IRS Announces Air Transportation Tax Rates Irs Form

Understanding the IRS Air Transportation Tax Rates

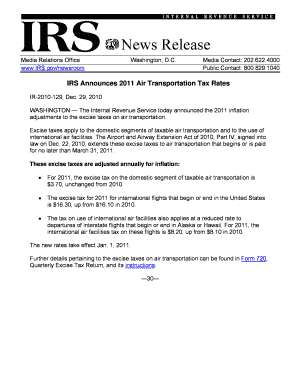

The IRS Air Transportation Tax Rates are established to impose taxes on air transportation services. These rates apply to various forms of air travel, including commercial flights and charter services. The IRS updates these rates periodically to reflect changes in the economy and transportation industry. Understanding these rates is essential for airlines, travel agencies, and individuals involved in air travel, as they directly impact ticket pricing and operational costs.

How to Use the IRS Air Transportation Tax Rates

To effectively use the IRS Air Transportation Tax Rates, businesses must first identify the applicable rates based on the type of air service provided. This involves reviewing the latest IRS announcements and tax rate tables. Once the correct rates are determined, businesses should incorporate them into their pricing structures and ensure compliance with IRS regulations during tax reporting. Keeping accurate records of ticket sales and taxes collected is crucial for accurate reporting and compliance.

Steps to Complete the IRS Air Transportation Tax Rates Documentation

Completing the documentation related to the IRS Air Transportation Tax Rates involves several steps:

- Review the latest IRS tax rate announcements to identify the current rates applicable to your services.

- Calculate the taxes owed based on the total sales of air transportation services.

- Document the tax calculations and retain records for compliance purposes.

- File the necessary tax forms with the IRS by the specified deadlines.

Legal Use of the IRS Air Transportation Tax Rates

Legal use of the IRS Air Transportation Tax Rates requires adherence to IRS guidelines and regulations. Businesses must ensure that they apply the correct rates to their services and accurately report tax collections. Non-compliance can lead to penalties, including fines and additional tax liabilities. It is advisable to consult with a tax professional to ensure all practices align with federal tax laws.

Filing Deadlines and Important Dates

Filing deadlines for the IRS Air Transportation Tax Rates vary based on the type of business and the frequency of tax reporting. Generally, businesses must file quarterly or annually, depending on their total tax liability. It is important to stay informed about specific deadlines to avoid late fees and penalties. Regularly checking the IRS website for updates on deadlines can help ensure compliance.

Required Documents for Compliance

To comply with the IRS Air Transportation Tax Rates, businesses need to maintain several key documents:

- Sales records detailing air transportation services provided.

- Tax calculation sheets showing how taxes were determined.

- Filed tax forms submitted to the IRS.

- Any correspondence with the IRS regarding tax rates or filings.

Examples of Using the IRS Air Transportation Tax Rates

Examples of applying the IRS Air Transportation Tax Rates include:

- A commercial airline calculating taxes on ticket sales for domestic flights.

- A charter service determining taxes based on the total fare collected from passengers.

- A travel agency incorporating tax rates into package deals for air travel.

Quick guide on how to complete irs announces air transportation tax rates irs

Effortlessly Prepare [SKS] on Any Device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents promptly without any hold-ups. Manage [SKS] on any platform with airSlate SignNow’s Android or iOS applications and simplify any document-centric process today.

The easiest method to alter and electronically sign [SKS] without hassle

- Obtain [SKS] and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Mark important sections of your documents or redact sensitive information with the tools that airSlate SignNow offers specifically for this purpose.

- Generate your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Verify all information and click the Done button to save your alterations.

- Choose how you would like to send your form, via email, text message (SMS), invitation link, or download it to your PC.

Eliminate concerns about missing or misplaced documents, tedious form retrieval, or errors that necessitate reprinting document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and electronically sign [SKS] to ensure seamless communication at every phase of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to IRS Announces Air Transportation Tax Rates Irs

Create this form in 5 minutes!

How to create an eSignature for the irs announces air transportation tax rates irs

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the IRS Announces Air Transportation Tax Rates Irs and how do they apply to my business?

The IRS Announces Air Transportation Tax Rates Irs refers to updated tax rates applied to air travel and transportation services. Understanding these rates is crucial for businesses that utilize air transport for shipping and logistics. By staying informed about these tax rates, you can accurately calculate costs and ensure compliance with IRS regulations.

-

How does airSlate SignNow help businesses manage documents related to the IRS Announces Air Transportation Tax Rates Irs?

airSlate SignNow provides a streamlined platform to send and eSign essential documents, including those relevant to IRS tax rates. With our solution, you can easily create and manage your tax-related documents, ensuring that you stay compliant with IRS Announces Air Transportation Tax Rates Irs. Our system enhances efficiency, allowing for quick processing and secure storage.

-

What features does airSlate SignNow offer that support compliance with IRS tax regulations?

airSlate SignNow offers advanced features such as customizable templates and automated workflows that simplify the process of document creation and approval. These features can help ensure that your documents align with the IRS Announces Air Transportation Tax Rates Irs. Additionally, electronic signatures are legally binding, providing an added layer of compliance.

-

Is airSlate SignNow cost-effective for businesses needing to adhere to the IRS Announces Air Transportation Tax Rates Irs?

Absolutely! airSlate SignNow offers competitive pricing plans that cater to businesses of all sizes while remaining affordable. Our solution helps reduce costs associated with paper, ink, and postal services, making it a cost-effective choice for managing IRS tax documents as required by the IRS Announces Air Transportation Tax Rates Irs.

-

Can airSlate SignNow integrate with other software to help manage IRS tax compliance?

Yes, airSlate SignNow seamlessly integrates with various business applications, such as accounting software and CRM systems. This allows for smoother management of financial records and compliance documents related to the IRS Announces Air Transportation Tax Rates Irs. Integration ensures that all relevant tax information is easily accessible and organized.

-

What benefits can my business gain from using airSlate SignNow in relation to IRS tax forms?

Using airSlate SignNow, your business can benefit from increased efficiency and improved accuracy in handling IRS tax forms. By automating the document workflow, you can reduce the risk of errors associated with IRS Announces Air Transportation Tax Rates Irs documentation. Additionally, an easy eSignature process accelerates approval times, enhancing overall productivity.

-

How can I ensure my documents are secure while complying with IRS tax regulations using airSlate SignNow?

airSlate SignNow employs advanced security measures, including AES encryption and secure cloud storage, to keep your documents safe. This is especially important when dealing with sensitive information related to the IRS Announces Air Transportation Tax Rates Irs. You can trust that your data is protected while maintaining compliance.

Get more for IRS Announces Air Transportation Tax Rates Irs

- 5092 sales use and withholding taxes amended monthly michigan form

- New york form it 635 urban youth jobs program tax credit

- Form it 640 start up ny telecommunication services excise tax credit tax year 2022

- Michigan fillio form

- Form it 135 fill in sales and use tax report for purchases

- Claim tax relief on a vehicle for drivers or passengers with a form

- Small business tax credit programs treasury department form

- Appellate division guidelines for captions and attorney form

Find out other IRS Announces Air Transportation Tax Rates Irs

- How To eSign Hawaii Time Off Policy

- How Do I eSign Hawaii Time Off Policy

- Help Me With eSign Hawaii Time Off Policy

- How To eSign Hawaii Addressing Harassement

- How To eSign Arkansas Company Bonus Letter

- eSign Hawaii Promotion Announcement Secure

- eSign Alaska Worksheet Strengths and Weaknesses Myself

- How To eSign Rhode Island Overtime Authorization Form

- eSign Florida Payroll Deduction Authorization Safe

- eSign Delaware Termination of Employment Worksheet Safe

- Can I eSign New Jersey Job Description Form

- Can I eSign Hawaii Reference Checking Form

- Help Me With eSign Hawaii Acknowledgement Letter

- eSign Rhode Island Deed of Indemnity Template Secure

- eSign Illinois Car Lease Agreement Template Fast

- eSign Delaware Retainer Agreement Template Later

- eSign Arkansas Attorney Approval Simple

- eSign Maine Car Lease Agreement Template Later

- eSign Oregon Limited Power of Attorney Secure

- How Can I eSign Arizona Assignment of Shares