Rev 419 2020-2026

What is the Rev 419

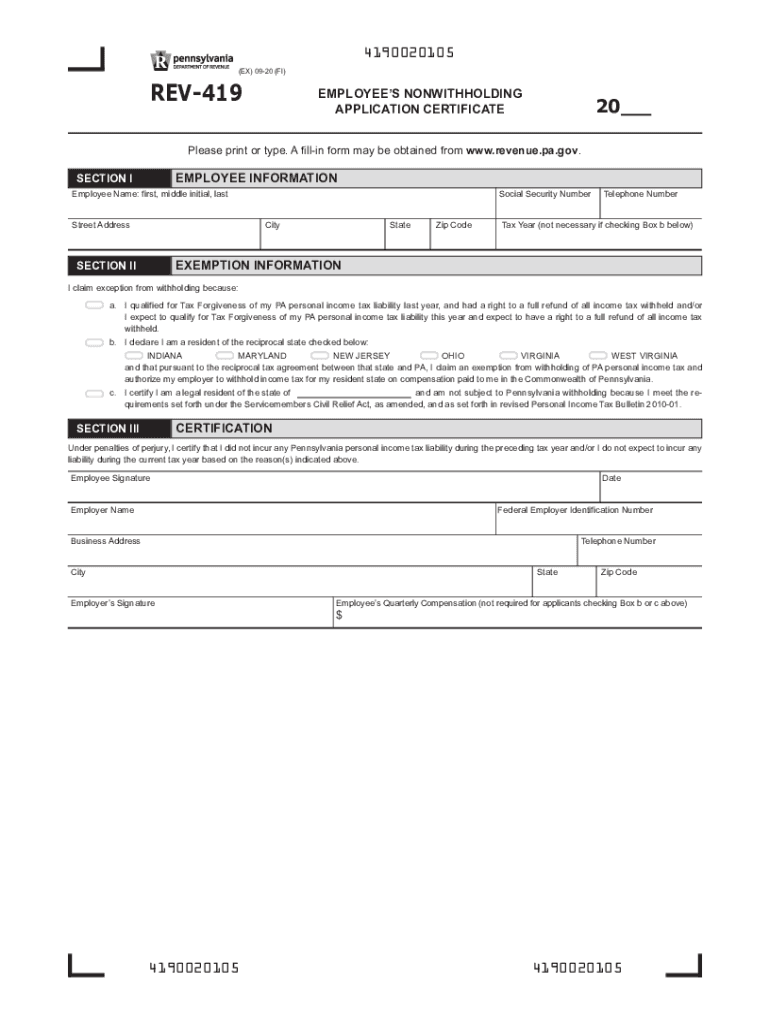

The Pennsylvania Rev 419 form, also known as the PA Rev 419, is a crucial document used primarily for tax purposes within the state of Pennsylvania. This form is utilized by individuals and businesses to report specific financial information to the Pennsylvania Department of Revenue. Understanding its purpose is essential for compliance with state tax regulations.

How to use the Rev 419

Using the Rev 419 form involves several steps to ensure accurate reporting of financial details. First, gather all necessary financial documents, such as income statements and previous tax returns. Next, complete the form by entering the required information in the designated fields. It is important to review the completed form for accuracy before submission. Finally, submit the form through the appropriate channels, whether online or via mail.

Steps to complete the Rev 419

Completing the Rev 419 form requires careful attention to detail. Follow these steps:

- Gather all relevant financial documents.

- Fill out personal identification information at the top of the form.

- Provide accurate financial data as requested in each section.

- Double-check all entries for accuracy and completeness.

- Sign and date the form where indicated.

- Submit the completed form to the Pennsylvania Department of Revenue.

Legal use of the Rev 419

The Rev 419 form holds legal significance as it is a formal declaration of financial information to the state. When filled out correctly and submitted on time, it can protect taxpayers from penalties and ensure compliance with Pennsylvania tax laws. It is important to understand the legal implications of the information provided, as inaccuracies can lead to audits or legal consequences.

Filing Deadlines / Important Dates

Filing deadlines for the Rev 419 form are critical to avoid penalties. Typically, the form must be submitted by the due date of your tax return. For most individuals, this is April 15 of each year. Businesses may have different deadlines based on their fiscal year. It is advisable to check the Pennsylvania Department of Revenue website for any updates or changes to these dates.

Who Issues the Form

The Rev 419 form is issued by the Pennsylvania Department of Revenue. This state agency is responsible for collecting taxes and ensuring compliance with tax laws. The department provides resources and guidance on how to properly complete and submit the form, as well as information on any changes to tax regulations that may affect its use.

Quick guide on how to complete rev 419

Get Rev 419 effortlessly on any gadget

Managing documents online has become increasingly favored among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, as one can acquire the necessary form and safely save it online. airSlate SignNow offers you all the tools required to create, modify, and electronically sign your documents rapidly without delays. Handle Rev 419 on any gadget with the airSlate SignNow Android or iOS applications and enhance any document-related procedure today.

The simplest way to modify and electronically sign Rev 419 seamlessly

- Obtain Rev 419 and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize signNow sections of your documents or conceal sensitive information with tools that airSlate SignNow provides specifically for that task.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal integrity as a conventional wet ink signature.

- Review all the information and then click the Done button to save your modifications.

- Select how you would like to share your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns over lost or disorganized files, tedious form searches, or mistakes that require reprinting documents. airSlate SignNow fulfills your needs in document management in just a few clicks from any device you prefer. Modify and electronically sign Rev 419 and ensure outstanding communication at every stage of the form preparation workflow with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct rev 419

Create this form in 5 minutes!

How to create an eSignature for the rev 419

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is rev 419 and how does it relate to airSlate SignNow?

Rev 419 is a crucial feature within airSlate SignNow that enables users to enhance their document signing process. By utilizing rev 419, businesses can ensure secure and efficient eSigning, streamlining their workflows and improving overall productivity.

-

What pricing plans does airSlate SignNow offer for rev 419?

airSlate SignNow offers various pricing tiers for its services, including access to rev 419. These plans are designed to accommodate businesses of all sizes, providing scalable solutions that fit budget constraints while maximizing value for document signing needs.

-

What features does rev 419 offer?

Rev 419 includes features such as customizable templates, audit trails, and user-friendly eSigning capabilities. These features work together to simplify the signing process and provide users with a seamless experience when managing their documents electronically.

-

How can rev 419 benefit my business?

Utilizing rev 419 can signNowly benefit your business by enhancing efficiency and reducing turnaround times for document signing. With its intuitive interface, your team can easily send, track, and sign documents, leading to faster decision-making and improved collaboration.

-

Is rev 419 secure for handling sensitive documents?

Yes, rev 419 is designed with security in mind, incorporating advanced encryption and compliance features to protect sensitive information. airSlate SignNow adheres to industry standards, ensuring that your documents remain secure throughout the signing process.

-

Can rev 419 integrate with other software applications?

Absolutely, rev 419 supports integration with various software applications, allowing businesses to embed eSigning capabilities seamlessly into their existing workflows. This flexibility helps enhance productivity and ensures that you can leverage your current tools effectively.

-

What types of documents can I sign using rev 419?

With rev 419, you can sign a wide range of document types, including contracts, agreements, and forms. This versatility ensures that no matter the nature of your document, airSlate SignNow provides a reliable and efficient solution for all your signing needs.

Get more for Rev 419

Find out other Rev 419

- Help Me With eSignature South Dakota Education Form

- How Can I eSignature Virginia Education PDF

- How To eSignature Massachusetts Government Form

- How Can I eSignature Oregon Government PDF

- How Can I eSignature Oklahoma Government Document

- How To eSignature Texas Government Document

- Can I eSignature Vermont Government Form

- How Do I eSignature West Virginia Government PPT

- How Do I eSignature Maryland Healthcare / Medical PDF

- Help Me With eSignature New Mexico Healthcare / Medical Form

- How Do I eSignature New York Healthcare / Medical Presentation

- How To eSignature Oklahoma Finance & Tax Accounting PPT

- Help Me With eSignature Connecticut High Tech Presentation

- How To eSignature Georgia High Tech Document

- How Can I eSignature Rhode Island Finance & Tax Accounting Word

- How Can I eSignature Colorado Insurance Presentation

- Help Me With eSignature Georgia Insurance Form

- How Do I eSignature Kansas Insurance Word

- How Do I eSignature Washington Insurance Form

- How Do I eSignature Alaska Life Sciences Presentation