Instructions for Form 4797 Internal Revenue Service 2022

What is the Instructions for Form 4797?

The Instructions for Form 4797 provide guidance on how to report the sale or exchange of business property. This form is essential for taxpayers who have disposed of assets used in a trade or business, including property held for investment. The IRS uses this information to determine any gain or loss from the sale, which will affect your overall tax liability. Understanding these instructions is crucial for accurate reporting and compliance with tax regulations.

Steps to Complete the Instructions for Form 4797

Completing Form 4797 involves several key steps:

- Gather necessary documents, including records of the property sold, purchase price, and any improvements made.

- Determine the type of property being reported, such as real estate or depreciable assets.

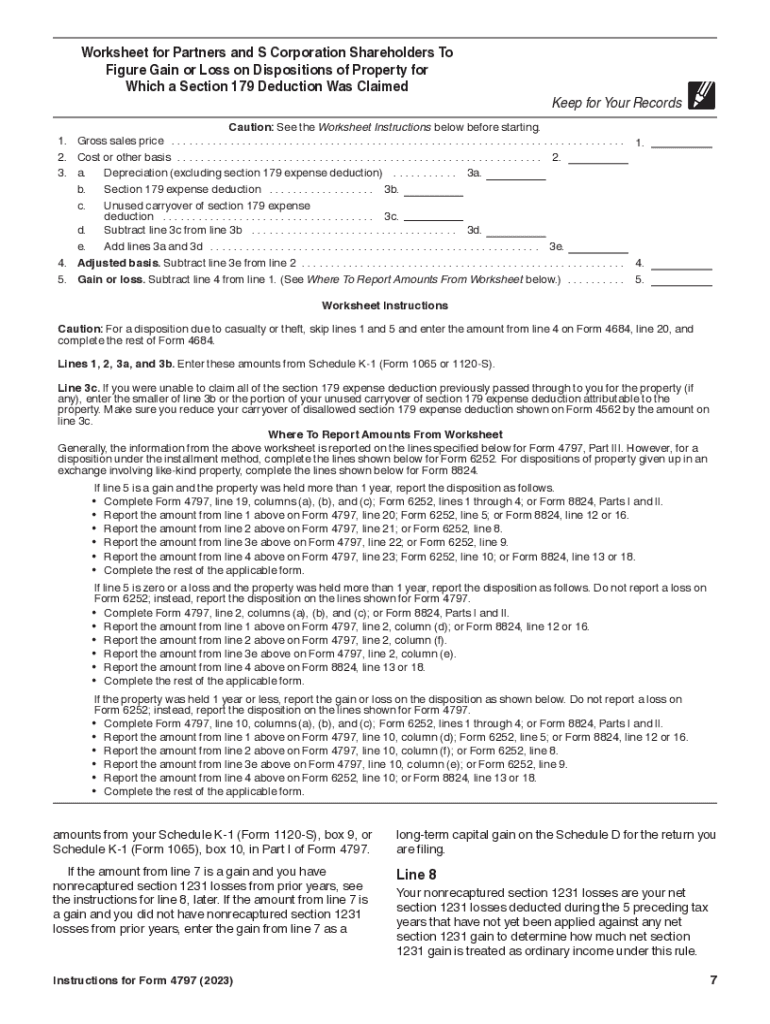

- Calculate the adjusted basis of the property, which includes the original cost plus any improvements minus depreciation taken.

- Report the sale details, including the date of sale, selling price, and any expenses related to the sale.

- Complete the form by following the specific instructions provided for each section, ensuring all calculations are accurate.

How to Obtain the Instructions for Form 4797

The Instructions for Form 4797 can be obtained directly from the IRS website. They are available in PDF format, allowing taxpayers to download and print them for reference. Additionally, you can request a physical copy by contacting the IRS or visiting a local IRS office. It is important to ensure you have the most current version of the instructions, as tax regulations can change annually.

Key Elements of the Instructions for Form 4797

Several key elements are crucial in the Instructions for Form 4797:

- Property Type: Understanding the distinction between different types of property, such as Section 1231 assets and capital assets.

- Reporting Requirements: Detailed information on what needs to be reported, including gains, losses, and applicable deductions.

- Special Considerations: Instructions on handling specific scenarios, such as like-kind exchanges or involuntary conversions.

- Filing Procedures: Guidance on how to submit the form, whether electronically or by mail.

Filing Deadlines / Important Dates

It is essential to be aware of the filing deadlines associated with Form 4797. Typically, this form must be filed along with your annual tax return, which is due on April 15th for most taxpayers. If you require an extension, ensure that Form 4797 is submitted by the extended deadline. Staying informed about these dates helps avoid penalties and ensures compliance with IRS regulations.

Penalties for Non-Compliance

Failing to accurately complete and file Form 4797 can result in significant penalties. The IRS may impose fines for incorrect reporting of gains or losses, which can lead to increased tax liability. Additionally, late filings may incur penalties based on the amount of tax owed. Understanding these potential consequences emphasizes the importance of careful preparation and timely submission of the form.

Quick guide on how to complete instructions for form 4797 internal revenue service

Complete Instructions For Form 4797 Internal Revenue Service seamlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly alternative to conventional printed and signed papers, allowing you to locate the appropriate form and securely save it online. airSlate SignNow equips you with all the tools required to create, edit, and eSign your documents quickly and effortlessly. Manage Instructions For Form 4797 Internal Revenue Service on any device using the airSlate SignNow apps for Android or iOS and enhance any document-centric process today.

The easiest way to edit and eSign Instructions For Form 4797 Internal Revenue Service effortlessly

- Obtain Instructions For Form 4797 Internal Revenue Service and click on Get Form to begin.

- Make use of the tools we provide to complete your document.

- Select signNow sections of the documents or obscure sensitive details with tools specifically provided by airSlate SignNow for that purpose.

- Generate your signature with the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you prefer to send your form, by email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or mistakes that require printing new copies. airSlate SignNow manages all your document management requirements in just a few clicks from any device you choose. Edit and eSign Instructions For Form 4797 Internal Revenue Service and guarantee excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct instructions for form 4797 internal revenue service

Create this form in 5 minutes!

How to create an eSignature for the instructions for form 4797 internal revenue service

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are IRS instructions for Form 4797?

The IRS instructions for Form 4797 provide guidance on how to report the sale of business property. This form is essential for calculating gains and losses from the sale of assets, and following these instructions can ensure compliance with tax regulations.

-

How can airSlate SignNow assist with IRS Form 4797?

airSlate SignNow simplifies the process of completing and submitting IRS Form 4797 by allowing users to eSign documents securely. This ensures that all necessary signatures are collected efficiently, making it easier to file your taxes accurately and on time.

-

What features does airSlate SignNow offer for managing IRS forms?

airSlate SignNow offers features such as document templates, electronic signatures, and easy sharing capabilities that streamline the management of IRS forms like the 4797. These features help ensure that your forms are filled out correctly and are submitted promptly, enhancing overall workflow efficiency.

-

Is airSlate SignNow cost-effective for small businesses needing IRS Form 4797?

Yes, airSlate SignNow is a cost-effective solution for small businesses that need to handle IRS Form 4797. With flexible pricing plans, businesses can choose the option that fits their budget while gaining access to essential features for document management and eSigning.

-

Can I integrate airSlate SignNow with other applications for IRS Form 4797?

Absolutely! airSlate SignNow integrates seamlessly with various applications, enhancing your ability to manage IRS Form 4797 and other important documents. This integration ensures a smooth workflow, allowing users to import data directly from other tools and reduce manual entry errors.

-

What benefits does eSigning with airSlate SignNow provide for IRS instructions Form 4797?

eSigning with airSlate SignNow presents numerous benefits for IRS instructions Form 4797, including enhanced security and a faster turnaround time. This not only ensures your submissions are signed and submitted quickly but also offers a verified record of compliance.

-

Are there templates available for IRS Form 4797 in airSlate SignNow?

Yes, airSlate SignNow provides customizable templates specifically for IRS Form 4797. These templates help users fill out the necessary information quickly and accurately, making the process of tax preparation easier.

Get more for Instructions For Form 4797 Internal Revenue Service

- Expiration date 01312023 form

- Va form 22 0976 application for approval of a programin a foreign country

- Restrictive covenants and title claimselliott ampamp company appraisers form

- Va form 26 8736a nonsupervised lenders nomination and recommendation of credit underwriter

- Fillable online water and wastewater tap fee and rate form

- 22 0989 education benefit entitlement restoration request due to school closure program suspension or withdrawal form

- Expiration date apr form

- Section 184 a addendum to uniform residential loan hud

Find out other Instructions For Form 4797 Internal Revenue Service

- Help Me With Sign Arizona Education PDF

- How To Sign Georgia Education Form

- How To Sign Iowa Education PDF

- Help Me With Sign Michigan Education Document

- How Can I Sign Michigan Education Document

- How Do I Sign South Carolina Education Form

- Can I Sign South Carolina Education Presentation

- How Do I Sign Texas Education Form

- How Do I Sign Utah Education Presentation

- How Can I Sign New York Finance & Tax Accounting Document

- How Can I Sign Ohio Finance & Tax Accounting Word

- Can I Sign Oklahoma Finance & Tax Accounting PPT

- How To Sign Ohio Government Form

- Help Me With Sign Washington Government Presentation

- How To Sign Maine Healthcare / Medical PPT

- How Do I Sign Nebraska Healthcare / Medical Word

- How Do I Sign Washington Healthcare / Medical Word

- How Can I Sign Indiana High Tech PDF

- How To Sign Oregon High Tech Document

- How Do I Sign California Insurance PDF