Filing RequirementsMinnesota Department of Revenue 2021-2026

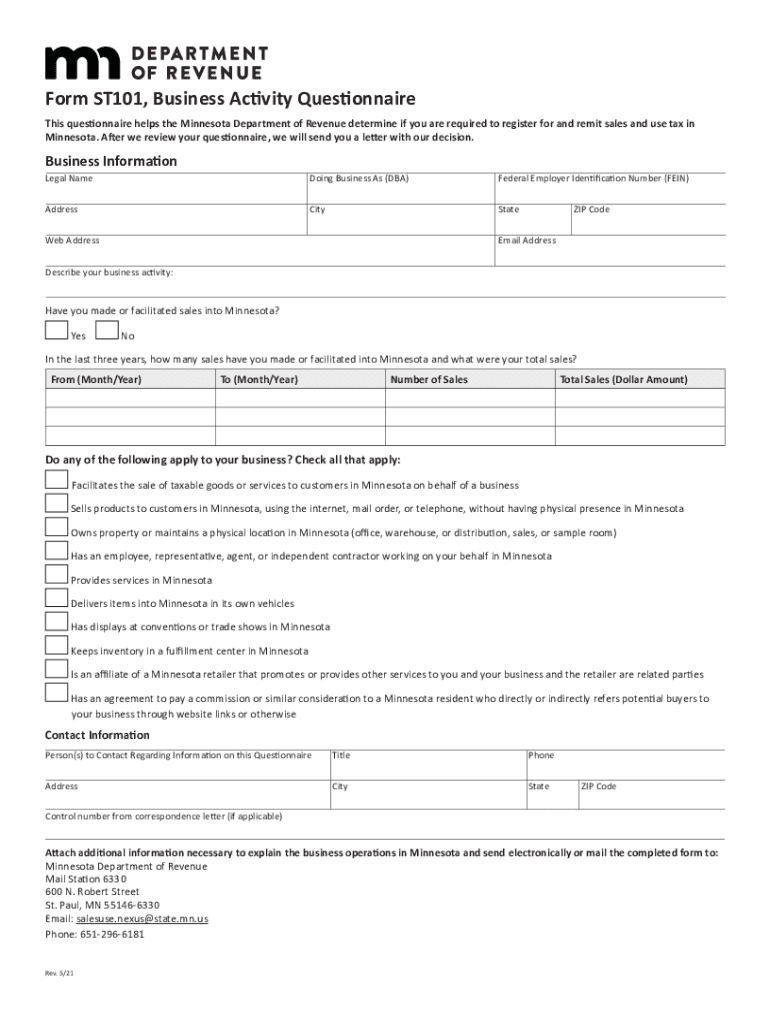

What is the ST-101 Form?

The ST-101 form is a crucial document used in the state of Minnesota for sales tax exemption purposes. This form allows eligible purchasers to claim exemption from sales tax on certain purchases. It is typically utilized by organizations such as non-profits, government entities, and other qualifying entities that meet specific criteria set forth by the Minnesota Department of Revenue. Understanding the purpose and requirements of the ST-101 form is essential for ensuring compliance and maximizing tax benefits.

Steps to Complete the ST-101 Form

Filling out the ST-101 form accurately is vital for obtaining sales tax exemptions. Here are the key steps to ensure proper completion:

- Gather necessary information about the purchasing entity, including legal name, address, and tax identification number.

- Identify the specific items or services for which the exemption is being claimed.

- Complete all required sections of the form, ensuring clarity and accuracy in each entry.

- Sign and date the form to validate the exemption claim.

Once completed, the form should be provided to the seller at the time of purchase, ensuring that all parties have a copy for their records.

Legal Use of the ST-101 Form

The ST-101 form serves as a legal instrument for claiming sales tax exemptions in Minnesota. It is essential to understand that misuse of this form can lead to penalties and fines. The form must be used only for eligible purchases, and the purchaser must maintain proper documentation to support their claims. Compliance with Minnesota tax laws is critical to avoid any legal repercussions.

Required Documents for ST-101 Submission

When submitting the ST-101 form, certain supporting documents may be required to validate the exemption claim. These may include:

- Proof of the entity's tax-exempt status, such as a letter from the IRS or state tax authority.

- Invoices or receipts for the purchases being claimed for exemption.

- Any additional documentation requested by the seller or required by the Minnesota Department of Revenue.

Ensuring that all required documents are submitted alongside the ST-101 form can facilitate a smoother exemption process.

Filing Deadlines for the ST-101 Form

While the ST-101 form itself does not have a specific filing deadline, it is important to present it at the time of purchase to ensure sales tax exemption. If the form is not provided when required, the purchaser may be liable for the sales tax. Additionally, it is advisable to keep track of any changes in tax laws or regulations that may affect the use of the ST-101 form in the future.

Examples of Using the ST-101 Form

The ST-101 form can be applied in various scenarios. For instance:

- A non-profit organization purchasing office supplies for its operations can use the ST-101 form to exempt these purchases from sales tax.

- A government agency acquiring equipment for public use may also utilize the ST-101 form to avoid sales tax on those purchases.

These examples illustrate the practical applications of the ST-101 form in real-world situations, emphasizing its importance for eligible entities.

Quick guide on how to complete filing requirementsminnesota department of revenue

Effortlessly Prepare Filing RequirementsMinnesota Department Of Revenue on Any Device

Digital document management has gained traction among companies and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to locate the appropriate form and securely keep it online. airSlate SignNow provides you with all the tools necessary to generate, modify, and eSign your documents swiftly without any holdups. Manage Filing RequirementsMinnesota Department Of Revenue on any device through the airSlate SignNow Android or iOS applications and enhance your document-based processes today.

How to Edit and eSign Filing RequirementsMinnesota Department Of Revenue with Ease

- Find Filing RequirementsMinnesota Department Of Revenue and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your eSignature using the Sign tool, which takes moments and carries the same legal validity as a conventional handwritten signature.

- Review the details and click on the Done button to save your changes.

- Choose how you would like to send your form—via email, text message (SMS), invitation link, or download it to your computer.

Forget about lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow caters to all your document management needs in just a few clicks from any preferred device. Edit and eSign Filing RequirementsMinnesota Department Of Revenue while ensuring effective communication at any stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct filing requirementsminnesota department of revenue

Create this form in 5 minutes!

How to create an eSignature for the filing requirementsminnesota department of revenue

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the st 101 form 2024?

The st 101 form 2024 is a tax exemption form used in various jurisdictions to signNow an entity's eligibility for tax-exempt status. Businesses need this form to receive certain tax benefits, making it essential for financial planning and compliance. Understanding the requirements for the st 101 form 2024 can help ensure that your business takes advantage of available tax exemptions.

-

How can airSlate SignNow help with the st 101 form 2024?

airSlate SignNow provides an efficient way to electronically sign and send the st 101 form 2024, ensuring that your documents are processed quickly and securely. Our platform simplifies the signing process, making it easy for users to complete necessary forms remotely. With airSlate SignNow, you can streamline your tax exemption paperwork and focus more on your business.

-

Is airSlate SignNow cost-effective for handling the st 101 form 2024?

Yes, airSlate SignNow offers competitive pricing plans that cater to businesses of all sizes, making it a cost-effective solution for handling the st 101 form 2024. Our platform reduces the need for physical paperwork and postage, which can lead to signNow savings over time. By choosing airSlate SignNow, you're investing in a solution that enhances your workflow while keeping costs down.

-

What features does airSlate SignNow offer for managing the st 101 form 2024?

airSlate SignNow includes a variety of features tailored for the st 101 form 2024, such as customizable templates, automatic reminders, and detailed tracking of document status. Our user-friendly interface allows you to easily fill out, sign, and send forms. Additionally, the platform ensures compliance with legal standards for electronic signatures, providing peace of mind when managing sensitive documents.

-

Can I integrate airSlate SignNow with other software for the st 101 form 2024?

Absolutely! airSlate SignNow offers seamless integrations with popular business applications, allowing you to manage the st 101 form 2024 within your existing workflows. Integrating our platform with tools like CRM systems and project management software streamlines your operations and keeps all your documents organized. This connectivity enhances your overall productivity and efficiency.

-

What are the benefits of using airSlate SignNow for the st 101 form 2024?

Using airSlate SignNow for the st 101 form 2024 brings numerous benefits, including increased efficiency, enhanced security, and reduced turnaround times. Our solution enables businesses to quickly complete and file important tax documents while ensuring that sensitive information is protected. By adopting airSlate SignNow, you can simplify your documentation process and focus on your core business activities.

-

Is there customer support available for questions about the st 101 form 2024?

Yes, airSlate SignNow provides dedicated customer support for users needing assistance with the st 101 form 2024. Our support team is available to help you navigate any challenges you may encounter while using the platform. Whether you have questions about document signing or need help with features, we are here to ensure your experience is smooth and successful.

Get more for Filing RequirementsMinnesota Department Of Revenue

- Hospital check in form

- Ris 50 texas form

- Mecosta county community corrections community service time sheet form

- Weekly payroll records report statement of compliance form

- Isda agreement template form

- Isda master agreement template form

- Isda novation agreement template form

- Nurse practitioner contract template form

Find out other Filing RequirementsMinnesota Department Of Revenue

- Electronic signature California Medical Services Proposal Mobile

- How To Electronic signature West Virginia Pharmacy Services Agreement

- How Can I eSignature Kentucky Co-Branding Agreement

- How Can I Electronic signature Alabama Declaration of Trust Template

- How Do I Electronic signature Illinois Declaration of Trust Template

- Electronic signature Maryland Declaration of Trust Template Later

- How Can I Electronic signature Oklahoma Declaration of Trust Template

- Electronic signature Nevada Shareholder Agreement Template Easy

- Electronic signature Texas Shareholder Agreement Template Free

- Electronic signature Mississippi Redemption Agreement Online

- eSignature West Virginia Distribution Agreement Safe

- Electronic signature Nevada Equipment Rental Agreement Template Myself

- Can I Electronic signature Louisiana Construction Contract Template

- Can I eSignature Washington Engineering Proposal Template

- eSignature California Proforma Invoice Template Simple

- eSignature Georgia Proforma Invoice Template Myself

- eSignature Mississippi Proforma Invoice Template Safe

- eSignature Missouri Proforma Invoice Template Free

- Can I eSignature Mississippi Proforma Invoice Template

- eSignature Missouri Proforma Invoice Template Simple