5092, Sales, Use and Withholding Taxes Amended Monthly Michigan 2022

What is the 5092, Sales, Use And Withholding Taxes Amended Monthly Michigan

The 5092 form is a crucial document for businesses operating in Michigan, specifically designed to report sales, use, and withholding taxes. This form allows businesses to amend previously submitted tax information, ensuring compliance with state tax regulations. The 5092 is particularly important for businesses that need to correct errors or update their tax liabilities, providing a clear pathway for maintaining accurate records and fulfilling legal obligations.

Steps to complete the 5092, Sales, Use And Withholding Taxes Amended Monthly Michigan

Completing the 5092 form involves several key steps to ensure accuracy and compliance. First, gather all relevant financial records, including previous sales and tax payment documents. Next, accurately fill out the form, detailing the necessary amendments to your tax information. Be sure to include any required supporting documentation that substantiates the changes being made. After completing the form, review it thoroughly for any errors before submission. Finally, submit the amended form to the appropriate state tax authority, either online or via mail, depending on your preference.

Filing Deadlines / Important Dates

Understanding the filing deadlines for the 5092 form is essential for compliance. Typically, businesses must submit their amended returns by the end of the month following the reporting period. For example, if you are amending a return for January, the deadline would be the last day of February. It's advisable to keep track of these dates to avoid penalties and ensure timely updates to your tax filings.

Penalties for Non-Compliance

Failure to comply with the requirements associated with the 5092 form can result in significant penalties. These may include fines, interest on unpaid taxes, and potential legal action from the state. Additionally, inaccuracies in reporting can lead to audits, which can be time-consuming and costly for businesses. Therefore, it is crucial to accurately complete and submit the 5092 form to avoid these repercussions.

Who Issues the Form

The 5092 form is issued by the Michigan Department of Treasury. This state agency is responsible for overseeing tax collection and ensuring compliance with tax laws. Businesses should refer to the Department of Treasury for the most current version of the form and any updates to filing procedures or requirements.

Required Documents

When preparing to submit the 5092 form, certain documents are required to support your amendments. These may include previous tax returns, sales records, and any correspondence with the Michigan Department of Treasury related to your tax filings. Having these documents readily available will facilitate a smoother completion process and help substantiate the changes you are making on the form.

Quick guide on how to complete 5092 sales use and withholding taxes amended monthly michigan

Complete 5092, Sales, Use And Withholding Taxes Amended Monthly Michigan effortlessly on any device

Digital document management has gained traction among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed paperwork, allowing you to locate the necessary form and securely store it online. airSlate SignNow provides all the tools you require to create, modify, and eSign your documents swiftly without delays. Manage 5092, Sales, Use And Withholding Taxes Amended Monthly Michigan on any device using airSlate SignNow Android or iOS applications and enhance any document-focused process today.

How to modify and eSign 5092, Sales, Use And Withholding Taxes Amended Monthly Michigan effortlessly

- Obtain 5092, Sales, Use And Withholding Taxes Amended Monthly Michigan and then click Get Form to initiate.

- Utilize the tools we provide to fill out your document.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically offers for this purpose.

- Create your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and then click on the Done button to save your updates.

- Select your preferred method for sharing your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device of your preference. Modify and eSign 5092, Sales, Use And Withholding Taxes Amended Monthly Michigan to ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 5092 sales use and withholding taxes amended monthly michigan

Create this form in 5 minutes!

How to create an eSignature for the 5092 sales use and withholding taxes amended monthly michigan

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

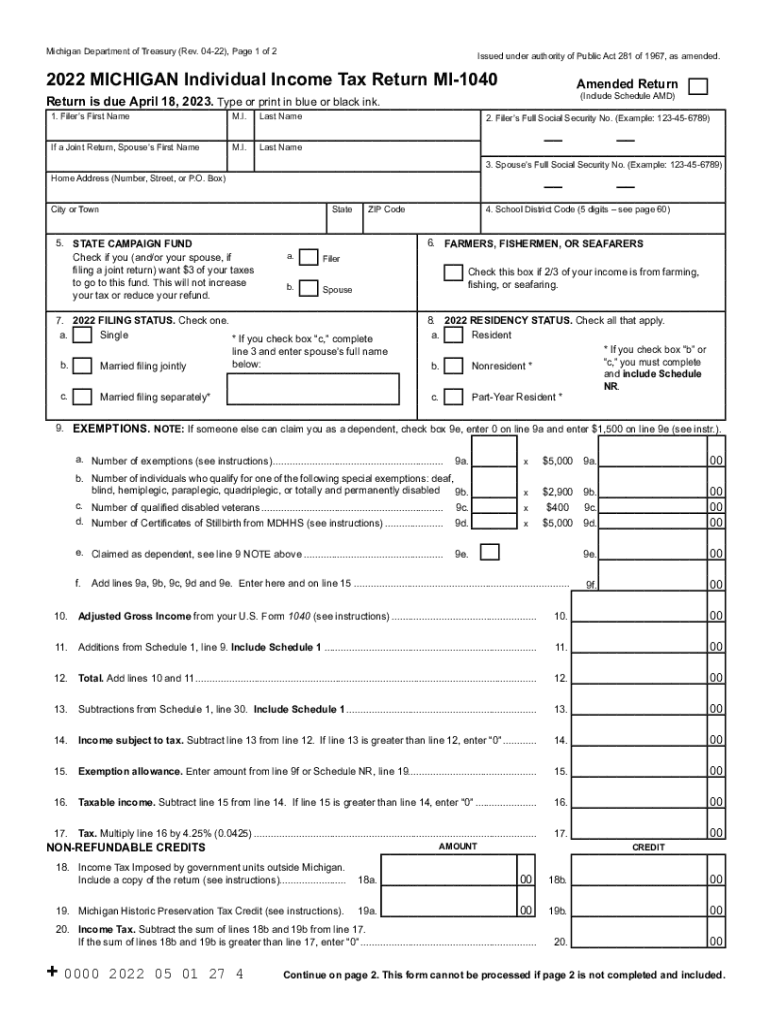

What is the current Michigan income tax rate?

The current Michigan income tax rate is a flat rate of 4.25% on taxable income. This rate applies to both individuals and businesses filing in Michigan. It's important to stay updated on any changes to ensure compliance.

-

How do I calculate my taxes based on the Michigan income tax rate?

To calculate your taxes based on the Michigan income tax rate, first determine your total taxable income for the year. Then, multiply that amount by the 4.25% rate to find your tax liability. Utilizing accounting tools or software can simplify this process.

-

Does airSlate SignNow assist in preparing documents for Michigan income tax submissions?

Yes, airSlate SignNow provides an efficient platform for preparing and signing documents relevant to Michigan income tax submissions. You can easily create, send, and eSign tax-related documents, ensuring a streamlined process throughout. Our platform offers versatility for various forms and agreements.

-

What features does airSlate SignNow offer for tax documentation?

AirSlate SignNow features easy document creation, template management, and secure eSigning to facilitate your tax documentation needs. These tools can help ensure your documents are accurately prepared and compliant with the Michigan income tax requirements. Moreover, the platform enables collaboration among team members for better accuracy.

-

Is airSlate SignNow cost-effective for small businesses managing Michigan income tax processes?

Absolutely! airSlate SignNow offers cost-effective solutions for small businesses handling Michigan income tax processes. With plans tailored for budget-conscious organizations, our platform provides the tools necessary for efficient document management without high overhead costs. You can maximize productivity and minimize expenses.

-

Does airSlate SignNow integrate with accounting or tax software for Michigan tax filings?

Yes, airSlate SignNow integrates seamlessly with various accounting and tax software, enhancing your experience when preparing Michigan income tax filings. These integrations can streamline your workflow, reduce data entry errors, and ensure that documents are accurate and ready for submission. The ease of integration makes it a valuable tool for businesses.

-

What are the benefits of using airSlate SignNow for Michigan income tax documentation?

Using airSlate SignNow for Michigan income tax documentation offers several benefits, including increased efficiency, cost savings, and enhanced compliance. The platform simplifies the document workflow through electronic signatures and templates, ensuring you meet all requirements with ease. Businesses can save time and focus on growth while handling tax-related processes.

Get more for 5092, Sales, Use And Withholding Taxes Amended Monthly Michigan

- Paving contract for contractor tennessee form

- Site work contract for contractor tennessee form

- Siding contract for contractor tennessee form

- Tn contractor form

- Tennessee contractor form

- Foundation contract for contractor tennessee form

- Plumbing contract for contractor tennessee form

- Brick mason contract for contractor tennessee form

Find out other 5092, Sales, Use And Withholding Taxes Amended Monthly Michigan

- Sign South Dakota Banking Limited Power Of Attorney Mobile

- How Do I Sign Texas Banking Memorandum Of Understanding

- Sign Virginia Banking Profit And Loss Statement Mobile

- Sign Alabama Business Operations LLC Operating Agreement Now

- Sign Colorado Business Operations LLC Operating Agreement Online

- Sign Colorado Business Operations LLC Operating Agreement Myself

- Sign Hawaii Business Operations Warranty Deed Easy

- Sign Idaho Business Operations Resignation Letter Online

- Sign Illinois Business Operations Affidavit Of Heirship Later

- How Do I Sign Kansas Business Operations LLC Operating Agreement

- Sign Kansas Business Operations Emergency Contact Form Easy

- How To Sign Montana Business Operations Warranty Deed

- Sign Nevada Business Operations Emergency Contact Form Simple

- Sign New Hampshire Business Operations Month To Month Lease Later

- Can I Sign New York Business Operations Promissory Note Template

- Sign Oklahoma Business Operations Contract Safe

- Sign Oregon Business Operations LLC Operating Agreement Now

- Sign Utah Business Operations LLC Operating Agreement Computer

- Sign West Virginia Business Operations Rental Lease Agreement Now

- How To Sign Colorado Car Dealer Arbitration Agreement