Mortgage Discharge Request Form 2021-2026

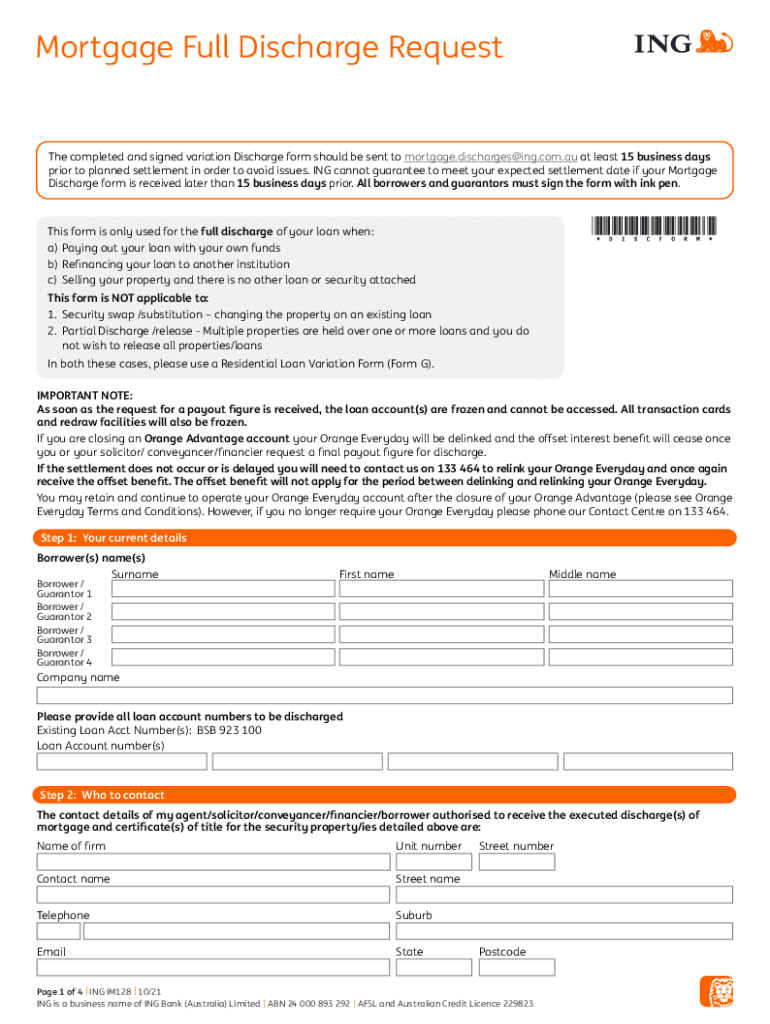

What is the Mortgage Discharge Request Form

The Mortgage Discharge Request Form is a legal document used to formally request the discharge of a mortgage from the public record. This form is essential for homeowners who have paid off their mortgage or wish to remove the lien from their property. By submitting this form, borrowers can ensure that their property title is clear of any encumbrances related to the mortgage, allowing for smoother transactions in the future.

How to use the Mortgage Discharge Request Form

Using the Mortgage Discharge Request Form involves several straightforward steps. First, ensure that all mortgage payments have been completed, and gather necessary documentation, such as proof of payment and identification. Next, fill out the form with accurate details, including the property address, borrower information, and mortgage account number. Once completed, submit the form to the appropriate authority, typically the lender or county recorder's office, to initiate the discharge process.

Steps to complete the Mortgage Discharge Request Form

Completing the Mortgage Discharge Request Form requires careful attention to detail. Follow these steps:

- Gather all required documents, including proof of mortgage payoff.

- Fill in the form with accurate personal and property information.

- Sign and date the form, ensuring that all signatures match those on the original mortgage documents.

- Submit the form along with any required fees to the designated office.

Key elements of the Mortgage Discharge Request Form

Several key elements must be included in the Mortgage Discharge Request Form to ensure its validity. These elements typically include:

- Borrower's full name and contact information.

- Property address associated with the mortgage.

- Mortgage account number and lender's information.

- Signature of the borrower or authorized representative.

- Date of submission.

Legal use of the Mortgage Discharge Request Form

The legal use of the Mortgage Discharge Request Form is crucial for ensuring that a mortgage is properly discharged in accordance with state laws. This form serves as a formal request to remove the mortgage lien from the property title, which is essential for maintaining clear ownership. Failure to properly discharge a mortgage can result in complications during property sales or refinancing.

Form Submission Methods

The Mortgage Discharge Request Form can typically be submitted through various methods, depending on the lender's policies and state regulations. Common submission methods include:

- Online submission through the lender's website or portal.

- Mailing the completed form to the lender or appropriate county office.

- In-person submission at the lender's branch or county recorder's office.

Quick guide on how to complete mortgage discharge request form

Effortlessly Prepare Mortgage Discharge Request Form on Any Device

Digital document management has gained signNow traction among enterprises and individuals alike. It serves as an excellent environmentally friendly substitute for conventional printed and signed documents, as you can access the appropriate forms and securely store them online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents swiftly and without delays. Handle Mortgage Discharge Request Form on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric operation today.

The Easiest Method to Modify and eSign Mortgage Discharge Request Form Effortlessly

- Find Mortgage Discharge Request Form and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize relevant sections of your documents or obscure sensitive information using tools specifically provided by airSlate SignNow for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you want to send your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or mislaid files, cumbersome form searches, or errors that require reprinting new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from a device of your choice. Edit and eSign Mortgage Discharge Request Form and ensure exceptional communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct mortgage discharge request form

Create this form in 5 minutes!

How to create an eSignature for the mortgage discharge request form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an ing discharge form and why is it important?

An ing discharge form is a crucial document used to formally release patients from healthcare facilities. This form ensures that all necessary information is documented, facilitating a smooth transition for the patient. Proper use of the ing discharge form can enhance patient communication and improve overall healthcare outcomes.

-

How can airSlate SignNow help with managing ing discharge forms?

airSlate SignNow provides a seamless solution for creating, sending, and eSigning ing discharge forms. Our platform simplifies the process, allowing users to send forms electronically and securely. This streamlines operations and reduces paperwork, ensuring that healthcare providers can focus on patient care.

-

Is there a cost to use airSlate SignNow for ing discharge forms?

airSlate SignNow offers competitive pricing plans to accommodate various business needs. You can choose a plan that suits your budget and usage for handling ing discharge forms effectively. Our service is designed to be cost-effective while providing premium features to enhance your document management.

-

What features does airSlate SignNow offer for ing discharge forms?

airSlate SignNow includes features such as customizable templates, user tracking, and automated reminders for ing discharge forms. These functionalities allow users to create tailored documents and keep track of their status. This enhances efficiency and ensures that all stakeholders are informed during the signing process.

-

Can I integrate airSlate SignNow with other tools for managing ing discharge forms?

Yes, airSlate SignNow easily integrates with various applications, enhancing your workflow for managing ing discharge forms. We support integration with platforms like Google Drive, Salesforce, and other popular tools. This allows you to centralize your document management processes and simplifies access to your signed forms.

-

What are the benefits of using airSlate SignNow for ing discharge forms?

Using airSlate SignNow for ing discharge forms offers numerous benefits, including increased efficiency, improved compliance, and reduced processing times. The platform's ease of use ensures that all staff can utilize it effectively. Additionally, it enhances document security with encryption, protecting sensitive patient information.

-

How does airSlate SignNow ensure the security of ing discharge forms?

airSlate SignNow prioritizes the security of your ing discharge forms by implementing advanced encryption and secure authentication protocols. All data is stored and transmitted securely, safeguarding sensitive information. Our commitment to compliance with industry regulations further enhances the trustworthiness of our platform.

Get more for Mortgage Discharge Request Form

Find out other Mortgage Discharge Request Form

- Can I eSign Hawaii High Tech Document

- How Can I eSign Hawaii High Tech Document

- How Do I eSign Hawaii High Tech Document

- Can I eSign Hawaii High Tech Word

- How Can I eSign Hawaii High Tech Form

- How Do I eSign New Mexico Healthcare / Medical Word

- How To eSign Washington High Tech Presentation

- Help Me With eSign Vermont Healthcare / Medical PPT

- How To eSign Arizona Lawers PDF

- How To eSign Utah Government Word

- How Can I eSign Connecticut Lawers Presentation

- Help Me With eSign Hawaii Lawers Word

- How Can I eSign Hawaii Lawers Document

- How To eSign Hawaii Lawers PPT

- Help Me With eSign Hawaii Insurance PPT

- Help Me With eSign Idaho Insurance Presentation

- Can I eSign Indiana Insurance Form

- How To eSign Maryland Insurance PPT

- Can I eSign Arkansas Life Sciences PDF

- How Can I eSign Arkansas Life Sciences PDF