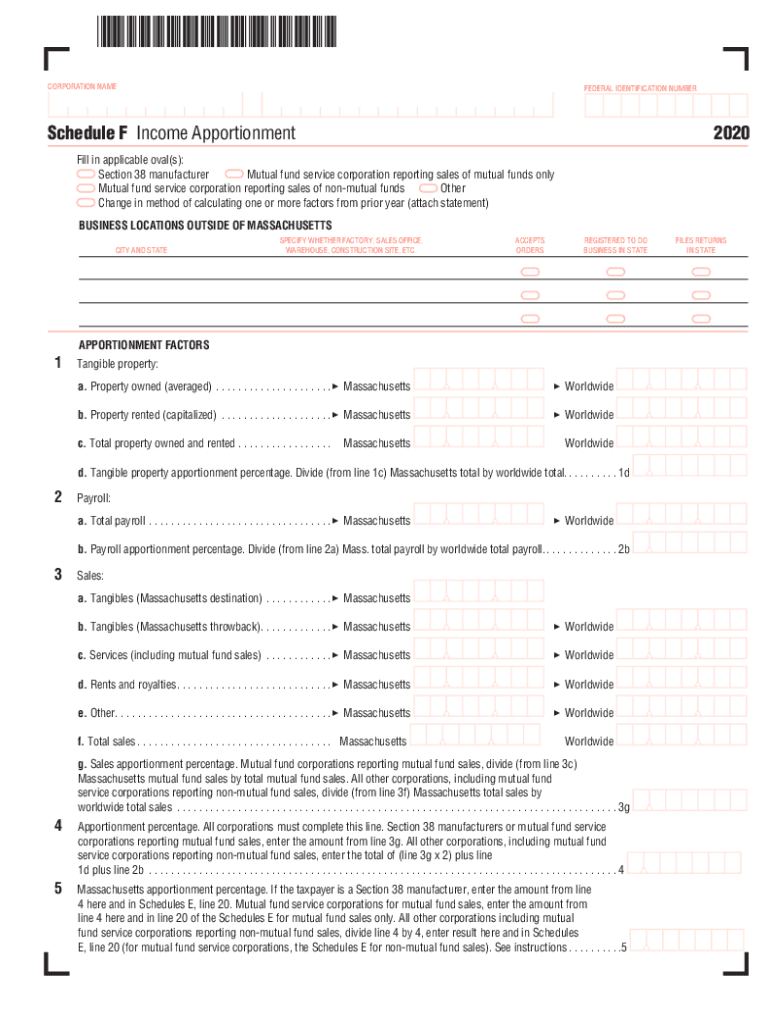

Schedule F Income Apportionment Form

Understanding the Schedule F Income Apportionment

The Schedule F Income Apportionment is a crucial form for farmers and ranchers who need to report income and expenses related to farming activities. This form allows taxpayers to allocate income and expenses from farming operations across different states, which can impact their overall tax liability. Understanding how to properly utilize this form is essential for accurate tax reporting and compliance with IRS regulations.

Steps to Complete the Schedule F Income Apportionment

Completing the Schedule F Income Apportionment involves several key steps:

- Gather all necessary financial documents, including records of income and expenses related to farming.

- Determine the total income generated from farming activities and categorize it appropriately.

- Identify expenses that can be deducted, such as operating costs, equipment purchases, and labor expenses.

- Allocate income and expenses to the appropriate states based on where the farming activities took place.

- Fill out the form accurately, ensuring all calculations are correct to avoid penalties.

Legal Use of the Schedule F Income Apportionment

The legal use of the Schedule F Income Apportionment is governed by IRS guidelines. It is essential for taxpayers to ensure that they are compliant with these regulations to avoid potential audits or penalties. The form must be completed accurately and submitted within the designated filing period. Additionally, taxpayers should retain copies of all documentation related to their farming income and expenses for future reference.

Required Documents for the Schedule F Income Apportionment

To successfully complete the Schedule F Income Apportionment, taxpayers need to gather several key documents:

- Income statements from farming operations, including sales records and receipts.

- Expense records, such as invoices for supplies, equipment, and labor costs.

- Any relevant state tax documents that may affect income apportionment.

- Previous year’s tax returns for reference and consistency in reporting.

Filing Deadlines for the Schedule F Income Apportionment

Filing deadlines for the Schedule F Income Apportionment align with the general tax filing deadlines set by the IRS. Typically, individual taxpayers must file their returns by April 15 of each year. However, if additional time is needed, taxpayers may file for an extension, which usually grants an additional six months. It is important to be aware of these deadlines to avoid late fees or penalties.

IRS Guidelines for the Schedule F Income Apportionment

The IRS provides specific guidelines for completing the Schedule F Income Apportionment. These guidelines include instructions on how to report income, deduct expenses, and allocate figures to different states. Taxpayers should refer to the IRS instructions for Schedule F to ensure compliance with all requirements. Adhering to these guidelines helps prevent errors and ensures that the form is processed smoothly.

Quick guide on how to complete schedule f income apportionment

Effortlessly Prepare Schedule F Income Apportionment on Any Device

Managing documents online has gained signNow traction among businesses and individuals. It offers an ideal environmentally friendly substitute for traditional printed and signed documentation, allowing you to locate the necessary form and securely keep it online. airSlate SignNow equips you with all the tools required to create, edit, and electronically sign your documents swiftly and without hold-ups. Handle Schedule F Income Apportionment on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to Edit and Electronically Sign Schedule F Income Apportionment with Ease

- Locate Schedule F Income Apportionment and click on Get Form to begin.

- Utilize the tools we supply to fill in your form.

- Mark important sections of the documents or obscure sensitive information with tools specifically provided by airSlate SignNow for this purpose.

- Generate your electronic signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Verify the details and hit the Done button to save your updates.

- Select your preferred method of sending your form, whether via email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors necessitating the printing of new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Revise and electronically sign Schedule F Income Apportionment to ensure exceptional communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the schedule f income apportionment

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

How can airSlate SignNow help me form tax money?

With airSlate SignNow, you can easily form tax money documents by sending and eSigning necessary forms electronically. Our platform streamlines the document management process, ensuring accuracy and efficiency while handling tax-related paperwork. This not only saves time but also helps in organizing your tax documents effectively.

-

What features does airSlate SignNow offer for managing tax documents?

airSlate SignNow provides various features that enhance the management of tax documents, including customizable templates, secure cloud storage, and automated workflows. You can create and manage forms to specifically cater to your tax needs, making the process of forming tax money less burdensome and more efficient.

-

Is airSlate SignNow cost-effective for businesses looking to form tax money?

Yes, airSlate SignNow offers competitive pricing plans that cater to businesses of all sizes, making it a cost-effective solution for forming tax money documents. With the potential to reduce printing and mailing costs, you'll find that our service pays for itself by streamlining the paperwork involved in tax preparation.

-

Can I integrate airSlate SignNow with other accounting software to manage tax money?

Absolutely! airSlate SignNow easily integrates with popular accounting and tax software, enabling seamless management of your tax documents and related processes. This integration allows you to efficiently track and form tax money, ensuring that your financial data is always aligned and up to date.

-

How secure is airSlate SignNow when handling documents related to forming tax money?

Security is a top priority at airSlate SignNow. We employ industry-leading encryption protocols and comply with data protection regulations to ensure that your documents related to forming tax money are safe and confidential. This gives you peace of mind when sending sensitive information online.

-

Can I access airSlate SignNow on mobile devices for forming tax money?

Yes, airSlate SignNow is fully optimized for mobile devices, allowing you to form tax money documents on the go. Whether you’re using a smartphone or tablet, our app provides all the functionalities needed for eSigning and managing tax-related paperwork, making it convenient and accessible.

-

What benefits does airSlate SignNow provide for small businesses needing to form tax money?

For small businesses, airSlate SignNow offers numerous benefits such as cost savings, improved efficiency, and reduced paperwork. By streamlining the process to form tax money, you can focus more on your business operations rather than getting bogged down by administrative tasks.

Get more for Schedule F Income Apportionment

- Cc11a michigan courts state of michigan courts mi form

- Personal information change bformb dekalb county schools dekalb k12 ga

- Resignation letter sample letters and templates form

- Banner referral form

- Www formsworkflow comformdetailsamended annual registration for limited liability company cd

- Pay discrepancy form

- Equine lease agreement doc form

- Gwinnett county public schoolselementary withdraw form

Find out other Schedule F Income Apportionment

- Can I eSignature Louisiana Courts Document

- How To Electronic signature Arkansas Banking Document

- How Do I Electronic signature California Banking Form

- How Do I eSignature Michigan Courts Document

- Can I eSignature Missouri Courts Document

- How Can I Electronic signature Delaware Banking PDF

- Can I Electronic signature Hawaii Banking Document

- Can I eSignature North Carolina Courts Presentation

- Can I eSignature Oklahoma Courts Word

- How To Electronic signature Alabama Business Operations Form

- Help Me With Electronic signature Alabama Car Dealer Presentation

- How Can I Electronic signature California Car Dealer PDF

- How Can I Electronic signature California Car Dealer Document

- How Can I Electronic signature Colorado Car Dealer Form

- How To Electronic signature Florida Car Dealer Word

- How Do I Electronic signature Florida Car Dealer Document

- Help Me With Electronic signature Florida Car Dealer Presentation

- Can I Electronic signature Georgia Car Dealer PDF

- How Do I Electronic signature Georgia Car Dealer Document

- Can I Electronic signature Georgia Car Dealer Form