Form 8821 2018

What is the Form 8821

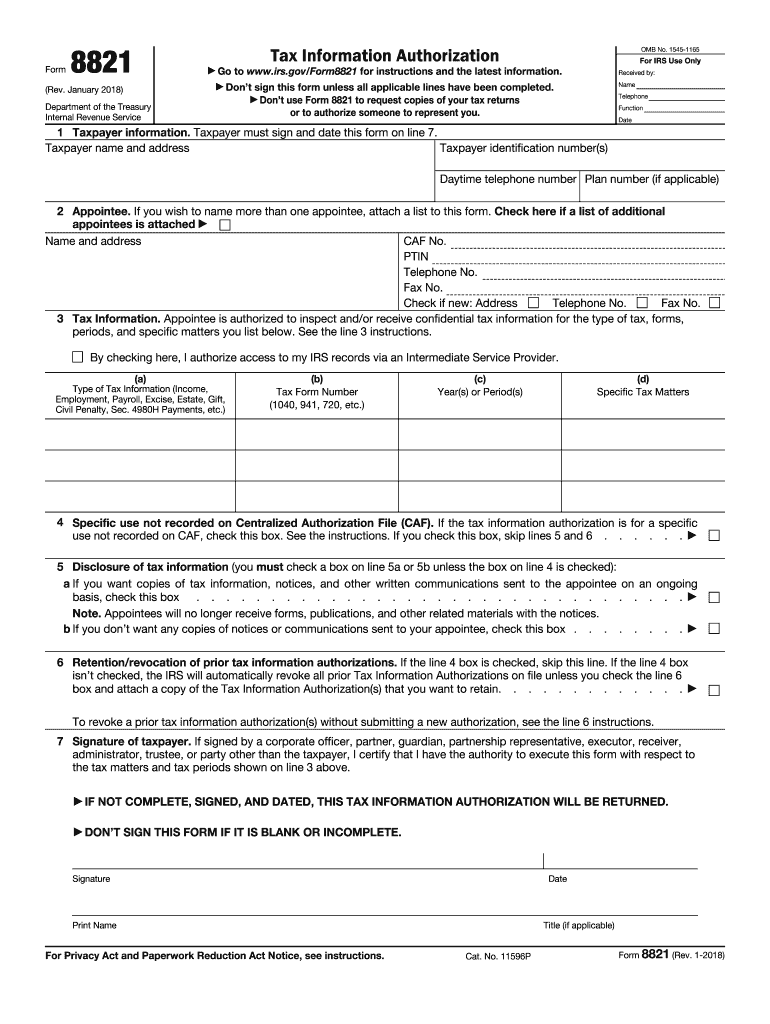

The IRS Form 8821, also known as the Tax Information Authorization form, allows taxpayers to authorize individuals or organizations to receive and inspect their tax information. This form is particularly useful for those who want to designate a representative, such as a tax professional, to handle their tax matters with the IRS. By using the 8821 form, taxpayers can ensure that their chosen representatives have access to the necessary information to assist them effectively.

How to use the Form 8821

To use the IRS Form 8821, taxpayers must complete the form by providing their personal information, including name, address, and Social Security number. Additionally, the taxpayer must specify the name and contact information of the designated representative. It is essential to indicate the type of tax information being authorized for disclosure, such as income tax, employment tax, or other specific tax matters. Once completed, the form should be submitted to the IRS to grant the designated individual access to the taxpayer's information.

Steps to complete the Form 8821

Completing the IRS Form 8821 involves several key steps:

- Provide your personal details, including your name, address, and Social Security number.

- Enter the name and contact information of the individual or organization you are authorizing.

- Specify the type of tax information you are allowing access to, such as federal income tax or other taxes.

- Sign and date the form to validate your authorization.

- Submit the completed form to the IRS, either by mail or electronically, depending on your preference.

Legal use of the Form 8821

The IRS Form 8821 is legally valid when completed correctly and submitted to the appropriate IRS office. It is important to ensure that the form is up-to-date and that all required fields are filled accurately. Taxpayers should only authorize individuals or organizations they trust to handle their tax information. Misuse of this form can lead to unauthorized access to sensitive tax data, so it is crucial to use it responsibly.

Form Submission Methods (Online / Mail / In-Person)

The IRS Form 8821 can be submitted through various methods. Taxpayers may choose to file the form online if the IRS allows electronic submissions for their specific case. Alternatively, the form can be printed and mailed to the appropriate IRS address. In-person submission is generally not an option for this form, as it is primarily processed through mail or electronic channels. Always check the IRS website for the most current submission guidelines.

IRS Guidelines

The IRS provides specific guidelines for completing and submitting Form 8821. Taxpayers should refer to the IRS instructions accompanying the form, which detail the necessary information required and any specific filing requirements. Adhering to these guidelines ensures that the form is processed efficiently and helps avoid delays in authorizing access to tax information.

Quick guide on how to complete irs form 8821 2018 2019

Discover the simplest method to complete and endorse your Form 8821

Are you still spending time creating your official paperwork on physical forms instead of doing it digitally? airSlate SignNow offers an enhanced approach to complete and endorse your Form 8821 and comparable forms for public services. Our intelligent electronic signature system provides you with everything necessary to handle documentation swiftly and in compliance with legal standards - comprehensive PDF editing, managing, securing, signing, and sharing capabilities readily available in a user-friendly interface.

Only a few steps are needed to accomplish filling out and signing your Form 8821:

- Upload the editable template to the editor using the Get Form button.

- Review what information you need to enter in your Form 8821.

- Move between the fields with the Next option to ensure nothing is overlooked.

- Utilize Text, Check, and Cross tools to populate the fields with your details.

- Enhance the content with Text boxes or Images from the upper toolbar.

- Underline what is essential or Conceal fields that are no longer relevant.

- Press Sign to create a legally recognized electronic signature using your preferred method.

- Include the Date beside your signature and finalize your task with the Done button.

Store your completed Form 8821 in the Documents folder within your account, download it, or transfer it to your chosen cloud storage. Our tool also offers adaptable file sharing. There’s no need to print your forms when you need to send them to the relevant public office - do it via email, fax, or by requesting a USPS “snail mail” dispatch from your account. Try it out today!

Create this form in 5 minutes or less

Find and fill out the correct irs form 8821 2018 2019

FAQs

-

Which ITR form should an NRI fill out for AY 2018–2019 to claim the TDS deducted by banks only?

ITR form required to be submitted depends upon nature of income. As a NRI shall generally have income from other sources like interest, rental income therefore s/he should file ITR 2.

-

Which ITR form should an NRI fill out for AY 2018–2019 for salary income?

File ITR 2 and for taking credit of foreign taxes fill form 67 before filling ITR.For specific clarifications / legal advice feel free to write to dsssvtax[at]gmail or call/WhatsApp: 9052535440.

-

How can I fill out an IRS form 8379?

Form 8379, the Injured Spouse declaration, is used to ensure that a spouse’s share of a refund from a joint tax return is not used by the IRS as an offset to pay a tax obligation of the other spouse.Before you file this, make sure that you know the difference between this and the Innocent Spouse declaration, Form 8857. You use Form 8379 when your spouse owes money for a legally enforeceable tax debt (such as a student loan which is in default) for which you are not jointly liable. You use Form 8857 when you want to be released from tax liability for an understatement of tax that resulted from actions taken by your spouse of which you had no knowledge, and had no reason to know.As the other answers have specified, you follow the Instructions for Form 8379 (11/2016) on the IRS Web site to actually fill it out.

-

Can I fill the form for the SSC CGL 2018 which will be held in June 2019 and when will the form for 2019 come out?

No, you can’t fill the form for SSC CGL 2018 as application process has been long over.SSC CGL 2019 : No concrete information at this time. Some update should come by August-September 2019.Like Exambay on facebook for all latest updates on SSC CGL 2018 , SSC CGL 2019 and other upcoming exams

Create this form in 5 minutes!

How to create an eSignature for the irs form 8821 2018 2019

How to generate an electronic signature for your Irs Form 8821 2018 2019 in the online mode

How to create an electronic signature for the Irs Form 8821 2018 2019 in Google Chrome

How to make an eSignature for putting it on the Irs Form 8821 2018 2019 in Gmail

How to generate an electronic signature for the Irs Form 8821 2018 2019 right from your smart phone

How to generate an electronic signature for the Irs Form 8821 2018 2019 on iOS

How to generate an electronic signature for the Irs Form 8821 2018 2019 on Android devices

People also ask

-

What is the IRS Form 8821 PDF fillable, and how can it benefit me?

The IRS Form 8821 PDF fillable is a document that allows taxpayers to authorize an individual or organization to receive their tax information. Using this fillable form can streamline communication with the IRS, ensuring that your tax matters are handled efficiently and accurately. With airSlate SignNow, you can fill out and eSign this form seamlessly to enhance your tax-related processes.

-

How do I fill out the IRS Form 8821 PDF fillable using airSlate SignNow?

Filling out the IRS Form 8821 PDF fillable with airSlate SignNow is straightforward. Simply upload the form, and use our intuitive editing tools to fill in the required information. Once completed, you can electronically sign the form, making the entire process quick and hassle-free.

-

Is there a cost associated with using the IRS Form 8821 PDF fillable feature on airSlate SignNow?

Yes, there is a pricing structure associated with airSlate SignNow, which includes access to features like the IRS Form 8821 PDF fillable. Our plans are affordable and designed to provide businesses with a cost-effective solution for document management. Visit our pricing page for more details on subscription options.

-

Can I integrate airSlate SignNow with other applications to manage the IRS Form 8821 PDF fillable?

Absolutely! airSlate SignNow offers various integrations with popular applications to streamline your workflows. You can effortlessly connect our platform with tools you’re already using to manage the IRS Form 8821 PDF fillable, enhancing overall efficiency.

-

Are there any benefits to using an electronic version of the IRS Form 8821 PDF fillable over a paper form?

Using the electronic version of the IRS Form 8821 PDF fillable offers numerous advantages, including immediate submission, reduced chances of errors, and easier tracking of the document. Electronic forms can signNowly speed up the process of getting tax information, giving you more time to focus on your financial goals.

-

Can I save a partially filled IRS Form 8821 PDF fillable on airSlate SignNow?

Yes, you can save a partially filled IRS Form 8821 PDF fillable on airSlate SignNow. Our platform allows you to save your progress and come back to the document whenever you need to complete it. This feature is particularly beneficial for complex forms that require additional time and attention.

-

What security measures are in place for my IRS Form 8821 PDF fillable data?

airSlate SignNow takes data security seriously, implementing advanced encryption methods to protect your IRS Form 8821 PDF fillable and other sensitive documents. We adhere to strict compliance protocols to ensure that your information remains confidential and secure during the signing and storage processes.

Get more for Form 8821

Find out other Form 8821

- Electronic signature Michigan Email Cover Letter Template Free

- Electronic signature Delaware Termination Letter Template Now

- How Can I Electronic signature Washington Employee Performance Review Template

- Electronic signature Florida Independent Contractor Agreement Template Now

- Electronic signature Michigan Independent Contractor Agreement Template Now

- Electronic signature Oregon Independent Contractor Agreement Template Computer

- Electronic signature Texas Independent Contractor Agreement Template Later

- Electronic signature Florida Employee Referral Form Secure

- How To Electronic signature Florida CV Form Template

- Electronic signature Mississippi CV Form Template Easy

- Electronic signature Ohio CV Form Template Safe

- Electronic signature Nevada Employee Reference Request Mobile

- How To Electronic signature Washington Employee Reference Request

- Electronic signature New York Working Time Control Form Easy

- How To Electronic signature Kansas Software Development Proposal Template

- Electronic signature Utah Mobile App Design Proposal Template Fast

- Electronic signature Nevada Software Development Agreement Template Free

- Electronic signature New York Operating Agreement Safe

- How To eSignature Indiana Reseller Agreement

- Electronic signature Delaware Joint Venture Agreement Template Free