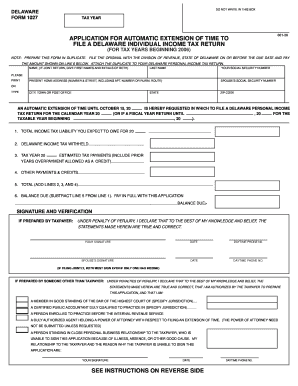

For TAX YEARS BEGINNING Revenue Delaware Form

What is the FOR TAX YEARS BEGINNING Revenue Delaware

The form FOR TAX YEARS BEGINNING Revenue Delaware is a crucial document used by businesses and individuals to report income and calculate taxes owed to the state of Delaware. This form provides detailed information regarding the taxpayer's financial activities during the specified tax year, ensuring compliance with state tax regulations. Understanding this form is essential for accurate tax reporting and fulfilling legal obligations.

How to use the FOR TAX YEARS BEGINNING Revenue Delaware

To effectively use the FOR TAX YEARS BEGINNING Revenue Delaware, taxpayers must first gather all necessary financial documents, including income statements and expense records. After collecting the required information, fill out the form accurately, ensuring that all figures are correct and reflect the taxpayer's financial situation. Once completed, the form can be submitted to the Delaware Division of Revenue, either online or via mail, depending on the taxpayer's preference.

Steps to complete the FOR TAX YEARS BEGINNING Revenue Delaware

Completing the FOR TAX YEARS BEGINNING Revenue Delaware involves several key steps:

- Gather all relevant financial documents, such as W-2s, 1099s, and receipts for deductible expenses.

- Download the form from the Delaware Division of Revenue website or access it through authorized tax software.

- Fill out the form, ensuring that all income and deductions are reported accurately.

- Review the completed form for any errors or omissions.

- Submit the form by the designated deadline, either electronically or by mailing it to the appropriate address.

Filing Deadlines / Important Dates

Filing deadlines for the FOR TAX YEARS BEGINNING Revenue Delaware are typically aligned with federal tax deadlines. Generally, the form must be submitted by April fifteenth of the following year. However, taxpayers should verify specific dates each year, as extensions may be available under certain circumstances. Staying informed about these deadlines is vital to avoid penalties and ensure timely compliance.

Required Documents

When completing the FOR TAX YEARS BEGINNING Revenue Delaware, several documents are essential:

- Income statements, including W-2 forms for employees and 1099 forms for independent contractors.

- Receipts and records for any deductible expenses, such as business costs or educational expenses.

- Previous year’s tax return, which can provide a reference for completing the current form.

Having these documents on hand will facilitate a smoother and more accurate filing process.

Penalties for Non-Compliance

Failure to file the FOR TAX YEARS BEGINNING Revenue Delaware by the deadline can result in significant penalties. These may include late filing fees and interest on any unpaid taxes. Additionally, non-compliance can lead to further legal consequences, such as audits or additional scrutiny from the Delaware Division of Revenue. It is crucial for taxpayers to adhere to filing requirements to avoid these penalties.

Quick guide on how to complete for tax years beginning revenue delaware

Effortlessly Create [SKS] on Any Device

Digital document management has gained signNow traction among businesses and individuals. It offers an ideal environmentally friendly substitute to conventional printed and signed documents, as you can easily locate the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage [SKS] on any platform using airSlate SignNow's Android or iOS applications and enhance any document-focused process today.

How to Modify and eSign [SKS] with Ease

- Obtain [SKS] and click Get Form to begin.

- Make use of the tools we provide to complete your form.

- Emphasize pertinent sections of your documents or redact sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which takes just seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the details and click the Done button to finalize your changes.

- Choose how you'd like to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searching, or mistakes that require new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choice. Edit and eSign [SKS] and guarantee outstanding communication throughout your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to FOR TAX YEARS BEGINNING Revenue Delaware

Create this form in 5 minutes!

How to create an eSignature for the for tax years beginning revenue delaware

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow and how does it relate to FOR TAX YEARS BEGINNING Revenue Delaware?

airSlate SignNow is a digital solution that facilitates sending and eSigning documents securely and efficiently. For tax years beginning Revenue Delaware, businesses can streamline their document management and compliance processes, ensuring they meet necessary state requirements with ease.

-

How does airSlate SignNow enhance my compliance for FOR TAX YEARS BEGINNING Revenue Delaware?

Using airSlate SignNow helps ensure that your electronic signatures are legally binding and compliant with regulations in Delaware. This is particularly important for documentation required FOR TAX YEARS BEGINNING Revenue Delaware, as it ensures your business adheres to local laws.

-

What are the pricing options available for airSlate SignNow for businesses focused on FOR TAX YEARS BEGINNING Revenue Delaware?

airSlate SignNow offers several pricing plans to accommodate different business needs, including options suitable for startups and enterprises. The pricing is competitive, making it an excellent choice for those looking to manage their document workflow efficiently FOR TAX YEARS BEGINNING Revenue Delaware.

-

What features does airSlate SignNow offer to support FOR TAX YEARS BEGINNING Revenue Delaware?

airSlate SignNow includes features such as customizable templates, bulk sending, and advanced tracking options. These features can signNowly benefit businesses preparing documents FOR TAX YEARS BEGINNING Revenue Delaware, ensuring that everything is organized and accessible.

-

Can airSlate SignNow integrate with other tools I use for FOR TAX YEARS BEGINNING Revenue Delaware?

Yes, airSlate SignNow offers integration with numerous applications and platforms, enhancing your workflow. By integrating with accounting software or CRMs, businesses can manage documents related to FOR TAX YEARS BEGINNING Revenue Delaware seamlessly.

-

Is airSlate SignNow secure enough for sensitive documents related to FOR TAX YEARS BEGINNING Revenue Delaware?

Absolutely! airSlate SignNow prioritizes security with robust encryption and compliance features. This is crucial for handling sensitive information related to FOR TAX YEARS BEGINNING Revenue Delaware, ensuring your data remains protected.

-

What are the benefits of using airSlate SignNow for my organization in handling FOR TAX YEARS BEGINNING Revenue Delaware documentation?

Utilizing airSlate SignNow for handling documentation related to FOR TAX YEARS BEGINNING Revenue Delaware offers speed, efficiency, and a reduction in paper usage. These benefits lead to cost savings and a more organized approach to managing tax-related documents.

Get more for FOR TAX YEARS BEGINNING Revenue Delaware

- Sinumpaang salaysay sss death claim sample with answer form

- Head office cpd debit card bank of india co in form

- Ecd learnership online application form

- Online item number form

- Election form 14

- Social insurance number application service canada servicecanada gc form

- Alankit tpa hospital empanelment form

- Bank of america signature card form

Find out other FOR TAX YEARS BEGINNING Revenue Delaware

- How Do I Sign Colorado Government Cease And Desist Letter

- How To Sign Connecticut Government LLC Operating Agreement

- How Can I Sign Delaware Government Residential Lease Agreement

- Sign Florida Government Cease And Desist Letter Online

- Sign Georgia Government Separation Agreement Simple

- Sign Kansas Government LLC Operating Agreement Secure

- How Can I Sign Indiana Government POA

- Sign Maryland Government Quitclaim Deed Safe

- Sign Louisiana Government Warranty Deed Easy

- Sign Government Presentation Massachusetts Secure

- How Can I Sign Louisiana Government Quitclaim Deed

- Help Me With Sign Michigan Government LLC Operating Agreement

- How Do I Sign Minnesota Government Quitclaim Deed

- Sign Minnesota Government Affidavit Of Heirship Simple

- Sign Missouri Government Promissory Note Template Fast

- Can I Sign Missouri Government Promissory Note Template

- Sign Nevada Government Promissory Note Template Simple

- How To Sign New Mexico Government Warranty Deed

- Help Me With Sign North Dakota Government Quitclaim Deed

- Sign Oregon Government Last Will And Testament Mobile