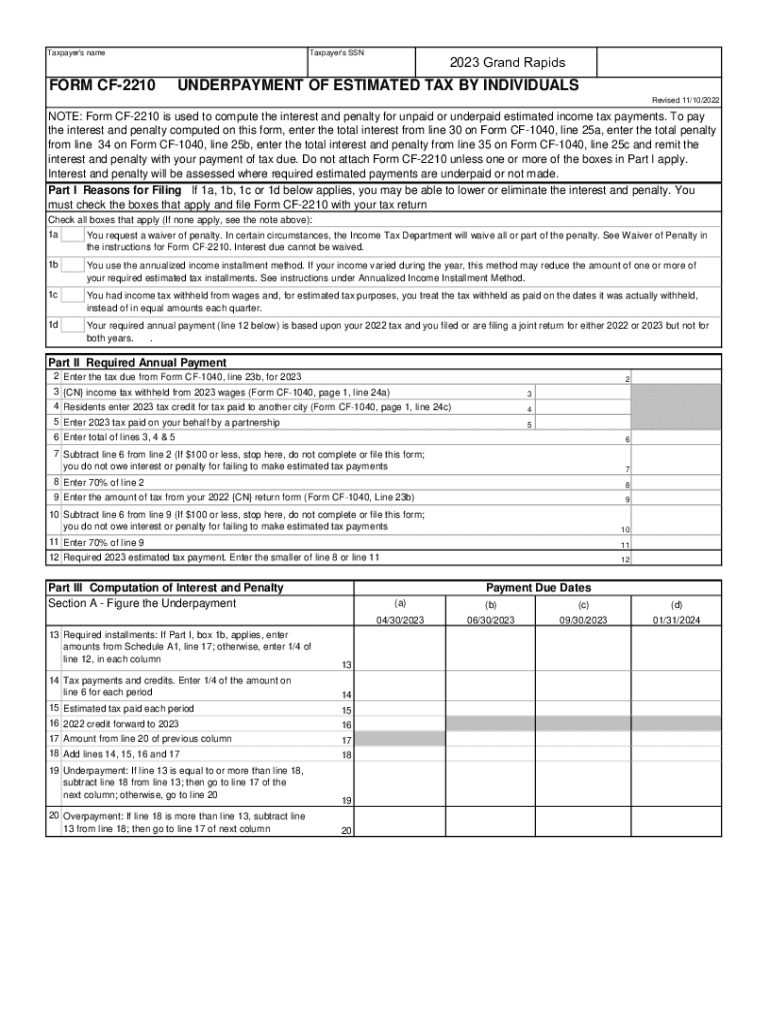

Taxpayer 's NameFORM CF2210Taxpayer 's SSN2023 Gra 2023-2026

be ready to get more

Create this form in 5 minutes or less

Find and fill out the correct taxpayers nameform cf2210taxpayers ssn2023 gra

Versions

Form popularity

Fillable & printable

4.7 Satisfied (33 Votes)

4.8 Satisfied (698 Votes)

4.7 Satisfied (161 Votes)

Create this form in 5 minutes!

How to create an eSignature for the taxpayers nameform cf2210taxpayers ssn2023 gra

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Taxpayer's NameFORM CF2210Taxpayer's SSN2023 Gra?

The Taxpayer's NameFORM CF2210Taxpayer's SSN2023 Gra is a crucial document for taxpayers who need to report their tax liabilities accurately. It helps in calculating any penalties for underpayment of taxes. Understanding this form is essential for compliance and avoiding unnecessary fines.

-

How can airSlate SignNow help with the Taxpayer's NameFORM CF2210Taxpayer's SSN2023 Gra?

airSlate SignNow simplifies the process of completing and eSigning the Taxpayer's NameFORM CF2210Taxpayer's SSN2023 Gra. Our platform allows users to fill out the form electronically, ensuring accuracy and saving time. Additionally, you can securely store and share the document with relevant parties.

-

What are the pricing options for using airSlate SignNow for the Taxpayer's NameFORM CF2210Taxpayer's SSN2023 Gra?

airSlate SignNow offers flexible pricing plans to accommodate various business needs. You can choose from monthly or annual subscriptions, with options that provide access to features specifically designed for managing documents like the Taxpayer's NameFORM CF2210Taxpayer's SSN2023 Gra. Check our website for detailed pricing information.

-

Is airSlate SignNow secure for handling the Taxpayer's NameFORM CF2210Taxpayer's SSN2023 Gra?

Yes, airSlate SignNow prioritizes security and compliance. We use advanced encryption methods to protect your documents, including the Taxpayer's NameFORM CF2210Taxpayer's SSN2023 Gra. Our platform is designed to ensure that your sensitive information remains confidential and secure.

-

Can I integrate airSlate SignNow with other software for the Taxpayer's NameFORM CF2210Taxpayer's SSN2023 Gra?

Absolutely! airSlate SignNow offers seamless integrations with various software applications, enhancing your workflow for the Taxpayer's NameFORM CF2210Taxpayer's SSN2023 Gra. Whether you use CRM systems, cloud storage, or accounting software, our platform can connect to streamline your document management process.

-

What features does airSlate SignNow offer for the Taxpayer's NameFORM CF2210Taxpayer's SSN2023 Gra?

airSlate SignNow provides a range of features tailored for the Taxpayer's NameFORM CF2210Taxpayer's SSN2023 Gra, including customizable templates, electronic signatures, and real-time tracking. These features help ensure that your documents are completed accurately and efficiently, reducing the risk of errors.

-

How does airSlate SignNow improve the efficiency of handling the Taxpayer's NameFORM CF2210Taxpayer's SSN2023 Gra?

By using airSlate SignNow, you can signNowly enhance the efficiency of managing the Taxpayer's NameFORM CF2210Taxpayer's SSN2023 Gra. Our platform allows for quick document preparation, easy sharing, and instant eSigning, which saves time and reduces the hassle of traditional paper-based processes.

Get more for Taxpayer 's NameFORM CF2210Taxpayer 's SSN2023 Gra

Find out other Taxpayer 's NameFORM CF2210Taxpayer 's SSN2023 Gra

- Sign Arkansas Doctors LLC Operating Agreement Free

- Sign California Doctors Lease Termination Letter Online

- Sign Iowa Doctors LLC Operating Agreement Online

- Sign Illinois Doctors Affidavit Of Heirship Secure

- Sign Maryland Doctors Quitclaim Deed Later

- How Can I Sign Maryland Doctors Quitclaim Deed

- Can I Sign Missouri Doctors Last Will And Testament

- Sign New Mexico Doctors Living Will Free

- Sign New York Doctors Executive Summary Template Mobile

- Sign New York Doctors Residential Lease Agreement Safe

- Sign New York Doctors Executive Summary Template Fast

- How Can I Sign New York Doctors Residential Lease Agreement

- Sign New York Doctors Purchase Order Template Online

- Can I Sign Oklahoma Doctors LLC Operating Agreement

- Sign South Dakota Doctors LLC Operating Agreement Safe

- Sign Texas Doctors Moving Checklist Now

- Sign Texas Doctors Residential Lease Agreement Fast

- Sign Texas Doctors Emergency Contact Form Free

- Sign Utah Doctors Lease Agreement Form Mobile

- Sign Virginia Doctors Contract Safe

be ready to get more

Get this form now!

If you believe that this page should be taken down, please follow our DMCA take down process here.