to File Electronically 2013-2026

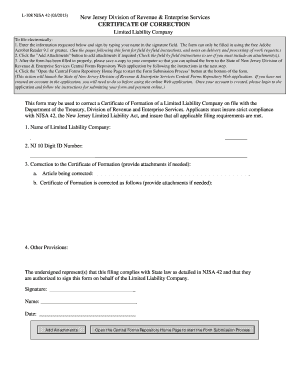

What is the l 108 Form?

The l 108 form is a crucial document used for business registration in New Jersey. This form is specifically designed for entities looking to establish their presence in the state. By completing the l 108, businesses can ensure they comply with state regulations and secure the necessary permissions to operate legally.

Steps to Complete the l 108 Form

Completing the l 108 form involves several key steps to ensure accuracy and compliance. Begin by gathering all required information, including business name, address, and type of entity. Next, fill out the form carefully, ensuring all sections are completed. Once filled, review the document for any errors or omissions. Finally, submit the form electronically or via mail, depending on your preference.

Legal Use of the l 108 Form

The l 108 form serves as a legal document that must be completed accurately to meet New Jersey's business registration requirements. When filed correctly, it provides legal recognition of your business entity, allowing you to operate within the state. It is essential to adhere to the guidelines set forth by the state to avoid potential legal issues.

Required Documents for the l 108 Form

To successfully complete the l 108 form, certain documents are required. These typically include identification for the business owners, proof of address, and any relevant business licenses or permits. Having these documents ready will streamline the process and help ensure that the form is accepted without delays.

Filing Deadlines / Important Dates

Filing deadlines for the l 108 form are critical to ensure compliance with state regulations. It is important to be aware of any specific dates related to business registration in New Jersey. Missing a deadline can result in penalties or delays in the approval process, so keeping track of these dates is essential for new businesses.

Form Submission Methods

The l 108 form can be submitted through various methods, including online submission, mail, or in-person delivery. Each method has its own advantages, such as speed and convenience for online submissions, while mail may be preferred for those who wish to retain a physical copy. Understanding these options can help businesses choose the best method for their needs.

Penalties for Non-Compliance

Failure to file the l 108 form on time or inaccuracies in the submission can lead to significant penalties. These may include fines, delays in business registration, or even legal action. It is crucial for businesses to understand the importance of compliance and to ensure that their submissions are accurate and timely to avoid these potential consequences.

Quick guide on how to complete to file electronically

Complete To File Electronically effortlessly on any device

Online document management has gained traction among organizations and individuals. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents rapidly without delays. Manage To File Electronically on any device using the airSlate SignNow apps for Android or iOS and streamline any document-related task today.

How to modify and eSign To File Electronically effortlessly

- Locate To File Electronically and click Get Form to initiate the process.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of the documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Verify the information and click on the Done button to preserve your changes.

- Select your preferred method for sending your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Modify and eSign To File Electronically and guarantee excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct to file electronically

Create this form in 5 minutes!

How to create an eSignature for the to file electronically

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is l 108 in relation to airSlate SignNow?

l 108 refers to a document management solution provided by airSlate SignNow that emphasizes efficiency in e-signing agreements. It allows users to streamline their document workflows, ensuring a seamless signing experience for both senders and recipients.

-

How much does airSlate SignNow cost for using l 108 features?

The pricing for airSlate SignNow's l 108 features is designed to be affordable and scalable. Typically, plans start at a competitive rate, which varies based on the number of users and additional functionalities you may require.

-

What are the key features of l 108 in airSlate SignNow?

The l 108 features within airSlate SignNow include eSignature capabilities, document templates, and real-time tracking. It also offers enhanced integrations with various CRM tools, making it a versatile option for businesses of all sizes.

-

What benefits can I expect from using l 108 with airSlate SignNow?

Using l 108 with airSlate SignNow provides signNow benefits such as reduced turnaround time for agreements, improved collaboration among teams, and greater accuracy in document handling. This solution empowers businesses to enhance productivity and maintain compliance in their operations.

-

Can l 108 integrate with other applications?

Yes, l 108 is equipped to integrate seamlessly with numerous applications, including popular CRMs and project management tools. This interoperability ensures that businesses can incorporate airSlate SignNow into their existing systems without disruption.

-

Is it easy to use l 108 on airSlate SignNow?

Absolutely! l 108 in airSlate SignNow is designed with user-friendliness in mind. The intuitive interface allows users to send and sign documents quickly, reducing the learning curve and enhancing user adoption.

-

How secure is using l 108 for my documents?

When utilizing l 108 through airSlate SignNow, your documents are protected by advanced security protocols. This includes encryption, secure cloud storage, and compliance with relevant regulations to ensure the integrity and privacy of your data.

Get more for To File Electronically

- Msha printable card form

- Direct behavior rating forms

- Emergency contact form save the children savethechildren

- Lefs follow up and discharge visit body mechanix physical therapy form

- Hamipatra in marathi format pdf

- Warning any misrepresentation made in the personal data sheet and the work experience sheet shall cause the filing of form

- International data transfer agreement template form

- Offer and acceptance contract template form

Find out other To File Electronically

- Sign Connecticut Real Estate Business Plan Template Simple

- How To Sign Wisconsin Plumbing Cease And Desist Letter

- Sign Colorado Real Estate LLC Operating Agreement Simple

- How Do I Sign Connecticut Real Estate Operating Agreement

- Sign Delaware Real Estate Quitclaim Deed Secure

- Sign Georgia Real Estate Business Plan Template Computer

- Sign Georgia Real Estate Last Will And Testament Computer

- How To Sign Georgia Real Estate LLC Operating Agreement

- Sign Georgia Real Estate Residential Lease Agreement Simple

- Sign Colorado Sports Lease Agreement Form Simple

- How To Sign Iowa Real Estate LLC Operating Agreement

- Sign Iowa Real Estate Quitclaim Deed Free

- How To Sign Iowa Real Estate Quitclaim Deed

- Sign Mississippi Orthodontists LLC Operating Agreement Safe

- Sign Delaware Sports Letter Of Intent Online

- How Can I Sign Kansas Real Estate Job Offer

- Sign Florida Sports Arbitration Agreement Secure

- How Can I Sign Kansas Real Estate Residential Lease Agreement

- Sign Hawaii Sports LLC Operating Agreement Free

- Sign Georgia Sports Lease Termination Letter Safe