Dex 41 2022-2026

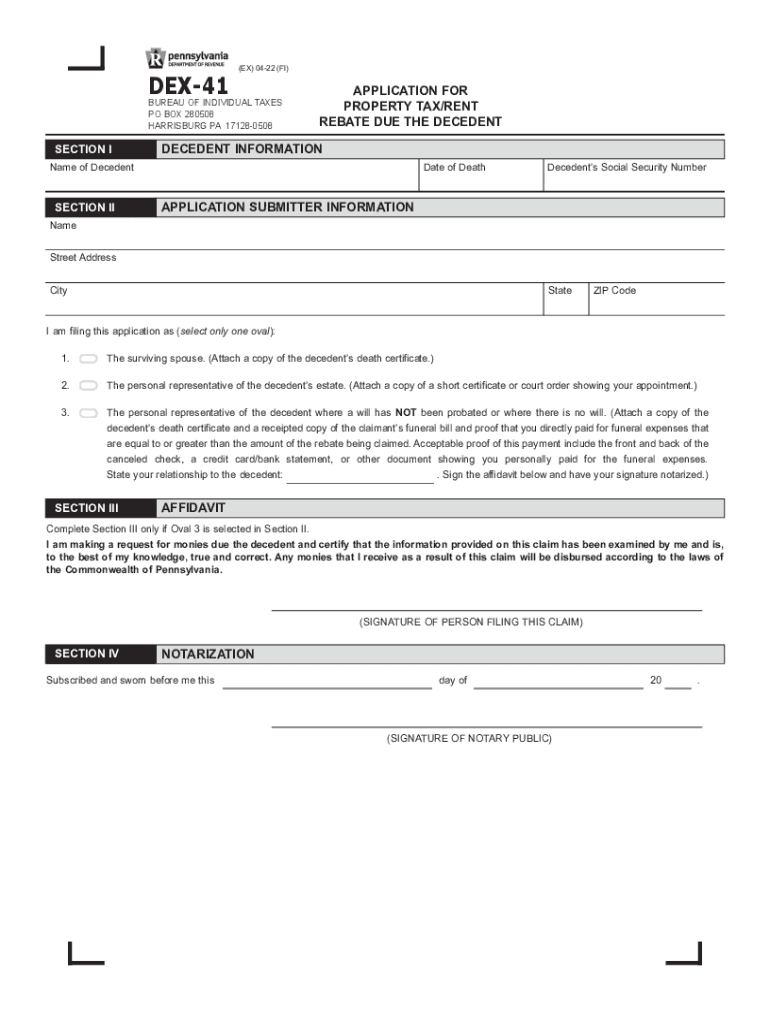

What is the Dex 41?

The Dex 41, also known as the PTRR Dex 41, is a form used primarily in the United States for property tax rent rebate applications. This form allows eligible individuals, such as senior citizens and disabled persons, to claim rebates on property taxes paid on their residence. The Dex 41 is essential for those seeking financial relief from property tax burdens, ensuring that qualifying applicants receive the benefits they are entitled to under state law.

How to use the Dex 41

Using the Dex 41 involves several straightforward steps. First, gather all necessary documentation, including proof of income and property tax payments. Next, accurately fill out the form, ensuring all information is complete and correct. After completing the form, submit it according to your state’s guidelines, either online, by mail, or in person. It is crucial to review the form for accuracy before submission to avoid delays in processing your application.

Steps to complete the Dex 41

Completing the Dex 41 requires careful attention to detail. Follow these steps:

- Obtain the Dex 41 form from your state’s revenue department website.

- Fill in your personal information, including name, address, and Social Security number.

- Provide details about your property, including the address and tax information.

- Document your income and any other required financial information.

- Sign and date the form to certify that the information provided is accurate.

Legal use of the Dex 41

The Dex 41 is legally binding when completed correctly and submitted according to state regulations. To ensure its legality, users must adhere to the guidelines set forth by the state’s tax authority. This includes providing accurate information and meeting any deadlines for submission. The form is recognized by state agencies and can be used to claim rebates, making it an important document for eligible individuals.

Eligibility Criteria

To qualify for the Dex 41, applicants must meet specific eligibility criteria. Generally, this includes being a resident of the state, being of a certain age (often sixty-five or older), or having a disability. Additionally, applicants must demonstrate financial need by providing income documentation. Each state may have unique requirements, so it is essential to review the criteria specific to your location to ensure compliance.

Filing Deadlines / Important Dates

Filing deadlines for the Dex 41 vary by state and can significantly impact eligibility for rebates. Most states have specific dates by which the form must be submitted to qualify for the current tax year. It is advisable to check with your state’s revenue department for the exact deadlines to ensure timely submission and avoid missing out on potential benefits.

Quick guide on how to complete dex 41 613534993

Prepare Dex 41 effortlessly on any device

Digital document management has gained traction among businesses and individuals. It serves as an ideal environmentally-friendly alternative to traditional printed and signed documents, allowing you to locate the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage Dex 41 on any device using airSlate SignNow's Android or iOS applications and enhance any document-focused process today.

How to modify and eSign Dex 41 with ease

- Locate Dex 41 and click Get Form to begin.

- Use the tools we provide to complete your form.

- Emphasize pertinent sections of the documents or obscure sensitive details with tools that airSlate SignNow specifically offers for that purpose.

- Create your signature with the Sign tool, which takes only seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searches, or errors necessitating the printing of new document copies. airSlate SignNow meets all your requirements in document management in just a few clicks from a device of your choice. Modify and eSign Dex 41 and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct dex 41 613534993

Create this form in 5 minutes!

How to create an eSignature for the dex 41 613534993

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is dex 41 and how does it relate to airSlate SignNow?

Dex 41 refers to a specific feature set within airSlate SignNow that enhances document management and eSignature capabilities. This feature allows businesses to streamline their workflows and improve efficiency by utilizing advanced options tailored to their needs.

-

How much does airSlate SignNow with dex 41 cost?

The pricing for airSlate SignNow featuring dex 41 varies based on the subscription plan you choose. Our affordable pricing models ensure that businesses of all sizes can leverage efficiency without breaking the bank.

-

What key features does dex 41 offer?

Dex 41 offers a range of features including customizable workflows, secure eSigning, and automated document tracking. These features are designed to help businesses manage their documents with ease and reliability.

-

What are the benefits of using airSlate SignNow with dex 41?

Using airSlate SignNow with dex 41 allows companies to enhance productivity through reduced turnaround times and minimized paperwork. It also provides a secure platform for document signing, ensuring peace of mind for users.

-

Can dex 41 be integrated with other tools?

Yes, dex 41 integrates seamlessly with various business applications such as CRM systems, project management tools, and cloud storage services. This allows businesses to create a cohesive workflow that incorporates their existing tools.

-

Is dex 41 suitable for all business sizes?

Absolutely! Dex 41 is specifically designed to cater to businesses of all sizes, from small startups to large enterprises. Its scalability ensures that all users can benefit from its features regardless of their organizational structure.

-

How secure is airSlate SignNow with dex 41?

Security is a top priority for airSlate SignNow, especially with dex 41. The platform utilizes encryption and secure data protocols to protect all documents and user information, offering users confidence in the integrity of their transactions.

Get more for Dex 41

- Drift management plan form

- San luis obispo county health permit department form

- Please print using dark ink cancer application ampamp form

- Off market sale consideration payment details form

- Edmonton gazebo permit form

- Sworn statement and proof of loss pdf city of lorain form

- Intercompany shared service agreement template form

- Option contract template form

Find out other Dex 41

- eSign North Dakota Doctors Affidavit Of Heirship Now

- eSign Oklahoma Doctors Arbitration Agreement Online

- eSign Oklahoma Doctors Forbearance Agreement Online

- eSign Oregon Doctors LLC Operating Agreement Mobile

- eSign Hawaii Education Claim Myself

- eSign Hawaii Education Claim Simple

- eSign Hawaii Education Contract Simple

- eSign Hawaii Education NDA Later

- How To eSign Hawaii Education NDA

- How Do I eSign Hawaii Education NDA

- eSign Hawaii Education Arbitration Agreement Fast

- eSign Minnesota Construction Purchase Order Template Safe

- Can I eSign South Dakota Doctors Contract

- eSign Mississippi Construction Rental Application Mobile

- How To eSign Missouri Construction Contract

- eSign Missouri Construction Rental Lease Agreement Easy

- How To eSign Washington Doctors Confidentiality Agreement

- Help Me With eSign Kansas Education LLC Operating Agreement

- Help Me With eSign West Virginia Doctors Lease Agreement Template

- eSign Wyoming Doctors Living Will Mobile