Form 8822 2011

What is the Form 8822

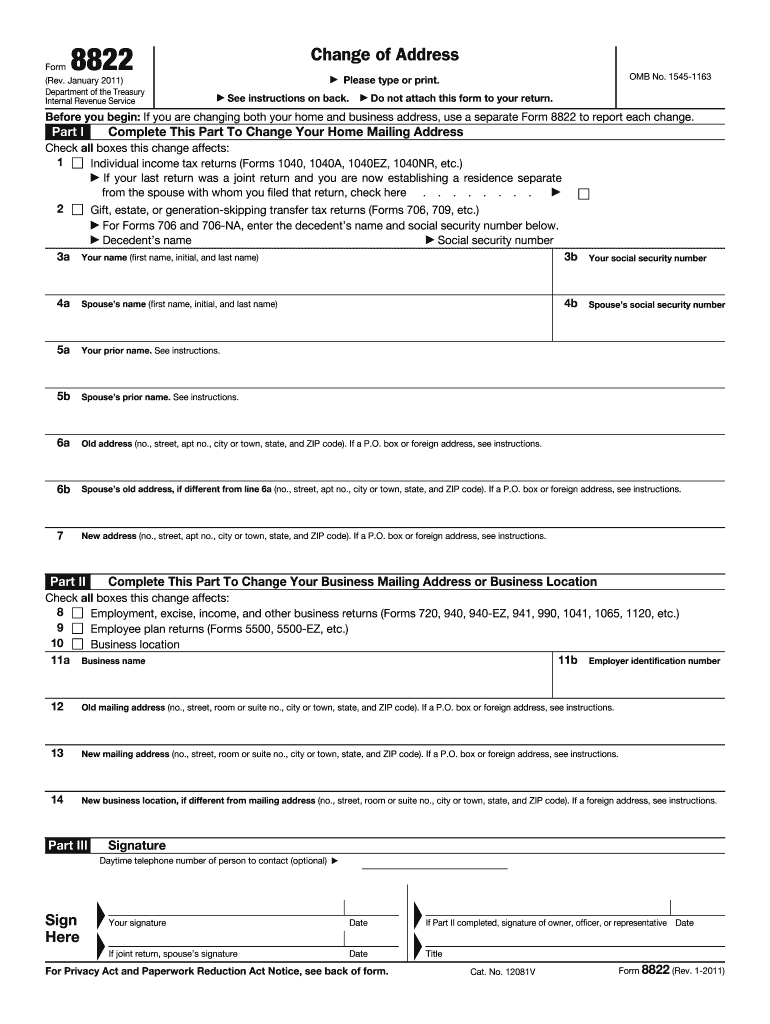

The Form 8822 is an official document used by taxpayers in the United States to notify the Internal Revenue Service (IRS) of a change of address. This form is essential for ensuring that the IRS has the correct mailing address for taxpayers, which helps in receiving important tax-related correspondence, including refunds and notices. It is typically used by individuals who have moved and need to update their address records with the IRS to avoid any potential issues with tax filings or communications.

How to use the Form 8822

Using the Form 8822 involves several straightforward steps. First, obtain the form from the IRS website or through authorized tax professionals. Next, fill out the required information, including your old address, new address, and personal details such as your name and Social Security number. Once completed, review the form for accuracy to ensure that all information is correct. Finally, submit the form to the IRS either by mail or electronically, depending on the available submission methods. This process helps maintain updated records with the IRS, ensuring smooth communication regarding your tax matters.

Steps to complete the Form 8822

Completing the Form 8822 requires careful attention to detail. The following steps outline the process:

- Download the form: Access the Form 8822 from the IRS website.

- Fill in personal information: Provide your name, Social Security number, and date of birth.

- Enter old address: Clearly state your previous address to ensure accurate records.

- Provide new address: Input your new address where you want IRS correspondence sent.

- Sign and date: Ensure you sign and date the form to validate your request.

- Submit the form: Send the completed form to the IRS address specified in the instructions.

Legal use of the Form 8822

The Form 8822 is a legally recognized document that allows taxpayers to officially inform the IRS of their address change. It is crucial to submit this form to maintain compliance with tax regulations. Failure to notify the IRS of an address change can result in missed communications, delayed refunds, or even penalties for non-compliance. By using the Form 8822, taxpayers can ensure that their tax records are accurate and up to date, which is essential for legal and financial reasons.

Filing Deadlines / Important Dates

While there is no specific deadline for submitting the Form 8822, it is advisable to file it as soon as you change your address. Doing so ensures that the IRS has your current information for the upcoming tax year. Additionally, if you are filing your tax return, it is best to submit the Form 8822 before the tax return is processed to avoid any complications. Keeping track of important tax deadlines can help you stay compliant and avoid issues with your filings.

Form Submission Methods (Online / Mail / In-Person)

The Form 8822 can be submitted through various methods, providing flexibility for taxpayers. The primary submission method is by mail, where you send the completed form to the IRS address indicated in the instructions. Currently, there is no option for electronic submission of Form 8822, but it is essential to ensure that the form is sent to the correct address based on your state. In-person submissions are not typically available for this form, making mail the most common method for filing.

Quick guide on how to complete form 8822 2011

Prepare Form 8822 effortlessly on any gadget

Web-based document management has gained traction among organizations and individuals alike. It serves as an excellent eco-friendly alternative to conventional printed and signed paperwork, as you can easily locate the necessary form and securely store it online. airSlate SignNow equips you with all the tools needed to generate, edit, and electronically sign your documents quickly without delays. Manage Form 8822 on any device with airSlate SignNow's Android or iOS apps and enhance any document-related workflow today.

How to edit and electronically sign Form 8822 without any hassle

- Find Form 8822 and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of your documents or conceal sensitive information using the tools that airSlate SignNow provides specifically for this purpose.

- Create your signature using the Sign tool, which takes just seconds and holds the same legal significance as a conventional handwritten signature.

- Verify all the information and click on the Done button to save your modifications.

- Choose how you'd like to deliver your form, whether by email, SMS, or invitation link, or download it to your computer.

No more concerns about lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you choose. Modify and eSign Form 8822 and guarantee exceptional communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 8822 2011

Create this form in 5 minutes!

How to create an eSignature for the form 8822 2011

The best way to make an electronic signature for your PDF file in the online mode

The best way to make an electronic signature for your PDF file in Chrome

The best way to make an eSignature for putting it on PDFs in Gmail

How to generate an eSignature from your smartphone

How to generate an electronic signature for a PDF file on iOS devices

How to generate an eSignature for a PDF file on Android

People also ask

-

What is Form 8822 and why do I need it?

Form 8822 is used to update your address with the IRS. If you have recently changed your address, completing Form 8822 ensures you receive important tax information and correspondence from the IRS without delay. Utilizing airSlate SignNow makes it easy to complete and submit Form 8822 electronically.

-

How can airSlate SignNow help me with Form 8822?

airSlate SignNow provides an efficient platform for electronically signing and sending Form 8822. With our user-friendly interface, you can complete the form quickly and securely, ensuring that it is submitted correctly and on time to avoid any issues with your tax records.

-

What are the features of airSlate SignNow for managing Form 8822?

airSlate SignNow offers robust features for managing Form 8822, including customizable templates and real-time tracking of document status. You can easily access your documents from any device and receive notifications once the Form 8822 is signed and sent, enhancing your document management experience.

-

Is there a cost associated with using airSlate SignNow for Form 8822?

Yes, airSlate SignNow offers a cost-effective subscription model that allows you to manage and eSign documents such as Form 8822. Our pricing plans cater to various user needs, ensuring you get value for your investment while simplifying your document workflow.

-

Can I integrate airSlate SignNow with other software while handling Form 8822?

Absolutely! airSlate SignNow seamlessly integrates with various software applications, allowing you to manage Form 8822 alongside your existing tools. This integration enhances your workflow, streamlining how you handle documents and ensuring all necessary information is easily accessible.

-

What are the benefits of using airSlate SignNow for Form 8822 submissions?

Using airSlate SignNow for Form 8822 submissions offers numerous benefits, including increased efficiency and reduced processing time. The ability to eSign and send documents electronically means you can complete your address updates quickly, reducing the likelihood of errors or delays.

-

How does airSlate SignNow ensure the security of my Form 8822?

Security is a top priority at airSlate SignNow. When you use our platform to submit Form 8822, your documents are encrypted and securely stored, ensuring your personal information remains protected throughout the signing process.

Get more for Form 8822

- Legal last will and testament form for married person with adult and minor children illinois

- Legal last will and testament form for civil union partner with adult and minor children illinois

- Mutual wills package with last wills and testaments for married couple with adult and minor children illinois form

- Illinois widow 497306610 form

- Legal last will and testament form for widow or widower with minor children illinois

- Legal last will form for a widow or widower with no children illinois

- Legal last will and testament form for a widow or widower with adult and minor children illinois

- Legal last will and testament form for divorced and remarried person with mine yours and ours children illinois

Find out other Form 8822

- eSignature New York Non-Profit LLC Operating Agreement Mobile

- How Can I eSignature Colorado Orthodontists LLC Operating Agreement

- eSignature North Carolina Non-Profit RFP Secure

- eSignature North Carolina Non-Profit Credit Memo Secure

- eSignature North Dakota Non-Profit Quitclaim Deed Later

- eSignature Florida Orthodontists Business Plan Template Easy

- eSignature Georgia Orthodontists RFP Secure

- eSignature Ohio Non-Profit LLC Operating Agreement Later

- eSignature Ohio Non-Profit LLC Operating Agreement Easy

- How Can I eSignature Ohio Lawers Lease Termination Letter

- Can I eSignature Ohio Lawers Lease Termination Letter

- Can I eSignature Oregon Non-Profit Last Will And Testament

- Can I eSignature Oregon Orthodontists LLC Operating Agreement

- How To eSignature Rhode Island Orthodontists LLC Operating Agreement

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed

- eSignature California Plumbing Profit And Loss Statement Easy

- How To eSignature California Plumbing Business Letter Template

- eSignature Kansas Plumbing Lease Agreement Template Myself