Michigan Fill Io 2022

Understanding the Michigan 1040D Form

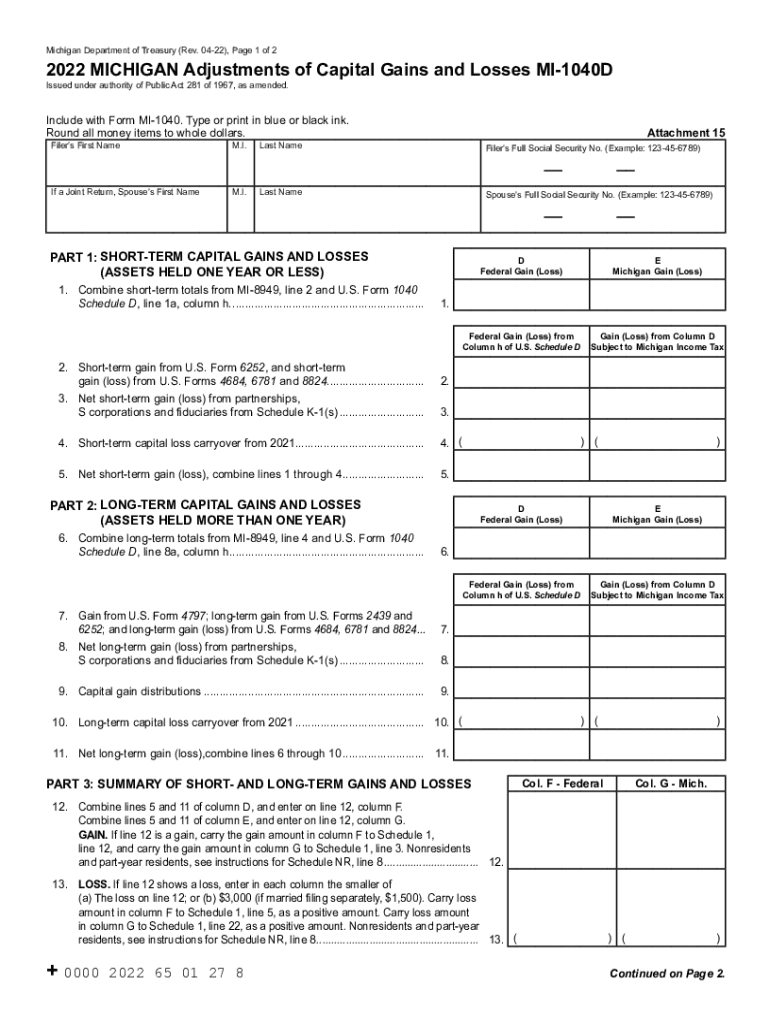

The Michigan 1040D form, also known as the Michigan Individual Income Tax Return, is a crucial document for residents of Michigan who need to report their income and calculate their state tax obligations. This form is specifically designed for individuals and is essential for accurately declaring income, deductions, and credits applicable to Michigan taxpayers. It is important to understand the specific requirements and sections of the form to ensure compliance with state tax laws.

Steps to Complete the Michigan 1040D Form

Filling out the Michigan 1040D form involves several key steps:

- Gather necessary documentation, including W-2s, 1099s, and any relevant receipts for deductions.

- Begin with your personal information, including your name, address, and Social Security number.

- Report your total income from all sources, ensuring to include wages, interest, dividends, and any other income.

- Calculate your allowable deductions, which can include standard deductions or itemized deductions based on your expenses.

- Determine your tax liability using the appropriate tax tables provided by the state.

- Complete any additional schedules if required, such as those for capital gains or losses.

- Review the entire form for accuracy before submitting.

Legal Use of the Michigan 1040D Form

The Michigan 1040D form is legally binding and must be completed accurately to avoid penalties. It is governed by state tax laws, and failure to comply can result in fines or legal action. When submitting the form, taxpayers must ensure that all information is truthful and complete. The form serves as an official record of income and tax obligations, making it essential for both the taxpayer and the state.

Filing Deadlines for the Michigan 1040D Form

Timely submission of the Michigan 1040D form is critical. The standard deadline for filing is typically April 15 of each year, aligning with federal tax deadlines. However, if this date falls on a weekend or holiday, the deadline may be extended. It is essential to stay informed about any changes to deadlines, especially in light of special circumstances that may arise.

Form Submission Methods for the Michigan 1040D

Taxpayers have several options for submitting the Michigan 1040D form:

- Online Submission: Many taxpayers choose to file electronically through approved tax software, which can streamline the process and reduce errors.

- Mail Submission: The form can be printed and mailed to the appropriate state tax office. Ensure that you use the correct address based on your location.

- In-Person Submission: Taxpayers may also submit the form in person at designated state tax offices, which can be helpful for those needing assistance.

Required Documents for the Michigan 1040D Form

To accurately complete the Michigan 1040D form, taxpayers should gather the following documents:

- W-2 forms from employers.

- 1099 forms for any freelance or contract work.

- Documentation for any deductions claimed, such as mortgage interest statements or medical expenses.

- Records of any estimated tax payments made throughout the year.

IRS Guidelines Related to the Michigan 1040D Form

While the Michigan 1040D form is specific to state taxes, it is important to be aware of IRS guidelines that may impact your state filing. Taxpayers should ensure that their federal tax return is accurately reflected in their state return, as discrepancies can lead to audits or penalties. Understanding both federal and state tax obligations is essential for compliance and accurate reporting.

Quick guide on how to complete michigan fillio

Easily Prepare Michigan Fill io on Any Device

Digital document management has gained popularity among businesses and individuals alike. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to find the right form and securely store it online. airSlate SignNow provides you with all the resources required to create, modify, and eSign your documents quickly without any delays. Manage Michigan Fill io on any device using airSlate SignNow's Android or iOS applications and simplify your document-related processes today.

How to Modify and eSign Michigan Fill io Effortlessly

- Find Michigan Fill io and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Mark important sections of your documents or conceal sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, laborious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and eSign Michigan Fill io while ensuring outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct michigan fillio

Create this form in 5 minutes!

How to create an eSignature for the michigan fillio

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the mi 1040 form used for?

The mi 1040 form is utilized for individual income tax reporting in Michigan. It allows residents to report their income, calculate their tax liability, and claim any applicable credits or deductions. Completing the mi 1040 accurately is crucial for ensuring compliance with state tax regulations.

-

How can airSlate SignNow help with the mi 1040 form?

airSlate SignNow makes it easy to send and eSign the mi 1040 form securely online. Our platform streamlines the document preparation process, allowing you to fill out and send tax forms quickly. This efficiency can help you meet filing deadlines with confidence.

-

What are the key features of airSlate SignNow for managing the mi 1040?

Key features of airSlate SignNow include customizable templates, real-time tracking, and secure storage for your mi 1040 forms. Additionally, users can collaborate with others and receive notifications when documents are signed, making the filing process seamless and organized.

-

Is airSlate SignNow cost-effective for eSigning the mi 1040 form?

Yes, airSlate SignNow offers a cost-effective solution for eSigning the mi 1040 form. Our pricing plans are designed to fit different budgets, ensuring that individuals and businesses can access essential eSigning features without breaking the bank.

-

Can I integrate airSlate SignNow with other tax software for mi 1040 preparation?

Absolutely! airSlate SignNow integrates easily with various tax software solutions to enhance your mi 1040 preparation process. This integration allows for a seamless workflow, enabling you to manage forms and documents in one place.

-

What are the benefits of using airSlate SignNow for the mi 1040?

Using airSlate SignNow for the mi 1040 offers several benefits, including enhanced efficiency, improved accuracy, and increased security. The platform allows you to eSign documents swiftly, reducing the time spent on manual processes and ensuring that your information is protected.

-

How secure is airSlate SignNow when handling mi 1040 forms?

airSlate SignNow prioritizes security by utilizing advanced encryption technologies to protect your mi 1040 forms and personal data. Our platform is compliant with industry standards, ensuring that your documents are safe from unauthorized access.

Get more for Michigan Fill io

- Minnesota release mortgage 497312125 form

- Contract deed seller form

- Contract for deed corporation or partnership seller ucbc form 3021 minnesota

- Assignment of contract for deed by individual seller purchaser or assignee ucbc form 3031 minnesota

- Minnesota form 4

- Warranty deed joint form

- Partial payment certificate mortgage or contract by individual ucbc form 61 m minnesota

- Partial payment certificate mortgage or contract by corporation ucbc form 62 m minnesota

Find out other Michigan Fill io

- Sign Washington Healthcare / Medical LLC Operating Agreement Now

- Sign Wisconsin Healthcare / Medical Contract Safe

- Sign Alabama High Tech Last Will And Testament Online

- Sign Delaware High Tech Rental Lease Agreement Online

- Sign Connecticut High Tech Lease Template Easy

- How Can I Sign Louisiana High Tech LLC Operating Agreement

- Sign Louisiana High Tech Month To Month Lease Myself

- How To Sign Alaska Insurance Promissory Note Template

- Sign Arizona Insurance Moving Checklist Secure

- Sign New Mexico High Tech Limited Power Of Attorney Simple

- Sign Oregon High Tech POA Free

- Sign South Carolina High Tech Moving Checklist Now

- Sign South Carolina High Tech Limited Power Of Attorney Free

- Sign West Virginia High Tech Quitclaim Deed Myself

- Sign Delaware Insurance Claim Online

- Sign Delaware Insurance Contract Later

- Sign Hawaii Insurance NDA Safe

- Sign Georgia Insurance POA Later

- How Can I Sign Alabama Lawers Lease Agreement

- How Can I Sign California Lawers Lease Agreement