Irs Address Form 2012

What is the IRS Address Form

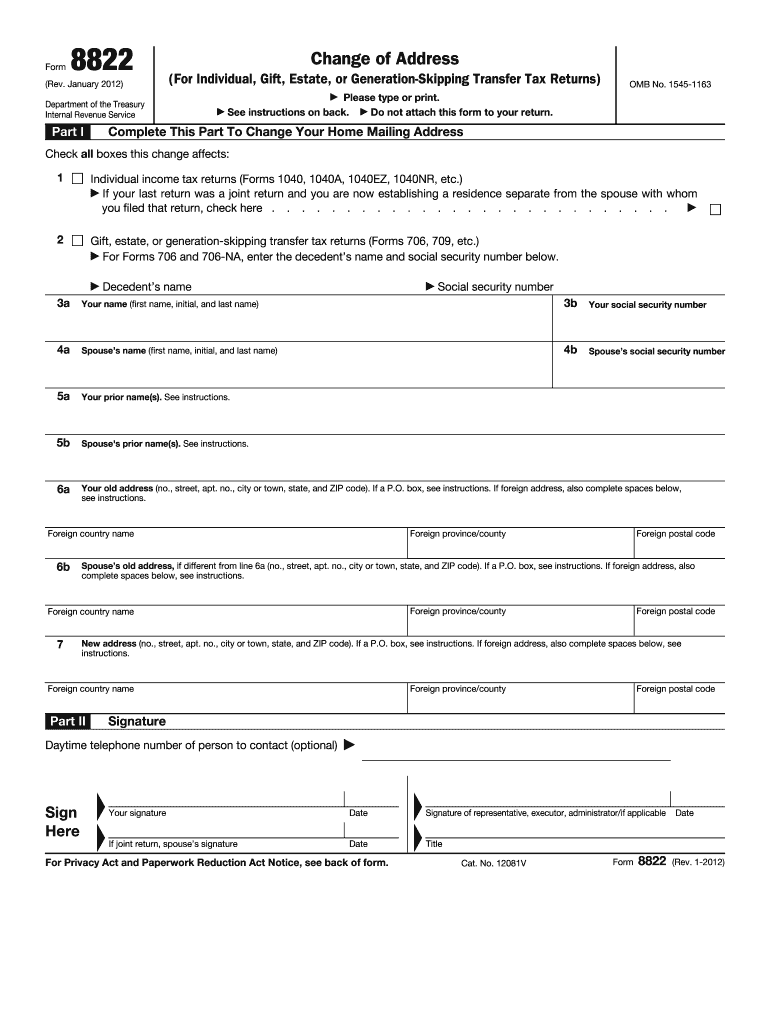

The IRS Address Form is a crucial document used by taxpayers in the United States to update or change their address with the Internal Revenue Service. This form ensures that the IRS has the correct contact information for individuals and businesses, which is essential for receiving important tax documents and communications. Properly completing and submitting this form can help prevent delays in processing tax returns and refunds.

How to Use the IRS Address Form

To use the IRS Address Form effectively, taxpayers must first obtain the correct version of the form. Once acquired, individuals should fill out their current information, including their old address and the new address where they wish to receive correspondence. It is important to ensure that all information is accurate to avoid complications. After completing the form, it can be submitted either online or through traditional mail, depending on the specific instructions provided by the IRS.

Steps to Complete the IRS Address Form

Completing the IRS Address Form involves several key steps:

- Obtain the form from the IRS website or through authorized distribution channels.

- Fill in your personal details, including your name, Social Security number, and both the old and new addresses.

- Review the form for accuracy, ensuring all information is correct.

- Sign and date the form to validate your request.

- Submit the form via the method specified by the IRS, either electronically or by mail.

Legal Use of the IRS Address Form

The IRS Address Form is legally recognized and serves as an official request to update personal information within the IRS records. When submitted correctly, it complies with federal regulations governing taxpayer information. Maintaining current address information is not only a matter of convenience but also a legal requirement to ensure that taxpayers receive their tax-related documents in a timely manner.

Key Elements of the IRS Address Form

Several key elements must be included in the IRS Address Form to ensure its validity:

- Taxpayer Identification: Full name and Social Security number or Employer Identification Number.

- Old Address: The address currently on file with the IRS.

- New Address: The updated address where future correspondence should be sent.

- Signature: The taxpayer's signature, which confirms the authenticity of the request.

- Date: The date on which the form is signed, indicating when the request was made.

Form Submission Methods

Taxpayers have multiple options for submitting the IRS Address Form. The most common methods include:

- Online Submission: Some taxpayers may be able to submit their address changes electronically through the IRS website, depending on their eligibility.

- Mail: The completed form can be mailed to the appropriate IRS address as specified in the form instructions.

- In-Person: Taxpayers may also choose to visit a local IRS office to submit their form directly, although this option may require an appointment.

Quick guide on how to complete 2012 irs address form

Prepare Irs Address Form seamlessly on any device

Online document administration has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly alternative to conventional printed and signed documents, allowing you to locate the appropriate form and securely save it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents quickly and without delays. Handle Irs Address Form on any platform with airSlate SignNow's Android or iOS applications and enhance any document-centric operation today.

How to modify and electronically sign Irs Address Form effortlessly

- Find Irs Address Form and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your electronic signature with the Sign tool, which takes only seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the information and click on the Done button to preserve your changes.

- Choose how you want to share your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Forget about lost or mislaid files, time-consuming form searches, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management requirements in just a few clicks from any device you choose. Edit and electronically sign Irs Address Form and ensure exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2012 irs address form

Create this form in 5 minutes!

How to create an eSignature for the 2012 irs address form

How to generate an electronic signature for your PDF file online

How to generate an electronic signature for your PDF file in Google Chrome

The way to make an eSignature for signing PDFs in Gmail

The way to generate an electronic signature from your mobile device

How to make an electronic signature for a PDF file on iOS

The way to generate an electronic signature for a PDF file on Android devices

People also ask

-

What is the Irs Address Form and how can airSlate SignNow help?

The Irs Address Form is a crucial document for individuals and businesses to update their address with the IRS. With airSlate SignNow, you can easily create, send, and eSign your Irs Address Form, ensuring that your information is submitted quickly and securely. Our platform simplifies the process, allowing you to focus on what matters most.

-

How does airSlate SignNow ensure the security of my Irs Address Form?

At airSlate SignNow, we prioritize the security of your documents, including the Irs Address Form. Our platform employs bank-level encryption and secure cloud storage to protect your sensitive information. You can eSign your documents with confidence, knowing that your data is safe.

-

What are the pricing options for using airSlate SignNow for my Irs Address Form?

airSlate SignNow offers flexible pricing plans to meet your needs when handling documents like the Irs Address Form. We provide a free trial to explore our features, and our subscription plans are competitively priced to ensure you get the best value. Choose the plan that fits your business size and requirements.

-

Can I integrate airSlate SignNow with other applications for my Irs Address Form?

Yes, airSlate SignNow seamlessly integrates with various applications, enhancing your workflow for handling the Irs Address Form. You can connect with popular tools like Google Drive, Dropbox, and CRM systems to streamline your document management and eSigning processes. These integrations make it easier to manage your forms in one place.

-

Is it easy to eSign the Irs Address Form using airSlate SignNow?

Absolutely! airSlate SignNow is designed for ease of use, allowing you to eSign the Irs Address Form in just a few clicks. Our intuitive interface guides you through the process, making it simple for anyone to complete and send documents quickly. Save time and effort with our user-friendly solution.

-

What features does airSlate SignNow offer for managing my Irs Address Form?

airSlate SignNow provides a range of features for managing your Irs Address Form, including customizable templates, bulk sending, and real-time tracking. You can easily modify your form to fit your needs and monitor its progress from start to finish. These features enhance efficiency and organization when dealing with important documents.

-

Can I access my completed Irs Address Form from any device?

Yes, with airSlate SignNow, you can access your completed Irs Address Form from any device—be it a smartphone, tablet, or computer. Our cloud-based platform ensures that your documents are available anytime, anywhere, allowing you to manage your forms on the go. Experience flexibility and convenience with our solution.

Get more for Irs Address Form

- 96 1321 historically underutilized business hub certification and centralized master bidders list cmbl registration form

- Attach to sc1040 sc department of revenue scgov form

- Doc viewer payroll tax forms city of newark

- 50 129 application for 1 d 1 open space agricultural use appraisal form

- 2019 form nj cbt 100s fill online printable fillable

- Revelation 916 kjv ampquotand the number of the army of the form

- Individual income tax forms sc department of revenue

- Form lf 5 ampquotstate of new jersey litter control fee return

Find out other Irs Address Form

- eSignature North Carolina Lodger Agreement Template Myself

- eSignature Alabama Storage Rental Agreement Free

- eSignature Oregon Housekeeping Contract Computer

- eSignature Montana Home Loan Application Online

- eSignature New Hampshire Home Loan Application Online

- eSignature Minnesota Mortgage Quote Request Simple

- eSignature New Jersey Mortgage Quote Request Online

- Can I eSignature Kentucky Temporary Employment Contract Template

- eSignature Minnesota Email Cover Letter Template Fast

- How To eSignature New York Job Applicant Rejection Letter

- How Do I eSignature Kentucky Executive Summary Template

- eSignature Hawaii CV Form Template Mobile

- eSignature Nevada CV Form Template Online

- eSignature Delaware Software Development Proposal Template Now

- eSignature Kentucky Product Development Agreement Simple

- eSignature Georgia Mobile App Design Proposal Template Myself

- eSignature Indiana Mobile App Design Proposal Template Now

- eSignature Utah Mobile App Design Proposal Template Now

- eSignature Kentucky Intellectual Property Sale Agreement Online

- How Do I eSignature Arkansas IT Consulting Agreement