Form 8822 Fill in 2008

What is the Form 8822 Fill In

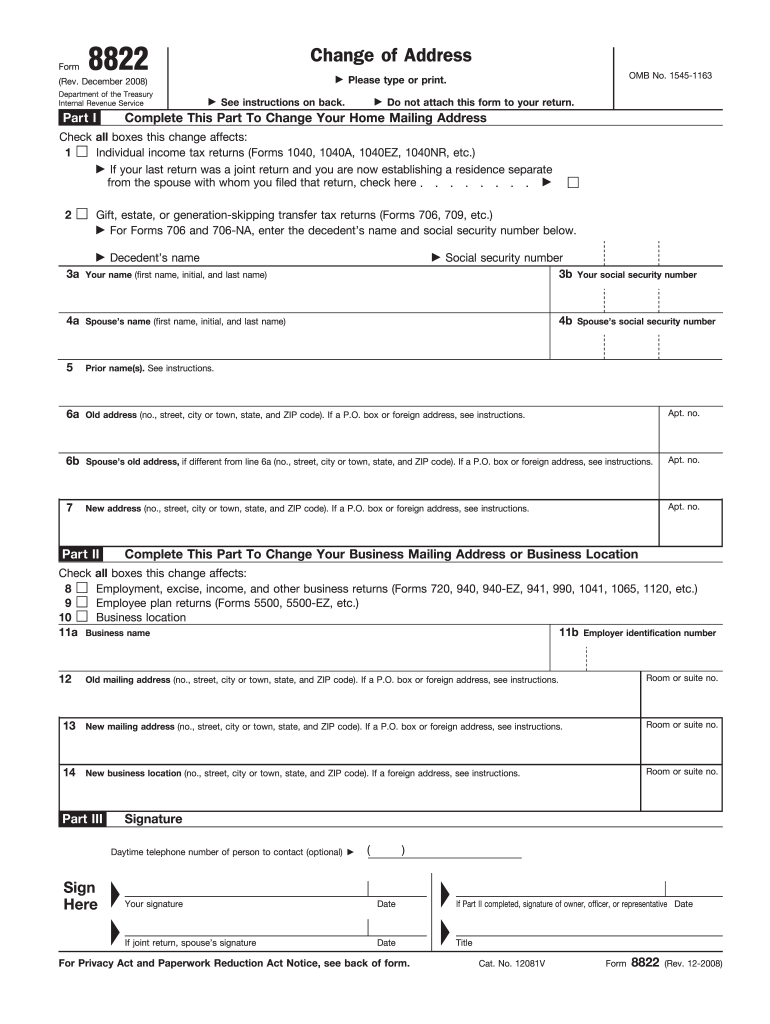

The Form 8822 is a tax form used by individuals in the United States to notify the Internal Revenue Service (IRS) of a change of address. This form is essential for ensuring that the IRS has the correct address for taxpayers, which is crucial for receiving tax-related correspondence, including refunds and notices. The form is specifically designed for individuals and cannot be used by businesses or other entities.

How to use the Form 8822 Fill In

Using the Form 8822 involves several straightforward steps. First, download the form from the IRS website or obtain a physical copy. Next, fill in the required information, including your old address, new address, and personal details such as your name and Social Security number. After completing the form, review it for accuracy. Finally, submit the form to the IRS by mail. It is important to ensure that the form is sent to the correct address specified in the instructions to avoid delays in processing.

Steps to complete the Form 8822 Fill In

Completing the Form 8822 requires attention to detail. Here are the steps to follow:

- Download or obtain a copy of Form 8822.

- Provide your full name and Social Security number in the designated fields.

- Enter your old address, ensuring it matches the address on your last tax return.

- Fill in your new address accurately.

- Sign and date the form to certify the information is correct.

- Mail the completed form to the appropriate IRS address listed in the instructions.

Legal use of the Form 8822 Fill In

The Form 8822 is legally recognized as a valid method for notifying the IRS of a change of address. To ensure its legal standing, it is important to complete the form accurately and submit it in accordance with IRS guidelines. Failure to notify the IRS of a change of address can result in missed correspondence, which may impact tax obligations and refunds.

Filing Deadlines / Important Dates

While there is no specific deadline for submitting Form 8822, it is advisable to file it as soon as you change your address. Timely submission ensures that the IRS updates your information promptly, helping to avoid issues with receiving tax documents. Additionally, if you are expecting a tax refund, submitting the form before filing your tax return can facilitate a smoother process.

Form Submission Methods (Online / Mail / In-Person)

The Form 8822 must be submitted by mail; there is currently no option for online submission. After completing the form, send it to the appropriate address based on your location, as specified in the IRS instructions. It is essential to ensure that the form is mailed to the correct address to avoid processing delays. In-person submissions are not accepted for this form.

Quick guide on how to complete form 8822 fill in 2008

Effortlessly Prepare Form 8822 Fill In on Any Device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an excellent eco-friendly alternative to traditional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow provides all the tools you need to create, modify, and eSign your documents quickly and without interruptions. Manage Form 8822 Fill In on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The Easiest Way to Edit and eSign Form 8822 Fill In Smoothly

- Locate Form 8822 Fill In and click Get Form to commence.

- Use the tools available to fill out your form.

- Emphasize important sections of the documents or redact sensitive information with tools specifically provided by airSlate SignNow for this purpose.

- Create your eSignature using the Sign tool, which takes moments and carries the same legal validity as a conventional wet ink signature.

- Review all the details, then click the Done button to save your changes.

- Choose how you would like to share your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow fulfills your document management requirements in just a few clicks from your preferred device. Edit and eSign Form 8822 Fill In and maintain exceptional communication at every stage of the form preparation workflow with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 8822 fill in 2008

Create this form in 5 minutes!

How to create an eSignature for the form 8822 fill in 2008

The best way to generate an eSignature for a PDF file online

The best way to generate an eSignature for a PDF file in Google Chrome

How to create an electronic signature for signing PDFs in Gmail

How to create an eSignature right from your mobile device

How to create an eSignature for a PDF file on iOS

How to create an eSignature for a PDF on Android devices

People also ask

-

What is Form 8822 Fill In and why is it important?

Form 8822 Fill In is a tax form used by individuals to notify the IRS of a change of address. It's important to ensure that the IRS has the correct address to send any future correspondence or refunds. Using airSlate SignNow simplifies the process, allowing you to fill in and eSign the form efficiently.

-

How can I fill in Form 8822 using airSlate SignNow?

With airSlate SignNow, filling in Form 8822 is straightforward. You can upload the form, enter the necessary information directly into the fields, and eSign it securely. This streamlined process saves time and reduces errors when submitting the form to the IRS.

-

Is there a cost associated with using airSlate SignNow for Form 8822 Fill In?

Yes, airSlate SignNow offers various pricing plans tailored to different business needs. You can choose a plan that suits your budget while gaining access to features that facilitate the easy filling and signing of Form 8822. The cost is competitive, ensuring you get great value for an effective solution.

-

Can I integrate airSlate SignNow with other applications to manage Form 8822 Fill In?

Absolutely! airSlate SignNow provides integrations with several popular applications, making it easy to manage your documents across platforms. This allows for seamless workflow management when filling in Form 8822, ensuring that all necessary information is easily accessible.

-

What are the benefits of using airSlate SignNow for Form 8822 Fill In?

Using airSlate SignNow to fill in Form 8822 offers numerous benefits, including improved efficiency and reduced paperwork. The platform also provides advanced security features, ensuring that your personal information remains confidential during the eSigning process. With airSlate SignNow, you can focus more on your business and less on paperwork.

-

Is airSlate SignNow compliant with IRS regulations for Form 8822 Fill In?

Yes, airSlate SignNow is fully compliant with IRS regulations, ensuring your filled-in Form 8822 meets all required standards. The platform's security measures protect sensitive data while maintaining compliance with government regulations, giving you peace of mind when submitting the form.

-

Can I save my progress when filling in Form 8822 on airSlate SignNow?

Yes, airSlate SignNow allows you to save your progress when filling in Form 8822. You can complete the form at your own pace, ensuring that all information is accurate before final submission. This feature is especially beneficial for busy professionals managing multiple tasks.

Get more for Form 8822 Fill In

Find out other Form 8822 Fill In

- How To Sign Wyoming Plumbing Form

- Help Me With Sign Idaho Real Estate PDF

- Help Me With Sign Idaho Real Estate PDF

- Can I Sign Idaho Real Estate PDF

- How To Sign Idaho Real Estate PDF

- How Do I Sign Hawaii Sports Presentation

- How Do I Sign Kentucky Sports Presentation

- Can I Sign North Carolina Orthodontists Presentation

- How Do I Sign Rhode Island Real Estate Form

- Can I Sign Vermont Real Estate Document

- How To Sign Wyoming Orthodontists Document

- Help Me With Sign Alabama Courts Form

- Help Me With Sign Virginia Police PPT

- How To Sign Colorado Courts Document

- Can I eSign Alabama Banking PPT

- How Can I eSign California Banking PDF

- How To eSign Hawaii Banking PDF

- How Can I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document