Irs Change of Address Form 2015-2026

What is the IRS Change of Address Form

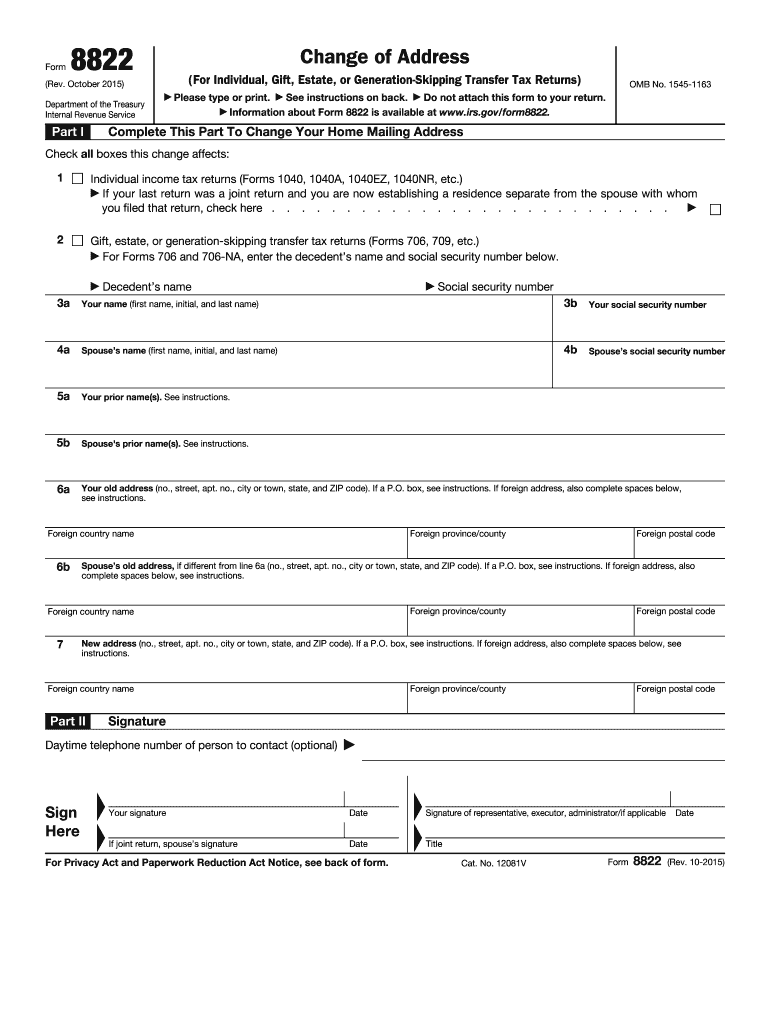

The IRS Change of Address Form, officially known as Form 8822, is used by taxpayers to notify the Internal Revenue Service of a change in their residential or business address. This form is essential for ensuring that the IRS has the correct address on file, which is crucial for receiving tax documents, refunds, and other important correspondence. By submitting this form, taxpayers can avoid potential delays in communication and ensure that they remain compliant with federal tax regulations.

How to use the IRS Change of Address Form

To use the IRS Change of Address Form, individuals must first obtain the form, which can be found on the IRS website or through tax preparation software. Once you have the form, fill it out with your new address and any other required information. It is important to provide accurate details to prevent any issues with processing. After completing the form, submit it according to the instructions provided, either via mail or electronically if applicable. Ensure that you keep a copy for your records.

Steps to complete the IRS Change of Address Form

Completing the IRS Change of Address Form involves several steps:

- Obtain Form 8822 from the IRS website or your tax software.

- Fill in your personal information, including your name, old address, and new address.

- If applicable, include your spouse's information if you are filing jointly.

- Sign and date the form to certify that the information is accurate.

- Submit the completed form to the address specified in the instructions.

Legal use of the IRS Change of Address Form

The IRS Change of Address Form is legally recognized as the official method for notifying the IRS of address changes. It is important to use this form to ensure compliance with tax laws. Failure to notify the IRS of an address change can lead to missed communications, delayed refunds, and potential penalties. Taxpayers are encouraged to submit this form promptly after moving to maintain accurate records with the IRS.

Form Submission Methods

The IRS Change of Address Form can be submitted through multiple methods. Taxpayers can mail the completed form to the address provided in the instructions. In some cases, electronic submission may be available through authorized e-filing services. It is essential to check the latest IRS guidelines to determine the most efficient submission method for your situation.

Filing Deadlines / Important Dates

While there is no specific deadline for submitting the IRS Change of Address Form, it is advisable to notify the IRS as soon as possible after moving. This ensures that all tax-related correspondence is sent to the correct address. Taxpayers should also be aware of any relevant tax filing deadlines to ensure that their address change is processed in time for the upcoming tax season.

Required Documents

When submitting the IRS Change of Address Form, no additional documents are typically required. However, it is advisable to include any relevant identification information, such as your Social Security number or Employer Identification Number, to facilitate processing. Keeping a copy of the submitted form for your records is also recommended.

Quick guide on how to complete irs form 8822 2015 2019

Discover the simplest method to complete and sign your Irs Change Of Address Form

Are you still spending time preparing your official documents on paper instead of doing it online? airSlate SignNow provides a superior way to finalize and sign your Irs Change Of Address Form and associated forms for public services. Our intelligent electronic signature platform offers everything you require to handle documents swiftly and in compliance with official standards - powerful PDF editing, managing, securing, signing, and sharing capabilities all available within an intuitive interface.

Only a few steps are needed to fill out and sign your Irs Change Of Address Form:

- Upload the editable template to the editor using the Get Form button.

- Verify what information you must include in your Irs Change Of Address Form.

- Move between the fields with the Next option to avoid missing anything.

- Utilize Text, Check, and Cross tools to complete the fields with your details.

- Modify the content with Text boxes or Images from the toolbar above.

- Emphasize what is most important or Obscure fields that are no longer relevant.

- Click on Sign to generate a legally valid electronic signature using any method you prefer.

- Add the Date beside your signature and finalize your work with the Done button.

Keep your completed Irs Change Of Address Form in the Documents folder of your profile, download it, or export it to your preferred cloud storage. Our service also offers flexible form sharing options. There’s no need to print your forms when filing them with the appropriate public office - do it via email, fax, or by requesting a USPS “snail mail” delivery from your account. Try it out now!

Create this form in 5 minutes or less

Find and fill out the correct irs form 8822 2015 2019

FAQs

-

How can I fill out an IRS form 8379?

Form 8379, the Injured Spouse declaration, is used to ensure that a spouse’s share of a refund from a joint tax return is not used by the IRS as an offset to pay a tax obligation of the other spouse.Before you file this, make sure that you know the difference between this and the Innocent Spouse declaration, Form 8857. You use Form 8379 when your spouse owes money for a legally enforeceable tax debt (such as a student loan which is in default) for which you are not jointly liable. You use Form 8857 when you want to be released from tax liability for an understatement of tax that resulted from actions taken by your spouse of which you had no knowledge, and had no reason to know.As the other answers have specified, you follow the Instructions for Form 8379 (11/2016) on the IRS Web site to actually fill it out.

-

How do I fill out a CLAT 2019 application form?

Hi thereFirst of all, let me tell you some important points:CLAT 2019 has gone OFFLINE this yearBut the application forms for CLAT 2019 have to be filled ONLINEThe payment of the application fees also should be made onlineNow, kindly note the important dates:Note the details regarding the application fees:Here, if you want the Previous Year Question papers, Rs.500 would be added to the application fees.Apart from this, there would be bank transaction charges added to the application fees.The application fees is non-refundable.Note one important point here that before you fill the application form, check for your eligibility.To know the complete details of filling the application form along with other information like the eligibility - in terms of age, educational qualification, list of NLUs participating and the seats offered under each category, CLAT Reservation policies, CLAT exam pattern, marking scheme, syllabus, important documents required to be kept ready before filling the form, kindly go to the link below:How to fill CLAT 2019 Application form? Registration OPEN | All you need to knowTo know how to prepare for one of the very important section of CLAT exam, GK and Current Affairs, kindly go to the link below:How to prepare GK & Current Affairs for CLAT 2019To practice, daily MCQs on Current Affairs, kindly go to the link below:#CLAT2019 | #AILET2019 | #DULLB2019 | GK and Current Affairs Series: 5 in 10 Series: Day 12For any other queries, kindly write to us at mailateasyway@gmail.comThanks & Regards!

-

For taxes, does one have to fill out a federal IRS form and a state IRS form?

No, taxes are handled separately between state and federal governments in the United States.The IRS (Internal Revenue Service) is a federal, not state agency.You will be required to fill out the the necessary tax documentation for your federal income annually and submit them to the IRS by April 15th of that year. You can receive extensions for this; but you have to apply for those extensions.As far as state taxes go, 41 states require you to fill out an income tax return annually. They can either mail you those forms or they be downloaded from online. They are also available for free at various locations around the state.Nine states have no tax on personal income, so there is no need to fill out a state tax return unless you are a business owner.Reference:www.irs.gov

-

How do I fill out the NEET 2019 application form?

Expecting application form of NEET2019 will be same as that of NEET2018, follow the instructions-For Feb 2019 Exam:EventsDates (Announced)Release of application form-1st October 2018Application submission last date-31st October 2018Last date to pay the fee-Last week of October 2018Correction Window Open-1st week of November 2018Admit card available-1st week of January 2019Exam date-3rd February to 17th February 2019Answer key & OMR release-Within a week after examAnnouncement of result-1st week of March 2019Counselling begins-2nd week of June 2019For May 2019 Exam:EventsDates (Announced)Application form Release-2nd week of March 2019Application submission last date-2nd week of April 2019Last date to pay the fee-2nd week of April 2019Correction Window Open-3rd week of April 2019Admit card available-1st week of May 2019Exam date-12th May to 26th May 2019Answer key & OMR release-Within a week after examAnnouncement of result-1st week of June 2019Counselling begins-2nd week of June 2019NEET 2019 Application FormCandidates should fill the application form as per the instructions given in the information bulletin. Below we are providing NEET 2019 application form details:The application form will be issued through online mode only.No application will be entertained through offline mode.NEET UG registration 2019 will be commenced from the 1st October 2018 (Feb Exam) & second week of March 2018 (May Exam).Candidates should upload the scanned images of recent passport size photograph and signature.After filling the application form completely, a confirmation page will be generated. Download it.There will be no need to send the printed confirmation page to the board.Application Fee:General and OBC candidates will have to pay Rs. 1400/- as an application fee.The application fee for SC/ST and PH candidates will be Rs. 750/-.Fee payment can be done through credit/debit card, net banking, UPI and e-wallet.Service tax will also be applicable.CategoryApplication FeeGeneral/OBC-1400/-SC/ST/PH-750/-Step 1: Fill the Application FormGo the official portal of the conducting authority (Link will be given above).Click on “Apply Online” link.A candidate has to read all the instruction and then click on “Proceed to Apply Online NEET (UG) 2019”.Step 1.1: New RegistrationFill the registration form carefully.Candidates have to fill their name, Mother’s Name, Father’s Name, Category, Date of Birth, Gender, Nationality, State of Eligibility (for 15% All India Quota), Mobile Number, Email ID, Aadhaar card number, etc.After filling all the details, two links will be given “Preview &Next” and “Reset”.If candidate satisfied with the filled information, then they have to click on “Next”.After clicking on Next Button, the information submitted by the candidate will be displayed on the screen. If information correct, click on “Next” button, otherwise go for “Back” button.Candidates may note down the registration number for further procedure.Now choose the strong password and re enter the password.Choose security question and feed answer.Enter the OTP would be sent to your mobile number.Submit the button.Step 1.2: Login & Application Form FillingLogin with your Registration Number and password.Fill personal details.Enter place of birth.Choose the medium of question paper.Choose examination centres.Fill permanent address.Fill correspondence address.Fill Details (qualification, occupation, annual income) of parents and guardians.Choose the option for dress code.Enter security pin & click on save & draft.Now click on preview and submit.Now, review your entries.Then. click on Final Submit.Step 2: Upload Photo and SignatureStep 2 for images upload will be appeared on screen.Now, click on link for Upload photo & signature.Upload the scanned images.Candidate should have scanned images of his latest Photograph (size of 10 Kb to 100 Kb.Signature(size of 3 Kb to 20 Kb) in JPEG format only.Step 3: Fee PaymentAfter uploading the images, candidate will automatically go to the link for fee payment.A candidate has to follow the instruction & submit the application fee.Choose the Bank for making payment.Go for Payment.Candidate can pay the fee through Debit/Credit Card/Net Banking/e-wallet (CSC).Step 4: Take the Printout of Confirmation PageAfter the fee payment, a candidate may take the printout of the confirmation page.Candidates may keep at least three copies of the confirmation page.Note:Must retain copy of the system generated Self Declaration in respect of candidates from J&K who have opted for seats under 15% All India Quota.IF any queries, feel free to comment..best of luck

-

Which IRS forms do US expats need to fill out?

That would depend on their personal situation, but should they actually have a full financial life in another country including investments, pensions, mortgages, insurance policies, a small business, multiple bank accounts…The reporting alone can be bankrupting, and that is before you get on to actual taxes that are punitive toward foreign finances owned by a US citizen and god help you if you make mistake because penalties appear designed to bankrupt you.US citizens globally are renouncing citizenship for good reason.This is extracted from a letter sent by the James Bopp law firm to Chairman Mark Meadows of the subcommittee of government operations regarding the difficulty faced by US citizens who try to live else where.“ FATCA is forcing Americans abroad into a set of circumstances where they must renounce their U.S. citizenship to survive.For example, suppose you have a married couple living in Washington DC. One works as a lobbyist for an NGO and has a defined benefits pensions. The other is self employed in a lobby firm, working under an LLC. According to the IRS filing requirements, it would take about 15 hours and $280 to complete their yearly filings. Should they under report income, any penalties would be a percentage of their unreported tax burden. The worst case is a 20% civil fraud penalty.Compare the same couple with one different fact. They moved to Australia because the NGO reassigned the wife to Sydney. The husband, likewise, moves his business overseas. They open a bank account, contribute to the mandatory Australian retirement fund, purchase a house with a mortgage and get a life insurance policy on both of them.These are now their new filing requirements:• Form 8938• Form 3520-A• Form 3520• Form 5471 (to be filed by the husbands new Australian corporation where he is self employed)• Form 720 Excise Tax.• FinCEN Form 114The burden that was 15 hours now goes up to• 57.2 hours for Form 720,• 54.20 hours for Form 3520,• 61.22 Hours for Form 3520-A.• 50 hours estimate for Form 5471For a total of 226.99 hours (according to the IRS’s own time estimates) not including time to file the FBAR.The penalties for innocent misfiling or non filings for the above foreign reporting forms for the couple are up to $50,000, per year. It is likely that the foreign income exclusion and foreign tax credit will negate any actual tax due to the IRS. So each year, there is a lurking $50,000 penalty for getting something technically wrong on a form, yet there would be no additional tax due to the US treasury.”

-

How can I fill out the BITSAT Application Form 2019?

BITSAT 2019 Application Forms are available online. Students who are eligible for the admission test can apply online before 20 March 2018, 5 pm.Click here to apply for BITSAT 2019Step 1: Follow the link given aboveStep 2: Fill online application formPersonal Details12th Examination DetailsTest Centre PreferencesStep 3: Upload scanned photograph (4 kb to 50 kb) and signature ( 1 kb to 30 kb).Step 4: Pay application fee either through online payment mode or through e-challan (ICICI Bank)BITSAT-2019 Application FeeMale Candidates - Rs. 3150/-Female Candidates - Rs. 2650/-Thanks!

Create this form in 5 minutes!

How to create an eSignature for the irs form 8822 2015 2019

How to create an eSignature for your Irs Form 8822 2015 2019 online

How to generate an eSignature for your Irs Form 8822 2015 2019 in Google Chrome

How to make an eSignature for putting it on the Irs Form 8822 2015 2019 in Gmail

How to generate an electronic signature for the Irs Form 8822 2015 2019 right from your smart phone

How to generate an electronic signature for the Irs Form 8822 2015 2019 on iOS devices

How to create an electronic signature for the Irs Form 8822 2015 2019 on Android

People also ask

-

What is the IRS Change of Address Form and why do I need it?

The IRS Change of Address Form is a crucial document that allows you to update your address with the Internal Revenue Service. Filing this form ensures that the IRS can send important tax documents and notifications to your new address, helping you avoid potential penalties or missed communications.

-

How can airSlate SignNow help me with the IRS Change of Address Form?

With airSlate SignNow, you can easily create, fill out, and eSign your IRS Change of Address Form online. Our platform simplifies the process, allowing you to quickly submit the form without the hassle of printing and mailing, saving you time and effort.

-

Is there a cost associated with using airSlate SignNow for the IRS Change of Address Form?

Yes, airSlate SignNow offers various pricing plans to suit your needs, including affordable options for individuals and businesses looking to manage the IRS Change of Address Form. Our pricing is transparent, with no hidden fees, allowing you to choose a plan that works best for you.

-

What features does airSlate SignNow offer for managing the IRS Change of Address Form?

airSlate SignNow provides features like document templates, automated workflows, and secure eSignature solutions for the IRS Change of Address Form. These features streamline the process, making it easy to ensure your form is filled out correctly and submitted promptly.

-

Can I integrate airSlate SignNow with other applications to manage my IRS Change of Address Form?

Absolutely! airSlate SignNow integrates seamlessly with various applications like Google Drive, Dropbox, and CRM systems. This means you can easily access, manage, and store your IRS Change of Address Form alongside other important documents.

-

Is airSlate SignNow secure for submitting sensitive documents like the IRS Change of Address Form?

Yes, airSlate SignNow prioritizes your security with advanced encryption and compliance with industry standards. You can confidently submit your IRS Change of Address Form knowing that your personal information is protected.

-

How long does it take to process the IRS Change of Address Form using airSlate SignNow?

The processing time for the IRS Change of Address Form can vary, but using airSlate SignNow expedites your submission. Once eSigned, you can instantly send your form to the IRS, ensuring faster processing compared to traditional methods.

Get more for Irs Change Of Address Form

Find out other Irs Change Of Address Form

- Electronic signature Texas Internship Contract Safe

- Electronic signature North Carolina Day Care Contract Later

- Electronic signature Tennessee Medical Power of Attorney Template Simple

- Electronic signature California Medical Services Proposal Mobile

- How To Electronic signature West Virginia Pharmacy Services Agreement

- How Can I eSignature Kentucky Co-Branding Agreement

- How Can I Electronic signature Alabama Declaration of Trust Template

- How Do I Electronic signature Illinois Declaration of Trust Template

- Electronic signature Maryland Declaration of Trust Template Later

- How Can I Electronic signature Oklahoma Declaration of Trust Template

- Electronic signature Nevada Shareholder Agreement Template Easy

- Electronic signature Texas Shareholder Agreement Template Free

- Electronic signature Mississippi Redemption Agreement Online

- eSignature West Virginia Distribution Agreement Safe

- Electronic signature Nevada Equipment Rental Agreement Template Myself

- Can I Electronic signature Louisiana Construction Contract Template

- Can I eSignature Washington Engineering Proposal Template

- eSignature California Proforma Invoice Template Simple

- eSignature Georgia Proforma Invoice Template Myself

- eSignature Mississippi Proforma Invoice Template Safe